Stagflation explained………at last

This article was published at henrymakow.com

Since the official start of the Credit Crunch in September 2008 a fierce debate has been raging whether we would be facing deflation or inflation. We can now establish that we will have a very toxic combination of both, known as stagflation.

Stagflation is the phenomenon of rising prices while demand in the economy falls as a result of which production tanks. It was first experienced in the late seventies and although it eventually disappeared, there was never given a satisfying explanation for it.

Proponents of both the deflation and inflation hypotheses in the aforementioned debate had strong arguments. Deflationists would say the banks were insolvent and would not be able to provide credit, leading to a diminishing money supply and declining prices. Inflationists would say Central Banking and Governmental policies of bail outs, QE1,2,x and stimulus would lead to more money in circulation, with rising prices as a result.

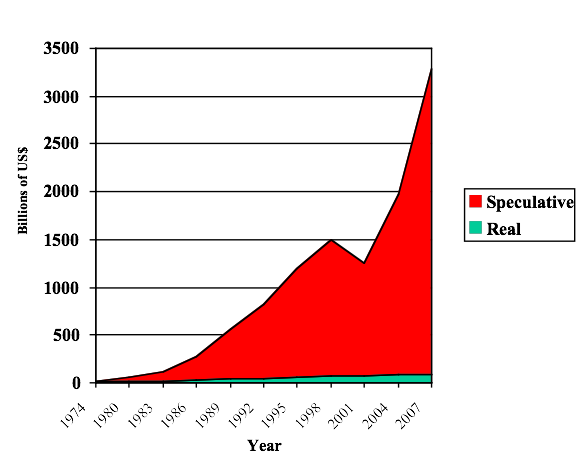

Both were right, but were missing a crucial key. This key is, that there are two economies. One is the real economy, where you and I operate. We work and make stuff. Cars, food, all sorts of services. And there is also what I would call the financial economy. This is the shadowy world of finance, FOREX, stock exchanges, commodity exchanges. The graph below shows the vast scale of this financial economy, which is many times bigger than the real economy.

Graph by Margrit Kennedy and Bernard Lietaer, based on BIS figures

Graph by Margrit Kennedy and Bernard Lietaer, based on BIS figures

What we see here is the transaction volume for the financial economy in red and the real economy in green. At this point we are talking about 5 trillion worth of transactions per day in the financial economy, many times more than in the real economy. We can also see that where the real economy grows in linear fashion, the financial economy grows exponentially. The unexpected decline we see around 2000 is explained by the introduction of the euro, which diminished FOREX speculation. A small price to pay for that giant leap towards World Currency.

It also shows that the financial sector began to exist in earnest only in the early seventies. This is explained by the rise of the computer. Most people won’t realize that even in the early sixties most wages were paid weekly…..in cash. It is the computer that made it possible for banks to connect everybody to their system. Before then, the administrative load of universally held bank accounts would have been unfeasible. It also explains why stagflation had not been around before the late seventies.

The financial and real economies to some extent interact, primarily via commodity exchanges. But it is very important that the financial economy is largely isolated. A lot of the hot money in the financial economy never reaches the real economy. Thankfully and by design, otherwise the dollar would not even have that meager 1% of the purchasing power it had in 1913. This is so, because for instance FOREX is just an eternal ping pong of transactions within the banking sector, leading to an eternal wealth transfer from the not so savvy to the usual suspects.

The above graph and the fact of two parallel economies also explains why in the last decades price rises were so much lower than the expansion of credit in that time span would suggest: a lot of the newly created money was siphoned off to the financial economy.

With this introduction of the concept of the parallel financial and real economies we can now understand what stagflation is, and why it is the inevitable outcome of the events of the last two years.

What we have is a deflation in the real economy but a massive inflation in the financial economy. What is causing stagflation is that a portion of this hot money is now entering the commodity markets, leading to semi hyperinflation in the primary sector (agriculture and mining). These rising prices there must be passed to producers in the secondary and tertiary sectors (industry and services).

An example of this process were the skyrocketing oil prices in 2009. It has been established that Goldman Sachs was using TAARP funds to drive up prices. Oil prices are not rising because of ‘Peak Oil’. There is no ‘Peak Oil’. There is only the old wine in new bags of ‘artificial scarcity’, which has been the main marketing tool of Big Oil since the days of Standard Oil. Oil prices exploded because of hot money driving it up, not because there is a lack of it.

Another example is the current rise in food prices. Or what to think of JPM cornering the copper market?

The deflation in the real economy is caused by the credit crunch, and transparently and by design exacerbated by the new Capital Reserve Requirements that were foisted upon the banking system by the Bank of International Settlements.

Corporations, especially those that are not part of the Transnational Cartels that are Big Business, are choked by lack of credit and going out of production, with rising unemployment as a result.

It is this combination, deflation in the real economy, strong inflation in the financial economy leaking out via speculation on the commodity markets that causes stagflation.

I would like to express my appreciation for Dick Eastman’s courageous and groundbreaking thoughts on the parallel economies and its implications.

Governments know that this is “Private Interest” destroying our economies, cultures and homelands. Both have to be involved in this shake down of the general global populations by a private cabal to bring us completely under their control. If this continues there will be a great uprising not just on the national level, but also within the international global economies who will oppose this move, by this small minority, on a global level.

Pathological illnesses is what drives them. They are planning prolong uprisings and death for the sole purpose to rule and control over everything. I recommend a re-reading of the ancient Greek wisdom tale of King Mitas and his obsession with “Gold”. He ended up killing everything he realized he loved.

They will treat us like the third world nation states that the internationalist have been planning since the takeover of the U.S. Federal Reserve System in 1913, and who were responsible for the First and Second World Wars, and against independent nations. Yet, their first major attempt, in the US, was Rothschild’s financing of the British in the Colonial Wars and again with the Southern States during the Civil War.

The Commercial powers are opposed to legitimate political rule and man’s inherited rights to be left to man’s own decisions. Again, their preoccupation with thief, murder and power, will do them in.

The “Chosen” and their minions have been identified as the enemy. Surely, it is obvious to those who are familiar with real history. This is serious “business”.

I listened to the first part of George Norey’s (Not sure of the last name.) radio broadcast last evening (Jan 25). He had two guests: one argued for the real econonmy and the inflation to come, while the other for the financial economy and for possibly deflation, but certainly not inflation. It was fascinating. There is definitely a philosophical divide when it comes to our current US economy, especially when two intellegent men cannot agree. The guest supporting the deflationary position stated that the US economy is growing because the stock market is growing. Your wonderful article certainly goes a long way to explain why he would take that position. Thanks so much.

echo (repetition) nomoi (rule of men) is just that and your graph shows it pretty well.

The blue area would be actual goods exchanged (end-user to end-user), the red one the number of exchange of currencies.

It all comes down to a basic mathematical property. Goods are commodities, currencies are relations. When you have 1 person, you have no relation; 2 persons, 1 relation; 3 persons, 3 relations;… n persons, (n²-n)/2 relations. You would have 10 persons, the 10 goods could be exchanged 45 times and would count on their accounting sheets as 45. And the more persons you add in the system, the crazier it gets

Excellent article! We are in inflation and deflation at the same time, I believe that deflation will eventually win and I’ll tell you why. The inflation part of the equation is artificial, the Fed has lowered rates to near zero, the banks are borrowing this “free” money and driving up commodity prices. Another bubble is in the making, it is artificial, and it will eventually pop. When it does strong deflation will be upon us.

In my essays I argue that deflation is good, it gets people to save and kills speculation. The Fed is run by predatory Jew banks, they want inflation for with inflation they can speculate and strip the populace of wealth. The Jewish owned banking system is not interested in stability, they are stripping all of the wealth from the (former) huge industrial economy. This is part of their religious plan to dominate the earth and all peoples.

They are doing everything to prop us their predatory system, bailing out the predatory banks at a cost of 30 trillion, writing swaps between each other at a cost of 2,000 trillion, buying up commodity contracts and rolling them forward creating a huge bubble in all commodities, the cost is gold at $1,400.

At every turn, their manipulation requires more draconian control and it only makes sense that in the end they will lose control during the revolution which is inevitable because they are making everyone extremely poor in the process. Interest rates are at depression levels, housing inventory accumulates, home prices are at 50% from 3 years ago and the people have no “money” to buy these steeply discounted homes because they are unwilling to borrow or the banks are unwilling to lend. So if you can’t get credit what is a house worth? Far less.

In the meantime we are all force to pay $3 for a loaf of bread because the cost of wheat and energy is artificial high, and whatever money we do scrounge is taken away by these high prices. Many people I know are digging for loose change just to buy gasoline. There are hundreds of thousands of full size pickups “parked” because the owner can’t afford the fuel.

So what is going to happen to cause “hyper” deflation? A random out of the blue event or series of events that trips up the derivative market, or stock market, or commodity market, or civil unrest, state muni default, or something happening to the IRS/FED, or confidence in the system, or foreign lenders fleeing Treasuries. In other words a sudden reversal in the fractal financial system, we are heading toward a sudden chaos point where all of the current unsustainable trends suddenly end.

My blogs and essays on credit, money, deflation:

http://theconfidencegame.blogspot.com/

http://usacreditdefault.blogspot.com/

http://deflationgood.blogspot.com/

HI Phishna,

Sorry, your comment was spammed, I only just noticed it. It’s funny, just the other day I noticed your work, now you have commented here.

Deflation is a major problem, it’s even worse than inflation. Inflation is bad for savers, but savers would not hoard cash, but invest in real assets, they would be fine. Deflation hinders the flow of money, leading to economic stagnation. Also, it favors creditors, as it increases the value of debt and the interest payed over it. The Banking Fraternity always loved deflation, which is why they like Gold even better than their paper printing presses. Gold as currency is closely linked to deflation, as yearly Gold production is not sufficient to allow for the extra liquidity needed to finance economic growth as a result of population growth and technological progress.

There is no need to stimulate saving. In a rational monetary system, saving is superfluous. Saving also hinders the flow of currency. Money is a means of exchange, not a store of value! There are better ways to maintain wealth for future consumption. See http://realcurrencies.wordpress.com/2010/11/03/on-inflation-saving-and-the-nature-of-money/ for a more in depth analysis.

Also I’d like to point out it is not debt, but the interest payed over debt, that is the problem. Money created in the form of interest free credit would make saving superfluous, would not exploit debtors (but would offer them the liquidity they need, but not yet have) and would be based on debt.

Nice to see you promote independent currency as a means of liberation. Spot on!

Thank you for another great article. A child will be able to understand the prob. if it’s explained this way , but clearly not our elected government.

I remember a Dutch economist by the name of Hank Monroby ( not sure about spelling of the name ) who wrote letters to several Dutch prime ministers about the subject. Wonder if he’s still around.

I lost the bookmarks to his site….i’ll do some searching, it might interest you.

Ed.

Thanks Ed!

I’m well aware of Hank Monrobey, we used to work together some time back and he taught me a great deal. His system, which he is still operating at the tender age of 86, is CMN International.

Ah, good. So you know him.

About 4 years ago i read some pieces he wrote that started my education on the matter of financial truth.

I just read his recent correspondence with our PM. He’s just ignored so…no salvation for the Dutch sheeple any time soon.

Hank Monrobey, 86 and still kicking….

Gotto love and respect that man.

An excellent and thought provoking article, Mr Migchels.

I derive more than a slight pleasure from finding articles like this as it gives me the chance to articulate some of my own thoughts by offering the explanation that just like there is a ‘shadow’ government controlling the visible government, there is a ‘shadow’ financial system that exerts control over our economic fortunes as well.

I agree that the ‘hot’ money you mention must not be allowed to circulate freely in the real economy as it would destroy it almost immediately by hyperinflation. However, the research I have made over the years would tend to indicate these two ‘shadows’ are joined at the hip and the effect of this combination on society is intrinsic to the predicament we find ourselves in today. This is because the ‘speculators’ are able to control the deliberate, limited ‘interaction’ of this ‘hot’ money into the real economy in the form of asset stripping of real businesses and installing other financial instruments of mass destruction through government mandate, etc.

Articles like this also remind me that money should not be valued in it’s self but merely used as a convenient medium of exchange to procure goods and services in a ‘common market’ so people can live in harmony and prosper.

I’ve been aware for some time that the ‘speculative’ economy uses money as a commodity in which the financial speculators have incorporated a notional value and the power to manipulate that value at will by using the derivatives markets and hedge funds. All made possible by a sophisticated and complicated mathematics combined with the enormous computing power at the disposal of these financial ‘speculators’ at the internationalist institutions they represent. All computing away since well before the internet existed.

How any one person can describe and quantify such a system in order to de-construct it would be a difficult and onerous task, but I’m hopeful because people are engaged, none the less, in the attempt.

I can see how this convergence of information technology, computer science, and financial services has enabled a ‘cross-over’ into the ‘real’ economy and how easily the ‘real common market’ that I am engaged in is affected (and now largely controlled) by the ‘speculative’ market, and yet the reverse does not seem to be happening.

I think the plight of self-funded retirees and their superannuation funds are an acutely relevant example.

It occurs to me that although the ‘real’ economy is the foundation/progenitor of the ‘speculative’ economy. In other words, without the ‘real’ economy the ‘speculative’ economy wouldn’t exist to derive it’s wealth from, and then cycled back through to generate more wealth from the ‘real’ economy. Yet the internationalist ‘speculators’ are in the process of looting and destroying the very economies that they piggy-backed onto to scam their wealth in the first place and that they need to survive.

WTF! Talk about bite the hand that feeds you!

Maybe their AI super-computers have calculated they don’t need us any more now they have self-replicating machines and the artificial intelligence to run them. The elite don’t need us as we were with inventive intelligence, or in our present numbers, at any rate. Now our future is as drones to service the machines and elite. We have been made obsolete by the technology we helped invent and implement.

IMO that’s because it was set up that way by the devious minds who thought along these lines in the first place.

However, I see that this is not a ‘brilliant’ financial scheme set up by certain powerful interests to make enormous wealth possible for the fortunate few but a rather insane and soon to be outed ‘Luciferian’ thought structure that posits wouldn’t it be great if we (the self-appointed elite) could create a system of control so absolute that we could rule the lives of others as Gods. Secure for a thousand years or more…..Heard that one before. Well this time they want to do it with a combination of debt, interest rates, war, radiation, oppression of civil liberties, geo-engineering, mind control (manufactured consent) through media manipulation, (and pharmaceutical control for those who don’t take the programming), dismantling the nation-state, imposition of a martial society, austerity, and last but not least, criminalising dissent. Sheesh!

It look like you’ve got a pretty firm grasp of what is going on Mr. Edwards!

I’d be interested to hear how you feel the situation should be addressed?

Anthony

Hmmmmmm…. Use cash where ever you can. Pay down credit liabilities. Stop spending money on frivolous consumer items. Don’t buy houses at inflated prises. Support small businesses in your area. This will not stop the overwhelming debt that is still building no matter what you or I do, however, governments and central banks have a habit of doing WHATEVER it takes to survive. I would hazard the guess that in the end the governments and banks will forgive each others debts to a large degree and the world will stumble on once more. (the only other option would be war at home, I suspect) But YOU and I will NOT be forgiven our debts to the government (taxes and charges) or banks (loans at interests + account keeping charges). This is all I can offer at the moment and it only applies to people in a position similar to my own. What most of the worlds population who have no money, no job, possibly live in a war

zone, or an area with inadequate to non-existent infrastructure do, well that would require the dismantling of the MIC and the outbreak of peace that may enable some negotiated settlements and a redistribution of wealth.

But these things are not up to me and I have no authority to impose them so the point is mute.

My experience of the psychology of the moneyed classes suggests that they will resist any move that will significantly thin their ranks. Fear as a motivator has a refined focus in these groups and is used much more effectively than amongst the rest of us. Control is an insidious constant that has been inculcated from an early age. Because of these factors and others it becomes apparent that these people will accept nothing less than a ‘miracle worker’ to solve their problems. In other words, they are not able to act even in order to ensure their own survival, or so it seems.

Much like the rest of us. The difference being that the system is all a lot of them have, so to think of it as less than perfect is not an option.

Institutionalised conflict of interest is fundamental to the continuing of the present system and 9/11 happened exactly as the government says it did to these people. They close their ears and switch off to any contrary evidence or arguments.

Can’t say I have even an inkling of how to deal with all that, Anthony!

Cheers.

Hi I am a house wife with 4 kids and was wondering if you have any advice or pointers or just something to share for a young family with kids, I found you from abledanger.net reading about c.h. douglas witch I found out about from brother nathanael @realjewnews.com thank you for showing that graph my husband talked about speculator wealth but that explained it to me very well and explains how in this world there could be so many $80millon dollar(and up) mansions everywhere I go I am so sad to see this thank you -marina