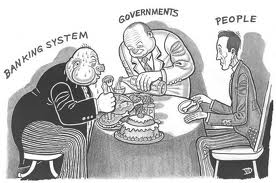

At long last: savers will pay for their folly of trusting banks

It was bound to happen and it’s a miracle it didn’t happen before. But in the next round of the crunch, savers will pay for their trust in banks. Cyprus is the first to do the right thing. Savers will be levied to keep the banks going: 10% on their holdings over 100k euro.

Obviously, it’s a disgrace that those without savings are paying to make whole those hoarding cash at banks when these banks do what they do all the time: go bust. That’s, after all, the implication of Government guarantees of these savings.

Cypriots will pay a 10% ‘levy’ of savings over 100,000 euros and almost 7% over savings below that.

Now that the taxpayer is broke (and upset), the inevitable is happening. It will only get worse. Governments are as broke as the banks and can no longer keep up guarantees of savings. And of course, why would they? Why do the poor have to guarantee the holdings of the middle class and the wealthy?

People keeping their money at the bank are not only supporting their own slavery, they are risking losing everything.

Here’s the Guardian reporting. Angry Cypriots are trying to get their money from the banks, but they closed down. So let this be a final stern warning, not from me, but from the real world: if you’re one of the happy few still holding money, get it out of the bank now.

Excellent! Thoroughly underreported in the media. They can do the same with cash, though with more dire consequences to the entire economy.

Nevertheless there will be countries where you can transfer your funds. Besides – we must still use the banking system – best to make some kind of wealth while we still can.

When the final chipped monetary system of weekly annulated credit is in place – all kind of independent wealth accumulation will be gone.

A smart man once said: “Only keep money in banks that you are willing to LOSE”

Now they’re going for open, brazen theft and confiscation. Suits those who trust and shill for the money system well.

Sir: Can anyone criticize and attempt to penalize “Savers” simply because they shelter their capital? Nonsense. If the argument concerns international money laundering, or inappropriate tax shelters, please say so. If my neighbor chooses to save parts of her family’s income every month, she has a right to do so without risk of being part of a badly conceived and implemented government scheme to save itself from inefficient fiscal and monetary policies.

Christ admonishes us to pass on what we receive, knowing Providence provides. So I don’t really believe in hoarding wealth, in whatever way.

But it’s undeniable many want to and there is no reason to stand in their way.

However: hoarding cash is not the right way: hoarded cash is no longer used for its main purpose, exchanges, and this hurts the community as a whole. That’s why I promote hoarding anything, except money.

Worse still is hoarding money in a bank, as the banks needs depositors and banks are the main enemy of mankind. Putting one’s money there is simply enabling the enslavement of both self and all others.

The worst case scenario is hoarding cash at a bank and then clamoring for a bail out when the bank goes bust. Obviously savers should not expect the taxpayer to guarantee their deposits.

Hopefully this makes more clear my position!

Anthony Migchels, Small savings is not hoarding.

Big difference between saving and hoarding. Hoarding is an irrational gathering beyond ones needs.

Savings is a rational response to an upredictable world.

True, deposit protection removes a ‘moral hazard’ for both the bank and depositors, which promotes bank speculation, fraud, and embezzelment.

But, small depositors’ unappreciation for moral hazard is not the driving force, it’s the bankers’ reckless behavior that threatens the system.

For that reason, I support deposit protection for small savers.

Deposit protection would not be much of a problem or really hurtful to the taxpayer if rules like with many municipial banks were in place (i.e. lending out only 50% of deposits under strictly supervised rules etc.). But those banks are almost extinct.

Accumulation of wealth is better done through transfer of that capital to tangible means like real estate (if not overpriced), gold, silver, education (still useful if done smartly) or investment in your own or someone’s business. Of course a hugely superior system would be one in which wealth accumulation is not desirable at all because everyone would be provided with ample housing, transportation and all necessary consumer goods in a de-facto money-less society, but mankind is nowhere ready for that.

Temporary savings can be done equally well in cash. The interest rate gain is a pittance anyway.

By the way: the money power ruled equally well even in times where the lower 80% never had a bank account (1970s UK!).