Inflation? Deflation? Stagflation?

Inflation is one of the Internet’s favorite buzzwords. But what are we really talking about? There’s more to it than most think.

Two common misunderstandings obscure the issue: mixing two different definitions and ignoring the different behavior of inflation in different monetary systems.

The first issue is fairly well known: there are two commonly used definitions for inflation.

The classical definition for inflation is a growing money supply.

The ‘modern’ definition is rising prices.

The classical definition is much better. Inflation may or may not result in rising prices. And, as we will see, in today’s system the rising prices are not caused by inflation.

A different thing in different systems

The second thing to keep in mind is that inflation means different things under different systems.

In a debt free system, simple money printing and spending into circulation a la the Greenback or Social Credit, the situation is the most straight forward. When the economy is operating at near maximum capacity adding more money to the money supply will lead to rising prices. If the economy grows, more money must be added to finance the additional trade and maintain full employment.

In our current system the situation is far more complex because there is interest on the money supply and this leads to all sorts of unexpected and counter intuitive side effects.

The basic problem is that if there is interest there is never enough money to pay of the debt + interest, because only the debt is created. Mathematically perfected economy™ provides us with the basic math.

It looks like this: P + I > P where P is the Principal and I is Interest.

What this means is that the demand for money is always more than there is in circulation. If P = 100 and I = 5% then P + I = 105, while there is only 100.

Thankfully the banker is kind enough to lend us the 5 to pay the interest also. Which means that after a year the money supply will be 105. But the demand for money will be 105 + I. etc.

This means inflation according to the classical definition. But do prices rise? No, because the effective money supply remains the same: all the extra money is just being created to pay off the interest.

So interest on the money supply has a deflationary effect. When the money supply is paper based, the banker can create new credit to finance interest payments, but that extra credit in turn will require debt service also.

With a Gold Standard the situation would be much worse: because the bankers would not be able to create extra Gold to pay for the interest, there would be eternal deflation because of ever higher interest costs on the circulating Gold, leaving ever less for normal trade.

So in our current system inflation is inevitable, but we do not expect rising prices because of a growing money supply. The money available for trade remains stable while the money supply itself grows.

Still we have seen that the Dollar has lost 97% of its purchasing power since 1913. So how can this be?

Well, since the money supply is interest bearing debt and since the money supply grows, the cost for money must grow also. And this is what is driving up prices all through the West: ever higher cost for capital as a result of an ever growing money supply.

At this point costs for capital already account for 45% of prices we pay.

This also explains why we must have economic growth every year: it is to pay off ever more interest. If the economy does not grow, we would see real incomes decline. In fact, over the last few decades, since the end of the post war boom in the late seventies real wages have been declining throughout the West. The reason being that the economy grows slower than capital costs.

Recapping: we have inflation in the classical meaning of the word, but this is not causing prices to rise as the effective money supply available for trade remains the same. Prices still rise, but this is not the result of inflation, but because of ever more interest payed over an ever growing money supply.

The Current Depression

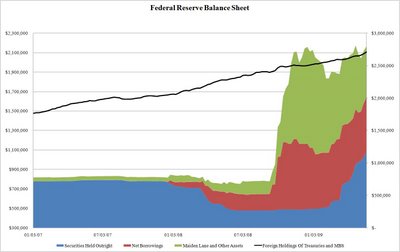

So what is our current situation? Are we facing (hyper) inflation? The standard case for hyperinflation is this graph:

This is the Fed Balance Sheet: it certainly suggests massive expansion.

This is the Fed Balance Sheet: it certainly suggests massive expansion.

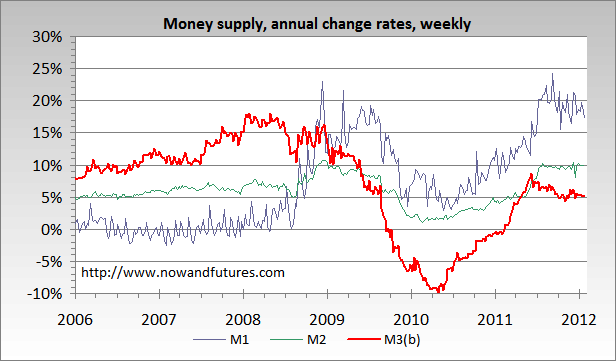

But here’s the graph showing the growth of the money supply:

As we can see M1 (cash + liquid assets) started to grow rapidly in the aftermath of Lehman’s demise. But M3 (a wider definition of the money supply, including assets harder to liquidate) started tanking badly. Even today it is growing much slower than before the depression began. And how about this graph:

As we can see M1 (cash + liquid assets) started to grow rapidly in the aftermath of Lehman’s demise. But M3 (a wider definition of the money supply, including assets harder to liquidate) started tanking badly. Even today it is growing much slower than before the depression began. And how about this graph:

This is the velocity of circulation. The real money supply is money times circulation and slower circulation means a smaller effective money supply.

This is the velocity of circulation. The real money supply is money times circulation and slower circulation means a smaller effective money supply.

This is why the Fed started printing extra money, leading to an expanding M1: the real monetary base as expressed with M3 was declining and a horrible contraction of the economy would have resulted without the Fed’s interventions.

When we look at prices, we get conflicting information. Paper assets and real estate are much down since 2008. But prices for food and energy are rising. Meanwhile the economy is tanking. This combination is known as stagflation.

Asset prices are down due to a contracting money supply as seen in the stats. Rising prices in the primary sector are explained by speculation on the commodity markets, driving up prices. These price rises are passed on throughout the supply chain. But this is not inflation: it is not a growing money supply that is causing these price rises, it is artificial demand created by Hedge Funds and the like.

Current Government reports on inflation suggest there is no problem. The Fed says inflation is about 2%. But its figures are unreliable: over the last decades the methodology to calculate the CPI has been manipulated to show lower numbers. Shadowstats, using the old ways, reports inflation of about 6%. This is relatively high, but still not quite hyperinflationary.

For the time being we can expect rising prices for our daily needs, while assets will continue to be depressed. In the longer run the question is whether the Fed can take the extra liquidity it created out of the system when velocity recovers. If it can’t we can expect more rising prices. But as long as the economy remains depressed as it is, we will have a combination of deflationary pressures in the domestic economy as a result of limited lending by the banks, combined with upward price pressures due to speculation on the commodity markets.

So why is Gold rising?

Normally speaking Gold would be depressed during deflation. So why has it been appreciating so much? Clearly it’s not just a hedge against inflation: it has appreciated too much for that.

The point is that Gold is regaining monetary status and more and more people are betting it will be money again. Demand for Gold will remain high as more and more nations are abandoning the Dollar as their medium of exchange for international trade. This in itself brings even more inflationary pressures for the dollar, as more and more of them are repatriated as they are no longer needed for international trade.

Conclusion

We don’t have inflation because of ‘irresponsible politicians’. In fact, if we look at the growth of the money supply since the War and correct it for the extra liquidity created to pay the interest, it was probably about 40%: not even enough to finance extra production through economic growth.

This sheds a different light on the popular claim that ‘politicians are debasing the currency’ or on the notion that fiat currencies are per definition inflated into oblivion.

Prices have been rising not so much because of inflation, but due to rising cost for capital.

This suggests a normally functioning currency board monitoring a non-interest bearing money supply should be able to manage the money supply effectively and maintain stable prices.

Currently the situation is more complex: there is a combination of both inflationary and deflationary pressures. Prices seem to be rising for food and energy, while assets remain depressed.

It is not rampant printing, but speculation in commodities and dollars being brought home because they are no longer needed internationally.

These conflicting trends make the situation obscure and it is difficult to make real predictions. Hyperinflation seems unlikely for the time being, but purchasing power will continue to decline for most people. Assets are declining in value, while the prices for our daily groceries and fuel and increasing.

Declining purchasing power and economic activity will continue until the Money Power has achieved its goals or until we find other ways.

Related:

Phoenix Rising, the Return of the Gold Standard

Why Gold is so strongly deflationary

Stagflation explained……..at last

Why is Gold appreciating?

Dealing with Inflation

Let’s say you’re a musician. You want to borrow. You want a new guitar. If I have a vault full of gold, you come to me for a loan. I give you 10 coins which you in turn trade for a guitar. You agree to give me back 1 coin per month for 11 months for a total of 11 coins. After the first month payment of one coin, I give you back that coin, that you just gave me, to play at my lavish wedding. You give me back that coin at you’re next payment to me. At the end of the month, I now have my ten coins, plus you played at my wedding. Why would you have to work for me when you could have used paper to acquire the guitar and not pay me anything? Times this scenario by billions. They don’t create the interest, you do.

Thanks for another fine article Anthony and I think you are right, it is deflation\stagflation that we need to be most concerned with as it is an inherent and inescapable problem with the privately owned interest-debt money systems that oppresses humanity today.

When one recognizes that virtually all money is temporary, the deflationary concerns become clear. Money is created by debt and as the principal on that debt is repaid, the money is destroyed. Money lasts only as long as the duration of the loans that create it.

Every day money is destroyed and new money must be created in order to keep the money supply from contracting. And, interest must also be paid which means that an ever increasing of new debt must be taken on just to maintain the money supply.

Our system would very quickly implode so government has stepped in to extend the pyramid scheme by borrowing huge amounts of money and never repaying the principal. Without the national debt we would have collapsed many years ago. The national debt, left unpaid, is a form of permanent money (money that doesn’t self extinguish) that can be used to repay other debt.

Of course, this is a temporary extension as sooner or later, the national debt becomes impossible to sustain. We are at the point where nation states can no longer sustain or roll-over the debt which will lead to a depression that will make the “great depression” look like a cakewalk.

Larry Larkin

Larry, there is no national debt. You can’t create more debt by transferring debt($). They want you to believe you have to buy back bonds. You don’t. The buyers of government bonds own worthless paper. I know it would be hard to convince anyone of this considering – We live in a world where someone will trade a house for a bunch of paper. The person who lives in the house now got the paper from a guy who chopped down a tree and made some paper. Now, the guy who lives in the house will give the guy who chopped down the tree a large percentage of everything he produces over his lifespan.

philo, the national debt is real and you can verify this at the following site:

http://www.usdebtclock.org/

If we didn’t have a national debt, there would be over $15 trillion less money in existence. What impact do you think that would have on inflation/deflation? Do you think people would have a more difficult time paying their bills?

I’m aware of that conditioning/propaganda site. But, as you were alluding to in your previous comment, there is less money because the bank has not facilitated new loans as old loans were extinguished. How much money there is has nothing to do with the national debt. That was created to push austerity. They can expand the cash supply any time they want. Inflation is mainly caused by people defaulting on loans of currency that didn’t exist before it was borrowed.

@philo What if your guitar was out of tune, causing embarrassment at the wedding? Could the lender cause you to default on the loan by restricting the money supply, therefore transferring the guitar to the lender as collateral? In that case, the lender could re-inflate the money supply causing the guitar to rise in value above the original 10 coin loan. This one way transfer of actual guitars between the people your not allowed to talk about and the gentiles exists whether interest is created by you or not.

Eventually the amount of guitars in circulation will exceed the people actually able to reasonably play them causing a complete economic meltdown, at which point the Bankers will introduce the new currency: a microchip implant.