George Whitehurst-Berry at subotaisbow.com: a news aggregator providing real monetary information

The ‘Alternative Media’ is dominated by the ultra right with its Rotschild Gold Standard. Thankfully there is now a news aggregator sharing real information on monetary reform.

Earlier this year we analyzed how the alternative media really is a bunch of Gold dealers plugging their specie. Especially the fact that Interest Free currency is not represented on the main aggregators is worrying.

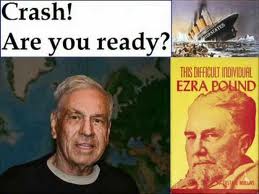

Former host of the GCN show, ‘Crash! Are You Ready?’ George Whitehurst-Berry is now filling that vacuum. He recently also kindly commented at Real Currencies.

Go have a look at www.subotaisbow.com to see what he’s up to!

Related:

Recovering Austrians

Hate the State, buy Gold and all will be well: an Alternative Media in crisis

Wayne Walton also has “UsuryFee Radio otherwise known as Mountain Hours Radio.” More details at this website: http://usuryfree.blogspot.ca/2012/06/usuryfree-radio-otherwise-known-as.html

Thanks!

I knew of his site, he reposted a couple of articles of mine, but it is now dawning on me he also manages an interest free regional currency! It seems we have a lot in common!

Why not return to basics with a race based currency? After all money is just Credit “Trust” in circulation. People of the same race and culture might have a better chance of avoiding the swindles recently demonstrated by wall street. Just a thought from book “MONEY the 12th and FINAL RELIGION. Thanks RDW

‘austriamics’ critic:

http://www.professorfekete.com/

looks like he (and others) are gonna be in Munich september 3-9

Guest Lecturers: Sandeep Jaitly (United Kingdom, feketeresearch.com)

Keith Weiner (United States of America)

Rudy Fritsch (Canada, beyondmises.com)

Peter van Coppenolle (Belgium)

Professor Juan Ramon Rallo

King Juan Carlos University, Madrid

Neither 100 percent reserve nor free banking:

A vindication of the Real Bills Doctrine

21st of march

http://www.zerohedge.com/news/antal-fekete-responds-ben-bernanke-gold-standard

nasoe@kt-solutions.de

on your link page i see you lack pointers that go even just

anywhere/somplace close to Ulrich von Beckerath (intimate of

Rittershausen to whom i HAVE seen Prof Fekete refer [in a footnote]

before).

To my mind that is a lack sore enough already, seeing that a still deeper

(green) understanding of ore and score (mine and minding) can be had at my

place alongside mentioned people (of whom by the way, work can be found

more conventionally [less colourfully] presented at Thomas Greco’s website:

http://www.reinventingmoney.com

Rudi Fritsch is website editor of

http://www.goldstandardinstitute.com/About.aspx

.. he has a great little graphic as one of 15 little revolving header images

it’s bonds, bills and gold triangle .. i would add photosynthetic variety as a

basket index option but that’s just me.

illicit interest arbitrage

a short circuit between

bonds .. and .. bills

saving …….. spending

——— gold ———

you blog tells me to slow down … but it won’t accept my comment in one piece …

Mr. Fekete is not critical of Mises and the school, he is critical of the mis-users of it; and he is certainly no friend of government-issued legal-tender.

He is critical of the austrians who purposely leave out from their religious dogma the collusion of criminal elements

He is critical of the phony gold standard: the gold-based currency and standard.

“what we have is far more than this self-defeating effort to keep gold out forever from the monetary system. What we have is a veritable brain-washing of the whole world about the role of gold in the economy, and blaming gold for the results that only keeping gold in the system could have prevented.”

“the debt crisis is a direct consequence of exiling gold from the monetary system. Gold is the only ultimate extinguisher of debt.”

“Mises was a great warrior fighting these usurpers and monetary hijackers with the sharpest weapon there is: human reason. We must follow his lead, even if sometimes it means that we have to introduce new ideas that go beyond Mises’ published opus.”

—Most of those people, claiming to be “Austrians” and followers of Mises, are NOT; they are religious gas-bags, parrotting dogmas for the benefit of predators

Gold-ite Lazarus Powell ripps into greenbacker John Sherman, and drives another nail into the figment of high interest rates:

“Mr. Powell. It is singular to me that the Senator [Mr. Sherman] cannot discuss a legitimate matter of finance without lugging in “Jeff Davis” here as a kind of bugbear to somebody. I do not know what Mr. Jefferson Davis has to do with this matter. The Senator says that I have announced that I believe the legal tender clause of your note bill to be unconstitutional. I so announced when the bill to issue them was passed, and I voted against it; and I really thought when the first bill was passed that the learned Senator from Vermont [Mr. Collamer] made an argument which ought to have satisfied every Senator here that it was unconstitutional. I do believe that the legal tender clause is unconstitutional. I do not believe that, if a man has contracted to pay me $1,000, which meant $1,000 in gold or silver coin, this Congress can pass a law saying that I shall receive it in paper money, and paper money that is at as heavy a discount as this is.

“The Senator says you cannot go on with the war without the issue of greenbacks, as I understand. I think, and I have always thought, that it was an unwise policy to issue one of them. I know very well that in these times it would be impossible to get along with the sub-Treasury law requiring all the receipts and disbursements of the public Treasury to be coined. I would have repealed that much of the sub-Treasury law, and I would have allowed the notes of solvent banks to be received and paid for the public dues; and then I would have gone into the market and borrowed money. Your bonds were selling at a premium, in gold and silver coin too, before you commenced grinding out this paper money. You have ground out paper money until now your bonds are at a discount, payable in paper money that is itself at a very heavy discount, a discount of some forty per cent. and upwards; forty-seven I believe to-day. This policy has already ruined the credit of the nation, or at least very much weakened it; destroyed it to a very great extent. In my judgment this has been caused by the unwise financial policy of the Government. I desire to keep up the credit of the Government, and I believe it cannot be kept up by the excessive issue of irredeemable paper money. That is my firm conviction. I wish to put, if I can do it, a little stiffening into the Senator’s bill, and I intend at the proper time to move to strike out the clauses which require these notes to be redeemed by what he calls “lawful money,” and to insert “gold and silver coin,” believing as I do that no bank issue will ever be of use to any country that is not convertible into gold and silver.

“I shall move further to amend the bill, if this money is to be thrown on the people, by striking out that provision which prevents it from being received for your customs. If we compel the people to take it in every direction, the Government itself should receive it. I think it is disreputable to a Government to issue and force on its people paper money that it will not take itself. I think that of itself is a clear indication that those who issue it have no confidence in it. If this money is issued and forced on the people, the Government should take it for all its public dues. It should treat the people as it does itself. It should not compel them to use a depreciated currency, while itself, for a large portion of its public dues, demands coin.”

(Senator Powell opposed the National Currency Bank bill, Senator Sherman was for it)

Does this site

http://www.subotaisbow.com

have any other purpose than trying to sell advertisement ?

they do a giant Graeber series i just found out

http://www.unwelcomeguests.net/614

We left off our reading of David Graeber with the statement that “The

logic of money was granted autonomy. Political and military power were

then gradually reorganized around it”.

Episode #614 – Granting Autonomy to The Logic of Money 1

Episode #610 – From Enclosure to Privatization (Luddism, Magna Carta and

Debt in The Middle Ages)

Hour 1 (i got both) is the same as this i guess:

http://unwelcomeguests.net/archive/610/AtG_2012.04.02_Protecting_the_Commons.mp3

interview with Peter Linebaugh