How to manage the Volume of Money in Mutual Credit

The notion that volume is irrelevant in Mutual Credit, as long as it is asset-backed, is quite widespread.

It’s a mistake and a serious one. It is badly damaging the credibility of Interest-Free Mutual Crediters and stalling the development of a platform. Usuronomics is the only winner.

Clearly the issue of Volume needs serious attention. Management of Volume is one of the key arguments Usuronomists of various persuasions use to rationalize their pseudo-science. Rising interest-rates dampen demand for credit and thus stops inflation, they will say. And although we know this to be a half-truth, rising interest rates in fact cause rising prices, albeit not through inflation but through higher cost for capital, it’s far from complete nonsense. The notion that endless credit creation is possible under Interest-Free Mutual Credit, whether we call it LETS, MPE, Bartering, Hours or whatever, is simply wrong and destroying our case vis a vis the open-minded.

The goal is not to insult those Interest-Free Crediters holding this position, men I highly respect and consider colleagues. The goal is to make a viable case for Mutual Credit and ridding ourselves of mistaken notions hindering the fulfillment of its promise. As long as serious doubts remain about the Volume issue, it will never happen. It is better to work these things out amongst friends than to get bludgeoned by Austrians, let alone the simpletons of the Mainstream.

Having said that, I had a bit of a problem getting a good handle on the take Mathematically Perfected Economy has to offer and I’m grateful to Australia4MPE for taking up the gauntlet and arguing MPE’s case on the matter. Our dialogue can be found at the comment section of the article on Money as part of the Commons.

MPE’s take and its problems

You’ll have to read the dialogue in its entirety to see what happened, but I’ll discuss it as fair as I can in my own words here.

MPE doesn’t talk about interest-free credit, as it offers promissory notes. The reason they stress this is because people assume they borrow from the bank, which is obviously nonsense. The bank doesn’t lend anything. The money is created by a promise to pay and the bank does the bookkeeping. Hence ‘debit’ and ‘credit’. But while the promissory note is a more pleasant notion than debt, it’s no different: the promissory note has to be repaid. The key is to understand that a Mutual Credit Facility (MCF) is not the creditor. It represents the creditor, which is really the community. That’s why it’s called Mutual Credit: we allow each other to buy now and pay later. By not charging interest to our neighbor, we obtain interest-free credit ourselves too. The MCF just organizes this, keeps the books and makes sure outstanding credit is good and repaid. It takes a fee to cover its costs.

MPE believes that volume is irrelevant, because the money is in fact circulating credit and this credit is backed by assets. Hence the value of the money, they say, is in reality the value of the underlying asset. In MPE, the ‘debtor’ repays the promissory note at the rate of consumption. So if a house is expected to be end of life after a hundred years, the interest-free mortgage can be repaid over a hundred years too.

But the problem with this is, that MPE only looks at the credit side of MPE. But once the promissory note has been spent into circulation, it starts to behave as money. It will be used in other transactions. And while the value of credit is the underlying asset, the value of money is a function of volume. If the volume increases, when more money will chase the same goods, prices will increase.

And the volume will increase in MPE. Catastrophically. Because people will be issuing more and more promissory notes. And these will fuel asset bubbles. And people will issue more promissory notes, backed by assets at already inflated prices. Ultimately it would be unsustainable and we would have a crash and then there would be many promissory notes in circulation no longer fully backed by assets.

MPE simply overlooks this and vehemently denies it.

The reason is, that MPE has a mistaken, or at any rate incomprehensive theory of inflation. It says that rising prices under usurious credit is not a result of growing volume, but because of escalating cost for capital, interest. And this is true of course. John Turmel calls this ‘shift B inflation’. Because the principle is created but not the interest, someone else must go into debt to finance these interest payments. But for this second debtor the interest is also not created, so a third must go into debt. Etc. This explains eternal growth of volume in all the post war economies. And also the need for ‘economic growth’, as ever higher interest charges require monetization of ever more natural resources and human activity.

However, while this is certainly correct in terms of the longer term development of the money supply, it completely ignores the horrible asset bubbles that have been the norm throughout the post war boom and beyond. The current real estate boom and bust was fueled by low interest rates. This actually is a clear and patent example of exactly what we’re talking about. Only higher interest rates (to stop the easy credit and growing money supply as a result of it) to kill the bubble would have prevented the crash.

Furthermore, early Government debt-free units also saw horrible inflation through overprinting. MPE may say that that was because there was no asset behind the debt-free notes, but that’s not (only) why they lost value. They lost value because the money supply was growing too quickly and more dollars were after an equal amounts of goods.

It matters not, whether the money is debt-free, commodity backed or asset backed credit. What matters is volume. This is what experience shows in all sorts of relevant examples. It is also well known by all economists. They don’t understand the effect of interest on prices, but they do know volume.

So how to manage volume?

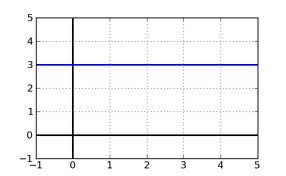

The volume must develop in parallel to the value of transactions in the economy.

Next, the money supply must always be as big as possible without raising prices. This is critical, otherwise there will be scarcity of money.

This means that the MCFs can dole out credit in limited amounts. There is a greater demand for credit than there is for money. We will probably need more credit than we can get from the money creation process itself. This can be comfortably solved with JAK Banking and some kind of Brokerages, which could turn out similar to Islamic Banking: sharing both in risk and profit and not on an interest basis.

This leaves the need for some kind of a Monetary Authority (MA) that regularly measures the money growth and decides how much more or less credit can be allowed. There should also be some policing, weeding out rent-seeking in the system, or for instance withdrawing large sums from circulation by rich players.

However, this can be well managed. The MA could be well restricted with a strict charter. It should make education a key target, so that every able bodied citizen understands by what (easy to comprehend) basic parameters the MA operates.

The MCFs should have equitable rules in place sharing the credit that the system can handle, so that each commoner gets his fair share in the Commons. Basically everybody would have a right to a certain amount of credit every so often. Extra credit can be obtained in many ways, as already mentioned.

Money will be abundant and stable. Rents would be decimated, because they are almost all based on cost for capital. The bottleneck in production will swing from capital to labor, meaning that labor will dominate the market place, as it should. Many people will be self employed again. No more wage slavery. They would be doing what they thought either comfortable or worth while, not what they must to survive. Incredible abundance would become the norm.

Conclusion

It’s just like land reform. We cannot just say “ok, go out there and take what you will”. We need reform that gives the commoner good access to his share of land.

The Commons must be free, meaning everybody can take his share, no more and no less. I don’t know how that should be done with land, although I have ideas, but in terms of Interest-Free Mutual Credit it’ll have to look something like the above.

Mutual Credit units are undoubtedly a viable and crucial model. Demurrage money may even be (slightly) better, but Mutual Credit’s great boon is its familiarity. It’s pretty much like what we have now, but completely at the service of the community, instead of the other way around.

Cheap, plentiful and stable.

Helping us to tap into a common abundance that we should probably fantasize more about.

Related:

Mutual Credit, the Astonishingly Simple Truth about Money Creation

Mutual Credit and Inflation

Interest-Free Credit (including MPE!) and the Management of Volume

Social Credit with Demurrage

Trackbacks & Pingbacks

- How to manage the Volume of Money in Mutual Cre...

- The Cult of Mathematically Perfected Economy and its Ridiculous Stance on Inflation | Real Currencies

- More on Inflation, the Value of Money and Money as Part of the Commons | Real Currencies

- More on Mutual Credit | Real Currencies

- How Money Rules | Real Currencies

- Anthony Migchels -How Money Rules | uNbound

- Anthony Migchels -How Money Rules – Stop White Genocide.

- How Money Rules | Justice4Poland.com

- Hoe het geld regeert en wat daartegen te doen - De Lange Mars Plus

All credit is mutual credit. The rationing of credit is the trick. Currently done by FICO scores and interest rates and collateral, it leaves at least 40% of the population without means. Check your stats course on the bell shaped curve. Further only about 2.73% of the population has the capability to excel in this system. Therefore, the rationing to credit ie money supply will have to be done by price and income management. In other words some kind of tax structure and supply management. Just a thought. Thanks.

I wish we would define money as an accounting identity that floats, allowing transactions to be mediated. Calling money as credit is only true if one squints really hard. Just because our current world paradigm is credit = money, does not make it a true statement.

Credit as money floats for a time, e.g. the term of the loan, and is recalled and disappears in discrete periods, e.g. the loan payment interval. The two behaviors, one of money, and the other “credit” are different. Money stays in the supply, and can be hoarded by rentiers. Advocates for money (me) need to be on guard for this…nothing is perfect. But, floating money that stays in the supply to match goods and services production needs to be a necessary component of the overall supply.

Credit disappears from the supply to cause money supply distortions. Yet, to the end user, the functioning of both units appears the same; the medium used for their transactions is taken on faith. The end user does not stop to think how the unit came into existence, or the path it takes, or how it floats, or how it affects volume. The end user simply accepts the unit, and therefore birth, death and cycle rates of the money itself are irrelevant to said user. However, the faith component of the end user can be shaken by volume distortions such as inflation or depression.

Credit can be turned into money. This is the secret of China, which uses state banks to lure industry. China then cancels loans, thus allowing the former credit to lose its “credit” association. In this way, what began as credit is now free to float in the money supply as money. Basel 2 rules allows this, and China sneakily uses this loophole. Because they use money, and money does not have associated high costs, China’s labor force becomes inherently more efficient. Foreclosing on homes is another way that former credit can become money. The loan contract is legally cancelled, and the credit no longer is compelled to drain into the double entry ledger.

In the case of mutual credit, some creditors could be “special” altruistic individuals, and simply have their assets on the books. Their asset was monetized and that money was spent into the supply. In this way everybody can use this former mutual credit money as a public good. These special people have then attached a portion of their wealth so everybody can use the created money. As long as the asset stays on the books, the money does not need to vector back to the bank and disappear. This can be accomplished with legal means and does not require coercion, but instead enlightened behavior. Those kinds of people are with us. Perhaps they can be further induced by owning a percentage share of the credit facility that created the money, which would maybe take a law change. Mutual banks, as envisioned by Bagehot are somewhat similar to this altruistic scheme, where the mutual banks would simply monetize the wealthy and issue money as a public good. The Venetian bank, also similar, used state power to recycle the savings of the wealthy, hence their wealth became public money and cycled for generations.

To control the money supply, some percentage of the supply could be credit where people pay their loans on time, hence the supply drains as the former credit money vanishes. Some built in drain bias as credit can be useful to offset any inflation. Another percentage of the supply could be and needs to be money. Yet another percent of the supply would be newly formed credit.

Newly formed credit cannot spew out of the banks in an asset bubble, particularly against land. Land does not follow supply and demand curves, as it is fixed quantity. Our recent housing bubble was most acute in fully developed, land locked areas. Therefore creditors need to work together in an enlightened way.

The money component of the supply reaches those who only have their labor to trade. Floating money is available to be traded for labor. In statistical terms, the shape of the curve changes because the population served has been expanded.

This is a quick reply, but my initial thoughts anyway.

‘The notion that endless credit creation is possible under Interest-Free Mutual Credit, whether we call it LETS, MPE,…’

No, MPE does not advocate endless credit creation, the newly issued money is a debt that must be retired, principal alone. In fact of all the other platforms you list it with, MPE is the ONLY ONE, that retires the money from circulation, with an obligatory schedule of payments. In fact, I used to advocate Social Credit/Greenbacks till I came across MPE.

Besides other than homes/cars I cant see many big ticket items requiring it. The VAST majority of transactions are paid using cash upfront whether rent, bills, grocery shopping, drinking etc etc.

‘MPE doesn’t talk about interest-free credit, as it offers promissory notes’

We’re not ‘offering’ it. Its what we ALREADY USE today. The problem is banks are laundering, republishing and imposing interest on the exchange. Promissory notes/contracts are used in every single nation on this planet as I speak and being laundered by banks at the same time. MPE is simply restoring the universal right to issue an unexploited promissory note.

,That’s why it’s called Mutual Credit: we allow each other to buy now and pay later. By not charging interest to our neighbor, we obtain interest-free credit ourselves too. The MCF just organizes this, keeps the books and makes sure outstanding credit is good and repaid. It takes a fee to cover its costs.

We don’t ‘borrow’ from each other. Obligors issue promissory notes/contracts which pay for the home on the spot to the true home seller (the true creditor). However the obligatory/debtor must retire/pay out of circulation the new money he has just issued into circulation (principal alone) at an agreed schedule of payments. His credit worthiness and ability to work and pay out the principal is the main concern. The money is backed by our labour and production, just as today.

‘But the problem with this is, that MPE only looks at the credit side of MPE. But once the promissory note has been spent into circulation, it starts to behave as money. It will be used in other transactions.’

It dousent ‘start’ to behave as money, it IS money. All the cash moved around are re-presented promissory notes.

‘And the volume will increase in MPE. Catastrophically. Because people will be issuing more and more promissory notes. And these will fuel asset bubbles. And people will issue more promissory notes, backed by assets at already inflated prices. Ultimately it would be unsustainable and we would have a crash and then there would be many promissory notes in circulation no longer fully backed by assets.’

Again we already issue promissory notes. And the rocketing home costs are there becase BANKS control the publication of the promissory notes by

A) Laundering the note between buyer/seller

B) Falsifying a debt to itself

C) Imposing interest on the exchange

MPE would dramatically reduce the cost of housing, and all these ‘asset bubbles’ were caused by the banks first crime of laundering our promissory notes. I dont get it Anthony, you love SC, but as soon as MPE comes up you bring up Austrian doga.

‘Furthermore, early Government debt-free units also saw horrible inflation through overprinting. MPE may say that that was because there was no asset behind the debt-free notes, but that’s not (only) why they lost value. They lost value because the money supply was growing too quickly and more dollars were after an equal amounts of goods.’

Well none of those had anything to do with our promissory notes. MPE is not debt free, the money is backed by our labour/production retired from circulation when created. Colonial scrip had no function to retire the money from circulation as MPE does AND it was attacked externally by the Brits printing it en-mass off the coast. These are the exact same Austrian straw-men we get from the elves 🙂

‘This means that the MCFs can dole out credit in limited amounts. There is a greater demand for credit than there is for money. We will probably need more credit than we can get from the money creation process itself. This can be comfortably solved with JAK Banking and some kind of Brokerages, which could turn out similar to Islamic Banking: sharing both in risk and profit and not on an interest basis.’

And you end this by pointing us right back the the very banks laundering our own promissory notes. We don’t need them Anthony, any institution claiming to ‘lend’ you your own own contract, backed by your own labour and production is fraudulent.

I want to issue my promissory note, free of Barclays, Fan and Freddie or the JAK Bank. I just need to get it published and retire the principal (alone). You keep saying ‘inflation’ without citing volumetric or price inflation. We cant have volumetric inflation with a usury system as there is always more debt that money in circulation. Interest is the root cause of price inflation.

http://australia4mpe.wordpress.com/category/what-is-the-root-cause-of-all-inflation/

Let me focus on the volume bits here Greenbacker:

“Again we already issue promissory notes. And the rocketing home costs are there becase BANKS control the publication of the promissory notes by

A) Laundering the note between buyer/seller

B) Falsifying a debt to itself

C) Imposing interest on the exchange

MPE would dramatically reduce the cost of housing, and all these ‘asset bubbles’ were caused by the banks first crime of laundering our promissory notes. I dont get it Anthony, you love SC, but as soon as MPE comes up you bring up Austrian doga. ”

The main thing is ‘imposing interest on the exchange’, that’s where most of the extra cost is. MPE solves this. Keep in mind I wouldn’t even be discussing this if MPE wasn’t interest-free and a MAJOR step in the right direction!

But the point is that house prices rise STRUCTURALLY because of usury and show ASSET bubbles through volume manipulation. MPE solves the first bit, but not the second.

These asset bubbles are not because of ‘laundering the note’, but because of ‘overprinting the note’! This is not Austrianism perse, this is well-established economic theory. It’s not ALL nonsense, you know, economics, hahaha. Ok. Most of it is, but this not!

“Colonial scrip had no function to retire the money from circulation as MPE does AND it was attacked externally by the Brits printing it en-mass off the coast. These are the exact same Austrian straw-men we get from the elves :)”

I’m not saying it’s the same situation! It’s a parallel situation. You’re right about debt-free having no mechanism to retire (although it could be taxed out of circulation), but the parallel is that it shows that an interest-free money supply can inflate and will inflate.

Inflation by definition is growing volume! Inflation will lead to rising prices.

It’s amazing that MPE doesn’t understand this!

PS: I can understand that you want to issue your notes.

What I’m saying is that i don’t see how it is possible to have everybody issuing their notes, backing them with inflating assets, without a horrible disaster!

“Colonial scrip had no function to retire the money from circulation as MPE does

Jct: You could pay your taxes with it and that’s how it was retired. Say they used Continentals to fix a bridge. When the taxes are collected to pay for it, they’re retired.

Then these ‘continentals’ basically are a form of interest-free credit, not so much debt-free money.

I used to advocate Social Credit/Greenbacks till I came across MPE.

Jct: I still advocate Social Credits or Treasury Greenbacks so what improvements makes you think MPE is better than the two currencies I already consider ideal 1/s currency mechanisms?

And what is your take on the notion that debt free money can only be lent at interest once spent into circulation? Doesn’t an interest-free credit based money supply solve this problem?

There can only be so much debt, denominated in terms of money, in relation to people in the economy. The question is, “who decides who gets to borrow how much, and who will lend?”

Just make me the dictator! I swear to God everyone will get what they deserve!

http://www.axiomaticeconomics.com/montagne.php

I tried reading this Aguilar dude, but it looks like some rather simple minded Austrian crap. He even calls MPE socialism.

Yea you beat me to the punch on that critique. I posted it too hastily earlier.

Note: I agree with Victor’s criticisms of Montagne’s 4 premises, but I do not endorse his vague ramblings about “socialism,” or his over-simplification of inflation, or his oversimplified explanation of why the Continental dollar or Wiemar Germany’s Deutsche marks failed. His remarks on the Continental dollar reveal his extreme ignorance of history. (The Continental dollar kept its value well for the first 2-3 years until counterfeiting caused their volume to go out of control and destroyed people’s trust in them. Victor also didn’t mention the coup de grace of the Continental dollar – they didn’t become totally worthless until the Continental Congress officially devalued them. His implication that the Deutsche mark was printed and spent into circulation is also false; that currency failed because of private speculation.) I fundamentally and morally disagree with Victor’s ad hominem attacks against people like Zarlenga, because in Victor’s subjectively skewed view of the world, anyone who advocates monetary reform is a socialist, but in my experience, advocates of monetary reform are generally opposed to Marxism because: 1. Marx still advocated bank credit. 2. I’ve yet to meet a monetary reform advocate who is on a radical crusade against private property and private enterprise.** In my opinion, monetary reform is the only way to transcend the bank credit narrative (which encompasses capitalism, socialism and communism).

** RBE/Venus Project advocates are an exception, but I consider them faux monetary reformers because they don’t actually seek to reform money, they seek to abolish it.

Does Aguilar ever mention in his work, “By the way, it’s an illusion that the bank is lending anything.”? If he was smart, he would argue that monetary reform is not derived from Marxist or socialist philosophy, but that it’s in the same category of Utopian philosophy, of which he is probably in. And he would argue that if everyone knew the simplicity of money creation, as soon as any disparity arose, the poor would disembark from society to start over. Ultimately, there would never be any structure.

He probably does not, but I haven’t read his book and don’t really have an interest in reading it. Other than his criticisms of 4 basic assumptions of MPE, it does not appear that I would agree with much else he has to say, based on the flaws in his views of history that I pointed out above. You have to admit though, his work is relevant to this blog entry and MPE because, as a dissenting viewpoint, his valid criticisms should be discussed.

And his invalid criticisms should be exposed and debunked, of course.

What comes of a discussion between two in agreement?

Aguila definitely believes banks lend.

He never addresses the whole, “obfuscation of our promissory obligations”, thing. He doesn’t know how to criticize MPE. It’s understandable though when Montagne is always using the term “borrow” in a misleading way.

I wonder how he makes a living. He gives no bio. That always explains a lot to me.

He thinks that’s a picture of George Washington on the MPE website.

Jct: After Mike Montagne’s 14-part video diatribe against me, it’s heartening to know that he had to publicly back down from a debate with me. Sure, he had his poster challenging the lesser lights of money reform, but he left me off his challenge and has been running ever since.

Since when, Turmel? Shit flies around this place. I’ll meet you anywhere, any time, on any matter.

mmontagne: Since when, Turmel? Shit flies around this place. I’ll meet you anywhere, any time, on any matter.

Jct: Big words from a guy who’s been ducking me for a year. Maybe I should go reproduce when I challenged you to a debate. You had your “debate wanted” poster attacking the lesser lights of the money reform movement but you didn’t include me despite your 14-part one-sided video diatribe against me. How about using Google+ to tape and post our debate? How about Thursday or Friday evening? Or some afternoon except Tuesday (retirement home accordion concerts). Your move.

I’d LOVE a debate between you guys! But you’d need a moderator. Who could do it?

Isn’t the idea in mutual credit system too that it’s ought to be self-regulating?

At least it’s that way in (the original) Ripple (and also in the analog-world minutocash.org concept).

Say I’m a lawnmower man and I want to issue promises of my service. Generally, I cannot issue more “hours” than my friends trust me. It’s in their **own self-interest** to limit the promises I can issue, and that is the whole point, at the heart at all these concepts, obviously. If they let me issue infinite promises of my lawn mowing, I’d be able to consume **their** services first for a long long time without ever “having the time” to fulfill mine.

I’d have to look into the way Ripple manages this Herzmeister.

Most mutual credit outfits we see today are either LETS or commercial barter. LETS usually has an upper limit for participants.

Barters are mostly flexible: they will give a standard credit limit and negotiate if more is necessary.

herzmeister: Isn’t the idea in mutual credit system too that it’s ought to be self-regulating?

Jct: Yes, a good mutual credit system is as easy to self-regulate as a good bank of poker chips though many might still remain confused.

A hypothetical situation for you: let’s say we live in a world of interest-free credit, whether it is called a mathematically perfected economy or a mutual credit system does not matter. As Anthony pointed out, it is necessary to control volume, but as greenbacker84 pointed out, even interest-free credit is tied to a debit and therefore will be repaid, which theoretically controls the total volume. You’re both right on those aforementioned points, but you’re forgetting a very important factor: DEMAND. If I can have interest-free credit, what is my motive to repay my creditor since there is no snowballing interest to coerce me to do so? Will I still lose whatever I purchased by my credit (ex. home foreclosure) after a certain period of time? What determines that period of time (I presume it’s a pre-negotiated contract)? But why not just get more credit (let’s say I offer my car and some other goods as collateral now) to bide my time, since it’s interest free, in order to repay my previous obligation (let’s say, on my house)? If volume is not reasonably controlled because everybody is taking out credits rapidly and taking their sweet time in repaying them, then the unit of account can (and probably will) no longer be an effective measure of value. Moreover, when anyone can get credit (with interest like the current system or without interest, it does not matter) to purchase whatever their heart desires, then there is nothing to prevent demand (and therefore prices) from bubbling. Just because the interest-free credit theoretically will be repaid, doesn’t mean interest-free credit won’t be overproduced in the short-run, thereby creating problems (bubbles). Interest is only one problem in the current monetary system, the 2nd is speculation and rapid increases in demand, leading to increases in prices – a problem that interest-free credit (if not prudently limited) actually exacerbates. For example, let’s say we have interest-free credit and everyone wants land. What is to prevent everyone from taking out credit to compete in buying land and creating a real estate bubble? From what I’ve seen of mutual credit and MPE, nothing is to prevent such a situation.

The way I see it, MPE/mutual credit systems are flawed because they are based on a fallacy – the idea that all credit is good so long as it is backed by an asset. This is a fallacy because:

1. It opens the door for the over-issuing of credit (which is denominated in the unit of account). Even if the over-issuance only happens in the short-run, if it causes prices to bubble, then it can destroy trust in credit, thus destroying the unit of account (ex. $), which is the standard of value in an economy. If the unit of account (ex. pounds sterling) is based on/exists in the form of gold/silver coins, then paper credit can fail while the unit of account will survive via the coinage, but that’s not how the world works anymore so if credit hyperinflates nowadays, then the whole monetary system (unit of account) is bound to fail. In a way (like during Wiemar hyperinflation), this problem is shared by the current monetary system, although reserve ratios are designed to curb this potential abuse. But, as Anthony mentioned, over-issuance of credit (and therefore the unit of account) can also be prevented by simply having an institution (like a JAK bank) limit the rate/total volume of credit creation.

2. Mutual credit/MPE disregards the fact that all credit depends on TRUST, and just because credit is purportedly backed by an asset doesn’t mean that it is or that that asset even exists (ex. if I take out credit by offering my car as collateral, then my car is destroyed or stolen by an unknown 3rd party, then said credit is no longer backed by anything).

3. The only way that giving the right to anyone with an asset to issue credit based on that asset could work (i.e. avoiding problem #1), is if the credit were denominated in assets (ex. weight, volume or number of cars, corn, video games, orange juice, etc.), and NOT in the unit of account (ex. dollars). Of course, such a system would be nothing more than a system of barter in which all people are trusted to issue notes representing a future claim on an asset – and there is nothing to prevent people from abusing that trust.

4. (Related to 3) If anyone can issue credit, then you end up with people abusing the system (free riders/free loaders) by issuing bad credit. This can be counteracted by letting people reject other people’s credit, but then what is to prevent the people who own the means of production (land, manufactured goods) from rejecting the credit of the poor? Will the poor generally be forced to trade in the credit of the rich? How will the poor buy land if their credit is worth nothing and landowners are never obliged to sell their land b/c they can always just issue credit to get out of financial squeezes? Two poor people may still accept each other’s mutual credit, but they can do that now too, and what do they have to sell that would make that much of a privilege? In this way, I believe that mutual credit systems will devolve into a Lyndon Larouche kind of monetary system where only the credit of those who own the means of production (agricultural giants, gold/silver owners, etc.) ultimately serves as currency. And forget forced wealth/land redistribution in attempting to get rid of problem #4; plutocrats would sooner kill, just like what happened to the Gracchi in Ancient Rome, the communists in 1871 Paris, etc. Forced wealth redistribution is the political ideology of the thief. Only money/taxes should be used to help uplift the poor.

5. If the unit of account (i.e. the standard of value and government symbol in which taxes are collected) is destroyed, then what do people pay to the government in taxes? Do they all just pay in kind (in goods or services)? That is horribly inconvenient and I don’t like the idea of the poor owing labor to the government for taxes.

Unrestrained mutual credit systems are flawed because they undermine the unit of account, they disrupt government finance and there is no punishment to prevent free riders from abusing the system or to prevent the rich from discriminating against the credit of the poor. Nor is there a legal limit on people realizing their demands, thus competing for scarce/finite assets and driving up their prices (asset bubbles). I believe that Anthony is trying to address some of these problems, by instituting some sort of limit on the amount of credit allowed. Such restraints could prevent mutual credit/interest-free credit from destroying the unit of account, but the institution charged with limiting credit/volume would have a great responsibility to be both prudent and just.

A final point on interest… If the rich/creditors are charitable and/or spend liberally on the services (wages) or produce of the poor/debtors, then it is possible for an economy with interest-bearing credit (like bank credit) to perpetuate itself, so long as interest payments are recycled rapidly into the economy by prodigal/charitable creditors so that debtors can earn enough money to avoid default. However, it’s quite possible (indeed probable) that creditors won’t meet that social obligation, thus causing the monetary system to falter as it so often has… although asset/price bubbles (which are caused by the natural tendency of people to pursue their demands/speculate on scarce assets like land, in combination with loose credit, which facilitates this human tendency) also contribute to causing the monetary system to falter. It is for this reason that I value Christian philosophy: because charity is the ultimate expression of economic free will and through charity, any economic system could work in theory. Unfortunately, asking all people to be charitable is asking quite a lot.

For problem #3, I ought to have mentioned hours as an example of credit denominated in “assets,” although I use the term assets for lack of a better term. I really mean, anything with value besides the unit of account.

If I can have interest-free credit, what is my motive to repay my creditor since there is no snowballing interest to coerce me to do so?

Jct: In LETS networks, you’d simply be written off when you die as one of the other sickly or retarded members of our family while those of us who took advantage of a new fair game ended up dying in the positive. In LETS, almost no one wants to be the bum who won’t give people back the time they gave him. Of course, you weren’t thinking in terms of a global timebank but in terms of money, debts and courts. With far more of us dying in the positive, it’ll be trivial to divvy up the negatives of the weak and the lazy. Because you may be a lazy bum doesn’t mean anyone else should be denied any trust for credit, we’ll find out your score when you die after the fair game. Bet you’d choose to join productive enterprise and contribute your share of Hours back, though. When you consider in the different terms of the global UNILETS timebank family-credit system.

that still doesn’t disprove my points. stalin was a douchebag but that doesn’t unmurder his millions of victims. also, i find you insinuation that i would be one of those free riders, just because i pointed out the fact that there will be free riders, to be imprudent, but i’m not going to waste my time being offended

i meant to say, “stalin was a douchebag but hating on a dead man doesn’t unmurder his millions of victims.” some people just don’t care about their reputations, but that doesn’t undo the harm they did while they were alive. moreover, since those free riders have unlimited interest-free credit, they can do a LOT of harm. unrestrained mutual credit should never be more than a contractual relationship between private individuals/businesses. it’s faults are too many for it to function effectively as the sole monetary system in an economy and any attempt to make it the sole monetary system of an economy must be accompanied by sufficient restraints on credit creation.

> Tom Reubens: i find you insinuation that i would be one of those free riders,

>Jct: Because you may be a lazy bum doesn’t mean anyone else should be denied any trust for credit, we’ll find out your score when you die after the fair game. Bet you’d choose to join productive enterprise

Jct: I just bet you’d choose to join productive enterprise. You’re the one insisting I’d lose my bet.

“i find your insinuation that i would be one of those free riders, just because i pointed out the fact that there will be free riders, TO BE IMPRUDENT.” i never insisted that i would be one of those free riders. in fact, all i said was why mutual credit/MPE is too flawed to be the sole monetary system in an economy, but you prefer to ignore what i actually said and instead resort to making unfounded ad hominem attacks against me.

*unrestrained mutual credit

“i find your insinuation that i would be one of those free riders, just because i pointed out the fact that there will be free riders,

Jct: I just bet you’d choose to join productive enterprise. You’re the one insisting I’d lose my bet. How come there are no such bums who’ve stiffed their networks the time owed in the many thousands of timebanks around the world? Where are all these free riders that can’t be deterred because LETS doesn’t enforce collections? Why do you think free riders haven’t taken advantage? Can’t you figure it out why the chances of others being bums are as low as you suggest the chance of your being a bum is? You’re offended being possibly thought of as untrustable free rider yet you offend everyone else as possibly untrustable in your statement. After all, you’re bemoaning an enforcement mechanism to allay your mistrust. Why do you think LETS haven’t suffered the abusers you fear so far? I think I know.

In fairness John: there are free riders in LETS systems. There are 80 LETS circles here and I’ve met the managers of all the main ones and they all say free riding is a (manageable) problem.

Hello John. Does Bouey is crock mean anything to you in your travels? Thanks RDW

Jct: One of our most infamous picket signs from the Bank of Canada protest days was “Bankers are Crooks.”

We also had a “Bouey is a crook” placard too.

Just because people have access to free credit doesn’t mean that they will get all they want. Won’t there still be due diligence in ascertaining one’s ability to repay in mutual credit? Won’t there still be legal penalties for reneging on promises to repay? Of course there will be. It would be insane to throw away all the principles and laws governing sound and fair business practice.

I would hope that there would be penalties to prevent abuses, as well as prudent limits on access to free credit. Only under those restraints do I believe that interest-free credit could maintain its value in the long run.

pm: Just because people have access to free credit doesn’t mean that they will get all they want.

Jct: Right, you can’t buy an auto if you don’t have a driver”s license. You can’t buy a tractor if you don’t have a tractor license and a farm.

pm: Won’t there still be due diligence in ascertaining one’s ability to repay in mutual credit?

Jct: Yes, the powerful winner will be able to pay the depreciation on a larger home and car than the lesser winner.

pm: Won’t there still be legal penalties for reneging on promises to repay?

Jct: Do you really want to punish your mentally-retarded cousin for being in the red and using spare resources you weren’t using anyway? The only penalty for dying in the negative while almost everyone else manages to die in the productive will be shame when we open your account and see you died in the negative with the sick and weak.

pm: Of course there will be. It would be insane to throw away all the principles and laws governing sound and fair business practice.

Jct: Isn’t it funny how the moment “open-credit-for-all” is announced, that some people always jump to the “forget the sound and fair business practice” and presume others would act in the same dummy way they feel they could, though they’re better than that. Why can’t people just accept that nothing changes much except everyone gets access to the family larder.

“If I can have interest-free credit, what is my motive to repay my creditor since there is no snowballing interest to coerce me to do so? Will I still lose whatever I purchased by my credit (ex. home foreclosure) after a certain period of time? What determines that period of time (I presume it’s a pre-negotiated contract)? ”

Contract! Just as today.

“But why not just get more credit (let’s say I offer my car and some other goods as collateral now) to bide my time, since it’s interest free, in order to repay my previous obligation (let’s say, on my house)? ”

That’s what I was saying in the article: there is more demand for credit than nature allows. So everybody gets some credit. Not as much as he wants, but interest-free. He can go to JAK Banks (and family and friends, which will become much, much more important in interest-free economics, because they don’t have much debt themselves and are not hunting for ‘return on capital’ with their savings) or brokerages.

“2. Mutual credit/MPE disregards the fact that all credit depends on TRUST, and just because credit is purportedly backed by an asset doesn’t mean that it is or that that asset even exists (ex. if I take out credit by offering my car as collateral, then my car is destroyed or stolen by an unknown 3rd party, then said credit is no longer backed by anything). ”

No, there is no trust. There is collateral. Like a house. And there is a contract.

That’s one answer.

But yes, there is trust. And there is reputation. And the age old human habit of sticking to his word. And there is dialogue if things go wrong. And if somebody is just screwing with the system en doesn’t want to normally talk, then there is a debt-collector with contract.

“3. The only way that giving the right to anyone with an asset to issue credit based on that asset could work (i.e. avoiding problem #1), is if the credit were denominated in assets (ex. weight, volume or number of cars, corn, video games, orange juice, etc.), and NOT in the unit of account (ex. dollars). Of course, such a system would be nothing more than a system of barter in which all people are trusted to issue notes representing a future claim on an asset – and there is nothing to prevent people from abusing that trust. ”

Such a system cannot work. A decent MCF knows what it’s doing. If course value is expressed in the unit of account function of the unit.

Yes, Tom, indeed, I am trying to address these issues and they can be well addressed. Thanks.

Thank you for your rational responses to my earlier post, especially for taking the time to reiterate the essential connection between managing the volume of credit and protecting the unit of account. That connection being the most important point I was trying to make, I was disappointed to see that it had thus far been ignored. As for problem #5, if the unit of account is protected, then problem #5 ceases to exist. It seems that we are in agreement on this issue.

It is for this reason that I value Christian philosophy: because charity is the ultimate expression of economic free will and through charity, any economic system could work in theory.

I couldn’t agree more. Charity is the great rock upon which it is all built.

“Unfortunately, asking all people to be charitable is asking quite a lot.”

That’s impossible.

But that’s also not the issue. The challenge is to design systems that promote charitable behavior.

Our current system is simply the weaponization of the love of money. By creating systems that promote humane conduct (by basically behaviorist rewards and penalties) we move in the right direction.

I agree. The nation’s monetary policy should be both sound and based on charity.

If we had a cast system of masters and slaves, and the slaves had to subsist solely on charity or starve, that would promote charity. Scientific studies that prove how sick I am as I drive past homeless starving people are our only hope.

Anthony, I would like to put in a request for your next blog article. Would you be interested in doing a piece on Quantity Theory and neutrality vs. non-neutrality vs. super-neutrality of money? Circuit theory and the interdependence of variables in inflation/deflation might come up as well. Richard Cantillon’s “Essai sur la nature du commerce en général” will prove a beneficial source. Of course, feel free to tell me to take a hike lol.

It says that rising prices under usurious credit is not a result of growing volume, but because of escalating cost for capital, interest. And this is true of course. John Turmel calls this ‘shift B inflation’.

Jct: John Turmel does not call “rising prices” due to interest “Shift B inflation.” Rising prices could be due to rising demand or lessened supply. Rising prices is a symptom, not the cause of Shift B inflation. I define inflation as a loss of purchasing power, okay? Not higher prices that could be due to honest scarcity or higher demand. Loss in buying power of my chips. My chips getting me less and less from the cage. So rather than more money chasing the goods, Shift A, I teach “same money chasing less (too-high-priced) goods after foreclosure,” Shift B. The opposite of Shift A. And both Shift A and Shift B have symptoms of higher prices, don’t they? So Shift B is not rising prices as they may define Shift A.

Besides,how many times do I have to repeat that LETS mutual credit networks don’t manage the volume of time-based chips. The more Hours registered with the timebank, the more Hour chips issued to your account. It’s a function of the delivery of energy, no management of volume allowed by the UNILETS global cashiers.

John, I agree with your assertion that interest causes a loss in purchasing power as opposed to inflation from an increase in the money supply:

What I don’t understand is how you attribute the loss of purchasing power to a reduction in the underlying collateral which results from foreclosures.

Foreclosures purge bad debt while allowing the money to remain in circulation (no money is destroyed) since the loan is written off (or at least some part of it). The money in circulation is available for the remaining “players” who are chasing the extra money required to pay interest charges.

Are you saying that this money, without accompanying debt, can cause prices to increase?

Larry: What I don’t understand is how you attribute the loss of purchasing power to a reduction in the underlying collateral which results from foreclosures.

Jct: If I had not foreclosed, your 10 chips would have gotten you 10 pieces of collateral. Once I foreclose, the loss of purchasing power of the 10 chips is caused by the reduction in collateral foreclosed to 9 watches One is gone!

L: Foreclosures purge bad debt while allowing the money to remain in circulation (no money is destroyed) since the loan is written off (or at least some part of it). The money in circulation is available for the remaining “players” who are chasing the extra money required to pay interest charges.

Jct: It’s not that foreclosures leave enough money for the other guys to all pay 11, it’s that the other guys all winning 11 mean you must end up foreclosed as your debt is purged. You’re saying ‘once a guy is knocked out, there’s enough for the others.” Yes. Better though,”once the others all come up with 11, one guy is knocked out.”

L: Are you saying that this money, without accompanying debt, can cause prices to increase?

Jct; Again, your angle is that we just pick off one mort-gager and now there’s his extra money to play with. Does it cause more inflation? Now, my angle is his money gets won by the other players and when he gets knocked out, it’s not as if his money is somehow still there to be won, it’s already in the hands of the other players. So, this “money without debt” can not cause more inflation, it’s the result of the past inflation. The inflation took place when you signed that 10 chips worth 10 watches now become 10 chips worth 9 watches later. So the price increase took place when you signed your mort-gage, not after some loser left his chips in everyone else’s stacks.

John, thanks for the generous explanation.

Temporal dimension to the money supply. This shows how opaque the unit is. Not included in the Casino model is the mixing of types. The foreclosed player has his former credit loosed into the money supply, where it can float. The legal debt contract, now canceled, must let any former credit be released from returning to the ledger.

Credit comes from the future, money comes from the past. To pay off a loan means that money or somebody’s circulating credit is grabbed from the public supply and vectored to the ledger. Money already exists in the supply and represents accumulations from the past. Again, either money or credit can be grabbed from the supply to pay down loans.

In today’s double entry world, credit issues forth and is good for paying taxes. Floating money (no credit associations) is also good for paying taxes. Since money is opaque, then the banker cannot know its origins, and must accept it when debtor pays down the loan. Any creditor, Casino or otherwise, will want his unit accepted for taxes, as that makes it acceptable to common markets.

Therefore, past accumulations (money) can vector into the bankers ledger to pay the future’s negative liabilities. Credit with usury assumes that the future will have enough “money” to pay today’s and tomorrow’s ledger.

Inflation isn’t really a problem into today’s world, where the liability column of banks in their multitude have made debt peons of the world. These liabilities must be served, and those “numbers” must be accounted for out of the money supply. The other possibilities to fixing debt deflation: 1) Haircut the ledger – which will mean reduced future banker profits. In most cases the original principle has already been paid. The ledger debts are decreased, thus debt deflation is reduced. 2) Debt free money issued by government, where said money then enters the banker’s ledger to cancel liability. 3) Issue Credit loans, especially targeting infrastructure, and then forgive the loans. This money path leaves productive infrastructure in its wake.

The Casino model doesn’t comprehend that there are different types of money…there are more than one type of chips and the money types travel different channels of flow and interact differently. If we instituted Casino money today, it would work for awhile as it canceled existing liabilities, then if it is allowed to “volume” up in excess of goods and services, inflation would rear its ugly head. And, Casino money would volume up as people take out loans against assets, and those same assets are positive feedback to the ledger. Goods and services i.e. peoples labor output, cannot expand at the same rate as abstract numbers “demand” money, that is self evident.

This is yet another aspect of money -that of information signaling by way of the market. Any model needs to account for markets and market types. Money is also information, and with credit as the money type the signaled value of the asset is important. Supply and demand determine prices, and prices inform assets already attached to the ledger. Excess money in supply then pushes prices creating a positive feedback loop. Crashes are the same, where the market signals declines, and less credit money is loaned as attached assets signal lost value, yet former debts must still be paid. This drains the supply, leading to depressions. Credit money in particular uses land, which is easy to asset bubble because land is one asset class used almost for the entire credit money supply.

80 percent of our current money supply is credit formed from land. Just the value of land in New York exceeds the value of all industry in the U.S.

Any serious monetary system must also comprehend taxes. Monetary policy and fiscal policy are twins, flips sides of the same coin.

When a bank forecloses, it then sells the property. The credits accrued cancel a portion of the debt and they no longer exist. If the banker doesn’t cancel the rest of the debt from his personal account, you have inflation. If this happens to many times, he goes out of business. Banking is all about winning. If you’re not a winner, you don’t get to be a banker.

The Casino model doesn’t comprehend that there are different types of money

Jct: Yes, the casino only deals with one type of money. What different types of Canadian money are you talking about?

“Because the principle is created but not the interest, someone else must go into debt to finance these interest payments.” – interest is created soon as a borrower agrees to pay it. If I owe the banker $100 interest, he now has $100 to spend. The bank has no money to start with. It would help you to think in terms of $the product that has this symbol on it, and $the credit used to purchase product.

Poor old simpleton me thinks that the more complex something is,the easier it is to subvert.Money is just a substitute for trust,in other words it can disguise a lie.Sacred economics makes me think of a concept I came across that I was mystified by- “temple prostitutes”.That was when I was exploring the subject of religion, thinking there may be something in it that led to truth.I soon realised that ,in the cause of domestic bliss,it’s better to say to the wife you’re off to church than the brothel!What I’m trying to say is that money is hot stuff,the devil’s plaything and it’s gonna burn your hands no matter how careful you are.You can only keep a standing army by paying them you know,that’s what money is for.In fact the more I think about it the more obvious it is that money is black magic-the creation of something out of nothing and usury is just it’s nastiest manifestation.If you want to exchange things,exchange them without a middle man to produce the “means of exchange”,he can only be a parasite or a prostitute,that’s the bottom line.Can you be half a vestal virgin?

The banker’s the pimp. So you’re a primitivist?

You are probably much closer to reality than yu think. Money is in fact the spirit of trust expressed between people as credit which then gets tactile in the creation of currency. Money as currently known is in fact currency which is effect not cause. Just a thought, Thanks.

No doubt, the volume of money in circulation may vary in ANY all-debt money system which could be a problem; especially if there is too little of it (e.g. between 1931 and 1933, the U.S. money supply contracted by 1/3 leading to the not-so-Great Depression).

Money in an all debt money system is temporary – that is that the money will be destroyed as the principal payments are made. Money perishes in the loan account; the asset (cash payment) cancels out the liability (term principal payment) at a rate equal to the duration of the loan. It is a zero sum game if no interest is charged and negative if interest is added.

For example, we know that the money supply will inherently contract (reduce) as a function of the math and a constant supply of new debt is required to maintain a stable-consistent amount of money in circulation. This is true regardless if the new money is created with or without interest.

If a 0% interest economy was indeed implemented, then it is safe to say that all would benefit in the elimination of usury (interest tax). It is also probably safe to say that eventually, prosperous people would need to borrow less which would drain the money supply. It is probably also safe to say that if the people were more prosperous, then they would have more money to spend and save which could increase the prices of some things (houses for example) above where the levels are now.

Congress should be the monetary authority as stipulated in the constitution. They should determine if there is too little money and respond by creating debt free money. The debt free money could be spent into circulation by the states with the amount divided based on population and area. This would place the spending decisions closer to the people and divide the power to create with the authority to spend.

Debt free money is direly needed today to help bridge the gap between the total amount of debt and a smaller amount of money. It would work as an elixir in getting the economy going again.

I agree that printing a batch of debt free notes would be helpful to kickstart the economy. We’d probably need a few trillion for the US alone. Say 10k for every living American, heck, even illegal immigrants might join the party. Give half to the people and the rest to the States for local investment.

However, it would not solve the problem permanently. These Trillions would be gobbled up through the interest drain pretty quickly.

I don’t believe shortage of money will ever be a problem in MC. Even if there would circulate zero, everybody would have all the money they would need, because they could go into debt always.

There will never be money scarcity in Mutual Credit, but there could be inflation if it’s not done right.

Anthony wrote:

Agreed, the debt free money would direly be needed to make the transition from the negative aspects of usury to a sustainable, interest free economy. I’d start by repaying the national debt with debt free money as it becomes due. This would effectively be a neutral transition as the money created to repay the debt would be instantly retired in principal repayment while leaving the money in the economy. It would neither be inflationary nor deflationary.

Anthony wrote:

I think that at least some minimum amount of money is needed, in liquid form, to operate a national economy. For example, a money supply minimum might be expressed as M1 + M2 (M2 actually includes M1) which I suspect would be somewhere between M1 ( $2.55 trillion) and M2 ( $11 trillion).

As we move away from usury, I think we will find that people will not need to borrow as much which would tend to drain more liquid forms of money.

Anthony wrote:

Perhaps low interest rates helped influence people to borrow more which if true; suggests that interest free loans will do the same?

However, I think the real estate bubble was primarily driven by totally separate factors (interest rates being a very small part):

Borrower requirements were removed – anyone could borrow large amounts which fueled a speculation bubble. We have all seen story after story about income and other “credit ability” measures being eliminated.

Down payments were eliminated in many cases – borrowers had no skin in the game and they were ripe to go upside down (owing more than the real estate is worth). Many chose to simply walk away.

Mortgages were guaranteed by the government (Fannie, Freddie, etc.). This removed risk and invited fraud.

Mortgages were issued and then sold and resold – creating new money with the same limited collateral (home). This creates a domino effect upon any foreclosures.

We know how to lend money and commercial banks, credit unions and savings and loans are capable of properly managing risk which greatly reduces the chance of a bubble. The problem is that the big investment banks (Wall Street) blew the real estate bubble on purpose and why not, they made record profits while we took the hit. Our risk, their reward.

Thanks for the discussion.

Interest rates now are lower than that we had before 2008. I believe that low interest rates are not the problem of boom, but easy credit and growing money supply, hence rising prices are. In order to have stable economy we should have almost constant money supply per capita (person).

You’re on a giant Monopoly® board.

If you read Yuji Ijiri or look at triple entry accounting systems such as Bitcoin’s blockchain, Trueledger or Loom, is the volume issue not resolved (as is Irving Fisher’s “money illusion”) within a “the receipt is the transaction” Ricardian contract 3-D framework (I refer to it as debit/credit/trebit). Could you not simply select a finite entity as the measurement of value… say fresh water for example (rather than Satoshi’s 21 million Bitcoin per se)… as water is able to communicate stewardship of land resources without being tied to the land as in the dilemma with property rights?

For example, if you chose a gallon of freshwater as the boundary for the recursion, then you could take a gallon of non potable water, (say draining across your neighbor’s driveway picking up oil from your neighbor’s car’s dripping oil pan) and clean it, then simply return it to the “commons” for a credit. In such a scenario fresh water, like gold or silver, serves as a finite definition of volume.

From a practical standpoint measurement of such a model could be expanded beyond your driveway per se into a regional solution… maybe based on a distinct watershed for example. In such a watershed scenario, wealth (or credits) could travel upstream, literally, from a community that is downstream within a watershed if the upstream community improved the quality of the water. Of course the unit of value would initiate within water as the recursion (like a gold standard) but could circulate throughout the economy like fiat. What would the value of your community be if the water was so pristine, even the water running through your storm drains, was drinkable?

People would probably exchange their automobiles for tennis shoes if it meant receiving their fair share of that wealth distribution from their downstream neighbors. What does the curve look like between the ratio of the value of a gallon of salt water as compared with a gallon of fresh water. Of course you could say, fresh water has little value when it falls from the sky equally on every person. Capturing falling rain is a bit of a challenge… that is unless you’re the land.

In such a model, the ultimate commons becomes the one ocean that we all share. The one ocean that our physical nature is headed to eventually. If you don’t believe me, then ask your heirs to spread your ashes on the top of your favorite mountain and then wait a couple of weeks. Or you can be buried six feet under and wait a few hundred years… same difference.

the much vaunted “credit system” of village idiots, groupies and deep researchers (turn everything into credit and every credit into notes)—

Mr. Daniel made a useful observation before the Senate hearings prior to the passing of the Act:

“The reason now given by bankers to reform the banking and currency system is the need of ‘more elasticity.’ Elasticity is the curse of the present credit money system, yet they want more of it, because it is most profitable to them.”

Secretary McAdoo,

November 15, 1914,

on the eve of firing up the federal reserve credit system

”

The opening of these banks marks a new era in the history of business and finance in this country. It is believed that they will put an end to the annual anxiety from which the country has suffered for the past generation about insufficient money and credit to move the crops each year, and will give such stability to the banking business that the extreme fluctuations in interest rates and available credits which have characterized banking in the past will be destroyed permanently. The Federal Reserve Banks provide for a system of credits based upon commercial paper, thus at last securing to the country an adequate supply of the necessary credits to mee the legitimate demands of business as they develop. The supply will be absolutely responsive to the demand, and thus business will be freed from the restrictions, limitations and injuries from which it has suffered in the past, because it has not been able to receive at the time when most needed the credit facilities which were essential to its regular and proper development. The whole country is to be congratulated upon this final step in an achievement which promise such incalculable benefits to the American people.”

during the cash system that was rampant at the close of the civil war, there never seemed to have been any problem of (cash)facilitating the moving of crops; after the country went onto the credit system there was this constant and recurring shortage of credit and lack of elasticity during harvest time…..

Could you summarize what you want in a monetary system? I don’t want to go through all the comments of the past year.

Try to do it in one paragraph.

I too am interested in what monetary system Name789 favors.

Total amount of money in mutual credit system is equal to count of participants multiplied by maximum allowed credit per participant. What you have to manage here ?

Dark Dirk: Total amount of money in mutual credit system is equal to count of participants multiplied by maximum allowed credit per participant. What you have to manage here ?

Jct: What if I need twice as much cement for my project as you do? Andwhat if there’s plenty of cement sitting there ready to be used? Or any other resource? Why should I be limited in my production by my credit line? In UNILETS, everyone has as much credit as can be used. Heck, everyone might start using twice as much cement and steel just because it’s there. No credit limits are needed, only purchase qualification approvals. If the kid’s trained to run a tractor and there’s an idle tractor, he can purchase it with it as the collateral for the loan and payments as the machine depreciates. What do you have to manage here either? Nothing by the cashiers.

“Why should I be limited in my production by my credit line?”

because if you have unlimited credit line you will abuse it. You will buy so much goods that it will be impossible to repay the credit. And if credit is unlimited so that money supply will be unlimited. In that case how you will determine the price of cement ? 10, 100 or 1000 ? You will flood the market with money and you will cause hyperinflation.

I like the way you think.

Jct: Heck, you can have open credit lines based on professional credentials and not have to manage anything.

Thus spake a true greenbacker; not the (present day) kind that Gary North and Woods call greenbackers. No silly class-room theories, no moronic equations; but practical experience

@philo, Reubens

take a look at my responses in reverse order; about 10 months ago I already explained it

[quote]

Treasury-notes are the only money that can afford the deceived, defrauded and abused American people sufficient and permanent relief. It has long been demonstrated beyond question that these notes, limited in volume to the needs of exchanges and equities, are “as good as gold”. There is absolutely nothing new or strange in this proposition to constitute gold, silver, and United States treasury-notes, the equal and self-redeemable currency of the American people. Thomas Jefferson –the most elemental American yet given to his country– laid down, in substance, the most pressing requirement of our own day.

Perfect money –“scientific money”– while quite possible, is so far beyond the conception of to-day that even to indicate it is unnecessary. But the United States can at least adopt some approximation to the financial system of France, which insures industry and protects freedom, instead of following the English system to general impoverishment and “a new form of slavery” for the masses of mankind. The French system has nothing of what Napoleon called “ideology” in it, but rests solely on experience and “the rule of thumb.” The French, however, are so alert in their ways that they often reach a point better, by merely looking at it with the naked eye, than we heavy Saxons do with a Lick telescope or a Greenwich observatory.

The money of France is very largely metallic –gold and silver, both full legal tender to the extent of their issue, excepting a small amount of subsidiary silver. As a general thing the two metals are about equally divided in value, at the ratio of one grain of gold to fifteen and-a-half grains of silver. At present, the value of silver coin in circulation is said to be six hundred and fifty millions of dollars, the value of gold coin being somewhat more. As the territory of France is small and compact, and the population nearly stationary, her volume of money has become a pretty well known and pretty well fixed quantity. As she looks to it that her exports shall equal if not exceed her imports, and as she prefers trade with countries using gold and silver to gold alone, she keeps the money metals that have come to her from the store of ages — the largest proportion that any European country has accumulated. But, in case of war or other derangement of her affairs, her gold and silver flow out of her own domains. Then, as a Nation, as a Government, she turns to the Bank of France, and makes its paper-issues legal-tender money to supply any deficiency of metallic currency that may take place. Thus the volume of money — “the circulation of the life blood of the community,” as the London Times once called it [February 16th, 1849.] — is kept flowing and domestic industry is not strangulated. Financial panics are British and American institutions, and the French have no use for them.

A currency of gold and silver, with free-coinage and with treasury-notes to supplement the inevitable deficiency of the “precious metals,” would be our natural American modification of French currency. Treasury-notes, like the similar issues of France through her Bank, would be absolute legal-tender for all private purposes, and redeemable in government-dues — revenues and taxes. It is now settled in economics that such money would all stand equal –absolutely equal– in any country emitting it in properly limited volume.

[/quote]

Ellen Brown and the groupies are working hard to discredit the concept of government-issued, debt-free money

You’d probably suck Thom Jefferson’s dick.

Following is another challenge to the MPE group from me and Darren Rooke, but just like our last challenge from several years ago (which was posted on here), I’m pretty sure there will be no reply. So, any of you MPEer’s want to sort out what’s posted below?

ARE WE ALL CRIMINALS JUST BECAUSE THE BANKING SYSTEM EXISTS??

Mike Montagne and the “Mathematically Perfected Economy”group assert that, if MPE gets in then they would arrest all those who have been engaging with the banking system (which means just about everybody) and charge them with treason, for being complicit in the crime of banking!!

So, let’s use an analogy to show what it is exactly he/they are claiming. Let’s say you were born into a society, where it was believed that magic tricks were real. Just imagine then, someone like David Blane or Dynamo are performing in front of you. He is levitating and making things seemingly disappear into thin air. Now, you totally believe what you are seeing. Which you would do wouldn’t you? But according to Mike Montagne, ‘somehow’ and even if nobody explained it to you…you should know that it is all nothing more than a TRICK!! A mere perceptual illusion.

But the best part is this, Mike Montagne himself is the one that knows that the banking system is an obfuscation. But then acts towards people who are tricked by it, as if they shouldn’t be!! Lol! So the point is, this particular crime (banking) is not like any other crime, for the fact that the crime is almost impossible to detect due to the inability of most humans to comprehend it, based on the fact that it requires a large amount of integrations of abstract concepts and of course because of the fact that those in power are the very ones who are obfuscating it.

If the banking fraternity are criminals, then they surly always have been and of course, outside of the power elite then there would have been a time when there was NOBODY who understood the obfuscation that is banking. So that being the case then, the question is….If banking are the criminals and all who are engaging with them socially are likewise also criminals because they are (according to Mike Montagne) Complicit in this crime then what we need to know is…

WHO ARE THE VICTIMS??

Just let that sink in for a moment.

Let us use another analogy to fully drive ‘the point’ home. Let’s say you are walking down the street minding your own business, when out of the blue somebody sticks a knife to your throat and says “give me your wallet or I’m gonna f**king kill you. So you comply and hand over your wallet. Now who in their right mind would say the following….”you were complicit in the crime because you allowed him to rob you, and that also means he was able to get away and so he will continue to rob many other people too. So not only are you complicit in the crime that he did to you, but you are also playing a part in all the other crimes he commits after you.”

NO!!! YOU ARE A VICTIM OF THE CRIME.

Now one difference between the crime of banking and say the robbery that I’ve just mentioned is, everyone knows that the robbery is obviously a crime. But what about banking when it comes to the average person? How do you know that that is a crime? Well like I explained with the magician analogy earlier, if you are born into such a world where great lengths have been gone to in order to hide the crime behind an illusion, then how can you possibly be to blame for not knowing when the ones in power are the very ones who have obfuscated it in the first place…who are the very ones who have made it look totally legitimate and therefore made it look nothing like a crime? Well of course, the answer is obvious isn’t it?

YOU SIMPLY DON’T KNOW IT’S A CRIME.

So let’s return to the question of, if banking is the crime, then…

WHO ARE THE VICTIMS??

The obvious fact that this question reveals by the process of rationally trying to answer it, is this…

The individuals who are not members of the elite banking fraternity are ‘not complicit’ in any crime of banking, but are instead, its victims. For there must be a victim in order for there to be a crime in the first place and if that isn’t the public, then there simply couldn’t be any victims…so it obviously must be them, for the ONLY other alternative is…THERE SIMPLY IS NO CRIME!

If Mike Montagne and his MPE group deny this obvious fact, then they themselves are not only the CRIMINAL MINDED ones, but are incapable of understanding beyond-their present level. As fully explained by William George Jordan in this following quote…

“Genius is great because it is decades in advance of its generation. To appreciate genius requires comprehension and the same Characteristics. The public can fully appreciate only what is a few steps in advance; it must grow to the appreciation of great thought. The genius or **the reformer should accept this as a necessary condition. It is the price he must pay for being in advance of his generation,** just as front seats in the orchestra cost more than those in the back row of the third gallery.”

– William George Jordan (the power of truth 1902)

The above was (ironically) posted on the MPE group Facebook page – PFMPE Monetary justice worldwide and someone dedicated it to Mike Montagne!!!

Here are the important points from the above quote to keep in mind in terms of what’s being revealed in this post regards Mike Montagne and his MPE group.

“The public can fully appreciate only what is a few steps in advance”

“the reformer should accept this as a necessary condition. It is the price he must pay for being in advance of his generation,”

So, this can only mean that, they themselves are indeed caught in the very same trap as the ones they are labeling – criminals (ie, the victims of crime/every day people) because the MPE group, if they were to get in, would genuinely be real criminals but lack the ability to see THAT THEY ARE. But in denying this fact is the very evidence that it is the MPE group who are the ones who are MENTALLY INCABABLE Of COMPREHENDING, which is one of their annoyances against the public at large because of them not being able to comprehend the crime of banking of which people like Dave Ardron uses as justification to refer to such people as idiots…but – by the same measure then, WHO’S THE IDIOT NOW, EH DAVE?)