Social Credit

(left: Clifford Hugh Douglas, the brilliant economist who invented Social Credit)

Social Credit is one of the main achievements of the 20th century in terms of monetary innovations. It solves poverty and depressed economies and provides a basic income to all. It reclaims the currency monopoly in the hands of the banking cartel, without centralizing power in State hands.

By Anthony Migchels for Henry Makow and Real Currencies

Social Credit was developed by Major Clifford Hugh Douglas, who penned a book with the same name in 1924.

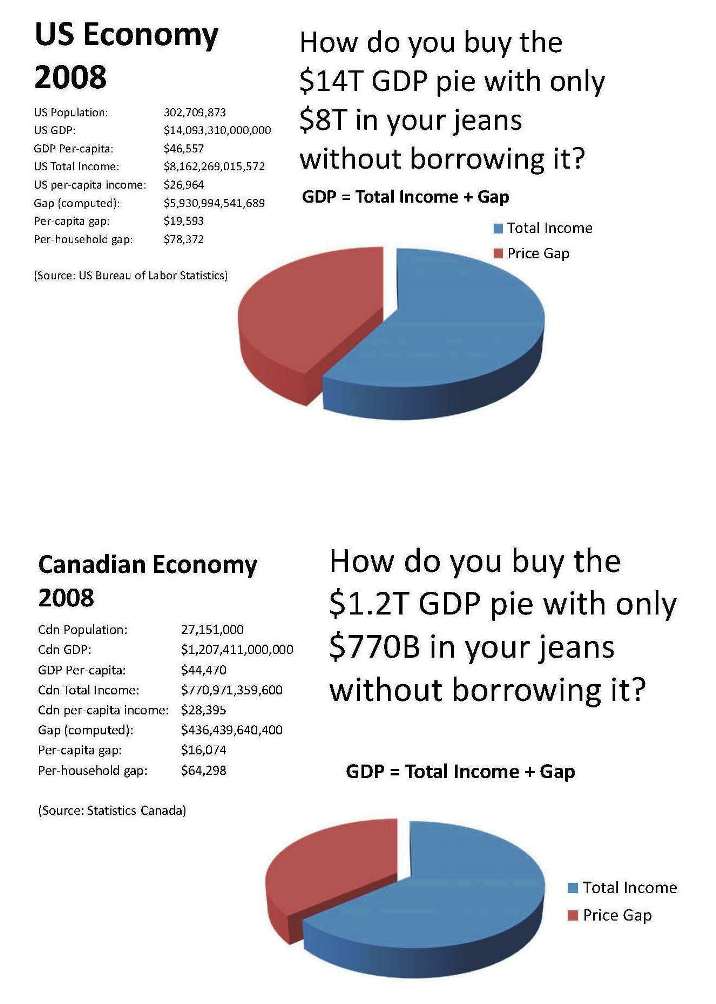

Its major breakthrough in terms of economic understanding is the so called ‘Gap’ or the A + B theorem. This refers to the gap between total income and total value of production. The latter being always higher than total income. As a result, society never has enough income to mop up all of its own production. Not only does this lead to depressed economies and to ever mounting debt to compensate for this lacking purchasing power, it also creates a strong incentive for corporations to look for markets elsewhere.

The Gap is a crucial notion. It is undeniably true that there is a structural lack of purchasing power in the economy. This is fundamental part of structural unemployment, for instance. Please see the diagram below the article for quantification of the gap.

Douglas also noted another trend in the economy: automation. He foresaw a time when many people were basically no longer necessary in the production process. These people are called the useless eaters by our masters, but Douglas, being a real human being, understood that production serves consumption and that the economy exists to feed the people, not the other way around.

To solve the problem he came up with an eminently practical and simple solution: let the Government print debt-free money to be spent into circulation by the people. Everybody should get an equal amount of money, whatever their income or asset position. The amount of money to be printed should equal the lack of purchasing power in the economy. If this is done correctly, it could be done with stable prices: the inflation in terms of a growing money supply would serve to buy up production for which there are insufficient funds available and thus would not lead to price pressures.

In this way Social Credit is associated with a Basic Income or National Dividend, both of which, incidentally and surprisingly, were supported by Mont Pelerin Alumni von Hayek and Milton Friedman.

Social Credit gained a lot of attention in the 1930’s, throughout the dominions of the British Empire (the white colonies) and the Axis powers. Ezra Pound favored it, wrote about it (in ‘What is Money For‘, an excellent primer for the unitiated) and discussed it with Il Duce at some point. In Japan it was highly regarded and gained a lot of traction. Also the Catholic Church, for instance the Michael Journal, promoted Social Credit as a solution to Usurious Usurpation.

Social Credit compared to the Greenback

With the Greenback I mean a debt free paper currency spent into circulation by the Government. Recently it has come to my attention that this is not actually what Abraham Lincoln did. I intend to come back to that at a later stage, but for now we’ll stick with the common notion that people have when talking about Greenbacks.

Social Credit is vastly superior to the Greenback as a way for Government to provide currency.

The fact that the cash is handed out to the populace to be spent into circulation not only ends poverty and solves the problem of the Gap, it also prevents the massive power centralization with the State that is associated with the Greenback.

When Government can print its own cash, not much good can be expected from it. True, it’s much better than letting a private cartel do it, but most people suggesting the State should print its own money equate that with the notion that the people would be printing their own money. This, to my mind, requires an extraordinary leap of the imagination.

Government is not the People. If kept small and in its cage it can be of use. But it is a threat always. It’s hard to think of a Government in human history that was not owned lock stock and barrel by the Plutocracy behind the scenes.

The simple fact is that Social Credit is probably the closest we will ever get to the notion of ‘the People printing their own money’, as they can spend it themselves. It truly is THEIR money.

The US Government, equipped with a debt free dollar would undoubtedly be an even worse threat to the world at large than a deeply indebted one.

Also, if Government can spend its own money into circulation, it would have a very strong incentive to badly inflate the money supply. This is what seems to have happened to the Chinese Emperor’s units and also to Washington’s Continental.

Social Credit, the Gap and Interest

Although the Gap, in terms of insufficient purchasing power, is a very important issue, it also in some ways obfuscates the real problem: the Gap is mainly debt service. Cost for capital: Usury.

It is not for nothing that the size of the Gap as calculated in the diagram below is about 53% of GDP. This is similar to the 45% of prices that Margrit Kennedy famously calculated to be related to cost for capital (interest).

And while Social Credit compensates the people for usurious financing of production, it does not end it. Corporations and people will still need banks to provide credit and these banks will have to be capitalized by savings. Both imply interest.

People insufficiently understand that Interest is per definition a wealth transfer from the poor to the rich. The rich have money and lend it out (or own the bank), while the poor must borrow money and thus pay interest.

Worse still, only very few people see the horrible truth: that eventually ALL the interest ends up at the very top of the food chain. Slowly but surely interest payments move up the ladder as even the very rich pay interest to the Money Power: the banking families at the very top. This is Usurious Usurpation.

This is how Rothschild has come to own the entire world.

So compensating for interest is not enough: interest itself must end. We can cannot allow the eternal wealth transfer to continue.

Of course we can not outlaw interest. But we can make it irrelevant: nobody is going to pay interest if he can get an interest free loan. Therefore Social Credit must be combined with Mutual Credit, which provides interest credit at cost price, which is a fraction of normal interest rates.

While many still have a hard time grasping how nefarious usury really is, it must be understood that we can easily do without. Just imagine: why should we be paying $300k interest over a $200k mortgage when we can easily have an interest free one? Only the richest ten percent of society gain with interest. The rest are paying more interest than they receive to the rich. They stand to gain from universal interest free credit.

Conclusion

Social Credit undoubtedly was a major breakthrough. Its analysis is sound. Its solution provides a basic income to all, ending poverty and wage slavery. It does not empower Government, but the people.

It may be the best way for Government to provide currency. It certainly is the best debt-free unit there is. But it still is not comprehensive: it does not allow for interest-free credit. In its classical version, that is, because modern Social Crediters have proposed combinations with interest free credit.

Of course, a money supply based entirely on interest-free credit also looks like a very viable option.

Also, Social Credit, while decentralizing economic power, still assumes a Government Currency Monopoly. This monopoly will have to go just like all the others, but that is a different story altogether.

Related:

Interest-Free Economics

Mutual Credit, the Astonishingly Simple Truth about Money Creation

Reassessing the Greenback and other Alternative Monetary Systems

On Interest

Usury: why we don’t build Cathedrals these days….

Trackbacks & Pingbacks

- Austrian Economics, Apostles of Austerity Defending Deflation « Real Currencies

- Social Credit « Real Currencies | The Money Chronicle | Scoop.it

- Austrian Economics, Apostles of Austerity Defending Deflation « NESARA AUSTRALIA

- A Primer for Recovering Austrians: the many systems behind ‘violent statist fiat’ currencies! « Real Currencies

- Interest-Free Economics « regionalcurrencies

- High Noon in Nicosia: what really went down in Cyprus? | Real Currencies

- High Noon in Nicosia: Banker Vs Depositor

- The Daily Bell: Usurious Commercial Banking is Freedom, Interest-Free Government Money is Tyranny | Real Currencies

- Social Credit with Demurrage | Real Currencies

- Libertarianism is Dying! Truthers Unite! | Real Currencies

- Social Credit | real utopias | Scoop.it

- Social Credit | The Money Chronicle | Scoop.it

- The Difference between Debt-Free Money and Interest-Free Credit | Real Currencies

- The Difference Between Debt-Free Money And Interest-Free Credit | Barnaby Is Right

- The Basic Income | Real Currencies

- Basic Income - Albion Express -

- Social Credit Monetary Theory | Money News Now

- Social Credit Monetary Theory | From the Trenches World Report

- Social Credit Monetary Theory: An alternative to the approaching collapse of the global financial system | RIELPOLITIK

- Social Credit Monetary Theory (VIDEOS) | Revere Radio Network

- More On Social Credit And A Letter By Dick Eastman | Real Currencies

- Letter to Anthony Migchels — discussing the best way to eliminate usury (interest slavery) | richard writings

- Japan back to its tricks this time calling whaling “scientific” | Tokyo Streets From a bd-1

Thanks for writing about Social Credit, Anthony.

I’ve been reading a couple of books about it recently, “We Hold These Truths” by Richard C. Cook and ” Social Credit Revisited” by Frances Hutchinson. These are recommended. Better still the handbooks produced by Geoffrey Dobbs including his “What is Social Credit?”

Richard C Cook covers the triumphs and failures of the Social Credit party including the Canadian party that achieved power in Alberta for a short period. He explains how the unnerved British establishment promoted Keynes to counteract the great successes Douglas’ theories were having in his day.

Needless to say this whole episode has been written out of history.

We need a ‘Social Credit’ movement more than ever today. It is a wonderful system……..but how to promote the idea when the owned mainstream media will never mention a word about it?

We should also remember that Douglas was, first and foremost, a Christian whose aims were social justice and world peace via the elimination of oligarchies.

fascinating Kev! I didn’t realize at all SC was this big at the time!

The problem with social credit can be illustrated perfectly by formal stability analysis. Stability is endogenous to a system while compensation for instability is exogenous to the system. That is instability creates a product that needs to be either countered or compensated for by adding energy/effort/actions to the system.

In the case of interest based debt growth, providing extra purchasing power only handles one of the symptoms of the instability but not others and in order to compensate all symptoms, constant vigilance of all aspects of the system is needed requiring the corresponding authority. Once such an authority is in place, the door is then opened to abuse of power and corruption.

The wisest choice is to establish a simple standard that doesn’t require preventive measures in the first place. The only function that I require of money is to provide stable liquidity, such is trivial to set up and run at a negligible cost. The other functions attributed to money we can do without since they are incoherent.

I agree for 80%: that is the part of the Gap that reckon is interest.

But the Gap is bigger than interest and SC is useful to cover that.

Also: a government operated Mutual Credit system (bibo) would not make me entirely at ease: government is government…….

There is no need for anyone to fill any gaps and there is no need for anyone to “run” a money system whether government or otherwise. These notions are born out of the false paradigm where money is irrationally thought to “circulate” and be the value of the wealth it represents. Money cannot be and does not need to be those things for it to fully operate as a stable record/measure of value.

Do you see what i am saying?

No, please explain it so I can understand it. I’m new to this stuff, so please explain your concept.

The correct model can be illustrated with the following simile:

Highway = Economy

Vehicles = Wealth

Toll booths = Accounts

Vehicle count = Units of currency

Vehicles circulate on the highway and are added and subtracted through toll booths as vehicles enter and leave the highway.

Wealth circulates in the economy and is added and subtracted through accounts as wealth enters and leaves the economy.

The only things that circulate are the vehicles/wealth NOT the Vehicle/wealth counts, in fact introducing the idea that the Vehicle/wealth counts can circulate and be traded not only defeats the whole purpose of keeping correct tabs on the circulation of vehicles/wealth through accounts/ toll booths but has no logical functional purpose OTHER THAN TO CONFUSE THE COUNTS.

Therefore and for there to be a stable money system, there is no need for any authority to issue money and control anything:

In fact according to control systems engineering and the mathematics of stability and measure, the ONLY requirements for monetary stability are:

a) All money must be generated only from transactions of value

b) All transactions are technically and in control systems parlance, PASSIVE BIBO STABLE

The above are the minimum and necessary requirements for a stable and dependable currency system and by extension stable unit of currency. All the rest that is not founded or directly required by the above is scientific and mathematically irrelevant and is an extension of the money brainwash where money is conceived as something of value that requires management and control. This scientifically, mathematically and ontological absurd notion, is the trap of monetary reformists, because it is what leads them into attempting to satisfy the “correct circulation” problem. But a clear functional analysis of money shows that money’s function is to record value AND NOTHING MORE, the notion of money “circulating” is an error that people make because of the existence of “portable” records i.e. cash, at one time the principle support for value records, but today that no longer is the case.

In short, the real problem is the false underlying “model” of what money is and does that simply does not hold under the scrutiny of logic and reason. This false notion Itself is the supreme brainwash.

I’m sorry, I don’t want to offend you, but that is way too much econ-babble to me. Reminds me of the term biz blab. Doesn’t mean anything.

Follow the simile, it is entirely consistent and it illustrates the absurdity of the money brainwash. Money is a record and as such does need to circulate, the circulation issue is a red herring based on a false model of reality.

Sorry I meant… Money is a record and as such does NOT need to circulate,..

Great article Anthony. Social Credit makes sense and it’s the first time I’ve heard about it. I remember studying the Greenbacks which would be a step in the right direction. This would probably stop most wars, people would be able to trade freely, and the scourge of usury would be gone. I hope this happens in my life time. I’m not sure about how this would work, but just the idea of having debt-free money and no interest would be amazing.

The problem for the “powers” is that they are greedy communists, fascists, socialists, and capitalists. But the economic system is still built upon violence because if you don’t pay taxes they’ll put you in a cage. This really does make sense.

Thanks,

Al

http://www.yamaguchy.com/library/pound_ezra/pound_cage.html

http://www.yamaguchy.com/library/kitson/kitson_index.html

http://www.yamaguchy.com/library/douglas/land.html

http://www.yamaguchy.com/library/mcgeer/mcgeer.html

http://www.heritech.com/ymagchy/mcgeer/index.html

Alberta Prosperity Certificate, issued by Social Credit

http://www.yamaguchy.com/library/uregina/prosperity2.jpg

great input, thanks much.

Are these stamps on the Porsperity Certificate a demurrage?

Thanks for this very interesting article.

Although I agree that usury is a huge problem, I don’t completely agree with the following:

“Although the Gap, in terms of insufficient purchasing power, is a very important issue, it also in some ways obfuscates the real problem: the Gap is mainly debt service. Cost for capital: Usury.”

Here is what Douglas had to say about the causes of the “Gap”:

“Categorically, there are at least the following five causes of a deficiency of purchasing power as compared with collective prices of goods for sale: –

1. Money profits collected from the public (interest is profit on an intangible)

2. Savings, i.e., mere abstentation from buying

3. Investment of savings in new works, which create a new cost without fresh purchasing power

4. Difference in circuit velocity between cost liquidation and price creation which results in charges being carried over into prices from a previous cost accountancy cycle. Practically all plant charges are of this nature, and all payments for material brought in frm a previous wage cycle are of the same nature.

5. Deflation, i.e. sale of securities by banks and recall of loans” (C.H. Douglas, “The New and The Old Economics”)

So, yes, point 1 is directly related to usury, and points 2, 4, 5 are indirectly related (2: it doesn’t make much sense to hoard the means of exchange if there is no interest; 4. a large proportion of these costs are related to usury; 5 becomes less relevant in the absence of an interest-bearing debt-based system). But other aspects of points 3 and 4 relate to the time aspect (the lag between “new costs” and “fresh purchasing power”, to use Douglas’ terminology), and would still exist in the absence of usury.

In fact this time lag is the Achilles’ heel of our economy, a weakness which has apparently been identified a long time ago by bankers, who then requested the exorbitant and unjustified privilege of being paid compound interest for merely having inserted themselves as a necessary cog in the “Gap”. But, again, getting rid of usury doesn’t by itself completely solve the “Gap”.

I’m not sure about the GAP as this is new to me, but the mere fact of getting rid of usury would go a long way to fix any economic problem. All financial problems center around usury because the charging of interest is evil.

I agree: even without usury a bit of the gap of the gap would remain.

However: Douglas forgot to mention interest itself in this (interesting) list. The problem is that not all the interest is spent back into circulation. Some is siphoned of to the financial economy (forex, stock exchange, etc), while another portion is used to back new loans in fractional reserve banking, meaning the interest returns as a new interest bearing debt.

in the article I said the gap was 80% interest. This of course is not science, but I think it is a fair estimate.

This is an interesting comment. It’s good to see that Douglas doesn’t blame technology alone, but it exposes the fact that there are numerous factors at play.

I just see “social credit” the solution as non sequitur to the whole “gap” theory.

Clearly, as Anthony has been pointing out for years, lack of purchasing power is a real problem. But is interest the driving factor? It has been pointed out that usury wouldn’t exist if income and savings were sufficient and/or credit was free. I’d have to ask why income and savings are too low before asking why people borrow money.

Income = (production x price) – overhead. We’re all under-producing, selling too cheap, and too much surplus is going to Wall Street, shareholder dividends and other non-productive costs. Click my name to read the “parity” article for a concrete example. Nobody can buy each others’ stuff or even make stuff because of inadequate intervention by “big government.” GM’s problem was not that their capital was tied up in investment, but that they’re a hedge fund disguised as a car company, and were bled for 30 years for the benefit of “investors”.

I would have to point to free trade and deregulation as the fountainhead, and consider usury as a mop-up operation to keep the underpaid masses afloat.

As for the problem of technology, let’s say I have a walnut tree and two rocks. To feed myself I have to spend all day cracking open walnuts, and half of my harvest rots on the ground. Someone stops by with a steel nut cracker, which he’ll sell me for 1% of my harvest. It will cut my time in half and allow me to harvest 100% of the nuts, but now walnuts will be worth half as much. Is it a good deal? Of course. Now I get 198% of the wealth and the same money with half of the work. Point being – value in the economy is dynamic, regardless of money. I want more walnuts, not more money. The supposedly static factors (ie amount of acreage, iron ore in the ground, man-hours) are effectively unlimited, as most is untapped and we have always found ways to expand them with new technology, by going to greater depths, etc.

One must accept that there is a gap between available goods and purchasing power, but not that this is an automatic process or that it can’t be fixed with regulation and production.

As for the solution, this comes down to whether or to what extent you believe power should be centralized. Do you want an economy driven by public works, high technology, high power, etc., or do you want it driven by retail consumption? Do you want to enforce trade, labor and environmental protections, or do you want consumers to “choose” responsibly?

Pardon – I meant …”technology or usury alone”

Lol, I just posted a comment on your blog…….. I’ll bring it here

I want to react to what you had to say to my SC piece on Henry’s yesterday:

“It presumes, as does the Austrian school, that “the state” can

do nothing right, so proposes to put purchasing power directly into the hands of Joe six-pack.”

Well, I indeed don’t trust the State. Why do you? After all: would you really be happy to give the Fed Govt a debt free (or, more importantly, interest free) unit?

Do you really think it will build high speed trains?

I’m worried it’ll just continue what it does best: rape, maim, plunder, murder, lie, invade and destroy. Mostly abroad, but more and more at home too.

Also, I’m not too happy with people like Lincoln and Roosevelt: they did centralize power in state hands, at the cost of the people and state rights. Worse: Roosevelt did not end the depression. He needed to get his country into the war, against the express wishes of most americans to get the economy going again. Roosevelt without a doubt was a highly criminal, deeply disturbed warmonger. None of his policies were effective or just. In no way was he any better than Adolf Hitler (whom I despise also, don’t worry).

I understand of course that there must be infrastructure etc. I’m most definitely not against Government perse. I don’t believe at all in anarchy or anarcho capitalism. But government is a limitedly useful tool, when run correctly. It is simply a fact of history that Government, wherever, whenever was in the hands of monied elites.

Also I’m not too happy with your scathing Joe Sixpack. Most certainly many people, especially the ‘lower’ half of the population are rather dimwitted and often morally corrupted (although not as bad as the psychopaths that gyrate to powercenters like Government). But they are people. They need care. Guidance by people who are willing to serve them, instead of dominate them. These people have full human rights. These human rights are not perse served best by using them as wage slaves in megalomaniacal and often superfluous government projects.

Government is not a human and as such has no rights whatsoever.

So in short: Joe Sixpack will buy some beers. Government will buy an even bigger army.

That’s why I’d rather see SC than a Greenback.

“Joe Sixpack will buy some beers. Government will buy an even bigger army.” Great quote!

I completely disagree with your assessment of Roosevelt, but will leave it at that for now. I should probably work up an essay on him and the New Deal.

If you give Joe Lieberman free money, yes – he’ll give it directly to Israel, Blackwater, Goldman Sachs, etc. Which is why you need candidates to put forward or endorse a concrete plan that doesn’t involve military build-up and let people vote for that. This is the essence of representative government. We’re screwing ourselves by being bad citizens, and we need leaders (including low-level agitators like you and me) to point that out. Roosevelt took office in 1932, and didn’t do any military build-up for 10 years, after Japan and Germany had both declared war on the US. He put through banking regulations, currency reform, social welfare programs and numerous public works projects.

The debate goes on!

Yes.

“provided there are then attached to the back hereof one hundred and four one cent stamps”

Each week somebody who ended up holding it –musical chairs after the music stops– had to buy a one penny stamp and stick it to the back of it; generally it were the stores who ended up holding it, i am sure they worked that one penny into the price somehow.

The certificates lasted until the Federal government outlawed the idea. The Alberta Treasury Branches fared better, they lasted until our lifetime.

Similarly, so-creds, farmers and labour manager to persuade the Ontario government to establish the Province of Ontario Savings Office, a fully government-owned province-wide bank; it was done away with 2001-3 (I bet I was the only one in 2001 who registered his displeasure with the minister in charge of POSO, i also got 15 minutes with my representative to tell him that i object.)

In British Columbia, Mr. Bennet wasn’t really a social creditor, he got into argument with the conservatives so he joined this no-name party and won the election with them; under their management the debt of BC was paid off, he had the cancelled bonds loaded on a barge and had them burned in the Vancouver harbour; in 1966 the so-cred government established the Bank of British Columbia –lasted for 20 years, then it was sold to the chinese

So-creds, farmers and labour ‘forced’ Prime Minister McKenzie King to buy back the shares of the Bank of Canada –not much good it did.

sad reality:–

When they had their own bank, did the good people of Ontario close their accounts with Royal, Montreal, TD, etc. and flock to POSO ? No. (education and persuasion is not the way to achieve change)

great info in your posts thanks; learning a lot

(education and persuasion is not the way to achieve change)

How do you believe change COULD be achieved?

I believe this to be an utterance of frustration rather than a statement of fact. Most refractory debt slaves have been programmed so thoroughly by the establisment in their lifetimes into believing that authorities know best and that their efforts can never amount to anything that it’s impossible to make any headway with them. You can bombard them with infomation or even give them some experience with a superior more equitable way of doing things; but if the powers that be say it’s better to live like a neo feudal serf then thats what they will believe and do.

So maybe you need to deprogram them before you can begin to educate and persuade.

Many people will never wake up. I think we must focus on those that do, and also offer services that clearly favor even those in a deep coma. That’s why I believe regional currencies are crucial: we can start offering interest free credit today. Even euro/dollar backed units (like the Chiemgauer (which do not allow interest free credit) help solve deflationary pressures.

The sheeple (but also children, (childbearing) women, the elderly, the infirm) will always need leadership and protection. While we are now led by ambitious men who lead to please their ego, we need people who will lead by serving.

This mantra of waking people up has been the staple since Sarah Emery “buy and read my book that will save the world”, and accomplished what it accomplished: nothing.

100 years ago Mary Hobart observed that the american voter is the dullest dullard, has anything improved since?

What you do, and what every other blogger does, is passing the time; it is a hobby, not some world-changing mission. Could Douglas or Kitson enact any of their theories into practice ?

Here is some reality:

As the locust generation (baby boomer maggot-infested hippies) came of age, societies in Europe and North America degenerated to the level of the royal court of Versailles. Between 2020 and 2050 the locust generation will die and leave behind 1.3 children for every two of them; the children of the locusts will die by 2100 and leave behind 1.1 children for every two of them; which means that in the year 2100 there will be less than half the number of white people on the planet than in the year 2000.

At the same time Europe and America are infested with people who really don’t care about monetary theories, they lived in cashless societies through most of their existence.

In Europe and Canada one-third (or more) of the people receives a government cheque, do ye think any of them will vote for something that will cut off that cheque ? The largest bond-holders are teacher federations, public employee unions, government pension funds –these nice people are also large share-holders of chartered banks– will they sit idly while some internet warrior eliminates the national debt, thereby cuts off their life-blood ? Ye need the military and political power first, then you may change the money system.

Mr. Mullins writes in “World Order” that the “parasite is not a particular species, but one which has adopted a certain way of life, the way of the parasite.”

http://www.yamaguchy.com/library/mullins/mullins_index.html

and the parasite always destroys the host

Syphillis is a parasite, and oh how good it feels when we are first getting it. If in a day or two it is not treated harshly that kills it, syphillis will attack the brain of the host, and then kill the host.

Oh how good it felt when the maggot-infested hippies first introduced the socialist programmes –free this, free that, free other; the desease was not treated and killed, so the locusts attacked the mind, and today we have two generation that grew up with the parasite idea that they have the right to other people’s sustenance “by the sweat of somebody else’s face shall they eat bread” as they interpret the Bible. The next stage has to be the demise of the parasite as he runs out of hosts to live off.

Ye had your chance (with Mussolini) and ye blew it.

Much truth here.

this blog is indeed a hobby more than anything else.

But at some point I’ll manage to get my new Gelre in the market: finally a unit that provides interest free credit in a euroconvertible way.

Hopefully I’ll have less time to blog then!

I don’t believe for a second this war is over or has even started yet.

We will win. But it’s not about currency.

It’s about men getting their head out of their balls and into the real world. they’re way too busy scoring pussy while the enemy is real. It’s not even the money power, but ego.

Thanks for inserting some realism about the prospects of white people. And that is coming from me, a maggot-infested boomer.

Thanks for the edifying post. Btw, I think I just misinterpreted a comment you made?

you must have, that was just a note between two male chauvinists of the worst kind and absolutely inappropriate…….

Hey! Just now getting the WordPress tech mastery together, logged on for my new Draw for Liberty blog (a couple of them you would like, not sure of the others 😉 and saw this delightful reply from you. I’m still giggling.

🙂

You can check the ‘notify me of follow-up comments via email.’ if you want to follow the thread.

Can’t find it from the pad… But I’ll care enough to keep checking.

Happy sunday!

I wonder if I should have gotten an email informing me of your reply. Off to check settings.

Thanks for explaining “Social Credit” and pointing out that the “interest problem” (usury) would remain with this approach. It seems that many monetary reformers basically fall into two camps; they either try to “engineer” a solution or “mitigate” the problem.

The engineers approach monetary systems with mathematical evidence of how a system should work. Often they can model the results and prove that interest should never be charged on the creation of new money. The math clearly proves that our interest bearing, debt money system cannot be sustained in a finite world. Usury is a destructive force that will inevitably bring the exponential growth of debt along with chronic shortages and the transfer of wealth up the pyramid (from borrowers to lenders).

Others try to mitigate the results of usury by invariably adding debt free money to the system. I would place “Social Credit” under this heading as you explained that Douglas defines a “Gap’ or the A + B theorem. This refers to the gap between total income and total value of production. The latter being always higher than total income.”

And, we know that there is a gap between the amount of available money and the total debt (P+I > P). In either case, debt free money could act as an elixir in helping to quench the gap. I suspect that ultimately, both approaches may be needed to repair and replace the existing system.

There is no substitute for a sustainable system to finally bring us a sustainable and equitable economy. I hope that someday we replace monetary theorists with monetary engineers. The Renaissance helped replace beliefs and superstitions with a scientific approach in most endeavors but inexplicably; monetary systems were never part of the discussion.

An engineered solution will probably require that some amount of debt free money be added to the economy, at least on a temporary basis – and maybe permanently. And of course, interest (usury) must be eliminated from the money creation process if lasting results are expected.

There is no reason why the federal government must be the entity to spend the debt free money into existence. It may be better to have the federal government create all money but then, allow more local jurisdictions (e.g. States) to determine how to spend the money. This would break the centralized lock and provide a needed check and balance.

Personally, I would prefer that the debt free money be exclusively spent on infrastructure, transportation, alternative energies and other productive projects that benefit humanity. That said, some Social Credit could also be a big help, especially at first, to get the economy going again.

It is my understanding (though I haven’t spent a great deal of time studying the system) that a Social Credit government, given the chance, would create its own money rather than borrow any at interest, ploughing this debt-free money into the economy to produce all society’s needs and ensure that society could buy the goods produced by putting a living wage in the hands of all the people. The ‘gap’ represents an add-on bonus……?

It is possible I don’t really understand this system, as proposed, properly…..but surely the whole point of ‘Social Credit’ was to deal with the ‘interest’ problem?

Not really Kev: Douglas wanted to fix the ‘gap’: he noted that the value of production is bigger than the wages paid, as a result of which there is never enough purchasing power to buy all the producers make. That’s why he wanted govt to print money and give to the people: so that they would have enough money to buy up all that was produced.

In fact: Douglas approved of usury and scolded monetary reformers against it:

“The rapturous iconoclasm of certain groups of monetary reformers’, to whom Usury”, the sparring-partner of the bankers “inflation” is the Scarlet Woman of Babylon, has had the inevitable effect of encouraging the financial authorities to abolish, for practical purposes, the interest paid on undrawn current balances, and deposit accounts. We do not say they would not have done it anyway – the one thoroughly sound feature of the banking system was its dividends to shareholders and its interest payments to depositors which I jointly with the insignificant mint issues, provided almost the only fresh unattached purchasing-power. It is obviously lost time to beg of our amateur currency experts to consider whether they really mean what they ask, which is, the replacement of unattached purchasing-power by loans. But they must not complain if we, and others with us, regard them as propagandists for totalitarianism. ”

The Social Creditor, Oct. 27, 1945.

Of course, Social Credit would lessen the interest drain: the money would be debt/interest free. People would have less incentive to go into debt. But debts would still require interest. Some interest drain would remain.

Rereading this statement of Douglas I must say he makes a very bad impression here. He says: “……..has had the inevitable effect of encouraging the financial authorities to abolish, for practical purposes, the interest paid on undrawn current balances, and deposit accounts. ….the one thoroughly sound feature of the banking system was its dividends to shareholders and its interest payments to depositors which…..provided almost the only fresh unattached purchasing-power”

But in the list that Transparent Unicorn gave us (see his comment below), he says:

1. Money profits collected from the public (interest is profit on an intangible)

2. Savings, i.e., mere abstentation from buying

The quote is of late 1945. Perhaps Douglas was already suffering from the Guilt by Association: the Nazi’s were the most forceful anti usury activists of them all. Their destruction made interest a taboo for at least 50 years.

Yes, this later quote leaves a bad taste. I am much more in agreement with the quote I provided below, which suggests that Douglas saw usury as a big part of the problem. Also, the 1945 quote seems to consider that it is a good thing to acquire “fresh purchasing power” in proportion to the amount of purchasing power one has already parked in the banking system. This not only appear to contradict point 2 of the earlier list (as you point out), but constitutes a justification of banking practices which favor Money Power rather than the people (i.e., the more money you have saved, the more “fresh purchasing power” you are entitled to).

Anthony wrote:

“..the one thoroughly sound feature of the banking system was its dividends to shareholders and its interest payments to depositors which I jointly with the insignificant mint issues, provided almost the only fresh unattached purchasing-power…”

This is not entirely correct, all dividends and interest to depositors is interest bearing debt principal recirculating. From a system’s point of view, the interest on savings does nothing to alleviate the interest on loans in the system. The only affect it has, is to compound savings i.e. temporarily paralyse greater and greater amounts of money.

Interest on loans causes P<P+I. Interest on savings parks a compounding sum of P aside but has no effect on the overall difference between P and P+I. Dividends are simply a distribution of profits and have no effect on the systems level.

As John Turmel explains, it is like water level in a pool, moving (splashing) the water around in the pool, has no effect on the level of water in the pool.

Just to be on the safe side Marc, this is not me, but Douglas. I certainly don’t agree with the quote.

Yes I thought that could not be Anthony talking 😉

I have not read carefully enough then. I thought this system was about abolishing government servitude to bankers by abolishing interest payments to them.

So government would still find themselves owing ever-ballooning trillions to international bankers under this system? This makes no sense. I read far too quickly, but how would this system possibly deal with the massive wealth transfer to the banks and their control over our political system if we still allow them to create the bulk of our money for us? I had assumed that the ‘dividend’ was superimposed on a ‘greenback’-style system…..obviously have a long way to go to grasp the essences of this subject matter.

Under Social Credit the Government, when running deficits, would still have to borrow money at interest.

Social Crediters commonly assume Interest as a problem is a red herring.

But the truth is, that the Medieval man worked 14 weeks per year and the rest was free time. We have already sacrficed our women to the labor market and it is not long before children will be working again too.

We need a system that creates interest-free money and recycles any ‘gap’, real or imagined, back to the people at large not to an elite. Does such a theoretical system exist?

absolutely. Interest free credit (check the solutions part of the Interest-Free Economics page to your right) is the main deal. Check the Mututal Credit article (it’s in the top posts at the moment) It may be the case that a bit of the gap remains, although the jury is still out on that one, this can be solved by Social Credit.

The horror is that it is so blindingly simple, but so many people, even among those waking up, just can’t see the nature of their slavery. They don’t fathom that interest is theft per definition.

Yes it does exist, if you build a money system as a simple record of value and follow the tenets of control system’s engineering, mathematics of stability and measure, it is trivial to do.

I suggest that you read: http://www.bibocurrency.org

Thank you.

KB

The basic point of the article I wrote is that Social Credit compensates for the interest, it does not abolish it.

On the other hand, when we take away interest, some of the gap probably will remain, although Marc Gauvin does not agree.

Anthony,

My comment was that a stable money system does not require filing gaps. When I said we don’t need an authority to “run” a money system, I meant that in the sense that apart from defining the correct money spec everyone can use without the need of authorities intervene or regulate peoples activity. This does not mean that there be no legal oversight just that when people play by the rules the system should be self regulating.

Marc,

There is still the “time” aspect of the gap – see my comment here (or better, read a more detailed description elsewhere):

https://realcurrencies.wordpress.com/2012/07/30/social-credit/#comment-5118

I read your exchange with Al Thompson and I’m still not sure that you have provided a solution for that (not that you have an obligation to do so, but you wrote that “a stable money system does not require filling gaps”).

This one got spammed TTU!

If you see money as a record and not as an object that circulates there is no Gap. Every transaction across the value chain produces its own units that are then canceled or added to existing balances. There is no time gap either.

The deep rooted error is the technically false model of money being a record and a circulating thing. It is like telling golfers that they points they score cannot be readily recorded by each player because the number they require to record the score is an object that needs to circulate to them in sufficient quantity first. The properties of a record of value simply have nothing to do with the properties of a circulating object.

Do you not see that associating the properties of circulating wealth with the properties of the record of circulating wealth is like associating the circulation of the golf ball with that of the record of that circulation. You need the ball to circulate to record the golf score BUT THAT DOES NOT MEAN THAT YOU NEED THE SCORE TO CIRCULATE TOO!!

It is this type of bullshit that is the primer for everyone to buy into the false pseudo scientific paradigm to provide a foundation for justifying lending that then leads to interest. It is this false paradigm that creates the false expectation of getting something for nothing ostensibly legitimately. It is what obfuscates the reality that only real goods and services provide anything of value.

The scientific reality is that all liquidity requirements can be resolved solely on the basis of money being a record and to there is no circulation requirement for money to be a record and if there is no circulation requirement there cannot be any gaps to fill.

Gap between total income and total value of production ??? The value is imaginary thing, therefore the gap is also imaginary thing. Actually there is no gap. It’s just a point of view.

How is supposed that social credit to be implemented exactly ? We just have to give some cash on monthly basis ? How we prevent hyper inflation ? How we prevent hoarding money ? How we are supposed to extract money from the system ?

“The value is imaginary thing, therefore the gap is also imaginary thing. ”

Well, the cost that went into producing are real.

The paid cost is already paid imaginary value. If you find people which are willing to pay the price that you require, which is product cost + some required profit, you are doing fine. But if there is no people willing to pay that price, than you are in trouble. You have to find some way to lower the price. May be neonate some lower prices with your suppliers or optimize your business. At the end you may continue to do business or may be your product or service is obsolete enough and will become history. So there is no GAP. There is real world, competition and imagination. If you presume that there is a GAP, than the question is how big is it ? Since the value is imaginary thing then the GAP is imaginary BIG.

This GAP theorem sounds to me like Marx’s idea of intrinsic value. I cannot understand it and my mind simply rejects to wrap around it.

May be there should be GAP, because if there is no GAP, nobody will try to optimize anything and at the end everything will stop.

Geee, I have missed the point with some miles. GAP is GDP – Total income. I have thought that GAP is something else.

nono Dark Dirk! The gap is the difference between production and wages. Production is always bigger than wages, meaning the economy can not mop up its own production (usury, profits, other reasons), leading to all sorts of problems. That’s why Social Credit just prints, to provide purchasing power with Labor to buy all it has made itself.

Thanks Marc,

but I already don’t like the ‘bibocurrency’ idea.

http://www.bibocurrency.org/English/Free%20Liquidity%20Revolution%20v3.1.htm

All these systems contain embedded assumptions that seem to be founded on ideas about the nature of money itself, rather than the emphasis being “what do we want money to do for us?”. i.e. What kind of world do we want to create and what kind of a money system will help us create it…..

The bibocurrency basics say:

Liquidity Liberation in 5 Steps

Step 1

Adopt the Passive BIBO Currency standard specification for money and @ unit (reference value of 1/10 of an unskilled human hour).

Step 2

Appoint trusted agents to record transactions and individual balances in strict adherence to the Passive BIBO Specification and unit. This can be offered as a service that can be set up and run by any trusted, responsible and certified members of your community paid in @ units.

Step 3

Perform as many transactions as possible using the @ unit.

Step 4

Demand all levels of government to adopt, support and implement the Passive BIBO Standard for all public expenditures and projects and to reduce and eventually eliminate all accounting in the current de facto standard.

Step 5

Actively demand the rescission of all contracts based on the flawed simultaneous treatment of money as both a unit of measure of value as well as a commodity of variable value measured in terms of itself.

Problems with this as baldly stated:

1) Intensive centralised government oversight required

2) Maximum ‘transactions’ recommended.

The following Buckminster Fuller quotations come to mind:

“You must choose between making money and making sense. The two are mutually exclusive.”

“We are blessed with technology that would be indescribable to our forefathers. We have the wherewithal, the know-it-all to feed everybody, clothe everybody, and give every human on Earth a chance. We know now what we could never have known before–that we now have the option for all humanity to make it successfully on this planet in this lifetime. Whether it is to be Utopia or Oblivion will be a touch-and-go relay race right up to the final moment.”

Kevin,

I don’t think you have understood the proposal. First bibocurrency makes 100% sense and it clearly defines money as record and nothing else. Second, the idea of making money as a goal is completely eliminated in bibocurrency because money is not a thing of value it is a record of value nothing more. Thirdly, there is absolutely no need for any government oversight at all, so I don’t understand where you got that idea. The five steps are not requirements for system operation they are proposals for getting off the current stuff.

Read the first page (below) and take note that it can be deployed by anyone and is accessible to all so there is no central control.

WELCOME TO BIBO CURRENCY

(B.I.B.O. IS AN ACRONYM USED IN CONTROL SYSTEMS ENGINEERING THAT REFERS TO “BOUNDED INPUT BOUNDED OUTPUT” THE SINE QUA NON REQUIREMENT FOR STABILITY IN THE TYPES OF SYSTEMS THAT INCLUDE MONEY SYSTEMS)

FIRST DISCOVER THE HEART OF THE BEAST HERE

PASSIVE BIBO CURRENCY IS THE FIRST MATHEMATICALLY AND SCIENTIFICALLY STABLE CURRENCY STANDARD WHERE MONEY BECOMES UNLIMITEDLY ABUNDANT WITHOUT LOSING STABILITY. IT CAN BE DEPLOYED BY ANYONE, ANY TIME, ANY PLACE AND FOR ANY TRANSACTION. ONLY SUCH A STANDARD CAN STABILISE THE WORLD’S NATIONAL AND SUPRA NATIONAL CURRENCY FINANCES.

ASK ANY BANKER, ECONOMIST OR POLITICIAN TO PROVIDE A RIGOROUS MATHEMATICAL DEFINITION OF STABILITY AND YOU WILL DISCOVER THAT THEY DON’T HAVE A CLUE OF WHAT STABILTY REALLY IS. YET THEY NEVER STOP ASSURING US THAT IS WHAT THEY ARE LOOKING FOR. THEY SIMPLY NEVER STUDIED STABILITY SCIENTIFICALLY AS WE DO ON THIS SITE.

SO IF YOU WANT TO HELP RESOLVE THE WORLD FINANCIAL CRISIS YOU URGENTLY NEED TO STUDY THE ONLY ROBUST MATHEMATICAL AND SCIENTIFICALLY STABLE MONEY STANDARD. TODAY, TO DENY A STABLE AND ABUNDANT MONEY STANDARD WHEN SCIENTIFICALLY PROVEN, IS TO PARTICIPATE IN A CRIME AGAINST HUMANITY STRETCHING THE ENTIRE GLOBE.

Anthony Migchels: Therefore Social Credit must be combined with Mutual Credit, which provides interest credit at cost price, which is a fraction of normal interest rates.

Jct: Already done. The sole reason I financed the first LETS Local Employment-Trading Software was because it conformed to Louis Even’s description in his Salvation Island Comic book. Greendollars are the very same interest-free credits as used on the island provided at a “service charge” cost. So I’m pleased to report that LETS social credits are being used around the planet as I work on uniting them into the UNILETS (UN International & Local Employment-Trading System) from the Millennium Declaration C6 to governments to use a time-based currency to restructure the global financial architecture.

May God save us from the United Nations and their Agenda for the 21st Century

{

http://www.un.org/millennium/declaration.htm

We the Peoples Millennium Forum Declaration and Agenda for Action:

Strengthening the United Nations for the twenty-first century

The United Nations:

1. To act as an independent arbitrator to balance the interest of debtor and creditor nations and to monitor how debt cancellation funds are spent.

2. To introduce binding codes of conduct for transnational companies and effective tax regulation on the international financial markets, investing this money in programmes for poverty eradication.

3. To immediately establish at the United Nations a global poverty eradication fund, which will ensure that poor people have access to credit, with contributions from Governments, corporations, the World Bank and other sources.

4. To adopt cultural development as the focus theme of one of the remaining years of the International Decade for the Eradication of Poverty (1996-2007).

4. To encourage its organs, especially the United Nations Environment Programme (UNEP) and UNDP, to actively support the establishment of sustainability centres to advise local governments on the implementation of Agenda 21 in local communities through comprehensive, integrated development policies and strategies. Such centres should be part of international networks for the exchange of knowledge and experience.

A major task of the world community in the twenty-first century will be to strengthen and greatly enhance the role of the United Nations in the global context. Governments must recommit themselves to the realization of the goals and mandates of the Charter of the United Nations. A challenging task is to firmly protect the integrity of the United Nations, counter the erosion of its role, and further strengthen and augment international institutions capable of implementing and enforcing international standards, norms and law, leading towards the formation of a new political and economic order.

3. To move towards creation of alternative revenue sources for the United Nations. The United Nations should set up expert groups and begin the necessary intergovernmental negotiations towards establishing alternative revenue sources, which could include fees for the commercial use of the oceans, fees for airplane use of the skies, fees for use of the electromagnetic spectrum, fees on foreign exchange transactions (i.e., the Tobin Tax) and a tax on the carbon content of fuels.

}

smoke weed, every day; then, gamble some in the Casino until you are out of debt; finally, free trade the country out of misery

http://disc.yourwebapps.com/discussion.cgi?disc=149495;article=126454

“smoke weed, every day; then, gamble some in the Casino until you are out of debt; finally, free trade the country out of misery”

I don’t know…….did I ever tell you I admire your style?

“I don’t know…..”

If you did, you would have known, I was referring to Mr. Turmel’s ideas

Jct: http://johnturmel.com/dougtxts.htm has my book reports on Douglas. He taught me a lot.

The Social Credit movement in Canada was destroyed from within by poster-boy Ernest Manning. He changed the tone from “Credit of the society belongs to the society” to “responsible government”.

A generation later, his son, Presto Manning, as poster-boy, parachuted into the Canadian Reform Party, and made sure that western discontent got nowhere

This is the problem when someone wants to make some intelligent changes that are meaningful, some knucklehead from the other side takes over and rides herd over the people who want these changes. This happened in the US so many times I can hardly count them. In these forms of government there is no political opposition. There’s no such thing.

name789: The Social Credit movement in Canada was destroyed from within by poster-boy Ernest Manning. He changed the tone from “Credit of the society belongs to the society” to “responsible government”.

Jct: And notice that the Judas Goat of the Alberta Social Credit movement was Aberhart’s right-hand man from the start! I don’t know when they turned him or if he was a bankster mole from the start but he’s the man responsible for taking Social Credit off the path to sociable credit while they had power. So the made him a Senator! Har har har. The only “Socred” who ever got so rewarded by the establishment.

Great article.

My Grandfather was a social creditor in the 1920’s in the UK. I have been brought up with these ideas. It’s great to see someone else putting these ideas forward again.

For those that don’t understand the issues surrounding the creation of money, can I recommend a short video series that I put together with my father (the Editor of Sustainable Economics http://sustecweb.co.uk). It’s at http://moneymyths.org.uk

The aim of the series is to explain the system that we have now and propose an alternative in language that everyone can understand and to explain some of the terminology that is often used by economists.

Thanks Rick!

Sustainable Economics using VISA, MasterCard, American Express –what exactly did you learn from your Social Crediter grandfather ?

The Cost of Climate Change

“For many centuries, money was mainly the creation of the State, with only minor supplements by private interests. Money created by the State is spent into circulation, and so enters it without creating debt. The State gets its face value, less the cost of creation. This is known as the seigniorage.”

Is Climate changing ? Are bankers causing this change ?

Climate change long before bankers and SUVs:

http://www.yamaguchy.com/forum/index.php?topic=7.0

Please remove the fake quotes:

http://moneymyths.org.uk/episode5.html

Guernsey Meat Market Notes:

http://www.yamaguchy.com/forum/index.php?topic=8.0

Occasionally read genuine Jefferson letters, too:

http://www.yamaguchy.com/library/jefferson/jefind.html

Not all interest is usury. Only the interest charged on the fractional reserve loans the banks make from nothing, because that’s truly asking something for nothing (ie, theft).

Market interest rates on loans made from real deposits would be non-problematic. But the interest would then truly accrue to everyone’s savings accounts, rather than concentrating in the hands of bankers, and savings accounts would have to be more like CDs (ie, you would not be able to access all your money at once).

Dear Anthony, is not the Social Credit just out of current context. Recently I saw a graph showing top 1% earning equally as the bottom 90% – as result of the “gap”. We can agree about the 45% average interest included in all prices. Expecting the govt to fill such gap is too much, they helped to create it. The SC they accept is in function of pacification of the bottom 50 million.

Hello.

I am Japanese. I’m reading and writing with machine translation.

I found a very interesting article on interest.

Is this article correct?

Let me hear your opinion.

Debunking the “Debt-Virus Hypothesis”

http://www.ardeshirmehta.com/DebunkingTheDebt-VirusHypothesis.html

No, it isn’t. What he overlooks is that the Usury is NOT spent back into circulation.

https://realcurrencies.wordpress.com/2013/04/01/is-there-enough-money-to-pay-off-debt-plus-interest-a-closer-look/

Thank you Anthony.

You wrote the following in the above article:

“The point is: much of the interest is siphoned off to the financial economy. Meaning it is not circulated back into the real one. Meaning usury does deflate the money supply and interest + debt can never be settled.”

Has the interest siphoned off to the financial economy disappeared? Or does it still exist?

Hi Anthony. I am not offended that you have used my gap graphic, but I insist that you give me credit. It will be sufficient if you reference it from Economic Cures ‘They’ Don’t Want You to Know by Liam Allone.

On the content of your article, it is almost entirely spot on but although I used to agree entirely with every point, I have come to see that I had one error – and so do you. Interest is profit. It is price markup of a particular kind. What is wrong with it under the present order of things is that the money for interest (i.e. the profit) is not created when the money (i.e. loan) is created. With social credit, the “just price” regulating mechanism takes that into account so that the interest (and all other forms of profit for that matter) is created too and now there is no mechanism by which all the wealth aggregates to the few. But in my book, I do identify one mechanism that does allow that aggregation to continue under social credit and all other forms of economic correction that would otherwise work (e.g. Professor Frederick Soddy’s National Economy proposals) and if you want to know what it is, go to http://www.economiccures.com and download the book. Search for inheritance and you will find the problem laid out in entirety.

Other than that, awesome article!