Mutual Credit, the Astonishingly Simple Truth about Money Creation

Mutual Credit is the way money is created in barters worldwide. Barters don’t barter. They don’t use national currencies to finance their trade and that’s why they are called that way. But they use their own means of exchange to pay each other, so ‘barter’ is a misnomer.

It is an extremely cheap and simple way of creating money. Every participant is given an account and credit. Let’s say 1 Unit = 1 Dollar. This is actually how many of these systems work: it creates transparent pricing by using the national currency as the unit of account, but not as a means of exchange.

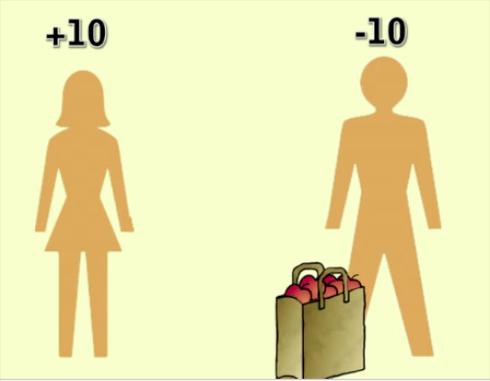

Let’s say every participant gets a 1000 Unit credit. In the beginning there is no money at all. It only comes into circulation when one of the participants uses his credit to pay another participant. If he uses his 1000 Units his balance is – 1000 U. His supplier’s balance is now +1000U. The total amount in circulation is now also 1000 U. This means there is always exactly as much in circulation as there is outstanding credit: a zero sum game.

If you understand the very primitive LETS, you basically understand how money should work. It really is that simple. Galbraith was not kidding when he said “The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal it. The process by which banks create money is so simple the mind is repelled. With something so important, a deeper mystery seems only decent”.

But there is no deeper mystery. This is it.

One of the key reasons why privately operated barter units are not dominating in the real economy, is because until recently there was no known mechanism to create convertibility to other units, most importantly the national units. Amazingly, many of these barters actively resist convertibility and believe non-convertibility is a strength. It is not, of course, as it hinders the liquidity of the unit.

Lately, however, the right way to convertibility has been shown by Bitcoin and the Gelre: on-line markets where the units can be traded in a free market environment is the solid way forward.

Let’s explore a number of items to elucidate the matter.

1. Zero reserves are required

Therefore, the Mutual Credit Facility (MCF) does not need savers. It does not need to attract outside capital. It does not incur capital costs in creating credit. It can therefore operate interest free.

2. Mutual Credit Facilities typically finance themselves with monthly fees. These can be very low, about 10 dollars a month. Of course the outlet does need a minimum numbers of participants to be effective and acquire sufficient income to operate. But with only a thousand firms participating, already a viable business is possible.

3. Governments can easily create National Currencies using Mutual Credit. Commonwealths on other levels can do so too.

4. Debts that are not repaid lead to unbacked units in circulation. The cost for taking these out of circulation can be covered by taking a small one off fee when the credit is assigned. Defaults typically amount to 2% of total outstanding credit.

5. Serious sums of credit are backed by collateral.

6. The creditworthiness of participants is much higher than with banking, because debtors are not burdened with interest.

7. In the case of payment problems, Mutual Credit Facilities will typically not act in the same barbaric ways that banks do. The debt does not grow if repayment is lagging, because there is no interest. If a debtor defaults, underlying assets will be liquidated, but in the way least harmful to the debtor.

8. The MCF is intrinsically stable: it cannot provide more credit than it has assets, because it has no assets. Even if the MCF goes bust because it cannot finance its own operation, all the outstanding debts will be repaid and settled in other currencies. People holding the defunct units can expect to be (almost) fully reimbursed, even though this may take some time.

9. MCFs should preferably be Not for Profit entities. But commercial MCFs certainly are possible too.

10. There are no laws to stop Mutual Credit in the marketplace. But of course regulators are inimical to them.

11. MCF units can have their own unit of account (like with LETS), or they can use the National Unit as such.

12. MCF units are a means of exchange and should never be hoarded. They should be converted to other currencies, precious metals, durable goods, invested or used in other ways when people want to store wealth.

13. Mutual Credit is peer to peer. The MCFs exists only to see to the administration it brings. It is fundamentally democratic.

It is in this incredibly simple way that humanity can finance itself interest free. We can get rid of interest, not by outlawing it, but by creating all the cash we will ever need at zero cost.

We don’t need interest, there is no economic need for it and fully functional ways of creating credit without it are available now.

It will make obsolete capital markets, speculation, and exploitation through artificial scarcity. It ends the losses to inflation. It allows decentralized control of the economy.

It only needs growing awareness and dedicated people to implement it.

Trackbacks & Pingbacks

- Debt Free Money alone does not solve Compound Interest « Real Currencies

- Mutual Credit, the Astonishingly Simple Truth about Money Creation |

- Usurious Usurpation « Real Currencies

- Mutual Credit for the 21st century: Convertibility « Real Currencies

- The Inflation vs. Deflation Dialectic « Real Currencies

- Financial Warfare 2012: Boycott all Banks « Real Currencies

- Budget of an Interest Slave « Real Currencies

- How about the Lectra? « Real Currencies

- Real Currencies

- Regional Currencies in Germany: the Chiemgauer « Real Currencies

- Regional Currencies in Germany: the Chiemgauer « Real Currencies | The Germany Site

- Ekonomi « Yasers hörna

- Pengar « Yasers hörna

- The Swiss WIR, or: How to Defeat the Money Power « Real Currencies

- Take your Money out of the Bank NOW! « Real Currencies

- Please support the Gelre! « Real Currencies

- Don’t hoard the Means of Exchange! (Part 1) « Real Currencies

- Social Credit « Real Currencies

- Social Credit « NESARA AUSTRALIA

- Mutual Credit, the Astonishingly Simple Truth about Money Creation « NESARA AUSTRALIA

- Is Social Credit the Answer?

- A Primer for Recovering Austrians: the many systems behind ‘violent statist fiat’ currencies! « Real Currencies

- Full Reserve Banking revisited « Real Currencies

- Interest-Free Economics « regionalcurrencies

- High Noon in Nicosia: what really went down in Cyprus? | Real Currencies

- Mutual Credit, the Astonishingly Simple Truth about Money Creation | seeds for natural justice

- mutual-credit-the-astonishingly-simple-truth-about-money-creation/ | dragon dreaming

- Is there enough money to pay off debt plus interest? A closer look. | Real Currencies

- The Daily Bell: Usurious Commercial Banking is Freedom, Interest-Free Government Money is Tyranny | Real Currencies

- Forget about Full Reserve Banking | Real Currencies

- Interest-Free Credit (including MPE!) and the Management of Volume | Real Currencies

- A Visit to Ireland | Real Currencies

- A Real Currencies Top Ten | Real Currencies

- How to manage the Volume of Money in Mutual Credit | Real Currencies

- Mutual Credit, the Astonishingly Simple Truth a...

- Mutual Credit, the Astonishingly Simple Truth a...

- Mutual Credit, the Astonishingly Simple Truth a...

- The Difference between Debt-Free Money and Interest-Free Credit | Real Currencies

- The Difference Between Debt-Free Money And Interest-Free Credit | Barnaby Is Right

- A Response to RealCurrencies | Economic Sanity

- Universal Expansion Group » Welcome!

- More on Mutual Credit | Real Currencies

- What Happened to the WTC Gold on 9/11? : The Corbett Report

- What Happened to the WTC Gold on 9/11? - RAW TRUTH

- James Corbett – The Corbett Report – What Happened To The WTC Gold On 9/11? – 5 August 2014 | Lucas 2012 Infos

- Corbett Report What Happened to the WTC Gold on 9/11?

- CIS – Does Rothschild own all Central Banks? | ronaldwederfoort

- For Men Money Mutual Account | bankloanmoney.com

- Install Money Mutual Loans | moneyargent.com

- Clearance Money Mutual Commercial | havenloan.com

- Free My Money Mutual | bankloanmoney.com

- Closeout Money Mutual Loan Repayment | moneystrive.com

- Get Money Mutual | moneycanwork.com

- Computer Tutorial Money Mutual Commercial | boobmoney.com

- letmoneyin.com: letmoneyin.com » Dependable Money Mutual

- Install Money Mutual Customer Service Number | moneydolla.com

- letmoneyin.com: letmoneyin.com » Closeout Money Mutual Loans

- letmoneyin.com: letmoneyin.com » Clearance Money Mutual Lenders

- Mutual Credit, the Astonishingly Simple Truth about Money Creation | HISTÓRIA da POLÍTICA

- Mutual Credit, the Astonishingly Simple Truth about Money Creation – HISTÓRIA da POLÍTICA

- Wederzijds krediet, de verbazingwekkend eenvoudige waarheid over het creëren van geld. – Nieuwsfrequent.nl

- Gilets Jaunes: Take your Money out of the Bank NOW! | Real Currencies

yes yes and yes,

That is what a Passive BIBO (stable)Currency standard is about. A monetary ruler anyone can carry in their pockets. No need to control the units, all that is required is that the transactions are recorded.

www,bibocurrency.org

Marc

Thanks Marc!

All money is credit in circulation. There is no need for collateral because the credit is a sacred expression of trust between a people. The trick is when a third party ie central bank pretends to have authority over that “credit” shared trust. Riddle for your thought. Why would you pay someone ie central banks interest to watch you borrow your own money from yourself? Thanks Rduanewilling

Hi Duane!

I’m quite sure that there will indeed be units that rely on trust only. In many respects the ‘softer’ the money is, the more effective it becomes.

I do, however, believe that, especially in the early phases of the transition, trust is not enough. I’ve come to understand the Germans, who like to say: ‘Vertrauen ist gut, Controle ist besser’ (Trust is good, control is better).

The point is that the 10% who don’t manage (or don’t want) to meet their obligations will disturb the rest.

Experience shows this even in small time LETS systems, where small communities (lot of social control) suffer from this phenomenon.

Rudenwilling..nice post..now we shoul ask what is it that jesus said to render to caesar? what duties are govts given exclusive jurisdiction over? What is it that govts deem to ‘lessen the burdens of government’? What is the opposite of commerce? Even if you are not a resident of a jurisdiction, what is the one act you perform that puts you automatically under the judiciary of that jurisdiction? In other words, we are giving a third party juriisdiction over our sacred trusts because we dont know how to operate them without burdening government.

What about the gap? How will LETS solve the problem of being able to repay that which is unrepayable? Producers will continuously need to rely on “someone” making up new credit to cover the outerwise-unrepayable B costs! I liked this idea when Tommy Kennedy came up with it a decade ago but he has never given me an answer to this question.

Unless you can show me how LETS can effectively deal with the Producer’s GAP, I am certain that it cannot succeed. Producers will not be able to liquidate their inventories because they will not be able to come up with money to meet their B costs. (i.e. they don’t pay it out in LETS wages so it is not there to cover the whole price) Only Douglas and Soddy thought this aspect through in their solutions.

Keynes acknowledged the gap but never addressed it or solved the problem. That’s why his model doesn’t work. Kennedy doesn’t even acknowledge the problem. Putting his head in the sand won’t make it go away.

Liam, could you please describe the GAP problem in your words? Preferably in a few sentences?

Thanks.

?if i understand your point. then: this “gap” problem is hidden as long as a particular system is recruiting new members (creating new credits), but would become very visible when the system is losing participants? i suppose an ideal system could keep growing until it is universal (or a member of a set of systems all of which are fully-convertible amongst each other), at which point the gap problem would disappear? [ps: what does the “B” stand for?]

We need to separate correct functioning of the money system from the question of social governance. A stable money system can be used in broke or prosperous economies, it does nothing to determine what happens it simply records transactions in a stable and accurate fashion and nothing that happens in the economy can interfere with its correct funcitoning. This is a fundamental issue, because the key function of measure that money provides requires that money be inert in order for it to be stable.. See: http://www.bibocurrency.org/English/The%20Scam%20short%20form.htm

If you read the Passive BIBO Spec here: http://www.bibocurrency.org/English/standard.htm, accounts can only be closed when they are null and the definition of Debt in @ (@ is the passive bibo currency unit symbol) it says the following:

Debt in @:

A commitment vis-à-vis the Community resulting from a negative Balance to continue delivering Wealth in the future through Transactions Accounted in @ until the Balance is no longer negative

Also rule number 3-b says: One can close an Account in @ provided the balance is null.

This means that settlement of commitment in terms of real value is left up to a separate social governance that may apply whatever legal measures to guaranty value remains in the community. One clear way of achieving this, is to require that the commitment represented by a negative balance be guaranteed by the patrimony of the account holder. But that is entirely the prerogative of the governance of the community in question.

This mutual credit sounds great. I want it for Ireland. We are paying out a fortune in interest charges here. I am interested to see the resolution of the B costs issue.

But, that aside, it is encouraging that there is a possibility to create money locally, and nationally. I want to do this in Ireland right away. We should create our own currency, using the Euro as unit of account.

With regard to B costs. My understanding of B costs is that it is all other costs aside from wages and dividends, which are A costs. Wages and dividends (A) go into circulation, to purchase production generally. But price includes (A) wages and dividends, plus (B) other costs. Therefore there is a gap between wages and dividends paid out in any time period, and prices required to buy what was produced.

This is referred to as the price gap in Social Credit.

The solutions to the price gap include a national dividend, a debt free and interest free payment made directly to households to fill the gap.

Thus (A) wages and dividends, plus the national dividend, are sufficient to meet the price of production in that period, without inflation or deflation.

The argument is, therefore, that a mutual credit system would also require a national dividend payment to fill the gap.

With the Passive BIBO Currency spec analysis it becomes clear that the only “B” costs in interest. The question of the lag in circulation which needs to be filled comes from looking at money as a thing that moves while in reality money is simply a record. Even when it is represented physically the pertinent attribute of money is the record that is carried from one account to another. Physical money comes by subtracting from one account carrying the positive ledger in one’s pocket until it past along and eventually is added to another account. What matters in money is the account not where the ledger is or how it is represented. In Passive BIBO we solve the “B” cost issue by allowing each transaction to generate its own numbers that later modify balances correspondingly.

I can understand a mutual credit system under ideal conditions: all participants are able to supply other participants with all goods and services that they need. Also, participants should have equity to collateralise their credit in case of non-supply of their personal services. Assets can then be liquidated to compensate document holders. Isn’t it expensive to get expert estimates on possessions? And to liquidate the assets in case of default? Also: how do you protect aginst forgery of notes–printing such secure paper instruments is extremely expensive?

How does a particpant buy an airline ticket if an airline does not paticipate? How does a participant get credit to buy a house? I accept the builder and materials’ suppliers may be participants but how can the manufacturer of the materials pay his expenses for raw materials etc

And what about payment for the house? It’s unlikely that participants business profits would be left in the fund to finance the purchase and it’s unlikely that the builder could wait for the buyers wages over 20 or 30 years to pay him. The builder needs liquidity to buy more materials to progress his business. At some point along the supply chain, there will be a company which wants paying in a recognised, current, international currency.

I am a supporter of such a scheme but until my questions are answered satisfactorily I am doubtful of the success of such systems. I do, however belive their can be a system created as an alternative to the bankster fiat currency. I have to say that any equity-backed system; such as a gold or silver-backed system is not what will liberate us from the banksters; they and their cohorts have got the lions’ share of these metals and it does not eliminate fractional reserve lending. Discussions like this on your site can put minds together to find the solution. I believe in the success of a system which allows credit aginst potential earnings of human beings. There are far more industrious, honorable and loving people in the world than criminals who would defraud us. The system can accomodate and make provision for this minority.

One major use of money is to capitalise business to bring prosperity, which will, in turn, enable expansion of the money supply to facilitate more investment in new business. I am sure a regional mutual credit system is adequate to facilitate exchange of goods and services locally but how can it provide capital for society to progress in building infrastructure and developing technology?

I am, eagerly, awaiting comments on my ideas.

Roger Manners

Gold backed currencies face the same problems: they are not accepted by all.

This is called ‘liquidity’: or what money will buy. That’s why it’s important to make Mutual Credit convertible to the national units. Please google (i’m in a hurry and can’t provide the link: convertibility Mutual Credit 21st century.

Roger,

More than anything it is a psychological issue, people have been brainwashed into believing that the current definition of money and money systems somehow makes sense and the problem is that we do not use the system properly. However that is simply not the case, the current system is provingly absurd starting with the very definition of money.

From a previous post:

….Here and in all BIBO Currency literature, money can only be defined coherently as a unit of measure represented by the @ unit, any other definition will render it useless for measuring wealth and its divisions. See: http://www.bibocurrency.org/English/standard.htm

Any two individuals can decide to perform a transaction and when they do, they mutually agree on a price where one side receives a positive entry and another a negative entry. At that very moment the number/money/credit is invoked i.e. money is “created”.

The math says that you can create any amount of money anytime anyplace and by anyone in this way (ASTA3 Requirements: http://www.bibocurrency.org/English/ASTA3.htm) etc, and the system will be stable if and only if the “outputs” negative and positive entries, never exceed the magnitude of the “input” (price). Furthermore and by extension, if all money is created in this fashion then the unit will also be stable by definition.

These are the only requirements for a stable money and money system. It is worth pointing out that the value and quality of the economy that emerges is not determined by the technical stability of the money but rather is determined by what people decide to transact, these two issues are confused when most people talk about money stability, but money design is one thing and economic management is another. All that can be said is that an unstable money system will destroy an economy but a stable economy is determined by what people freely decide to produce and using a stable money. That is stable money is not an end it is a rational means for providing liquidity i.e. measure value and its divisions.

What this means, is that what people call mutual credit is not only feasible it is the only scientific and logical way to guaranty stability of money systems and of their currency units. Put in other words the current system is 100% scientific bullshit (you can take that (along with the math) to the bank ;-)).

This is not because of how we manage the current design but because of how money is defined within the design . Basically the fallacy is that money can operate as a unit of measure as well as scarce commodity this definition is ontologically absurd (cannot be sustained rationally nor empirically) and by embracing this idea the function of measure is destroyed and the whole system becomes arbitrary nonsense.

To investigate the fallacy see this:http://www.bibocurrency.org/English/The%20Scam%20short%20form.htm

The question of guarantees and sufficient collateral is another issue also and should not be built into the money design as is today. It is a social governance issue and each community can decide what measures to take in order to deter abuse of credit etc., but it is vital to distinguish social governance from the technical and normative definition of money and money systems. This confusion has been greatly exploited to undermine the alternative money movement as a means for completely reforming money everywhere.

The fact is that mutual credit following to the bibocurrency standard IS infinitely more useful, stable, dependable and trustworthy than the dollar, euro, and any other currencies operating under the current de facto standard. Also it is absolutely accessible to all for any transaction. This is entirely from a scientific and logical perspective and backed by state of the art control systems and information technology theory and practice.

Marc

Dear Marc

Thank you for responding to my ideas. I cannot argue against most of what you have written; except your line which reads: ’the value and quality of the economy that emerges is not determined by the technical stability of the money but rather is determined by what people decide to transact’, I disagree with the idea that most people make decisions about what they transact because the vast majority of people on the planet don’t have the luxury of deciding what they transact: they exchange their labour for food and water.

Yorkshire men have a reputation of being blunt and I’d like to define ‘blunt’ in this context as meaning ‘A spontaneous reaction to something, expressed in fundamental, concise, language’. So, in my Yorkshire man way I have to say Marc: ‘You didn’t answer any of my questions and you went “Global” on money creation theory; I only wanted comments regarding mutual credit systems’.

The fraudulent money system in place now is not complicated; it seems complicated because we have all been born into a world controlled by the creators of the money, which has never encouraged us to analyze its origin and. In fact, has given us an education system which doesn’t talk about this subject.

It’s a bit like looking at monuments of war for the first time in our lives, showing glorious men killing one another along with the state of the art guns, bombs, planes etc; we take this as being normal and inevitable because there was no time before we were born for us to ponder or argue about this—it must be ok because all the clever people on the earth before we arrived accept the merit of war. Yet, what can be more disgusting than men and women decapitating and dismembering other men, women and babies. Of course, those clever people who were present when we arrived on the planet came the same way as we did—they accepted the conditions which their parents, before them had accepted all their lives .

It’s very misleading when people say ‘The banksters create money out of thin air’. This is simply not true: all money is backed by the labour of mankind—even gold: In most cases, the banksters credit your account with a number, which costs them almost nothing and, at some point, you have to work to get some numbers or banknotes from an employer’s account, in order to reduce the balance on your account to zero and that means., also, paying interest to the criminals who have been operating this fraud, dependent on war, deception, blackmail, threat of violence and murder, for millennia.

To conclude Marc: I do not recommend describing a new monetary system that you cannot explain to a 10 year-old child/Yorkshire man: after all, our current system is that easy to explain—You ‘borrow’ money which has no value until you sign to repay it and then, after you’ve spent it, you work to pay it back to the bank which created the money, that was backed by the collective labour of humanity. What did the bank contribute to the value of the spending power of the numbers or the banknotes? Nothing apart from negligible printing and administration costs and it’s that simple. The bank has stolen your labour with the complicity of your government, which legalized the fraud.

Roger,

You are right that in today’s world under the current false money paradigm a small percentage of people have any choice in what they produce or do economically. However, under a stable money system that everyone has access to as most people have access to rulers to measure length. that would change substantially. In any case, making decisions about what we do and don’t do or say or don’t say, or defend or don’t defend is really a question of consciousness, we will do whatever to survive limited only by what we believe is worth dying for.

5/8/2012

Folks,

Re: The Money Time Bomb

This discourse is the best I’ve read about fictional money. Congrats to all who have replied. However, we need to solve some problems first. We don’t want to carry around with us, heavy sacks of U. S. Minted coins; even paper dollars are becoming obsolete. We have the technology to convert entirely to electronic media — the best example being the “store” debit card. Most major stores have them and have the computer software to handle each transaction at a Point of Sale (POS) terminal. By using Debit Dollars, we solve the accounting problem and the mechanical aspects of the two-way conversion problems. Agreed?

The Federal Reserve note or the U. S. Treasury note or bond is a simple IOU – the promise to pay in the future with more fictitious money. Thus dollars represent value only if the issuer (FRS) or the U. S. Treasury (UST) (1) issues new fictitious money in exchange for old fictitious money and (2) the dollar’s purchasing power remains constant. We know that (1) is TRUE since the FRS and USA can simply hit a button and thus “print” money dollars. What is not true is (2). The FRS and UST have created a money time bomb by issuing fictitious money (Trillions) which inflates and thus devalues its purchasing power.

The only monetary system which works is one which is convertible in goods and services and is mostly constant in the exchange rate for those goods and services. Fixing the exchange rate to Euro’s or dollars simply repeats the same failure we find with Euro’s and dollars. Let’s invent our own monetary system – the “Leaf”.

Say one Leaf will buy a loaf of bread or a gallon of milk. Say my labor is worth four Leafs per hour as a day laborer. A doctor will charge 500 Leafs per hour for his/her services. The “value” of a leaf can be fixed by a survey of food, fuel – the “cost of living index” cast in Leafs. The index will change slowly over time or not. We solved the accounting problem with computers and we now have solved the convertibility problem, since we know how much a loaf of bread, a gallon of milk, etc, cost in dollars and Euro’s at any point in time. We will need to establish a national “cost of living Leaf index” (COLLI) with regional variations. A network of MCF’s will allow the monthly survey of the Leaf’s COLLI to be conducted automatically via the Internet and with regional variations.

Our last problem is how, mechanically, to provide vendors with the cash flow from Leafs into fictional sovereign currency. Banks have typically converted currency for a fee. At regional airports in Europe and at most major border crossings, there are money changes who do the same for a fee. We could create our own member-owned credit unions to do the same, or create physical barter exchange markets at which a money changer booth(which could be a branch of our Leaf Credit Union) can be established, complete with POS and connection to the merchant credit banking system. You should watch the really good explanation of how this works in Argentina at: http://www.youtube.com/watch?v=dsn_cCXHAvE

Now you understand why the Mercados de Trueque uses coupons. That market takes in Pesos and gives out coupons. We take in FRS “dollars” and give out our Leafs for a small fee. We put no restrictions on the use of Leafs and freely convert Leafs back into USD for a small fee. Thus, when a vendor, having sold goods and services, presents 1000 leafs, the money exchanger in the booth issues FRS dollars, less a small fee at the currently posted conversion rate. These small fees are what pays for the POS system and the people who run it. Essentially, the fees are split 50/50 between the customer and the vendor, since the customer pays the fee to convert from USD to Leafs and the vendor pays the fee to convert from Leafs to USD.

A discussion of Mercados de Trueque, would be incomplete without some way of bringing the buyers and sellers together in a physical location – a market. I propose we create physical facilities near a truck stop, a passenger rail stop, major bus terminals or in an abandoned warehouse or empty industrial building near transportation hubs. Large urban areas should have several while suburban a few and rural areas very few. We create a netwoked membership of farmers, ranchers, consumers and food co-ops. Each can name itself. I prefer the “Fair Trade Exchange of (your city or location)” (FTE)

Each FTE or groups of FTE’s will charge an initial membership fee of say $100 and a monthly fee of say $15.00. Further, each FTE will “sell” Leafs in sufficient amount to raise the funds for the lease payments for six months and the remodeling expense and some advertising expenses. In addition, the FTE rents floor space to the vendors for XXX Leafs per square foot per month. The USD’s collected in exchange for the electronic Leafs and/or floor space rents, will pay for the capital expenses. The monthly income from the membership fees plus the exchange fees will take care of the expenses of operating the FTE.

I would like to see each FTE deal exclusively in Fair Trade products and in Certified Organic products. It may take a while for that to happen, but we ought to set such trade as a main goal.

Each FTE can also be a flea market, a yard sale, a garage sale, a Farmer’s Market, a Plaza del Mercado, a delli, and a fuel station. For instance, I would set-up a “store” in a cubical along the inside of the perimeter wall in which to sell wood pellet-fueled stoves and boilers, plus the pellets in bags. I would also arrange for bulk deliveries to homes, stores and factories of the wood pellets. I could also offer to sell AND install a complete wood pellet heating and cooling system using a licensed HVAC or Plumbing contractor.

This long comment is necessary to bring the solution into sharp focus and lead us from the talk stage to the action stage. I invite comments here and emails to me.

Regards, Jim Miller; jimmiller5417@gmail.com

Sales taxes

You may have noted in the Mercados de Trueque [ http://www.youtube.com/watch?v=dsn_cCXHAvE ] video that the Argentine government allowed the markets to operate and grow to 1400 without taxation. Our USA States which collect sales tax, would not be so lax. We will be forced to collect sales tax and remit them to the State. The solution is simple. Each vendor “collects” the sales tax on each item sold by including the sales tax in the unit price of the item. When the vendor exchanges his/her/its collected Leafs, the sales tax is first calculated and deducted, then the exchange fee is deducted and USD is paid to the vendor on the balance at the then current exchange rate. The FTE then remits the sales taxes collect to the state, along with an digital list of the vendors paying the taxes and the amount paid by each vendor.

This way the State gets its tax revenue and will support the FTE’s, not challenge them. It will be hard for any Legislature or Governor to challenge this way of doing business among the voters. Most counties, cities, and school districts also take a bite of the sales tax revenue, so they will be in favor of FTE’s. Even the puppet federal office holders may get the message – don’t fool with the FTE’s. I would not be surprised to see many local and independent vendors copy our system or join it. The MegaMarketeers, with their proprietary company debit card system, will be left out in the cold.

Feel free to re-post this comment on all of the blogs dealing with new currencies. I invite comments here and emails to me.

Regards, Jim Miller; jimmiller5417@gmail.com

Why worry about fiat currency exchange rates?

The FTE currency exchange booth could post as many exchange rates as there are types of fiat currency. Heck, we could have an exchange rate for pints of Ripple. We could telephone each liquor store in the State or region, county, city or town, get their price for a pint of Ripple, then average the prices and get the exchange rate. The paper bag would not be counted. See Wikipedia’s discussion on digital currency exchanges: http://en.wikipedia.org/wiki/Digital_currency_exchanger

Feel free to re-post this comment on all of the blogs dealing with new currencies. I invite comments here and emails to me.

Regards, Jim Miller; jimmiller5417@gmail.com

California Regulations:

California enacted the Money Transmission Act which requires a license for certain classes of money transfer. Unless exempt, an applicant (corporation or LLC) must pay a $5000 application fee and have $500,000 of net tangible equity. (CA Financial Code §2030). A federally chartered credit union is exempt. (CAFC §2030 (d). Therefore, it would be in the best interests of the FTE to become an unlicensed agent of a federally chartered credit union. As an alternative, the CU could establish one of its branches in the FTE.

Later on, if the FTE bought the building and had $500,000 of equity in the building, then it would qualify for a license. By that time it would have yearly audited financials which it could supply to the CA Dept of Finance. It would also make sense to become an unlicensed agent of a credit union because of the need to access the merchant banking system to enable members to purchase Leaf using their bank or CU cards. The rub is that the credit union must agree to be liable for the actions of the unlicensed agent.

We might also consider the goal of establishing our own credit union which would then establish a branch CU office in each of the networked FTE’s in the State of California.

For a discussion of the new law, read: California’s New Money Transmission Law

http://josephandcohen.com/2011/05/californias-new-money-transmission-law-sweeps-up/

Feel free to re-post this comment on all of the blogs dealing with new currencies. I invite comments here and emails to me.

Regards, Jim Miller; jimmiller5417@gmail.com

If you understand the very primitive LETS, you basically understand how money should work. It really is that simple.

Jct: Local Employment-Trading Software is really just time-based poker chips where you pledge Hours of labor to Hours of tokens or Greenmoney linked to the Hour in your national currency. And the United Nationsl International & Local Employment-Trading System UNILETS Millennium Declaration C6 for a time-based currency is global.

Actually what we have proven mathematically at http://www.bibocurrency.org, is that mutual credit is the only way to obtain a stable unit of economic exchange, because the requirements for stability are:

1) The units must be generated by transactions

2) The transactions must BIBO stable

The Stable Currency Unit Theorem states:

A Passive BIBO Stable Money System by definition implies that all of the system’s component Transactions are also necessarily Passive BIBO Stable. Therefore, it directly follows that if every Transaction is a Passive BIBO Stable process and all money created is necessarily a product of such Stable Transactions, then all such money maintains a Bounded ratio with all system inputs i.e. units are stable by definition!

Which means that you don’t even need to provide a fixed numèraire if those two simple requirements are met.

But remember making money stable the question of accessibility is no longer as it matters not:

· who performs the Transactions that generate the Currency

· when the Transactions are performed

· what Wealth is Transacted

· why we Transact the Wealth

· how many units are generated

ALL THAT MATTERS IS THAT THE TRANSACTIONS THAT GENERATE UNITS ARE PASSIVE BIBO TRANSACTIONS. ABSOLUTELY NOTHING ELSE MATTERS!

This sounds great and it is compared to the nightmare conventional money creates. But, we have to keep in mind that we will have to provide the social governance that the money system was providing as a stable money precludes its use as a means of control of the economy.

Correction the second requirement should read:

2) The transactions must Passive BIBO stable

“Give me control of a nation’s money supply, and I care not who makes its laws.” –Rothschild

Just print up your own money exclusively for your friends/family/community.

Hitler did the same(Reichsmark). Abraham Lincoln did the same(Greenback).

https://en.wikipedia.org/wiki/Greenback_%28money%29

https://en.wikipedia.org/wiki/Reichsmark

Francisco “Pancho” Villa did the same. When the feds defeated him it became worthless.

Reblogged this on Irish Tory.

“Every participant is given an account and credit. Let’s say 1 Unit = 1 Dollar….. Let’s say every participant gets a 1000 Unit credit….. ”

Who is the authority that initially creates my account? I want to talk to him, someone made a mistake, my intial credit should be a trillion units, a thousand is only for the peasantry.

You are a peasant!

Run you’re own system if you want to be God!

Every participant is given an account and credit. Let’s say 1 Unit = 1 Dollar….. Let’s say every participant gets a 1000 Unit credit….. ”

a) Who is the authority that initially creates my account?

Jct: http://facebook.com/john.turmel/info has my “open credit” line where I create the credits in my account. So you could too if you could trust yourself to keep it honest.

I want to talk to him, someone made a mistake, my intial credit should be a trillion units, a thousand is only for the peasantry.

Jct: Okay, so nobody would trust a guy claiming a billion in credit. Though both you and I have a trillion hour credit line in a UNILETS, an open credit line, of course, over your actual lifetime, you may only have 50 years * 2,000 hours worth of work in you, 100,000 hours, so before the yacht manufacturer considers selling you that 1Million Hour yacht, he’s going to look at your account to see whether he wants to deal with you.

Of course, the peasant is making his 1 or 2 Hours per hour, and Lady Gaga is making 10,000 Hours per hour, so what is it about your shingle with your open credit line that would make you nervy enough to try to say you could pay for a Million Hour yacht? Oh, we gave you the credit so you’re going to use it whether you can pay it or not? LIke I said, no one’s going to trust someone claiming a billion hours.

See, as long as you think in terms of “dollars,” you can go off on irrational tangents like you’d want take your billion out and walk around with it. Sure, okay, here are 2 big suitcases full of your billion credits, walk around with them all you want but it’s still going to cost you a tenth of a credit for a coke. After a while, you’ll realize how stupid it was to take out and lug around all those credits you didn’t need but simply demanded because you thought walking around with your billion credits would make you better than the solid-working peasant walking around with a thousand.

Roger James Manners: I can understand a mutual credit system

under ideal conditions: all participants are able to supply

other participants with all goods and services that they

need. Also, participants should have equity to collateralise

their credit in case of non-supply of their personal

services. Assets can then be liquidated to compensate

document holders. Isn’t it expensive to get expert estimates

on possessions? And to liquidate the assets in case of

default? Also: how do you protect against forgery of notes-

printing such secure paper instruments is extremely

expensive?

Jct: In your open-for-inspection UNILETS timebank account,

the equity is the manpower of the borrower to produce work

energy. No other asset is needed. Besides, if you bought a

20,000 Hour home ($200,000US), the house would be the equity

backing up those chips, not your promise. Those assets could

be liquidated should you die.

As or expert estimates, they aren’t needed since the credit

line is based on manpower, not the asset’s estimated value.

Besides, it can start at the price you bought it for, minus

depreciation and plus improvements.

We can protect against forgery and fraud by putting crooks

in jail, the same way every government protects its chips.

Though I haven’t noticed the Taj Mahal suffering any

counterfeiting of their chips. And if that’s still a worry,

don’t use your paper check, use your online account to do an

online trade. Now no one can game it. So online for big

transactions, paper tokens for small.

RJM: How does a participant buy an airline ticket if an

airline does not participate?

Jct: How to do a deal with someone who won’t deal? You’re

right. If they won’t deal, we can’t do a deal. Or we can

find a friend with some government chips who’ll trade for

your local ones so you can use the government ones with the

guy who’d rather buy his tomatoes with FED money than Local,

though it’s the same tomato. Anyway, those businesses who

refuse to take barter tokens will get less business than

those who participate should deservedly go broke. But yes,

if the airline won’t take our chips, we can’t use our chips.

Good point. So we can only do deals with people willing to

do deals. But then again, the benefits we gain from

establishing a LETS to do deals ourselves does not really

suffer from the refusal of some businesses to not

participate. The more barter we do, the better. Are you

saying that because we can’t deal with the airline, we

shouldn’t deal with ourselves?

RJM: How does a participant get credit to buy a house?

Jct: By emailing a 20,000 Hour IOU to the owner. Have you

forgotten, you create it yourself.

RJM: I accept the builder and materials’ suppliers may be

participants but how can the manufacturer of the materials

pay his expenses for raw materials etc.

JCT: Doesn’t it depend on whether the Mr. Materials is

taking barter bucks. When the Russian banking system crashed

in the 1990s, 25,000 corporations paid each other and

employees in their own tradeable checks. Of course, if one

manufacturer insisted on being paid in official rubles when

there were none, traders looked for someone else and the

idiot went under. Maybe you’re right. If we can’t barter

with everyone, how can bartering with 90% help?

And what about payment for the house? It’s unlikely that

participants business profits would be left in the fund to

finance the purchase and it’s unlikely that the builder

could wait for the buyers wages over 20 or 30 years to pay

him. The builder needs liquidity to buy more materials to

progress his business. At some point along the supply chain,

there will be a company which wants paying in a recognized,

current, international currency.

JCT: Right, at some point, one Russian company decided they

wanted payment in government rubles, not corporate rubles.

So what, everyone goes to his competitor using the

alternative currency and the idiot demanding scarce rubles

goes broke. Now that I think of it, maybe there wouldn’t be

so many stupid people doing what you suggest.

RJM: I am a supporter of such a scheme but until my

questions are answered satisfactorily I am doubtful of the

success of such systems.

JCT: And if you can be doubtful despite the thousands of

successful LETS around the world, then I’m sure your

question will never be satisfactorily answered. If the fact

it works can’t convince you, what else can?

RJM: I do, however believe there can be a system created

as an alternative to the bankster fiat currency.

JCT: So you do believe an alternative can be created but

haven’t yet figured out how it would work despite looking at

thousands of LETS working models.

RJM: I have to say that any equity-backed system; such as a

gold or silver-backed system is not what will liberate us

from the banksters;

Jct: LETS is an equity-backed system, the equity being

labor, and it will liberate us.

RJM: they and their cohorts have got the lions’ share of

these metals and it does not eliminate fractional reserve

lending.

JCT: No one’s suggesting we go to yellow rock here. So don’t

go there.

RJM: Discussions like this on your site can put minds

together to find the solution.

JCT: The point is some of us have found the solution while

you’re still looking. Evidently, you don’t see UNILETS as a

solution despite the fact it works.

RJM: I believe in the success of a system which allows

credit aginst potential earnings of human beings.

JCT: And you didn’t notice that that’s exactly what UNILETS

timebank does?

RJM: There are far more industrious, honorable and loving

people in the world than criminals who would defraud us. The

system can accommodate and make provision for this minority.

JCT: My point exactly, You’re’ the guy worrying about paying

back the debt and criminals, not me.

RJM: One major use of money is to capitalize business to

bring prosperity, which will, in turn, enable expansion of

the money supply to facilitate more investment in new

business. I am sure a regional mutual credit system is

adequate to facilitate exchange of goods and services

locally but how can it provide capital for society to

progress in building infrastructure and developing

technology?

JCT: What’s the difference between chips issued for

exchanging small goods and services but not for large. I

think King Henry had big tallies to build roads and small

tallies to pay workers.

RJM: I am, eagerly, awaiting comments on my ideas.

Jct: I only responded because there were too many things

that needed to be handled. But if working models don’t

convince you LETS works, I doubt anything can.

Liam B Allone: What about the gap? How will LETS solve the

problem of being able to repay that which is unrepayable?

JCT: How does one solve and unsolvable problem? You’ve got

us there. We can’t solve the unsolvable problem either.

Unless it’s only unsolvable to you. So let’s see what’s so

unsolvable?

LBA: Producers will continuously need to rely on “someone”

making up new credit to cover the otherwise-unrepayable B

costs!

Jct: I thought it had been explained that when everyone had

a timebank account, they would be the someone making up the

new credit to cover the “otherwise-unrepayable B cost.” You

must be talking about Major Douglas’s A/(A+B) theorem where

A=Principal of money in circulation and A+B are the prices

trying to recuperate the Principal + Interest + other

expenses in the prices. Notice the Principal and other

expenses demanded in the price are all paid out to other

businesses and governments which will spend them back. Only

the interest was never created or paid out. Only the

interest is the flaw. So if the only B cost is I, then

Douglas’ A/(A+B) theorem reduces to Turmel’s P/(P+I)!

Notice I said “B cost,” because that was Douglas’s big

mistake in his social credit analysis. The only true B-cost

is the interest, all the others, taxes, overhead, do not

cause a shortage of money. Regardless, even if all his costs

were costs, our ability to command our interest-free credit

provides the tokens to handle the current shortage.

LBA: I liked this idea when Tommy Kennedy came up with it a

decade ago but he has never given me an answer to this

question.

JCT: I have. People’s credit can cover any imbalance caused

by the other non-instability costs you worry about.

LBA: Unless you can show me how LETS can effectively deal

with the Producer’s GAP, I am certain that it cannot

succeed.

JCT: And now that you’ve been shown that the gap between A

in the numerator and the A+B in the denominator, that gap

being the B costs, is only the interest cost and since LETS

has done away with the interest cost and only commands a

service charge, there is no gap. Then again, Douglas would

have called the service charge a B-cost, again proving the

other B-costs than interest are not instabilities.

LBA: Producers will not be able to liquidate their

inventories because they will not be able to come up with

money to meet their B costs. (i.e. they don’t pay it out in

LETS wages so it is not there to cover the whole price) Only

Douglas and Soddy thought this aspect through in their

solutions.

JCT: Yes, if the problem really existed, it would be a

problem. But since the gap does not exist, it isn’t.

LBA: Keynes acknowledged the gap but never addressed it or

solved the problem. That’s why his model doesn’t work.

Kennedy doesn’t even acknowledge the problem. Putting his

head in the sand won’t make it go away.

JCT: Maybe Kennedy didn’t acknowledge the problem because he

knew is wasn’t a problem but didn’t want to take the time to

correct you.

Anthony Migchels: I’m quite sure that there will indeed be

units that rely on trust only. In many respects the ‘softer’

the money is, the more effective it becomes.

I do, however, believe that, especially in the early phases

of the transition, trust is not enough. I’ve come to

understand the Germans, who like to say: ‘Vertrauen ist gut,

Controle ist besser’ (Trust is good, control is better).

JCT: So who’s IOU for an hour of labor do you think should

not be trusted. A poor child? Why trust him? So how to you

expect a starving African orphan to meet your trustability

threshold?

LBA: The point is that the 10% who don’t manage (or don’t

want) to meet their obligations will disturb the rest.

JCT: First, I don’t think I’ve ever heard of someone

stiffing a timebank for the hours owed. But presume it is

10% of humans who can’t be trusted to return the time their

friends in their circle loaned them. Actually, I doubt it’s

that high who will lose the esteem of their friends by

stiffing on time owed. But let’s go on and presume that 10%

have stiffed on their first 100 or 1000 hours of IOUs and

won’t work them off and now no one will deal with them any

more.

How does having those 10% of the database sitting idle

disturb the rest of the game? Are you saying that because

they were sitting on some questionable IOUs, they stopped

using their good ones? Lenny stiffed the group, we’d better

stop trading and get back unemployed to avoid being stiffed

by someone else for a few hundred hours.

AM: Experience shows this even in small time LETS systems,

where small communities (lot of social control) suffer from

this phenomenon.

JCT: Actually, LETS experience has not shown many stiffs for

time owed. A guy who’ll stiff you for a scarce $50 bill

won’t stiff you for an abundant 4 hours of labor too often,

especially if his credit line dies in the eyes of his peers

if he stiffs.

Hi Anthony,

I support Positive Money, which is a pro full reserve organisation in Britain. I’ve written several articles for them.

One of the arguments PM puts for full reserve is that under full reserve the only money in circulation is money created interest free by the government / central bank machine. So that amounts to the same thing as your Mutual Credit suggestion, doesn’t it?

Another idea I have for you is that to the extent that a fractional reserve system simply engages in money creation (as opposed to lending) they don’t or wouldn’t charge interest: they’d only charge administration costs, plus the normal sort of profit any business expects to make.

I.e. suppose a population wanted money, but didn’t want to borrow (at least not from banks), individuals in that population would open accounts at banks, ask banks to credit their accounts with money and pledge assets to back the money so credited.

But that is not a loan in the normal sense: that is asking someone (the lender) to forgo consumption so that the borrower can spend. That is, banks in that scenario would not need to pay interest to anyone to “obtain” the money, so there is no reason they’d need to charge interest to “borrowers”. They’d just charge administration costs.

My blog is: http://ralphanomics.blogspot.co.uk/

Also, could you let me know what pro-full reserve organisations there are in your country? The people at Positive Money like keeping in touch with what is going on in other countries. Thanks.

Take a look at the following: http://www.bibocurrency.org/English/DebunkingMoneyPsyOpV1.0.htm and http://www.bibocurrency.org/English/SimplePassiveBIBOLiquidityMessageV2.0.htm. Money is not a thing that circulates. Its only possible rational function is that of an annotation of value. We don’t money control we don’t need central banks, all that it part of the money psyop.

That’s what the science says anyhow.

Hello all,

thx for the article.

There is no need to have 2 sides: + and –

Because then you create twice the ‘distance’ instead of once.

As one person already offered something (food by example), then only the needed money for it needs to be created on the spot. That’s all. You can agree together by example that everybody can do that unto a max each month, this creating of money. And with each transaction, you let dissolve automatically a part of this amount again. By example 1/1000.

By freeing the thinking about money, seeing that she is the expression now of Given entrance to something, the old paradigm totally collapses. So money is the Result of the receiving/giving moment. It is created By the moment of receiving/giving.

This also means that facilitating our money also comes in a total different area.

Money-place.net works that way.

Well, there is giving and taking. The producer gives, the consumer takes. Debit and Credit are expressions of this.

There is nothing wrong with giving and taking. People desire balance in it. Adults do, anyway.

Of course,there are many human relations where this is not so. For instance: the parent gives, the child takes. It can never really reciprocate. Just like a teacher gives and a student takes. However, a parent once was a child and a child will be a parent later. A student is the teacher of tomorrow. Money is not really part of these relations.

But in the economy, where we exchange labor, goods and services, debit and credit simply represent the taking and giving.

This is very interesting, You’re a very skilled blogger. I have joined

your rss feed and look forward to seeking more of your wonderful

post. Also, I have shared your website in my social networks!

Thanks for your efforts to increase money consciousness. Personally I think that another currency cannot be a sustainable solution to global money issues. I think stronly that people should be educated about the true money game. The true money game isn’t gold, sliver, shares, jobs… The true money game is CASH FLOW. As long as 97% doesn’t know the real name of the game, their CASH will always FLOW to the 3% who does know the rules of the game! So the answer is EDUCATION, so more people can and will be entrepreneurs to offer great services to the world and exchange services, products and knowlegde. And more people can be aware of the money tricks like taxes, interest and monthly fees for overpriced services. Learn to take better care for your money and your money will take care of you!

In the meantime the mass needs an honest currency which a proper government is perfectly capable of providing.

I really appreciate your blog..i have been reading a lot about the money system and the issues people have with interest or usury and the solutions people are proposing….i like the mutual credit model you have explained..however i disagree with everyones general views on interest/usury and that it serves no real purpose..on the contrary i beleieve it is gods way of demonstrating to someone what it is like to be denied the ability to serve god which in essence is to serve your brothers. The fact people get into debt is to serve emotional wants and desires which then spills out into business and then government..but it all begins with us…..if everyone paid their debts there would be no money left and the banking system would dissappear as there would be no uae for it..but also the economy would stop..if people really wanted to they could crush the banking system by paying off every debt and then refuse to partipate in anything related to economics…the point being the banking elite know and understand peoples subjective weaknesses and actually believe by charging interest are doing gods work….if we want change it must be done on an individual basis which takes a thorough understanding of many subjects including law and religion…but your mutual credit model has merit within this individual change….thankyou

Thanks Dingo!

Yes, our enslavement through Usury is a symptom of a deeper malaise: original sin. Our disobedience to Spirit. Usury is the price we pay for worshipping Mammon, for our fear of power, instead of faith in the One.

It’s also symptomatic of the spiritual disease of egotism: ‘I wouldn’t lend without interest’ in fact means: eat shit, go the rich for a loan. The implication is: I’ll eat shit too and be an interest-slave for all my life, if only I have a 0,000001% chance of being rich one day myself and being able to put my boot on everybody’s elses face with usurious debt.

Mutual Credit is impossible without a basic understanding that we are brethren and must cooperate by accepting our mutual promise to pay.

Usury is impossible with this understanding.

Mutual Credit is impossible without a basic understanding that we are brethren and must cooperate by accepting our mutual promise to pay.

Do you think its possible for everyone to change at once or that its more likely each of us has to choose our own path individually? Are we all really ready for a money system built on trust?

Build a bridge and people will cross it. Build a road and people will follow it. As President I would trigger a welfare revolution by abolishing welfare and phasing in a guaranteed basic income for every man, woman and child.

Great ideas here! Although I like some of the factors on mutual credit, especially the fact that “The creditworthiness of participants is much higher than with banking, because debtors are not burdened with interest.” But still I think that a new currency system is not the best solution to global economic crisis. For more related infomation visit bankruptcyexpertscairns.com.au.