Why is Gold not rising?

As we have discussed time and again, the main driver for Gold’s rise in the last decade has not been fear of inflation (mainly because there isn’t any) but uneasiness with the prospects of the Dollar and the Empire and ‘speculation’ Gold would be money again. But if this is the correct analysis, why has Gold stopped rising for 18 months now?

While this question is impossible to answer, there are a number of issues worth discussing to get a better picture.

The reports pointing in the direction of a Gold Standard have been mounting massively over the last months. Here’s yet another from last September by Business Insider on a paper by Deutsche Bank, that made some waves in the Gold community. It contains some interesting points, most notably Deutsche Bank addresses the most important Mainstream argument against a Gold Standard: that the economy grows quicker than the World’s Gold supply. Meaning that there is a structural decline in the amount of Gold compared to total economic activity, which is deflation. Deutsche Bank says the problem is real, but smaller than thought: part of the economic growth of the last decades was due to unmerited credit expansion and that would not happen under a Gold Standard.

According to Deutsche, Gold supplies grow at 1.6% per annum, while the economy, corrected for artificial credit induced growth, grows at about 2,2%. Deutsche considers this manageable.

However: this is true of the US economy, the World economy at large grew much quicker over the last decades and since the move to Gold is clearly global, Deutsche seems to be doing what vampires usually do: spin reality into oblivion.

Another interesting point in the paper is that Deutsche Bank says the market is wrong to handle Gold as a normal commodity. Gold is already money, says Deutsche, because it is held by Central Banks as part of their reserves.

Obviously, Interest-Free Economics has another definition of money: that which is agreed upon to be a means of exchange.

Gold is not money. Until we agree it is, of course.

But it is quite typical, the way wealth and store of wealth is automatically mistaken for money.

Gold is wealth. Like every other commodity. It represents value, because people want it. The amazing thing about Gold is, it is good at only two things: looking pretty and being expensive. This fact is even used as a rationale why it should be money. But in this regard it is quite similar to diamonds. And we don’t consider diamonds money, do we?

Very few people consider Gold money. But clearly we are being ‘educated’.

Gold is being sold as a solution to debt. The narrative goes: we’re all crack whores wanting ever more easy credit. But alas, reality is reality and that’s why it’s good to have Gold, because it cannot be printed and thus there can be no more debt than money.

Forget all that. The problem is not debt, it’s interest. Should we stop paying interest on the debts and use that ‘debt-service’ to pay off the principal instead there would be no debt left in 20 years.

But let’s not get into that now. Because the whole idea of ‘steady volume’ (of money) when on a Gold Standard is so…

Volume

There are a few issues to keep in mind, when considering the volume of Gold and thus the volume of the money supply when under a Gold Standard.

In the first place, the official numbers about volume. You hear these numbers: 150 thousand Tonnes. Wiki mentions 171 thousand.

Forget about that too.

Nobody knows how much Gold there is, but I’ll tell you this: there is much, much more than that. In fact: this is one other way Gold resembles diamonds. It is well known that De Beers and the Russians share only a small fraction of what they’ve got. For obvious reasons.

Remember Peak Oil? They do everything they can to create ‘artificial scarcity’. That’s what monopoly does.

As a reminder, here’s how the Protocols put it:

22. YOU ARE AWARE THAT THE GOLD STANDARD HAS BEEN THE RUIN OF THE STATES WHICH ADOPTED IT, FOR IT HAS NOT BEEN ABLE TO SATISFY THE DEMANDS FOR MONEY, THE MORE SO THAT WE HAVE REMOVED GOLD FROM CIRCULATION AS FAR AS POSSIBLE.

Mining

Recently National Geographic reported on 150 Trillion in Gold in deposits in the sea. Imagine the inflation that 150 trillion worth of Gold would bring!

These will not be mined, or reach the market. Not in time to stop the long term deflation that we face with resurgence of Gold as currency, anyway.

The role of mining is not very important. Sure, some Gold enters the market. But the world’s acknowledged Gold supplies grow only a little each year and the price is based on the inventory that we have.

Perhaps this is one reason why Gold mining shares have not been doing quite as well as many expected. Losses of 30% have been reported. Many have been burnt while buying Gold mining stocks, automatically assuming high Gold prices would be good for them. But other dynamics in Gold mining might be much more important than its impact on Gold prices, or vice versa. Nonetheless: the Rothschilds are getting back in mining again, so perhaps a new dawn arises for Gold mining after all. Or is it yet another of their diversions, suckering even more investors? That’s the problem with market gazing: they will fool you all of the time.

Paper ‘Gold’

The other thing about volume is, that because of paper Gold, which is the standard at the current Gold market, there is much more ‘Gold’ in circulation than these 171,000 Tonnes wiki mentions. So we have a double bind: real Gold is artificially scarce, but paper Gold is artificially plentiful.

How much more paper than Gold is there outstanding?

I don’t know, but it’ll be much more.

As we know, paper Gold is manipulated to the core. One of the early Internet heroes was Bill Murphy, still going strong today with www.gata.org, exposing how the big banks rule the paper metal market and keep bullion down. To prevent exposure of their fiat empire through Gold appreciation. Or so the story goes. Conveniently.

For the time being, everybody is still holding their breath and playing along in the paper Gold scheme. Meaning paper Gold is still priced the same as physical Gold. But at some point the landlord always comes and the rent is due. So it is with all that paper. People at some point are going to want to know who’s who. And this is a moment of truth that the Gold community has been waiting for for quite some time now.

Notwithstanding its suppression, Gold rose, from $250, to $1800. And now it has been stuck at that level for about 18 months. What drove its rise to begin with? Mainly speculation it would be money again.

We’ve seen how the money supply is tanking and that we are in deflation. Many say prices are rising, especially for the basics, but we’ve pointed at Money Power managed speculation in the primary sector (commodities, mining, agriculture), forcing prices up, which is not the same thing as an increasing money supply, which is inflation. We have stagflation, not inflation. Clear proof of that are not only the money supply statistics, but also tanking housing- and paper assets. The Dow should be at 5,000, this 14,000 nonsense is entirely a Fed fabrication. The Fed has only been fighting deflation in the financial economy, not in the real one. Just look at the pressure on wages and the massive unemployment because wages are not going down quickly enough to match supply and demand. Should the rising prices for basics that we see be a result of monetary inflation, wages would be rising too.

So it’s not inflation that is driving Gold and deflation normally speaking leads to automatic Gold suppression too. No, the growing monetary role of Gold is what is driving it. It seems Gold needs to be at $40,000 per ounce to mop up all fiat currency. That is the promised land of Austrian Economics and Gold buggery.

But the Powers that Be managed to suppress Gold for so long, was it just ‘investors’ making it go up? I guess not. The involvement of ‘small investors’ is just a whitewash. The rise of Gold has been a carefully orchestrated affair. And its current stagnation is undoubtedly also a part of that. Perhaps it was going too fast. Or there are tactical reason. There are all sorts of dynamics behind the scene that we simply cannot know of.

But all the believers have their eyes on the ball and it’s coming. No doubt.

The paper Gold empire is built on the dollar. It’s built on the credibility of the US Empire and it is a cornerstone of the US Empire. The fall of Comex, the paper Gold bourse ‘par excellence’, will coincide with the rest.

‘Fiat’ has nothing to do with it

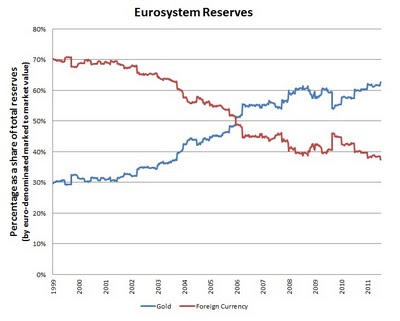

It has little to do with ‘fiat’ money as such. The Euro, for instance, will live. Here’s a cute stat courtesy of FOFOA.

Blue represents Euro Gold reserves, red paper assets. As you can see,they more or less balance each other. Everything the reserves lose to paper ‘inflation’, is compensated by the rise in their Gold assets.

Blue represents Euro Gold reserves, red paper assets. As you can see,they more or less balance each other. Everything the reserves lose to paper ‘inflation’, is compensated by the rise in their Gold assets.

Meaning Frankfurt is ready to back the Euro by Gold at any time. The Euro will not have many problems in the coming transition. This is no coincidence of course: the Euro cannot fail. If the Euro fails, there can be no World Currency. FOFOA rightly maintains Gold backing was always the plan for the Euro.

There is no such graph for the Dollar. There are two reasons for this. Officially, it is because all Gold the Fed holds is still priced at $45, because the Fed’s accountancy rules ‘force’ it to book it at the price it was bought. The Euro reserves are ‘marked to market’: they are booked at current market prices.

The real reason, as we know, is that there is no Gold at Fort Knox. It is not for nothing that Nixon ended convertibility. And what was left then, has been pledged a thousand times since.

This does remind of another glaringly obvious fact of life. Most of the known Gold reserves are held by Central Banks. Maybe not the Fed, but the others do hold much gold. This is reported every day by the ‘Alternative Media’. So why would these banks hate Gold?

This is just one of those many cognitive dissonances that we are continuously bombarded with. Of course the (Central) Banks don’t hate Gold. The reason they own it all (that we know of) is because they love it so much.

Conclusion

I’m not worried about the prospects of Gold. I don’t have any, but those that do needn’t lose sleep over their investments. Gold is becoming money and the whole rise of it has been painstakingly planned and executed over decades. The wealth transfer from the have nots to the haves will be legendary. It will further the deflation the Money Power wants. It is easily combined with supranational units like the Euro and what is being developed elsewhere. In fact, Gold IS World Currency. If everybody uses Gold to back their units, what difference does it make whether they call it a Yuan or a Yen?

If you are looking to ‘preserve wealth’ and strike it rich in the process, get as much Gold as you humanly can.

Related:

Why Gold is so strongly deflationary

Phoenix Rising, the Return of the Gold Standard

The US Empire is Not the Money Power!

Bloomberg, the dying Fed and the birth pangs of the new Gold Standard

Germany, the Money Power’s Golem in Europe

Trackbacks & Pingbacks

- Gold Prices Make Push to Retake $1,600 | Wall Street Stocks

- Gold Mining Stocks Simple Steps To Stay Ahead | Brandy & The Gang

- Penny Stock Research Reveals Bargain In Mining Stocks | Penny Stock Research

- Rare Earth Elements Still Rare, But Precious Metals Getting Scarce At This Rate | Rare Earth Elements

- The Dying Dollar | Real Currencies

- The Dying US Dollar and the Rise of a New Currency Order | ZugReport.com

- Why is Gold not rising? « Document The Truth

- The Dying Dollar and the Rise of a New Currency Order | World Chaos

- Your Money | The Information Distillery

- A World Bank Whistleblower making Waves (and promoting Gold) | Real Currencies

- Rothschild’s Federal Reserve: ‘The Dollar Is Our Currency And Your Problem’. | Political Vel Craft

- Rothschilds Federal Reserve - BottomLiningIt.com

- Rothschild’s Federal Reserve: “The Dollar Is Our Currency And Your Problem”.

- Rothschild’s Federal Reserve: “The Dollar Is Our Currency And Your Problem” | Nesara News Network

- The BRICS Bank: Next Stop On The Road To World Currency | Real Currencies

- Rothschild’s Federal Reserve: “The Dollar Is Our Currency And Your Problem” | Nesara Network

Mike Stathis published several articles on gold as an investment for the sheeple, eg: http://www.veteranstoday.com/2011/06/18/understanding-the-proper-use-of-gold-and-silver/

Stathis says that gold dealers are active in the “conspiracy theories” community (fact) and majority of those lumpen-investors are wasting their money. Stathis says that gold bullion price is expected to fall in the long term. Gold is overpriced.

It’s an interesting article! He has many things right, that’s for sure.

But he doesn’t mention the ‘gold as money’ development. And that is what I believe to be the fundamental driver.

“Gold as a money” Stathis discusses in other articles I believe.

another issue is, I didn’t mention that in the article, but I should have, that very few of the sheeple have gold. If 1% of americans own Gold, I’d be surprised. The Money Power is working on getting at least a little Gold with the people, to obtain some sort of ‘legitimacy’ for their current move.

The big money will be made by the insiders, but if a handful of ‘awakened’ share in the bounty, it doesn’t look so one sided.

Anthony – there are investors and lumpen-investors. I do not have TV set but probably Bloomberg, CNN, etc are for the latter group. Great analysis of American society was presented by C.Wright Mills half a century ago (e.g. Power Elite, American Middle Class). We were indoctrinated with this “middle class” concept.

Majority of Americans have no financial assets (except for credit card debt :). Stathis again, this time about poverty in America: http://www.veteranstoday.com/2011/06/11/poverty-in-america-the-big-picture/

In the long run economics nothing more than trying to predict the psychology of the money-elite.

You may have a point here.

The common man knows nowadays that money is created out of thin in air. The elite don’t like this. So also to re-establish confidence a ”gold-standard” could help. (It is still fractional reserve banking though).

But in reality money is backed by oil. For example if Shell needs a loan for a new plant, the bank can not say ”Well Shell I can loan it to you within 6 months first I have to get the gold to back this massive loan…”

Willem Middelkoop is still lyrical about Gold ans silver, stocks in mining companies although his Commodity Discovery fund has made some losses in the past years. So gold and silver stocks is still tricky http://www.marktgevoel.nl/weblog/2224/guru-polizei-middelkoop-doet-een-boscartje.html

He thinks there is a new moneysystem coming in the future where gold and silver trade might play a bigger role or where gold and silver trade are being made forbidden…

http://www.dekritischebelegger.nl/grondstoffen/goud/willem-middelkoop-goud-en-zilver-breken-uit-in-2013/

It’s an interesting read by Willem. A good summary of the War on Gold by the Empire. I actually gave him a vintage copy of Sutton’s book, knowing he’d appreciate it 🙂

What I’m is that the Money Power is done with the dollar as reserve currency. Those running the Empire of course want to maintain their leverage.

But the advent of Gold as currency is resistance against the US Empire. NOT resistance against the Money Power. This is the key issue.

“But the advent of Gold as currency is resistance against the US Empire. NOT resistance against the Money Power. This is the key issue.”

Exactly.

It seems to me that silver is a better way to go. “They” hold all the gold and they will use it to manipulate as they always have done. It seems to me that they have a little less of a tight hold over silver since it is useful for other purposes now.

Silver used to be the poor man’s Gold. But there is little of it left, since most is used by all sorts of industries. The silver market is also tightly controlled: JPMorgan seems to be in the middle of that.

I don’t think the money power is too interested in Silver as currency: it broadens the money supply and this is not what they want at this stage.

Diamonds can’t be money because they lack fungibility. Gold is currently a medium of exchange in some islamic countries and it’s traded like a currency (some currency traders say) in the international markets. In my opinion gold is currently money. If it was demonetized, its value would be much closer to silver’s, which is more scarce nowadays. This, of course, doesn’t mean that a global gold currency would monetize it further. This doesn’t mean gold is good as money.

I still have to read “Debt: the first 5000 years”. I’m not sure, but I think someone told me that there gold was chosen as money not by the free market but by state enforcement. Well, I’, not sure where I heard it but someone told me it was this king the one who made the first gold legal tender laws: http://en.wikipedia.org/wiki/Sargon_of_Akkad

Maybe it wasn’t true…

Sorry…global gold currency wouldN’T monetize it further

Why wouldn’t diamonds be fungible? True, some of them have names and they are probably not. But 99% of diamonds are pretty average. They are fungible, not?

No, they’re not. From wikipedia:

http://en.wikipedia.org/wiki/Fungibility

“Diamonds are not fungible because diamonds’ varying cuts, colors, grades, and sizes make it difficult to find many diamonds with the same cut, color, grade, and size.”

Even if you find two identical diamonds, their combined value is not the same of a diamond double the size. A big diamond is often worth many times its weight in smaller diamonds.

Besides, diamonds can be produced artificially: it’s just 3d carbon. So, no, diamonds will never be money.

Ok, thanks, I didn’t fully grasp the meaning.

Your last point is true of Gold too, that’s an important issue. Not that it can be printed. But there are massive private stashes out there with which they can inflate at will. Which they have done routinely, looking at all sorts of asset bubbles in the past.

We’ll have to live with the fact that the volume must be managed, simply because there is no way around it.

What? Is there a process to produce gold atoms? I mean…it’s supposed to happen through nuclear fusion in the stars, but…

Of course they can hoard, take it out, hoard again…

nono, I meant the latter: because of secret stashes they can mimic it……

Considering the matter further, this whole fungibility thing is a little outmoded. Diamonds would never circulate, just as nobody is going to walk around with gold coins. It’s used to back paper and the paper is always 100% fungible

Well, if the trust completely disappears, no one is going to accept any paper. You could see gold circulating again. In fact, it does circulate in some places: http://www.youtube.com/watch?v=nNtIsSWVJBI

And if it’s with paper, iamonds backed paper still wouldn’t be fungible.

In any case, money doesn’t need any backing at all. What are we discussing?

haha, quite right!

Whenever a new fiat currency is being introduced the price of gold goes up. Once the currency is introduced the price of gold starts going down in order to prop up the value of the new currency. This is what we are witnessing.

Value of gold today will keep going up. May go up to $10000… impossible to predict the top. Then the gold backed currency will be introduced….Bancor….SDR…..Amero…Euro…..I have no clue what it will be called. Then price of gold will start to crash to prop up the new currency. Looks like the game will start on 01/05/2013.

Correction. Game will start on 05/01/2013.

China and the rest of the BRICS may be a key to understanding the puzzle. From what I can tell, China’s three big State banks are playing rope a dope with private banking “debt money powers.”

The currency loop is that a dollar comes into being with deficit spending, or hypothecation at a U.S. or Eurodollar credit bank. That dollar is spent on an imported Chinese good, and ultimately lands in Chinese manufacturer’s pocket. Said dollar is then traded out for a Yuan by a Chinese State Bank. The Bank creates Yuans from nothing in order to do the currency trade. Therefore, the State Banks are issuing a form of Greenback money.

The former dollar is now acquired by Chinese State Bank, and is recycled back the U.S. to buy a TBill. (By buying TBill’s, China limits buying of U.S. goods in order to maintain demand for China’s goods.) Buying TBills effectively raises the value of the dollar due to supply and demand e.g. dollars are taken out of market until the U.S government. re-spends, but with TBill debt instrument yoking future American’s wealth. Extra Yuans now enter the Chinese market as Chinese Manufacturer spends, driving the Yuan down in value. But, the drop is not too much, as the Chinese economy grows and needs the extra Yuans. Why? Because whole industries are lifted out of the U.S. and transferred to China for wage arbitrage. Captains of industry and Wall Street take some of wage arbitrage as they export their Chinese good back to the U.S. In other words, it is U.S. captains of industry and Wall Street that fund the relocation of industry. This is aided and abetted by Chinese State Banks. This mechanism hollows out wealth and knowledge from the former superpower, but temporarily enriches the usury banking, corporate, and Wall Street parasites.

Importation duties to the U.S must remain low, because of dollar as reserve status. This means that dollars must be made available to buy oil and to serve as currency reserves in other countries. Therefore the U.S is importer of last resort in order to source dollars to the world. Wall Street is counting on Reserve Status to remain in place along with low tariffs. See Triffin’s dilemma.

China also forgives loans, making their former credit money lose its liability association. Forgiving debts means that Yuans can float in the supply with no debt, an efficient type of money. The Yuan former credit does not need to return to banker’s ledger and disappear. Only a State Bank can do this as a form of economic warfare, and Wall Street’s private banks have not figured it out. This is a rope a dope strategy to gain new additional industry. China also copycats American and other foreign industry by funding copycat industry with “loans,” and thus climbs the knowledge and wealth curve rapidly. This is more rope a dope as Chevrolets, Apple, and even Samsung, etc. are copied, usually by Chinese workers moon lighting in a copy cat factory.

So, real wealth is redounding to China and debt yoking is redounding to America. The usury parasite is in a feeding frenzy taking wage arbitrage , but will not make inroads into China. The State Bank System is a secret weapon allowing China’s money power and state power to merge into a form of fascism. China will play along and buy Gold with some of their surplus dollars. They have also bought heavy stocks of Copper as a hedge as well. But real wealth is knowledge and industry and ability, and ultimately the money will reflect the underlying value.

Some of the Gold run up was also speculation money coming from Quantitative Easing. QE puts a floor price on Bonds, but it also allows cheap credit loans to fund a carry trade, and speculations in commodities (like Gold). QE is usually a swap of new money for a bond held on the books as reserves in a usury bank. The usury bank looses the interest income, and then has to make it up somehow, often by engaging in speculation such as carry trade hot-flows.

“If everybody uses Gold to back their units, what difference does it make whether they call it a Yuan or a Yen?”

Ehrm, .. well, bycause they don’t and so it doesn’t … or rather they can’t pretend their unit is more universal than Gold .. only sun/soil based units of account and stores of value can compete w it on that score, … Dollarites tried for that most wanted centrality status but bog & buckle down in and under ‘splodin cost of coercion, push&blowback from/via real sitelinks which call their bluff bluster and bullie shite, iow, ‘cave’ in on them like a ton of bricks .. not fake [&] fiduciary ‘ceilings’ easy to ‘raise’, the ‘propper upper’ ‘resting’ on the hidden ground here being the milplex, turning it(‘s nevermore to be found sound any longer ground) into off-limits disaster zones; it’s called the 4940 gooooglie hit “strategic area denial” (listen to Douglas Dietrich what our evillords tried on that score in Iraq), or better yet: ‘terra ANnullius’, a truth schizoically aboutfaced into false flag revenue streammerce guided to ‘free’ world safehouses of the poxy clips.

Perhaps that wasn’t very clear, let me try again:

Technically, not ‘everybody’ does, … just the distrustful or unfamiliar yet venturesome clearinghouse trader — degenerated into a myopically numbers and code manipulating venture capitalist precipitously; gambling invaded the net and banking, hoaxes migrated from hollywood into the news business; working their moronism from home to destroy all homeliness far and wide — who likes to see for himself if the transport costs of the local surplus cannot be lowered and to get a little fresh competition off to a good start; essentially it’s a new market tool that makes up for inability to do a very thorough examination and or breach through and out of the circle of those already very habituated to and indeed, reliant on the price of something as is (and/or expressed in similar essentials).

Ultimately, the backing is the thing itself, secondarily, the desire for it and thirdly, tempered by the transportation difficulties; gold is a diffusion and risktaker tool … paradoxically. Sunshine and soil formation will shortly become way more interesting. The lowland’s golden age (based as it was on musketry, pure infamy of entitlement through ‘fight unfairage’) is almost over (thank gods and goddesses).

Hmm, that’s prolly not much better eh?

Perhaps that wasn’t very clear, let me try again:

Technically, not ‘everybody’ does, … just the distrustful or unfamiliar yet venturesome clearinghouse trader — degenerated into a myopically numbers and code manipulating venture capitalist precipitously; gambling invaded the net and banking, hoaxes migrated from hollywood into the news business; working their moronism from home to destroy all homeliness far and wide — who likes to see for himself if the transport costs of the local surplus cannot be lowered and to get a little fresh competition off to a good start; essentially it’s a new market tool that makes up for inability to do a very thorough examination and or breach through and out of the circle of those already very habituated to and indeed, reliant on the price of something as is (and/or expressed in similar essentials).

Ultimately, the backing is the thing itself, secondarily, the desire for it and thirdly, tempered by the transportation difficulties; gold is a diffusion and risktaker tool … paradoxically. Sunshine and soil formation will shortly become way more interesting. The lowland’s golden age (based as it was on musketry, pure infamy of entitlement through ‘fight unfairage’) is almost over (thank gods and goddesses).

Hmm, that’s prolly not much better eh?

There is getting to be a lot of talk on the internet about the powers-that-be and games being played on high financial plains. The nature of money, the ability to define what is money, the ability to create fiat money, what actually has value to future humankind, these are important subjects to let out for fresh air and distribution. Nonetheless, it’s hard to see how this talk will have any effect. Sure, more and more people will be aware of events unfolding toward the end of some kind of global market fascism. But will any actions conceived or executed by counter-cultures make a difference? I fear not. The talk is all that will happen, as the means of stopping the leviathan may require more solidarity, sacrifice, and action then there is available.

Of course we can make a difference. Just like Gandhi defeated the Queen’s monopoly on Indian salt through non-violent disobedience, we can defeat the money powers by NOT ACTIVELY COLLABORATING WITH THEIR SCAM. They cheat us because we let them.

By choosing new monies (different forms of mutual credit, freicoin, ripple, etc) as our preferred medium of exchange, we can demonetize the usd, eur, gold and any other flawed money they come up with. We produce real goods and services instead of financial scams and derivative illusions. We have the power, we just forget it too often.

After reading your article here and your “problem is interest” link, I don’t think you really understand money. There is nothing that I see that will fix anything nor does it do much of anything except make it worst.

You seem to confuse money with production. Money is only a medium of exchange but is not the reason why you have an economy. Economies come from people making things and trading with other people. Money only helps to facilitate that trade. Money acts as a medium of exchange not a producer of it. You can inflate it and have more in circulation or you can deflate it and have less. But The reason why you have money is so that you can trade something for it. If their is nothing to trade, (nothing of value) than it is worthless. So, the real economic driver is individual production, not production based upon lose loan standards and money created out of thin air. All that does is to make things, that otherwise would not exist, and things that cannot exist when the correction occurs. This is always a natural limitation of money do to the limitations of the land and diminishing returns.

What you seem to propose is nothing more than more wealth concentration, not less. And wealth concentration is what the problem is. What is needed is the decentralization of wealth and the ending of lots and lots of government restrictions.

HOwever, this is what governments exist for. They exist to concentration money, and thus production. This is why we have national currencies and borders. It keeps money and wealth from leaving nations. It keeps others from competing with political friends and allies. This is what mercantile economies are all about. inflate the domestic currency, restrict the domestic production, and export to another people who have money (so that they can trade their currencies with) and buy things that they don’t produce domestically.

The real problem with the economy is that there are too many restrictions on production, not interest. This is what happens when governments, or public banks for that matter, control the money. They always pass laws to inflate the money. Why? So they can collect more taxes, spend more money, and concentrate more wealth.

Why? Because the cannot overcome diminishing returns, which make cost rise. Markets are great wealth decentralizationists. Without regulations or mass inflation, it would be very hard to get a monopoly on anything. And local business it would be small business that would rule over large corporations (would would not even exist). This is the dirty secret. Without inflating the money supply not only would not not have large businesses but you would not have most governments.

No, what is really needed is for people to determine their own from of money based upon private contracts. And for a government that only decide what form of money it can collect, and not levy private property for taxes. What is not needed is for the common “we” to decide what money is as if they how the power.

Today, people are buying gold not as a currency hedge but as a investment alternative. But, if governments would mandate a return to gold, it would be the end for them and almost all international distributions channels. It would also be death for a lot of people whom live in inner cities which is why they keep printing money. The world would change over night as shelves go bare, until enough people have access to gold. BUt of course would would just go locally for their needs assuming that there are people producing things. OF course, fiat money and the thinks that you propose only create more people that produce less and less leaving them with no alternative to violence. This is how little somalia are created.

ANd if you really wanted to fix everything and put the country on the right path then all you need are three things.

1) 100% banking reserves so that banks cannot lend out more money than they have.

2) ownership rights over deposits so that banks cannot speculate with other people money

3) and banks that only act as intermediaries with those people who want to speculate with their own money and who money is tied directly to the loan.

Implement this and everything else will come together. Eventually you will have sound money, low if any interest, and money that buys more things, not less (inflation) over time.

Test

“Gold and Silver are money. Everything else is credit”—J.P. Morgan

“Gold is not money. Until we agree it is, of course”—What a stupid statement. Gold isn’t money but paper is? Paper backed by what? Zip! And of course the more fiat that is printed, the more valuable it becomes. Keynes, thru and thru. For thousands of yrs(ck your Bible) gold/silver have been money. Paper is just a reformed tree and will always go back to its original value. Zero. I’ll hold my metal. You hold your paper. We’ll see who wins out.

Paper isn’t money robertsgt40. Until we agree it is.

Money is a means of exchange agreed upon as such. That’s the very definition of money.

The notion that wealth is money (or money is wealth) is very widespread and just about the most fundamental lie the Money Power has circulating for the better part of 5000 years now.

“We” agreeing on it being of value has nothing to do with it….the note is legal tender because they with the guns and power said so right on the note….at least in this country. Only when hyper inflation sets in do we all agree that we won’t trade any longer in it.

I agree though that it’s a fundamental lie that it has any value…especially now that it can’t be exchanged into silver of gold.

No Government can force a unit on a population at a price level it does not want. History shows that without a doubt. Sure there is law, but there is also tacit agreement and acceptance.

Hi Anthony, First, I am admittedly too critical. That being said, I thought your article was excellent! It was informative and well-written. Most importantly, it flowed well, was very interesting and informative, and I didn’t want it to end.

My only issue is your reply above. You stated:

1. Money is a means of exchange agreed upon as such. That’s the very definition of money.

2. The notion that wealth is money (or money is wealth) is very widespread and just about the most fundamental lie the Money Power has circulating for the better part of 5000 years now.

I added the numbers. #1…you are obviously a bright guy. You don’t need to prove it. The #1 comment reads like that….IMHO. Your definition deletes what is in almost every published definition. “Money is a means of exchange in the form of coins or banknotes.” Your definition seems to imply money could be golf balls….or chickens. Many forms of money have been backed by gold, in whole or in part. I think your definition is more akin to barter. I do understand your point that if we agreed to use golf balls instead of coins and wrote numbers on the golf balls, showing a value, they could be used as money, but then the definition would have to be amended to insert “golf balls” in place of “coins.”

#2. On this one I am really lost. The amount of money the individual has is a general way we determine his wealth on a monetary or financial basis. I’m not sure how in the world you would determine wealth in any other way, unless perhaps you are saying “money” has no intrinsic value (unless backed by gold…assuming you believe gold has an intrinsic value). At one time, whoever had the most horses and land was considered the most wealthy. However, most of society has moved past that and rather than carry chunks of gold…we used paper dollars…which were initially backed by gold. Yes, if you really start thinking about it, none of these things really has and intrinsic value. Not the piece of paper which we call a dollar, not a piece of gold, which isn’t really used for much of anything. But without it, we would have to bring our three goats down to the Apple Store to trade them for the new iPad. if we didn’t have something that we all agreed would represent our wealth, then we would never get past a barter system. What am I missing? How would you measure wealth….by all our possessions?

I look forward to your response and thanks again.

Thanks C.J.

Ad #2: this is exactly what it’s about: the difference between money and wealth.

When we say ‘he has a lot of money’, we usually mean ‘he has a lot of assets’.

For instance you can be a billionaire and have only enough money in the bank for next week’s groceries: your wealth is in your business, your land, whatever.

Wealth should NOT be hoarded in money or paper assets. Money is to EXCHANGE wealth, not to HOARD it.

Money should always be sunk into assets, or it defeats its very purpose.

A fabulous reason to support the second amendment, without which we are at the mercy of the government

Government can also use positive incentives to get people to accept paper money. Would you rather pay your taxes in gold coins or paper notes?

seems to me there is no difference.

I’d choose to keep the gold and pay my taxes in paper money. If the gold is demonetized, at least I still have a shiny rock that I could sell to a jeweler or hold on to in anticipation that humanity’s historical fascination with gold will cause it to appreciate in value again during the next crisis. If the paper money is demonetized, I could use it as a book mark, kindling, or scrap paper, but no matter how you look at it, the commodity value of gold is greater than the commodity value of a demonetized paper dollar. Show me an incident where demonetized paper is worth more than demonetized gold, and I’ll concede that there is no difference.

Of course, I misunderstood your intent.

But everybody would pay with paper first and use the specie to hoard wealth. Gresham’s law.

Precisely.

Gold could be demonetized just like paper.

If gold were demonetized, its price would be near silver’s or even below.

You would not “lose it all”, but that’s like saying that zimbawue’s dollar’s have “intrinsic value” because when demonetized they can be used to start fires.

There’s no such thing as intrinsic value. If you follow the Austrian school, its fonder Carl Menger already told you that. Too bad Mises forgot it when talking about money.

You lack critical thinking skills and the ability to investigate.

15 Trillion in gold at the bottom of the sea? Right now it costs $1,300 oz to mine gold on land…..what do you figure it would cost to mine it at the bottom of the sea? 10-30K oz maybe? It might at well be on Jupiter….

The reason the central banks hate gold right now is because they are accumulating it. In 1933 when Roosevelt and his bankster pals stole all privately held gold they paid a ‘hated’ price of a little over $20 oz for it and then when they had it all they set the price at $35 oz. That’s why they hate it now….and they don’t own it all….yet.

The bankers own or otherwise control all the gold and have done so for thousands of years. There is no doubt about it.

They have preparing the return of Gold as currency for decades and they have hidden it as ‘opposition’ in the Alternative Media, aka Austrian Economics.

Excellent article. Fortunately, if the global financial system were to return to gold-backed paper (which would almost certainly engender deflation), it wouldn’t actually prevent monetary reformers from pursuing an alternative such as social credit. Moreover, if the bankers’ end game is to establish international currencies (Euro, Amero), they might be making a big mistake. The experiences of the PIIGS nations under the Euro is undeniable proof that international currencies don’t actually solve social problems. International trade may be facilitated, but each nation loses sovereign control over their money system; and history is filled with examples of money being used as a social tool to lift people out of poverty, increase employment levels and increase production (http://etext.lib.virginia.edu/users/brock/webdoc6.html). I expect that during times of crisis, the monetary reform cause will be increasingly popular among the people of those nations who have been robbed of such an important social tool.

It’s remarkable in support of me to have a web page, which is useful for my know-how.

thanks admin