Austrianism is Dying! Truthers Unite!

It transpires that leading Libertarian websites have been catastrophically hemorrhaging visitors over the last 18 months. Gold buggery is definitely on the wane and this means that the classical enemy of Populist Monetary Reform may be on the way out. The Goldites have been confusing the Populists for 150 years.

This is the chance of an era to find common ground for a widely supported Monetary Reform Movement.

By Anthony Migchels for Henry Makow and Real Currencies

Here are two stunning Alexa graphs. Lewrockwell.com:

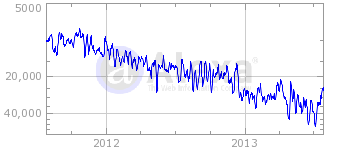

Mises.org:

Gary North is also down from about 30,000 to 60,000.

Surely Lew Rockwell’s site and Mises.org are at the heart of Libertarian agitation. They showed solid growth up to late 2011 when they started bleeding visitors. It must be remembered that this was during the Paul campaign, that could have seen the Goldites take over the Republican party, should Paul have resisted Diebold manipulation.

Such a disastrous turn of events has profound implications. Quite clearly the Powers that Be had plans for Libertarianism. As we have been discussing at length, the whole thing was built up over decades and co-opted the Truth Movement in the 2008 and 2012 elections.

Over the last year we have seen clear indications that Libertarianism was mainstreaming. But this is not really important. People still stuck in the Republican-Democrat dichotomy will believe anything, what matters is that Austrian Economics within the Truth Movement has more or less ended as a force. The Truth Movement is the real opposition and the bankers are losing the battle for their mind, also in terms of economics.

Confirmation of this is a recent bizarre rant by North. In a confused diatribe, using the word ‘crackpot’ at least 20 times, he first blathers on endlessly about Keynes being an anti-semite sodomite crackpot (doesn’t Gary know John Keynes was into young boys too?) and then completely loses it in describing American Populism. Said he: “It is, lo and behold, the Rothschilds. In other words, it’s them Jews. It’s them Jews again. It’s always them Jews. Them Jews is everywhere. Them Jews is everything bad. Them Jews is rich. Them Jews. Them Jews. Them Jews. Get them Jews!”

It’s hard to think of a more pathetic example of auto-combustion.

Few still believe that Gold will stop the bankers. Gold is deflationary, which would worsen an already grim scenario and does nothing to end Usury. America itself is in the absolute worst of positions to go Gold because nobody has any, the Federal Reserve least of all.

Rand Paul recently suggested a Gold commission, but without his father he is useless in the Truth Movement. The only one really plugging him is Alex Jones, who was also instrumental in giving Ron ‘Arabs did 9/11’ Paul the platform he needed. But just about everybody has been distancing himself from Jones, especially the last few months saw a flurry of people calling him out for many different reasons. Jones is regularly being slaughtered by his own feedbackers.

The other day hard-core Zionist Rand Paul was calling for war in Syria. Claiming Obama only wanted to fight Assad to a stalemate our man brazenly came forward: ‘I’ve told them I’m not sending my kids or your kids or any American soldiers to fight for stalemate. When we fight, we fight to win, we fight for American principles, we fight for the American flag and we come home after we win.’

What does it all mean?

Austrianism was and always has been the Money Power’s tool to subvert American Populism all throughout the 20th century right up to today. Ed Griffin’s ‘the Creature of Jekyll Island’ is just the perfect example of how they steamroll any platform for monetary reform by confusing the uninitiated. With the decline of Gold buggery we see a vacuum right at the heart of the Truth Movement.

The international implications of this trend are hard to fathom. As we know Austrianism fits well with the rise of the Gold backed Yuan. The Euro also was designed to be backed by Gold. Ron Paul never intended to win the elections and Lew Rockwell, right after Paul’s legendary backstabbing, claimed he was only there to educate the masses on the wonders of Austrian Economics. So it’s not too clear tPtB want a Gold Standard for America, or perhaps he was just too early.

The Truth Movement is the natural heir of the great American Populists who fought for plentiful money ever since the Civil War. But what is the Truth Movement? The great thing is: nobody knows. It’s one big mess and everybody associated with it has his or her own particular perspective. But there does seem to be a certain loose consensus. 9/11 Truth of course. The idea that the world is run by some bankers (Rothschild & Co), that they are trying to establish World Government and that they use wars to create the chaos they need to get there. It despises Zionism and Imperialism. It is more spiritual than religious.

Bankers have bought the entire world by offering bookkeeping services and slapping usury on those with debit accounts. This is called banking and it’s the mother of all hoaxes. It’s the kernel of the New World Order. They brought all Nations and all Governments to their knees and chained us all to interest-slavery with the only commodity that mankind can create in infinite amounts with the stroke of a pen.

If the results would not have been so utterly excruciating for untold billions of people, it would have been funny.

The answer is clear: we desperately need monetary reform. With the Gold meme in decline, more serious proposals are finding a platform. And there are many. There is the American Monetary Institute run by Zarlenga. They managed to get Kucinich on board, who launched HR2990 in Congress. Shortly thereafter he lost his seat, but this was quite a feat nonetheless.

There are the Hamiltonians/Larouchians, for instance the United Front Against Austerity. Ellen Brown’s Public Banking is also heavily influenced by Hamiltonian thinking.

These proposals certainly are very American and would go a long way. They would end the depression and interest payments by the State.

But they do not solve interest-slavery for the common man. He would still have to go to a bank to pay $300k interest on a $200k mortgage. These proposals (with the exception of Public Banking, which can be easily done on City level) also tend to centralize power in Washington and personally I’d like to see more decentralization to the States and local communities.

There are also the interest-free crediters. Mathematically Perfected Economy is one example. Hour money another. Thomas Greco is big on Mutual Credit clearing. These proposals are very strong because of their principled stance against Usury, which is absolutely key.

There are also the Europeans, people like Margrit Kennedy and Bernard Lietaer, who are strongly anti-usury, anti hoarding (of money) and promote regional/complementary currencies.

There are also the proposals that I would loosely categorize as the ‘Chicago Plan’. The AMI is quite close to it. Bill Still has been offering solutions in that direction. Positive Money comes to mind. A weakness of these proposals is full-reserve banking.

And let’s not forget Social Credit, which remains a force.

Conclusion

With Austrianism facing decimation, a united Monetary Reform platform seems more possible than ever.

Sound money is

1. Interest-Free

2. Stable, no boom/bust cycle, which is a result of tampering with the volume of money

3. Decentralized in the sense that local communities and economies have access to cheap credit

The current proposals as discussed show great promise but the finishing touch is lacking. We need a wide scale debate. This will enhance both the proposals and the public interest and understanding.

Banking is One and those that own it are the Money Power. As Michael Hoffman put it: ‘if there is a greater evil than the Money Power, than the Bible is lying……To say that the Money Power is at the very top of the evils that we need to work against basically overwhelms people. They want something else to fight…….Freedom from interest on money, is essentially the battle for freedom from the Money Power……We reject the weaponization of the love of money as it is represented by interest on loans of money!!’

This is, and remains, the challenge for both the Truth Movement and the Human Race.

(Thanks to Faux Capitalist for pointing out the Libertarian Alexa ratings)

Related:

Babylon = Usury! We want Interest-Free Money!

The Ron and Rand Paul Betrayal

How the Money Power created Libertarianism and Austrian Economics

End the Fed: a Trojan Horse destroying the Truth Movement from within

Why Tom Woods is wrong about the Greenbackers

Greenbackers vs. Goldbugs, by Eric Blair (Activist Post)

The Daily Bell calls it quits…

Meet the Real Deal: Michael Hoffman on ‘Usury in Christendom’

Forget about Full Reserve Banking

Trackbacks & Pingbacks

- Pearls of Liberty August 3, 2013 | Pearls of Liberty

- What happened to Brother Nathanael and his U-Turn on Ron Paul and Monetary Reform? | Real Currencies

- Ed Griffin admits the Bankers own all the Gold and that Usury is the issue | Real Currencies

- Ellen Brown runs for Treasurer in California! | Real Currencies

- Let’s forget about Ron Paul. It’s time to move on. | Real Currencies

- Brother Nathanael Calls for National Convention on Monetary Reform! | Real Currencies

- Positive Money and the Chicago Plan | Real Currencies

libertarianism is yearning for the certainty of life before toilet training. Good Luck

I think that maybe you are overestimating Rockwell and North’s importance. Though they both give interviews, neither has their own radio shows or video broadcasts. Their regular following consists of wonks and academics (so-called). The rise and subsequent decline in their sites numbers reflect interest generated by the elections.

It’s people like Tom Woods, Peter Schiff and Karl Denninger (to name but a few) that keep libertarian and Austrian conversation going for the masses. If their numbers went down, then maybe I’d be as exuberant as you are. Until then, I’ll just remain hopeful.

Nonetheless, there are things to be happy about. Ron Paul and Mitt Romney didn’t become president. A public bank is opening up in San Francisco http://webofdebt.wordpress.com/2013/07/29/green-light-for-city-owned-san-francisco-bank/ And Syria appears to be defeating the terrorist death squads.

btw, United Front Against Austerity is not affiliated with La Rousch. As Tarpley says, they’re too busy with process reforms to ever engage in any real activism on behalf of the poor and working classes — which is what UFAA is all about.

Well, Rockwell’s sites (mises.org too) is much, much bigger than Woods’s and Woods works for Rockwell!

The big question here is what the relation between Gold prices and this trend is. Once COMEX goes down they’ll have a second lease of life, no doubt.

about UFAA: ok, but both Tarpley and Deadeye are staunch Hamiltonians, I’d say!?

Absolutely. 🙂

Don’t you think that the course he teaches regularly has probably a greater impact than site numbers?

Yeah the metals ETF’s are getting slaughtered .In the meantime sales of pohysical gold/silver are skyrocketing.lol

Oh yes, it’s just a matter of time before COMEX is busted. The only question is when.

Well – Alex Jones looks more and more like an agent – agree on that.

He could have supported Bill Still as a Libertarian Candidate in the last election cycle, he stuck with Ron Paul instead to the bitter end and then switched to Gary Johnson. Well – I guess he is plugging Rand Paul again now.

Either way – even if he is just too stubborn for his own good – the movement seems to change.

On the other hand Australia and UK are already implementing new Internet regulations under the guise of porn-control. We’ll see who wins that race – will they attain total internet control before suffient enlightenment of the poeple?

Anthony,

I agree with you 100% that there must be a wide scale debate. All that I would add here is that the scale of the debate, because monetary policy effects the entire human race, must be WORLD wide. In this moment I perceive that the catalyst to absolutely energize a worldwide debate on monetary reform is the story of former World Bank attorney and whistleblower Karen Hudes. In my view her witness testimony, what she has seen and knows, may be the most important story on Earth. To be perfectly clear, Karen Hudes’ story has more consequences for humanity than any other.

Thank you,

Jerry

Anyone who gives a shit about debating these issues is here on this blog. This is it buddy. It’s not that hard to find. Is Karen Hudes exposing that banks don’t loan anything?

Philo,

Nice to meet you. The reason that I mention Karen Hudes is because she has discovered massive corruption at the World Bank, where she worked for 20 some years. The World Bank is the top of the pyramid. I have listened to interviews and she seems rational, intelligent and concerned. Her July 13 two hour interview with Kerry Cassidy, whatever your view of her as an interviewer, was extremely informative. My point in recommending people hear her story is that when enough people become aware, then the worldwide discussion of financial systems, including fractional reserve banking, as well as all the issues and viewpoints discussed here, will begin sooner than if her story is not widely known. Just trying to help my brother.

Thank you,

Jerry

One must realise the the whole system is based on fraud based on

of exponential growth in debt and compound interest. Interest is transferring money from the poor to the rich, thus ENSLAVING us all from cradle to grave.

This is done by design from 1694.

A paper back published in the 70s ”None dare call it conspiracy” by Garry Allen is a starter for most of you.

When it was published they never thought it would sell so only 10 copies were brought out.It was old out with a week, a second batch of 1000 was also sold out within a week, a third batch of 10,000, also with in a week, forth batch of a million with an year, so it went on to win the price for the most popular paper back.

”Grip of Debt’ by Michael Robotom was another good one published in the eighties.

Ellen Browns ”Web of Debt” is the next best.

In order to keep the debt based Ponzi scheme going, they have been raping the Third World where U$2trillion per year is transferred in the Western Banks.

”Confessions of an Economic Hitman” John Perkins is an eye opener with respect to Third World Debt.

The powers that be have dug a too big hole either by design or stealth.

The Derivative obligations is U$1.5Quadrillion.

The Global GDP is U$60 to 70 Trillions.

They will pauperise every before they establish the NWO,but have come stuck, will they start WW111.?

The NWO was established with the invention of banking.

There is more to NWO as follows

The Illuminati Depopulation Agenda

Posted: 31 Jul 2013 11:35 PM PDT

While the global elite construct underground bunkers, eat organic and hoard seeds in Arctic vaults; the global poor are being slowly starved thanks to high commodity prices and poisoned with genetically modified (GMO) food. Austerity measures aimed largely at the poor are being imposed on all the nations of the world. Weather events grow more deadly and

brushfire wars more frequent. An AK-47 can be obtained for $49 in the markets of West Africa. The depopulation campaign of the inbred Illuminati bankers is accelerating

http://www.pakalertpress.com/2013/08/01/the-illuminati-depopulation-agenda-2/?utm_source=feedburner&utm_mediu

Who is voluntarily believing a bank is lending? Who is voluntarily part of a population control industry fueled by greed?

”Who is voluntarily believing a bank is lending? Who is voluntarily part of a population control industry fueled by greed?”

We all are brainwashed

this got spammed moneylender, hence the delay!

A fundamental understanding on why interest on money simply cannot be sustained in a finite world is needed. Fortunately, we have mathematics to unequivocally prove that interest on money is a pyramid scheme that invariably and inescapably leads to the destruction of any society.

Once interest poisons an economy, it will compound through many means including multiple transactions (e.g. raw material supplier pays 5% credit line, manufacturer pays 5% in buying raw materials through debt, wholesaler pays 5% credit line to buy inventory and consumer pays 5% in credit card used to purchase the goods).

The formula for calculating compounding interest:

D=P(1+r)n

D = Debt at the end of year

P = Principal borrowed

r = annual rate of interest

n = year in question

Note that the “n” (superscript) is referred to as the “exponent” in math. This is why the debt grows “exponentially”.

We can observe the exponential growth of debt taking place today through a chart that was prepared by Chris Martenson in an article entitled “Death by Debt” — see Chart here

We can also observe the financial collapse of other societies through history that resulted from the cancerous growth of debt. For example France’s debt grew from less than a billion Francs in 1790 to over 80 billion by 1797 – shortly thereafter followed by a Revolution.

Apologists for usury often claim that exploding debt is from “fiat currency” – surely, if the money were backed by gold, this would not happen! This argument doesn’t hold water when one considers that many gold backed economies defaulted (overcome by debt) in bankruptcy while under a gold standard (the US for example and most of Europe left the gold standard in the beginning of the 20th century not because they wanted to, but because they were effectively bankrupt).

The type of money used doesn’t matter in usury, all will fail (copper, gold, sea shells, raccoon pelts, paper notes) under the insatiable growth of debt.

Other apologists contend that if only the state could be the banker, surely this would solve everything. Again, it doesn’t matter who owns the bank, usury is fatal. Some would contend that the state could simply return the interest to the folks – all of it! But, why collect it if the true intent is to return it equitably, amongst the borrowers who need it most?

And there are those who claim that a return must be provided in order for investments to be made. This is true when one buys stocks but not in the creation of new debt money. Debt money doesn’t come from investors, it is simply typed into a bank account – for free. Banks can profitably qualify borrowers for loans through application and processing fees – interest is NOT required. Commercial banks are doing this today with mortgages that they sell but do not hold.

Finally, there are those who say that the interest may be repaid as long as the loans are structured properly. You could, after all, repay 11 tokens when only 10 exist if the bank were to give you one back to use twice. Of course, loans are not structured this way – it is a strawman argument.

Hopefully the people can figure out that humanity is enslaved by interest bearing debt that will eventually destroy our society.

The banker doesn’t “give” away tokens. He purchases something from you as a borrower with a token so you can give the token back to him. That’s how he gets all his stuff.

Why would anyone vote this comment down and not refute it? Pathetic. Or maybe they just don’t like the fact that’s what bankers do.

What’s unsustainable is all of the securities of the world are being gobbled up by fewer people. That means the ratio of producers is growing less to those who are consuming and producing nothing.

That includes everyone from your elderly retired neighbor to the guy on a 900′ yacht. The game is monopoly.

Brilliant explanation. Compound interest is like a ubiquitous value added tax on steroids, only worse. It’s not the various forms usury can take, but usury itself that is the problem.

Thanks for the nice words pm, I agree – “usury is the problem”

I couldn’t agree more Larry and here we’re not even talking about the cost of it all to the many……..

The problem with gold is not that it’s deflationary. It’s that it’s a substance that doesn’t do anything. You can loan it to someone, but still, it will do nothing. Debt is what makes the world go ’round. The banker’s role is to facilitate that debt by creating the illusion he’s lending when in fact it is the accumulator of credits that is lending. When you earn a dollar, you can rest assured that a borrower will be pricing his ware in terms of a dollar because you are his lender. BANKS DON’T LEND ANYTHING(for the uninitiated).

Intrinsically, Gold is just as you state. However, when it is use as a reserve for currency, it is ascribed an artificial market value and can be deflationary due to it scarcity. A few elite individuals/groups can horde a the world’s supply and drive market price up which in turn makes debts paid in gold backed currency artificially high by an exponential magnitude.

There you used the word “intrinsically”. “Intrinsic” is a one word oxymoron. Just like “gold reserve currency” is an oxymoron. Gold is just a way of convincing people you have money, so you should be the one who’s facilitating the debt people are trading in their commerce. A banker can only convince a person that they’re loaning them something if the person thinks the banker has money. There has never even been a gold reserve currency and there never will be. Money is debt, always has been. Bankers don’t loan anything and never have.

Two thumbs down with no rebuttal. Wtf?

Why would anyone be a gold-bug? Is North a banker agent? Does he know banks don’t lend anything? Is he sincerely seeking a solution to something that can’t be solved? Are his popularity stats just a cyclical thing? Are they a sign of civilization collapsing?

Congratulations on another great article Anthony! Interesting how mentioning the name Rothschild brings out the allegations of anti-semitism when nothing anti-semitic has been said. I wonder how much the Rothschild Syndicate pays these fools to do that. Your research seems to be spot on. I am working on the logistics for a parallel currency for my home state of Arkansas. The “ArBuck” will be issued as a multi-merchant gift card. It will convert into Dollars at a proposed 10 to 9 rate with the discount going to the Arkansas consumer. I have a hunch that the Syndicate plans to destroy the Dollar and every currency tied to the dollar in Atlas Shrugged fashion. They will then very likely come forward as the Saviours of mankind, wearing their Austrian hats to offer us their New World currency backed by gold. In designing the ArBuck I see where charging interest on loans could be used effectively and occasionally to reign in any inflation tendencies. This would serve to contract the volume of credit in circulation for ethical purposes. Inflation is a tax that should go to public benefit rather than to the bankers profit. It taxes everyone equally and requires no bureaucracy to collect. When you get a chance, check out the articles I posted in Facebook under “The ArBuck.” Kindest regards.

Are you going to have your own ArBuck bank with its own network of electronic transfer machines?

The depression has been and will always be. It just moves around. It’s always in the slums of Calcutta and Buenos Aries. Many are living a higher standard of living than ever, but fewer than most.

Anthony,

Your realcurrencies website has been a wonderful resource and your articles have helped in enlightening many people.

The American Monetary Institute run by Zarlenga and

Ellen Brown’s Public Banking are also right on the truth.

You have almost single handed exposed and defeated the money monger funded Austrian Economics false Hegelian dialectic.

More importantly you have explained the whole money problem in simple easy language. The money problem afflicting humanity is damn easy to understand. It becomes confusing to understand because of deliberate obfuscation and creation of false Hegelian dialectic like Austrian economics to control and mislead the people. The universities and textbooks are also controlled and highly misleading. The conspiracy against mankind is mind boggling compounded by the fact that most people have no interest in this matter and want to just go on with their simple lives. Make no mistake the money control by a few is the greatest evil in this world. It truly is the Satan’s grip on mankind leading to all other evils.

The money mongers have become exceedingly wealthy. But the good news is the world is run by its own laws of Karma. Even the dinosaurs could not survive forever. I can tell, you have already assured your name will be among the true Kings when the real history of mankind is written.

What if the American Monetary Institute run by Zarlenga and

Ellen Brown’s Public Banking aren’t right on the truth. What if Austrian economics is going to flourish as long as money exits? What if Anthony isn’t using simple and easy language and the money problem isn’t easy to understand because of that? What if there’s no Satan and people are just evil? Karma? What if you’re just part of the conspiracy whose job is to stroke ego’s?

Knowing others is wisdom, knowing yourself is Enlightenment.

Judging by the ratings on our consecutive comments, others like brown-noser’s and don’t like their fallacious paradigms questioned. And this is the best site on the web, pathetic.

No one is bothering to respond to you anymore, since it seves no purpose. Questioning and improving one’s outlook is beneficial, but only if something substantial is being offered. An exchange of ideas and opinions is a means of learning – meaningless or destructive comments provide nothing and are used by Trolls, Sockpuppet-Users and Agents of all sorts. The occasional crazy one is welcome too, but he obviously won’t attract a crowd just like in the real world.

The purpose of this blog is destruction. I’m either going to destruct your paradigm or you’re going to destruct my paradigm. Destruction of one’s paradigm is painful, sorry. How can you speak for everyone?

http://www.youtube.com/watch?v=Id6nCa_OTEM

Your vacuous criticisms are pathetic. You haven’t said anything here that hasn’t been addressed and disabused. Everyone here knows money is an artificial construct that only become evil through usury. It should be just a vehicle for wealth transfer, not wealth in and of itself, or a tool to plunder and create insurmountable debt. That people agree with one another expresses only an appreciation for a commonly held truth, not a desire to please anyone. There is nothing wrong with playing a devils advocate, but you go too far with this sycophant blather. It’s the most desperate ad hominem.

People are evil, so they invented money. Disabuse that.

Some people don’t like that state of affairs and want very much to do away with usury.

So doing away with usury is going to make people good?

It’s going to prevent evil people from enslaving everyone with monetary debt. If people were immune to temptation, there would be no need for safeguards against corruption.

Only the grace of God can make people good.

Money is debt, no?

No. Real money, as discussed here is merely a medium of exchange for labor, services and products and has no unearned rents attached in the form of interest. As a loan, it is solely principle.

Is that what’s discussed here?

Can someone purchase something put $1 on a piece of paper and purchase something without having to do anything in return?

Yes, its called public assistance for the poor, sick, unemployed and elderly. Charity is nice, but a very unreliable safety net.

Who determines who’s poor etc.?

Who’s the lender?

Ideally for me, a public bank. Others here have different ideas, but all would issue interest free principle.

What does the public bank have to lend?

Interest free Credit for the purchase of goods, services and labor.

How does someone lend “interest free credit”?

How is there no debt if there’s a loan?

There is no onerous debt. If I borrow 25 dollars I must only return 25 dollars that I generate via my labor.

So money is debt?

No. Money is the medium by which you pay your debts. Debt is the product or service that you owe payment in exchange for consuming.

So you owe money, and you owe a product or service?

Okay, philo. It’s been fun. http://www.youtube.com/watch?v=kTcRRaXV-fg

That video didn’t say anything about money or owing a product or service.

It’s about your method and intent.

The method is syllogistic dialogue. It’s how anyone actually learns anything important other than metaphorical picture weaving or illustration with animated characters in the process of doing something.

The method is sophistical nincompoopery. All you do is parse what people say into irrelevant and contentious avenues of thought. I’ve had plenty of experience with trolls using this technique. You can discuss things with them for hours — and get nowhere.

Is there such a thing as syllogistic dialogue?

What about checks and debit/credit cards? Are they money? I can make transfers with my phone. Is my phone money?

Thanks so much for this RR, well appreciated!

Reblogged this on Recovering Austrians.

As I see it, if everyone abided by the following we would not need money, nor would we therefore need a treasury.

.

James 2:8 “If you really fulfill the royal law according to the Scripture, “You shall love your neighbor as yourself,” you do well …”

.

Matthew 6:19 “Lay not up for yourselves treasures upon earth, where moth and rust doth corrupt, and where thieves break through and steal:…”

.

1John 3:17 “But whoso hath the world’s goods, and beholdeth his brother in need, and shutteth up his compassion from him, how doth the love of God abide in him?”

.

Matthew 6:24 “No house-slave is able to serve two lords: for either he will hate the one, and he will love the other; or else he will cling to one, and he will despise the other. Ye cannot serve God and wealth.”

.

1Timothy 6:6-10 “Now godliness with contentment is great gain. For we brought nothing into this world, and it is certain we can carry nothing out. But having food and clothing, with these we shall be content. But those who desire to be rich fall into temptation and a snare, and into many foolish and harmful lusts which drown men in destruction and perdition. For the love of money is a root of all kinds of evil, of which some lusting after were seduced from the faith, and they themselves pierced through by many pains.”

.

Matthew 23:11-12 “But the greater of you shall be your servant, and whoever will exalt himself will be humbled. And whoever will humble himself shall be exalted.”

I agree, but there will never be such a utopia before the second coming. The best we can do is try to make our monetary systems and forms of governance take into full account the fallen state of man.

Utopia is an idealistic place. Who is trying to create a place without coming up with a detailed description of how everything is going to work within that place and how to get there?

I don’t normally respond to trolls, but Philo you are confused and it is not helping the people here. Money is not debt. It is an abstract entity that mediates between debtors and creditors. I call it an accounting identity. Money exists in two forms, intangible ledger entries, and also in physical form. The physical form is tangible proof that the intangible exists. Humans like gold because it is a Noble metal that doesn’t rust, hence the physical form provides assurance that the intangible form is also “good as gold.”

When you pick up an item at the store, you have become a “quasi” debtor. The store is the creditor. When you purchase the item, your money divides down to a price, and is then used to mediate between the debt and credit contract just formed. The money allows the transaction to take place, and debts and credits then cancel out. Therefore money is not credit nor is it debt, it is a medium of transfer.

Is a forest credit or debt? When we take a tree and cut it down, make timber, and sell it into the market – only then does it become monetized. It was the raw materials of earth and the labor energy of man and machine, which then progressed to commodity. That commodity is then traded in a market, where money helps in the exchange transaction.

Do this. Go up to your friend and say, “give me your cell phone (mobile if you are European).” Then ask them what they are feeling. That feeling is the debt/credit contract just formed in your minds. It is an intangible force caused by our evolution, where we traded goods with each other and expected fair play. The now new holder of the phone has become a debtor, and the creditor is owner who formerly had possession of said phone. In order to cancel the debt/credit contract just formed, the phone can be passed back to the original owner. Now ask the original owner what they are feeling. Credits and Debts are mathematical positive and negatives, and they cancel each other out. Passing the good, the phone back to creditor, instantly cancels the credit/debt contract. A good canceled the contract, not money. Money divides down at the moment of transaction, then STANDS IN AS A GOOD, and helps mediate the debt/credit transaction. Ask you friend if he would take money for his phone. And of course he will, we all have a price. The price is money’s ability to divide and find a common understanding between human debt/credits, thus allowing the contract to cancel.

Money stands in as a GOOD, but is not a good. Money is NOT CREDIT, but helps facilitate credit/debt contracts. Because it stands in as a good, weak human minds conflate money as a good. It is equally true that since our current world paradigm is double entry ledger credit banking, that weak human minds think that all money is credit.

If a bank cancels its debts, as in China, does that Yuan still need to vector back to the banker’s ledger to cancel into nothing? The answer is no, and hence that Yuan becomes floating. It can float and mediate credit/debt contracts forever. PUleease, we all know how a bank hypothecates on a double entry ledger. You are too sophomoric for this website. Go away and learn something, then come back and contribute in a meaningful way.

Learn about Mutual Credit and other forms of money creation, there is plenty to read here if you are willing to listen and learn instead of spouting off and being annoying.

How in the hell can you say I’m not helping anyone here? What a fucking ego. Step up and have a dialogue with me. You’ll prove to yourself what b.s. you just said.

I would have to agree with Philo and say that money is issued as a debt.

The way I see it “money” is issued when a signed promissory note pledging the result of ones own productivity is exchanged for tickets or tokens.

Why does the ticket value have to be payed back when it is already paid for?

How can tickets be issued as a debt when the ticket issuer has nothing and produces nothing?

We should not even deal with such type of people –

The General Epistle of Barnabus chapter 9 “………wherefore it is not the command of God that they should not eat these things; but Moses in the Spirit spake unto them, …….neither says he, shalt thou eat the eagle, nor the hawk, nor the kite, nor the crow; that is thou shalt not keep company with such kind of men as know not how by their labour and sweat to get themselves food; but injuriously ravish away the things of others; and watch how to lay snares for them; when at the same time they appear to live in perfect innocence………so these birds alone seek not food for themselves, but sitting idle seek how they may eat of the flesh others have provided; being destructive through their wickedness……..”

Luke 6:34-35 “And if you lend to those from whom you hope to receive what thanks is there to you? For the sinners lend to sinners, so that they may receive the same. But love your enemies, and do good and lend, hoping for nothing in return and your reward will be much; and you will be sons of the most high, because He is kind to the unthankful and evil ones”.

Did God die to fulfill your debt on a giant thing that looks like a T to make a point? The balance is the most basic accounting tool.

Here is comment by Astle, referencing Aristotle:

“the scholars still clearly understood the actuality of money and that it was an evincement of the law . They still understood it was but so many numbers injected into a circulation amongst the people relating value to value, and not in any way influenced by the material on which these numbers as laws were recorded.”

The notion that money must come into being as credit is refuted by history at many points. It is the volume of abstract numbers that must match value, or in other words, goods and services. Our output as humans is matched by money, and hence money is a vehicle for exchanging our output…our value. These numbers are a function of law, and we have the power to change said law.

A simple thought experiment: The law requires tangible money to be recalled, old money is to lose its value, and be replaced by new money. Losers in a war have lost their basis in law, and hence their money becomes valueless.

All of that said, you can have money come into being as credit, for example mutual credit, and still have it behave properly. But, the nature of money is law, not credit. The notion that a good must be hypothecated to create money is a lie of gigantic proportions. People who use money to trade their output have no idea where it came from. It is simple faith they are using when they trade, and that faith is part of the law and faith nature of man.

In science, if you have contradictory evidence, it disproves theories.

As far as my “arrogance” goes, I don’t have to be a nice as Anthony. The truth is a velvet covered iron fist. The truth has weight to it, and it mails home and smashes into us. The truth sticks in the brain and festers because it cannot be ignored.

Making ad-homiem attacks and strawman arguments are the provinces of losers, especially when they make claims in the face of obvious truths.

Here is a link to Babylonian Woe, where the quote above is located:

http://www.yamaguchy.com/library/astle/astle_index.html

Why would anyone reference a man whose job was to train conquerors on the topic of money? Just because Astle never said money is debt and there is no money without debt doesn’t mean he wasn’t full of shit.

In fairness, I agree with REN on several issues philo.

Our current money may be debt, but we all know money can be created debt free. REN has never made another impression on me than very knowledgeable while looking to become even better, I see no arrogance in his stance. Meanwhile, you do come off as arrogant, even if only to provoke: you say things like ‘I’m here to shatter your illusion’. But I don’t see you listen, or really respond to what people say. And this is the hallmark of a non-arrogant person.

The people commenting and discussing here are all well informed. We have disagreements on many issues, but nobody is speaking here without a solid footing in economics.

Lastly: I, with REN, do not think your interventions are really helping people…….

It’s good to converse and I’ve always appreciated your sharp mind, but I also appreciate the other minds here and I hope you can show similar appreciation to them and their positions.

I guess our goal here is mainly to get better so we can prepare for what is coming, not so much being right or scoring points.

Give an example of debt-free money.

Social Credit. Newly mined Gold, minted and spent into circulation. Salt. Just a few that come to mind.

You mentioned some commodities that can be used for barter and the word “credit”. Does anyone have credit if a loan hasn’t been made?

No philo, are you kidding?

I don’t take Gold or Salt in the transaction because I want Gold or Salt, but because they will give me what I DO want. That’s the essential nature of money as a means of exchange. Gold or Salt as money don’t derive their value from their nature as commodity, but from our agreement to use it as money.

Social Credit is debt free paper printed by the state and spent into circulation by the people:

http://realcurrencies.wordpress.com/2012/07/30/social-credit/

A commodity is a barter trade substance and there isn’t going to be any car manufacturing built on bartering. Promises are what makes the world go around. Can I be issued paper, buy a bunch of stuff and leave the state with it?

Another: There’s no faith involved. If you earn a dollar bill(because you put a $1 on your product), you’re guaranteed a borrower is going to put a $1 on his product to extinguish the debt between you and him. The money debt.

really? Is not the debt settled the moment you received the dollar?

No, the debt is established as soon as you receive the bill. It’s just a piece of paper remember. You had to work and traded your work for a piece of paper.

Ok, I’ll address this for example: If the bank cancels all debt in China, the people will be walking around with a bunch of useless paper and no food on store shelves.

This is correct of course: China’s money is credit based.

You’re also right about interest-free credit being debt.

But it’s easy to think of non-debt based items that can be used as money, I just mentioned a few.

China cancels debts, and hence that portion of their money supply looses its credit association. In effect a large component of their supply becomes debt free. When a bank takes a haircut, a legal maneuver, the liability side of the double entry ledger is erased. This magic eraser makes the former “credit” as money loose its credit association. Therefore, that credit money already circulating in the supply is cast free. When the government rolls over Bonds, and then makes the FED reimburse profits, then the money issued as credit by the banker is essentially debt free. The debt ledger held by the bankers is then held over an ignorant population as a form of coercion, when in reality the Banks and FED are a creature of the law. There is no balancing, the only thing that matters is the volume of money in the supply relative to goods and services being produced. When a house or a car is repossessed, the credit/debt contract collapses, and the former credit money in the supply looses its credit association. This is why bankers like depressions, as it helps their con game because the supply needs money to offset banker credit and its associated usury.

Mass Bills were issued and circulated, and they were good for paying taxes. They were not a promise to receive in anything (like Gold) and they circulated as money. The Bank of Canada, Guernsey Islands, Australia all experimented with portions of non debt type money in their supply.

An example in modern times is South Africa. To get the natives to mine Gold and Diamonds, a head tax was imposed. Law and Force (the tax) made the natives work in the mines. Marketplaces then developed and a money economy was born.

It only takes one example to disprove a theory.

More examples: MEFO bills and Federer money, which funded a war time economy. Money is not credit, but it can have credit associations if the system is so designed. The lie of money being credit has been passed down for thousands of years as truth; this lie is fundamental to the operations of usurious private money masters.

For creditors to release their money savings, and make loans, they need to be enticed with positive interest. Most, if not all economists take this on faith, and most do not examine this principle. Therefore, one hears canards uttered as if they were truths. If money doesn’t have debt association, then it becomes worthless. Yes, if all debt is repealed, in that case money looses it’s velocity “force” to return to the ledger. But, velocity forces are not only “enticement.”

Taxes are a force to make the “paper” move. In this case it is a punitive force, a kick from behind rather than something which entices. Do you care if your car is front wheel drive, or rear wheel drive? I opt for rear wheel drive if it means no usury.

Government spending and demanding it’s portion of the economy be in its unit of account forms acceptance, a type of faith agreement. Mutual Credit is really money circulating among those who are in high agreement. We will need Mutual Credit because our governments have been usurped by private double entry creditors. But, like gravity makes you fall toward earth, money has its ultimate basis in the law. I don’t really like that it is so, but I’ve come to accept it. I am not going to turn my head away from the usurious elephant in the room.

The other side of the contract is debtor force. Debtors can choose not to pay, so in some respects they have power over Creditors. But, usually the law is invoked and punitive force is slammed down on debtor’s head. They go to jail. They can also have assets seized, which is a force i.e loss of wants.

We need to come to grips with Credits and Debts, and how money mediates between them. Creditors (enticed to make loans with positive interest) are usually over Debtors, and this is an element of usury.

“For creditors to release their money savings, and make loans, they need to be enticed with positive interest.” – If by this you mean bankers, they don’t loan their savings. That would be loaning debt, because money is debt. They don’t loan anything. Maybe the confusion is because it sounds like I’m saying there is no lender.

Your so called “cast free” money isn’t money. It’s worthless pieces of paper and ledger credits watering down the value of the actual money. It’s called inflation. The FED has nothing to reimburse anyone. How does slave labor have anything to do with establishing a money economy other than money creates slaves? Can you please make shorter comments? You can make as many as you want.

Philo, there is a very big distinction between credit as money and money. Money is an accounting identity that circulates in the supply, allowing transactions to be consummated. Credit as money issues forth from the double entry ledger. It is hypothecated into existence, and then circulates as money, then recalled to the ledger. When it enters the ledger if extinguishes from existence. A positive meets a negative (liability).

Really, there is nothing you have said that we don’t know already. You are like a little kid in the classroom that keeps shouting. Your noise is drowning out the serious minded folks here. .

When credit as money looses its credit association, it no longer needs to return to the ledger. It then becomes money. More specifically it then becomes floating money. In the case of China, other debtors can then grab that former credit as money, and use it to pay down their credit loans. This is a major feature of the Chinese economy, perhaps the major feature. Yet, your noise keeps this notion from even being expounded upon.

A real money economy would have savers loan out their money OK. NOT BANKING CREDIT. We all know how banks work.

Nuances in how Mutual Credit works, such as not calling in loans, could do the same. I’m trying to get at a real point here.

1. You’re talking about yourself.

2. Stop with the personal attacks, it doesn’t make you seem intelligent.

3. Do defaults have anything to do with inflation?

4. There can be no savers unless a loan has already been made.

5. Shorter comments will help us get to a point easier.

6. if you care about nuances, why don’t you write a dissertation on exactly who qualifies for how much credit?

Anthony already told you that if there is gold coinage, say if somebody digs something out of the ground, coins it at the mint, that becomes debt free money. It is seigniorage against the money supply.

Instead of just making false allegations, please consider that I’ve been trying to teach you things. Yet, you are unwilling to consider these points. It is without any shadow of a doubt that we have had periods in history with free coinage. That “money” then goes on to become savings. There was no loan to make savings.

We just gave you dozens of examples of debt free money, and also how debt money can be freed.

Yet, you are unwilling to consider these obvious truths and still stick doggedly to a false position. Money doesn’t have to come into existence with debt. I’m sorry your belief system is based on shibboleths and untruths.

Reasonable people listen and consider the evidence, and then if necessary, change their belief system.

Gold is a commodity. Are you going to stamp $1 on an oz. of gold? $100,000,000 on an oz. of gold?

Can you just rebut my premise or give a simple premise? You’re really starting to concern me. I consider you an intelligent person whom I’d like to be great friends with. You are teaching me. I don’t just believe without question everything I hear. I’m not a Nazi following Hitler.

No, money is an abstraction, like numbers. Commodity money is used to control the ledger. I’ll speak more on it later.There are a lot of moving parts to money systems. It is not simple, but once you break through a few roadblocks it will get better.

Can you make your points in separate comments so they can be addressed one by one?

The Austrians use A-Priori reasoning. They invent an idea, and said idea is then used to build up their mind control in layers. If you question their flawed base assumptions, upon which their towering edifice is built, it comes crashing down. Things like human action and value theory are good examples of intellectual traps used to snare the unwary. Using usury to break down their edifice of B.S. is a great, because it gets right to the heart of the matter.

Both sides of the dialectic use A-Priori to mask their agenda.

After hardened iron was invented, silver could be mined more easily. International bullion brokers would sidle up to the unwary, and whisper lies such as money is silver. Of course the money masters controlled the mines. In reality the masters wanted to make loans on their clay ledgers. The abstract numbers on the ledger were created by a slave bearing down with a pen like stylus. But, to pay off the abstract numbers required commodity money. The abstract ledger money would be required to grow with usury, and be paid off with unlike types i.e. commodity metal such as gold or silver. If you couldn’t pay a growing abstraction, because there wasn’t enough commodity money in the supply, then they get your house or your wife or kids, or make you a slave. Once you are a slave, you most likely get to work in the mines till death.

It is no accident that Jesus was killed for silver, because silver was “international” meaning it ringed the trading entrepots of the Mediterranean. International commodity money is beyond the reach of the state. This is why silver money debts could not be jubileed; silver debts were a generational contract. The bullion brokers and counting houses also controlled the exchange rate of Gold:Silver. So, these banking money masters would take the profits on east/west exchange difference between gold and silver. The also controlled the caravan routes upon which the east west spice and money trade traveled.

When Jesus couldn’t recognize the Pharisees God, he most likely saw Babylonian money masters. It is easy for money masters to enter the temple, and then put well-meaning, but simple minded (in the ways of money) priests into debt. All of the trading entrepot cities used Aramaic as the money language. So, Israel was fully infected with the usury money master parasite. The Pharisees and their progeny went on to write the Babylonian Talmud, to codify control.

The first step is to control the Temple with A-Priori reasoning, and then control the State. The ultimate objective is to use the State as a shield to protect your confidence game. At the same time, spread A-priori disinformation and control the minds of the sheeple. If anybody gets close to understanding money science, shut them down by all means. Jesus was a huge threat.

On the other side of the dialectic are the foul words, “money is debt.” The objective is to control the ledger, put people in debt, induce usury and thus control society. This is why Chicago School type debt money masters are the same people as Commodity money masters.

Excellently put. Though I am afraid that most states in the world shield the money power quite well already and have been doing so for quite some time.

Would not surprise me if Jesus was also preaching plenty on the destructiveness of usury, which makes it a by far more compelling reason to ged rid of him. Unfortunately the New Testament is by no stretch complete and has likely been massively tampered with over the centuries – certainly in the early stages of Christianity.

The steps to a better world are clear to most here anyway: First get rid of usury in an ever improving system and who knows later maybe get rid of money altogether when technology has been freed and has advanced sufficiently.

If you think about it, it is truly foolish: When there is no sufficient money, it does not even pay to harvest agricultural crops for sale. Sooner or later usury and the money system will have to go – or otherwise an ever growing part of mankind will sit around in joblessness, idleness and complete slavery to a powerful few.

So you think Austrians are actually trying to keep bankers in control of the planet and not sincerely trying to come up with a solution to the disparity they believe is caused by the current banking practices? And they’re using mind control to do it? Or is it that they can’t even figure out for themselves what’s actually going on?

Anthony, Meme and others have proven conclusively that Austrian mind control funding is provided by money masters. That information is available here under the links he has provided.

It’s easier to diagram, but we have to use words. 1) You go to the bank and hypothecate a loan. 2) The double entry ledger is marked up 3) The liability side of ledger is marked with both principle and usury of your new loan. Also, you and your asset are attached to the ledger as a legal maneuver. 4) The principle of the loan is spent by you into the lower loop of the money supply. 5) Labor and producers use this lower loop as a public good, to trade their output.

The bottom loop of money supply is always under drain pressure, as double entry credit disappears upon re-entry into the ledger. Some of the usury portion is re spent by the banks as employee wages, and also to pay “savers.” This creates a mind control, where savers think their money is being loaned by the bank. The rest of the usury portion – and it is a lot of money-goes on to become stagnant usury capital.

Stagnant usury capital paretos to the top 1 percent of the banking pyramid. There it aggregates to be used to fund the mind control. Sorry about that, but your labor and output creates these funds as part of a system design. You can see the large usury funds flowing about world financial centers today, as it seeks out returns. In my view, the bottom loop should be able to save their wealth and not have it stolen by gamesmanship.

The usury take unbalances the bottom loop, and hence the bottom loop must be filled or it will collapse. Keynes convinced governments that they had the duty to take out loans from private banks, and fill the bottom loop. The loans issued against govt bonds can be rolled over forever, hence the current world paradigm we are in now. Of course, the poison is the rolling over becomes an exponential usury “debt” function. Before Keynes, economies engaged in mercantilism, where they tried to drain money from other economies to fund their usury take on their lower loops. Countries that have large trade surplus are still mercantilist.

Since the bottom loop is always under drain pressure, usury capital in the upper loop retreats and waits for labor to present its perishable goods and services for cheap. In this way you pay for your own mind control and debt peonage.

When the disinformation curtain is pulled back, both double entry creditors and Austrian Gold buggers want a lower loop that is depressed and with them in control of stagnant usury capital. It is two poles of the same dialectic.

So, the answer to your question, is unfortunately yes. The Austrians are all about ensaring young minds and leading them down a cul de sac of disinformation. Where do Austrians get their funding? Follow the money.

If everyone who’s opposed to Austrianism said, “From now on we’re going to support every policy you want to implement,” what would happen? One paragraph if possible.

Private gold hoards would control the “reserve” loop of private banks. Gold would also be in the basket of currencies that settle international trade imbalances. So, in this way, the private gold hoards stick their nose, like a camel, back into the tent. Either way, it is the same people, private usury capitalists i.e. the banking elite. The world accelerates into one world government.

The bottom line is that money is an abstract entity that follows rules and laws. Money is law and force, it is not gold or silver. One of the lies told to humanity is that Gold or Silver or something precious is at the base of money. These base assumptions need to be challenged, or you enter into their a-priori reasoning. As soon as you accept that something abstract is tangible, then you get pulled down their rabbit hole. Their reasoning is one layer of plausible lies added to more.

Controlling the volume of Gold, would then have a follow on effect, where other money types can be contracted or expanded as desired by the hoards. Small amounts of gold contraction and expansion in the reserve loops, then controls the abstract ledger. Even better, since their hoards are confined to reserve loops and international baskets, their precious metals cannot easily get into the hands of labor.

So your saying everyone would see their policies don’t work and wouldn’t consider an Austrian worthy to lick the bottom of a boot? Isn’t that what you want?

Their policies would work for them, but not for the bulk of humanity. It would be something like the matrix, where most people plugged in would be convinced that Gold is money, and that debt peonage is normal. Average sheeple would have no other frame of reference. Mind control for the sheeple, and rivers of wealth and power for the controllers. It’s a good gig if you are in the top 1% financial elite. And you can keep it all in the family and pass it down for generations.

We already live in a matrix where people believe a bank is lending something and this isn’t a big monopoly game.

Aren’t you saying money is abstract and it’s tangible?

You aren’t paying attention. Money has two forms, the abstract and the tangible. The dominant form is the ledger i.e. intangible. Only about 3 percent of the money supply is coins and bills. Gold or silver as a money is far removed from the reality of money, which is abstract numbers relative to goods and services. Whenever you get mismatch of types, you know a game is being played, and you are the target. The ledger is what is important, and focus there.

The Austrian’s would reintroduce gold as the physical form (tangible) and then let it be a controlling element on the ledger. It would be placed in reserve loops where it would be necessary to have on hand in order to hypothecate loans. You don’t hear the Austrians talking about eliminating the double entry ledger do you? The double entry mechanism is like a function machine in math, inputs are assets and future output of labor, and output is banker (debt) money. The input now needs gold to control the output. The human then is in debt bondage, and his debt instruments are traded on markets, as if he is a commodity. It is a continuation of debt peonage, and the controllers are those who own gold hoards. Who owns the hoards? All the gold mined in history is still around. It is about one human death per ounce. Gold is bloody and it is pathetic that mankind is still pretending it is money.

Also, as soon as Gold is monetized, it becomes extremely valuable. The private hoards now have a superior capital position and can buy up now depressed real assets from laboring producers. Two birds with one stone, buy up real assets – gaining wealth and control, and increase international control of the banking system. The U.S. especially takes it in the rear, as the reserve currency wants to return home from overseas.

In the past, gold and sliver would be melted down and spirited out of country. This is a form of full spectrum warfare, as it collapses an economy.

The founding fathers wanted us to have our own country and not to be under debt peonage control of foreign money masters.

Isn’t a coin or bill just a representation of money? The same size piece of paper can have $1 on it or $100 on it. A coin with 10 cents on it is smaller than a coin with 1 cent on it.

Ink on a ledger is money. Digital memory in a computer may represent money. It is abstract, just numbers. The physical representation of money is not very relevant. Pretty soon we will be beaming our accounts with our cell phones, and physical money will disappear.

I personally hope we never lose the physical aspect of money. Purely digital forms of money that can be controlled by a centralized authority, whether that be government or a corp, represents a threat to one freedom, privacy and life. The RFID chips the government wants to replace all physical monies with can be monitored and turned off, leaving you without a means of survival should you become unpopular with whomever is in control.

What’s the process in how the ink credits end up on the ledger or the credits originate in the computer?

Bankers never had enough gold if everybody wanted to redeem it for paper at once. Why would they now?

The bankers will recall gold from the lower loop (us) during depressions. The upper loop of financial capitalists will hoard it, and use it to control the double entry ledger, and as well to mediate large international transactions. They will make sure the economy periodically has depressions by their control mechanisms. This means the U.S. role as reserve currency will be diminished or eliminated. The U.S. military is still a problem for the masters though.

That was the answer to a different question or something. Maybe you could clarify?

You want to eliminate the double entry ledger? Are you saying pieces of paper should be given to people and other people are going to accept those pieces of paper that were given away and a modern economy is going to function like that?

Money at its root is law. As long as money is lawful, the people will use it. This is not speculation, it has been done. In particular, as long as money is available in the exact velocity- volume relative to goods-services, it will be well received.

If all debt was called right now, all the paper and coins would be sitting in a bank. Do you understand that?

Banking was conceived in iniquity and was born in sin. The bankers own the earth. Take it away from them, but leave them the power to create money, and with the flick of the pen they will create enough deposits to buy it back again. However, take away from them the power to create money, and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of bankers and pay the cost of your own slavery, let them continue to create money..

~ Josiah Stamp – Bank of England Chairman, 1920s

No Debt = No Money, DEBT is the money of slaves

Yeah, I wasn’t asking you, and you didn’t even answer the question. Notice how Stamp doesn’t offer a solution? The solution is the end of civilization. Money is the money of slaves.

The solution is simple.

Publicly owned Central Bank to issue Interest Free Loans for productive capacity.

It’s self regulatory, money supply remains constant = Nil inflation

Debt is the money of slaves, but money as such is a medium of exchange

It’s only simple if that’s your religion and you refuse to bother thinking about all the mechanics involved with banking whether it be public or private.

The Bank has to be Publicly owned.I have seen most of the contributions thus far in this posting and in previous ones too.

Most of you all are all over the places and keen on scoring cheap points,hence no clarity in thinking.

That is why I keep it simple so that it can gel with most of the public.

There have been success full track records to my proposals.

Australia,Canada,Gurnsey, New Zealand and recently Malaysia,not forgetting the US.

History is on our side.

Someone is going to have to come up with a detailed plan someday if the public is going to buy it. The examples of public banks you’ve given are no different than any other bank. Executives making millions of dollars and not lending anything.

You do not know what you are taking about, none of the banks wre involved in fractional banking, nor did the directors make money

No bank is involved in fractional banking. There is no fraction. For money to exist there must be debt. Money = debt. There isn’t a banker on the planet that thinks debt can be lent.

and I-don’t-know is on third…

Can you come up with an intelligent rebut?

Who’s on first…

Do you think people are given a $100k credit line not having to pay it back plus interest?

You are all muddled up.

You do not know how a government expenditure is funded.

You do not know where 97%of the money supply of any country at any one time is derived from.

As to your latest posting I am proposing Interest Free Loans,not handing out money willy nilly

You are muddled up. You can’t even answer a simple question. All money is derived from a bank taking a promissory note for money and then paper is issued to the person or an account is credited. There is no loan without debt. You won’t be loaning anything, a bank has nothing to loan.

Government is funded by taxation.

Should all those pieces of paper be given away to people?

Weren’t the founding fathers a bunch of slave owning aristocrat politicians who knew that civilization is just a huge monopoly game?

The Bank of England came into being in 1694. This was the first time a private bank hosted a government. When the bank started to attack the Colonies, the revolutionary war began. Benjamin Franklin makes it clear in his statements that by restricting colonial scrip, and forcing the Americans to pay debts in Gold, it collapsed the Colonial economy, thus leading to high unemployment and then war. The supposed “tea party type taxes” were only a symptom of BOE predations, not the cause.

Whatever the failings of the founding fathers, they tried to put humanity on the right course. It was the best chance we have had. Since Babylonian times, the money masters have been jerking humanity by the short hairs. We cannot evolve to our higher selves as long as the parasite is part of our system.

Some of us understand how the money system works. Austrian mind controllers are an organ of the parasite, still trying to maintain its control. Consider, a really successful parasite will infect the brain and reproductive organs of its host. The parasite forces the host to feed and even what to think.

Consider slavery, it was an institution funded and controlled by the masters. In the ancient silver mines, slaves were needed to cheaply extract the ore. Who owned the slave ships ? It was the masters, mostly located at the BOE and in Amsterdam. The downtown financial center of london, is actually banker owned land “The City of London.”

So, the locus of evil in our time, is the money mechanism. Don’t blame the victims, look for the masters who are pulling the strings.

Didn’t Franklin really only care about where the next prostitute was?

If man was going to evolve to a “higher self”, don’t you think he would start by not buying slave manufactured clothing and slave grown food?

There is no loan until the principle is spent. Now there’s debt to be extinguished. You can’t just spend without doing anything in return.

REN wrote:

Hello REN, I enjoy your articulate posts and usually learn something. However; I am not following your two references to a “double entry ledger” system as it appears that you object to the procedure?

The double entry ledger complies with GAAP (Generally Accepted Accounting Principles) which I contend works fine and serves us well.

The all debt, interest bearing money system cannot be sustained, no matter what is used as money; but – the double entry system is not part of the problem. In fact, it is part of the solution as it explains a number of aberrations in the current system.

Let me give you two examples of how the use of a double entry ledger (GAAP) can help clarify the complicated Federal Reserve system. The Federal Reserve violates GAAP every time they create “reserves.” Reserves are a quasi liability to the Fed which magically become assets to the banks.

And, when the Fed writes a check, the money is created as it does not exist in any account – there is no balance. Neither of these events comply with GAAP and they should tell us that something is terribly awry in the system.

You mentioned that “The liability side of ledger is marked with both principle and usury of your new loan….” but I don’t think that is true. The principal (liability) and asset match and are canceling entries upon repayment. Future interest is not a liability as it may be negated by paying off the loan ahead of time. Interest instead is part of a banks projected revenue.

The double entry ledger will serve us well as we move to interest free loans. In which case, the banks future revenue may be anticipated through processing and collection fees.

Larry, If your system is money, the double entry ledger works. If the system is banker credit, it does not work. Consider the housing bubble: An asset is hypothecated, and debt instrument is created, and banker money enters the money supply. The asset is usually part of the FIRE sector (Finance, Insurance, and Real Estate). Insurance counter signs the ledger making it A rated, and real estate is pushed by new money creation because land doesn’t follow supply demand curves. This causes asset inflation, leading to more hypothecation, more debts, etc. in a feedback loop. The banker still gets his usury take, and the economy eventually collapses as debts outgrow productivity. The humans have their output collateralized as mortgage backed securities, which the FED eventually has to swap for in QE3. Productivity is siphoned away as rents paid to the masters in the form of debt payments.

With a money economy, no banker money (credit) is hypothecated into existence. Money already is in the supply ready to be deployed, not created. The double entry ledger becomes a mechanism for defining how collateral will be transferred to creditor in the event of debtor failure to pay. Important, Creditor is no longer the banker assuming credit powers. Creditors become us, the savers (and I would add demurage to encourage loans to eliminate usury.) The double entry ledger no longer creates banker money, and hence is not the primary tool used by banking masters to control populations with debt bondage.

In today’s credit money master world, bankers have interjected themselves between creditors and debtors (us). Their function should be to assess risk and allocate our saved capital, not make capital. We trusted them to hold our money, and they turned around and screwed us by taking seigniorage and usury profits of making money. The current incarnation of the double entry ledger may follow good accounting rules, but it does not stand up to scrutiny. And besides, what accountant really understands money, mostly they think in terms of numbers adding and subtracting.

When I attack the double entry ledger, I’m pointing out that it is the main instrument of the masters; the locus of their control. I fully mean the credit hypothecation mechanism of double entry in combination with FIRE sector, that has mounted and parasitized mankind.

If banks give out interest free MONEY loans (somebody’s savings) and then collects fees, that is very consistent with my world view on how a real economy should work. Banker’s return to their limited role of handling OUR money. The double entry mechanism’s behavior morphs to being useful, a subtle but important point.

Larry, one more point please. If a legally constituted monetary authority can issue credit it can enter the same channels as money. In this way, money savers would have competition were they to hoard the money supply. BUT, it is one of my contentions, that credit must have the feature of jubilee.

It is axiomatic, that private money creating corporations will NOT jubilee excess debts associated with credit and usury. Therefore, the legal method for creating credit must have a jubilee fail safe mechanism, and this fail safe is extremely unlikely given the rent seeking power mad behavior of money master parasites.

Credit attaches to the future, and the future is unknown. Money already is, and hence comes from the past. Credit means future money (or future credit as money) must be in the supply to pay back loan payments, and former credit then disappears.

To my mind, both credit and money have rules that are axiomatic, and beyond debate. Yet, we debate the concepts because they are purposefully hidden from out view.

The point of axiomatic rules is they are debatable. “Money is debt” is not an axiom, I can prove it.

Philo, I proved to you that money is not debt. Did you already forget your lesson? Quit blabbing. You are messing up Anthony’s website, where people come to learn from each other. It is not point and counterpoint, trying to get the best of each other. If we know something, we pass it on, and it gets vetted. If an idea has no merit it should be dismissed. If an idea is reasonable, it finds resonance among like minded individuals. Larry was asking me a reasonable question, and our conversation has nothing to do with you. Larry is a sharp guy who can think for himself.

Can you just find the dialogue where you proved money is not debt and re-post it? Most of everything you post is regurgitated from crank economists. Anthony is free to delete comments if he chooses. Or he could re-post on a fresh page. Or he could post an analysis of a dialogue in the comments section. I’m not trying to “get the best” of anybody. I’m helping you plug the holes in your theories. You’re going to need an iron clad plan if you want it to sell. Are you the ultimate judge of what has merit? Larry is free to reply to everything you or I post, I think, unless he got blocked.

That’s why you can only win with an Austrian in your own mind. You can’t ask, “Why would anyone use someone else’s gold coin as a debt instrument when they could use a piece of paper as a debt instrument?” You can’t see that the paper is only money if it represent debt.

Who is the money deployed to Ren? Isn’t the deployer going to write down the names and expect the debt that was created when the deployee purchased something with the money be extinguished before he dies? This sounds like the policy I came up with five years ago. Instead of $100k be issued by a bank at interest to one person, $10k be issued to 10 people at no interest. I wasn’t considering the implications of everyone being illumined to the simplicity of money creation.

You can’t loan someone’s savings. They’re already debt. You can use them to purchase securities that may become worthless. That’s why I included brokerages in my policy.

REN; thanks for the explanation. No doubt, the real estate bubble provides a great example of how investment banks engage in fraud. Mortgage-backed Securities (MBS or Collateralized Debt Obligations) were created by the big Wall street investment banks in 2004 and they were wildly popular with investors. And they were used as capital by investment banks to create money for their own accounts.

Companies like Bear Sterns were pledging the same mortgages into multiple MBS bundles while other brokers used foreclosed real estate and the bundles were rated A. Bad mortgages were given out, on a growing basis, to keep up with demand while providing ponzi pay-offs in the form of dividends to keep the scheme going.

In 2008, the system began collapsing which prompted TARP to stop what was becoming a domino effect that was taking down the “too big too fail” banks that perpetuated the scam. The “toxic assets” were worthless and rather than allow the system to cleanse the bad debt, the banks were bailed out.

I just don’t see how double entry accounting procedures can be blamed. Maybe I’m missing your point.

Larry, here is a thesis paper that describes the double entry mechanism. As well it shows the creation of M1 is a function of commercial banks, which in turn use the double entry ledger. Making loans against mortgages, and also commercial paper, MBS, Stocks, etc. allow a uncontrolled growth and collapse of the money supply.

As Huber says, this double entry credit mechanism expands and contracts bubbles. It makes the economy gyrate widely.

The double entry ledger is blamed because it creates credit against assets such as mortgages (causing asset inflation) and also against financial vehicles (which are leveraged). The double entry ledger when coupled with the credit mechanism is a clear danger, especially in private hands whereby the profit motive/usury is the dominant driving force.