We are in Stagflation

This article was published at henrymakow.com

Since the official start of the Credit Crunch in September 2008 a fierce debate has been raging whether we would be facing deflation or inflation. We can now establish that we will have a very toxic combination of both, known as stagflation.

Stagflation is the phenomenon of rising prices while demand in the economy falls as a result of which production tanks. It was first experienced in the late seventies and although it eventually disappeared, there was never given a satisfying explanation for it.

Proponents of both the deflation and inflation hypotheses in the aforementioned debate had strong arguments. Deflationists would say the banks were insolvent and would not be able to provide credit, leading to a diminishing money supply and declining prices. Inflationists would say Central Banking and Governmental policies of bail outs, QE1,2,x and stimulus would lead to more money in circulation, with rising prices as a result.

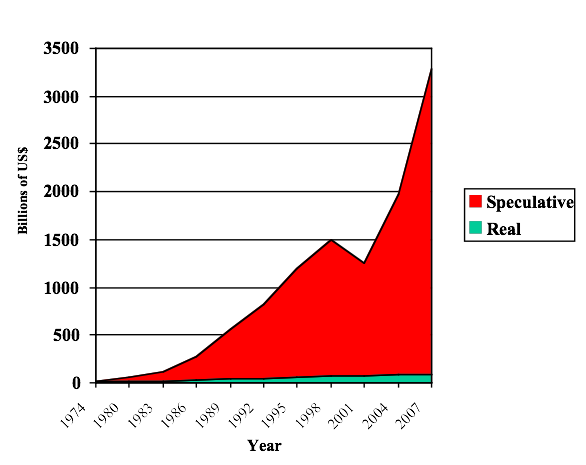

Both were right, but were missing a crucial key. This key is, that there are two economies. One is the real economy, where you and I operate. We work and make stuff. Cars, food, all sorts of services. And there is also what I would call the financial economy. This is the shadowy world of finance, FOREX, stock exchanges, commodity exchanges. The graph below shows the vast scale of this financial economy, which is many times bigger than the real economy.

Graph by Margrit Kennedy and Bernard Lietaer, based on BIS figures

Graph by Margrit Kennedy and Bernard Lietaer, based on BIS figures

What we see here is the transaction volume for the financial economy in red and the real economy in green. At this point we are talking about 5 trillion worth of transactions per day in the financial economy, many times more than in the real economy. We can also see that where the real economy grows in linear fashion, the financial economy grows exponentially. The unexpected decline we see around 2000 is explained by the introduction of the euro, which diminished FOREX speculation. A small price to pay for that giant leap towards World Currency.

It also shows that the financial sector began to exist in earnest only in the early seventies. This is explained by the rise of the computer. Most people won’t realize that even in the early sixties most wages were paid weekly…..in cash. It is the computer that made it possible for banks to connect everybody to their system. Before then, the administrative load of universally held bank accounts would have been unfeasible. It also explains why stagflation had not been around before the late seventies.

The financial and real economies to some extent interact, primarily via commodity exchanges. But it is very important that the financial economy is largely isolated. A lot of the hot money in the financial economy never reaches the real economy. Thankfully and by design, otherwise the dollar would not even have that meager 1% of the purchasing power it had in 1913. This is so, because for instance FOREX is just an eternal ping pong of transactions within the banking sector, leading to an eternal wealth transfer from the not so savvy to the usual suspects.

The above graph and the fact of two parallel economies also explains why in the last decades price rises were so much lower than the expansion of credit in that time span would suggest: a lot of the newly created money was siphoned off to the financial economy.

With this introduction of the concept of the parallel financial and real economies we can now understand what stagflation is, and why it is the inevitable outcome of the events of the last two years.

What we have is a deflation in the real economy but a massive inflation in the financial economy. What is causing stagflation is that a portion of this hot money is now entering the commodity markets, leading to semi hyperinflation in the primary sector (agriculture and mining). These rising prices there must be passed to producers in the secondary and tertiary sectors (industry and services).

An example of this process were the skyrocketing oil prices in 2009. It has been established that Goldman Sachs was using TAARP funds to drive up prices. Oil prices are not rising because of ‘Peak Oil’. There is no ‘Peak Oil’. There is only the old wine in new bags of ‘artificial scarcity’, which has been the main marketing tool of Big Oil since the days of Standard Oil. Oil prices exploded because of hot money driving it up, not because there is a lack of it.

Another example is the current rise in food prices. Or what to think of JPM cornering the copper market?

The deflation in the real economy is caused by the credit crunch, and transparently and by design exacerbated by the new Capital Reserve Requirements that were foisted upon the banking system by the Bank of International Settlements.

Corporations, especially those that are not part of the Transnational Cartels that are Big Business, are choked by lack of credit and going out of production, with rising unemployment as a result.

It is this combination, deflation in the real economy, strong inflation in the financial economy leaking out via speculation on the commodity markets that causes stagflation.

Related:

Inflation does not diminish debt and it does not destroy wealth!

Inflation? Deflation? Stagflation?

I like to describe stagflation as domestic deflation and foreign inflation. We have less money in the domestic economy circulating, and thus, wages and rents decline while prices for commodities rise. Prices for commodities rise because commodities are being demanded in international markets, many with growing money supply and growing economics, and because our money is flowing overseas because of trade deficits and interest payments, including interest payments on national debt.

but your point is also valid… the rich are richer and the poor are poorer… we have less real economy and more faux economy in financial capital markets.

Yes, I agree with this, it’s probably part of the story.

The Chinese converting their dollar holdings to more tangible stuff is also a driver.

Money should loop in an economy many times, thus allowing transactions to be consummated at lowest cost. However, our deficit spend money is usually credited to a bank account of unemployed. There it may go on as spend and it buys a good. Unemployed are unlikely to save. That purchased good could be Chinese or any number of foreign items (U.S. centric view here), since the U.S. economy is hollowed out. New money demand stimulates additional imports. The dollar then recycles back from a foreign economy into a domestic T-Bill. A debt insturment (Federal Reserve Note) returns as to buy a debt instrument (TBill), allowing ponzi growth of compounding interest.

Other deficit spend monies enter the economy and go on to pay down private bank balance sheets. The private debt to GDP ratio is 200:1, mostly due to asset inflation of housing. Delveraging by paying down private debts is creating a balance sheet recession. Flows of money to pay usury or to pay down debts have the same effect as not being available to create demand. The real economy of producers are having their money tokens siphoned away by the game.

In today’s case, new deficit spend money cycles once in the economy, and drains off to the private banking sector (FIRE sector) for deleverage, or recycles as a debt instrument. It will take a Tsunami of new money to pay off the growing debt claims in financial sector, not to mention the heavy private debts of most citizens.

The other option is to wipe out debt claims with a jubilee. Good luck with that one.

Any new money entering the economy just blows through it, not creating wealth or demand in its wake.

Sorry, private debt is 200% of GDP. So, buying down private debts is something economists overlook. They think the private banking sector nulls out to nothing. In other words, Credit Money (Bank Money) returns and becomes a net zero as it disappears into balance sheet. The negative numbers of liability meet the postive number of Credit Money. When they get together they cancel out. But, amazingly, economists don’t consider the usury, which in turn is a function of debt claims.