Austrian Economics, Apostles of Austerity Defending Deflation

“In a word, knowing by the experience of many centuries that people live and are guided by ideas, that these ideas are imbibed by people only by the aid of education provided with equal success for all ages of growth, but of course by varying methods, we shall swallow up and confiscate to our own use the last

scintilla of independence of thought, which we have for long past been directing towards subjects and ideas useful for us.”

Protocol Nr. 16

“The Power of Ideas will prevail!”

Ron Paul

Intellectual dishonesty is the hallmark of the leadership of Austrian Economics. Nowhere is this more palpable than with their disingenuous, dishonest and destructive defense of deflation. Now that we are facing the greatest deflationary bust since the Great Depression, with the worst still to come, Austrian Economics rises as the main defender of the Money Power’s onslaught.

Time to dispel their lies and misrepresentations concerning deflation point by point.

One of the key weaknesses of Austrian Economics as a philosophy/pseudo science is its reliance on deductionism. However, while this may be a weakness in terms of truth-seeking, it is major asset in terms of its real purpose: mind controlling the masses, wearying of Keynesian gatekeeping. With fuzzy ‘logic’, which by its nature suffers from the bullshit in, bullshit out dilemma, it is easy to obscure the obvious. Mind Controllers are fully aware that the brutish Goyim mind is not interested in facts and careful observation. It is interested in the power of ideas. And when one idea fades in the face of practice, it easy to conjure up a new one to keep the antfarm busy.

Harsh words? Extensive experience in debating Austrian Economists have shown time and again that they are absolutely not interested in promoting learning. They are interested in promoting their case. A case, as Real Currencies and others have documented extensively, the Money Power created out of nothing solely for its own purposes.

Considering the fact that defending deflation amounts to nothing less than defending the Money Power’s obvious attempts to create an uprecedentedly severe world wide depression, there is every reason to reject their inane ‘theories’ vociferously.

The more so, because history clearly shows that depressions like these are used by our self declared masters to soften up resistance against large scale ritual murder, also known as World War.

So scolding Austrian Economics and its leaders does not imply disdaining the many people who have found the courage and the independence of thought to reject the obvious failures of Mainstream Economics. They are the seekers, inadvertently walking into the trap that the Money Power prepared for them with great effort and discipline.

Let’s hope that debunking Austrianism helps them to seek further and others to avoid falling for it altogether!

So what again is deflation? There are two definitions: a contracting money supply and declining prices.

The first definition is the classical one and best. Declining prices often are a result of a contracting money supply, but not per definition.

The real issue is the contracting money supply itself, which is associated with busts. Every major recession or depression in recorded history was associated with a contracting money supply.

And yes: Austrian Economists try desperately to obfuscate this fact, as we will see.

What the Austrians ignore and don’t want you to know

1. Reality

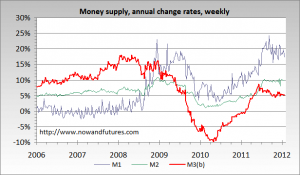

Of course! It’s the power of an idea, it has little do with facts based in real life. Just imagine: defending deflation in the face of the destruction in Greece, where the money supply is contracting at a rate of 10% per year and the economy with a whopping 7%. And while Greece is probably the worst case for the time being, it’s happening all over the West, including in the US itself. Real unemployment in the US is at 20%. Why? Because the money supply is tanking:

This is the simple truth, but all the Austrian Economists and Gold Dealers parading as the ‘alternative media’ have been scaring us to death with their hyperinflation fearmongering.

So this is the reality of deflation. Defending it means defending Greece. Few would do that, if they realized what they were actually doing.

2. During deflation, the value of debts increase in real terms.

Does that sound like a good idea when the whole planet is swamped in debt? Of course, the problem is compounded by the fact that interest payments also rise in real terms.

Debtors are the great majority of the population. Creditors the small minority. Austrianism is famous for defending the rights of creditors and capital in general. This shows in their defense of deflation also. Only the rich benefit from deflation.

Their outright lies

1. Deflation is declining prices. Great, right?

This is a lie, not because this definition is not fairly widely used, but because Austrian Economists define inflation as a growing money supply. So this is a clear ‘inconsistency’, but just a little too comfortable for them not to be considered an outright lie.

Often those mentioning this will say: prices decline because of technology. Rothbard was famous for this nonsense. Sure they sometimes decline because of technology. For instance cell phones and computers. But that has nothing to do with deflation in the real sense of the word and Austrian Economists know it. How do I know they do? Because they continue this nonsense, even when corrected.

2. Depressions are not associated with deflation

This is so incredibly stupid it hardly is worthwhile mentioning it, but it is a good example of how far these people actually go in hiding the obvious. Not only does it fly in the face of what has been common knowledge for ever, most certainly in the United States, their proof is most telling. They offer this study….by the Federal Reserve.

Now consider this: they made a name for themselves by exposing the Fed’s and Mainstream (Keynesian) Economics’s downplaying of inflation and the associated manipulation of volume, and then, when it comes to deflation, they use a study by the Fed ‘proving’ there is ‘hardly a relation between deflation and depression/recession’.

3. Their ‘misunderstanding’ of the business cycle

Yes, Austrian Economics is wrong about the business cycle, their main pride. Their heroes Mises and von Hayek noted that busts usually were preceded by booms. Booms caused by ‘too lax’ credit by the banks. This results in overinvestment, or ‘malinvestment’ after which a corrective bust is unavoidable.

In this way Austrianism actually makes people call for the bust to happen as soon as possible: the longer it is postponed, they say, the worse it will get. This is not entirely untrue, but considering the easy way deflation can be managed, it amounts to having people call for their own destruction unnecessarily.

Also, with this explanation they igore the fact that an interest bearing money supply MUST grow, to finance ever higher interest costs to society, fueled by the growing money supply itself. Or, as with a Gold Standard, face structural depression, due to ever smaller money left for real trade because the money supply cannot grow.

This is the famous P + I > P formula as put forward by Mike Montagne, where P is Principal and I is interest. It explains why money is always scarce when taxed with interest.

Worse still: despite this inherent flaw of interest on the money supply, the real problem is that the Banking Fraternity manipulates the volume willingly and knowingly. The Boom/Bust cycle as we know it is a completely artificial phenomenon, that would even occur, would the Money Power stop charging interest. The point is that during a deflation they are the only ones with cash, enabling them to buy everything up that the populace at large is selling at fire sale prices in a desperate attempt to get out of debt.

By hiding this fact, just like Mainstream Economics does, Austrian Economics just exposes itself as controlled opposition.

Conclusion

In the face of the horrible destruction that the Money Power is visiting on the entire world with its ‘credit crunch’, its valiant knights known as Austrian Economists keep the gates against the real opposition clamoring for reflation.

Reflation of the economy, not by handing over trillions to busted banks, but by an interest strike or even just handing out interest free credit or debt free money to the population (which is Social Credit) would easily solve the depression overnight.

But that would be ‘inflation’. With fiat money! Statist violence! Oh horror of horrors! That would certainly rob the rich of the CHOICE, LIBERTY and FREEDOM to choke us by withholding credit! How dare we!

Related:

Why Gold is so strongly deflationary

The Inflation vs. Deflation Dialectic

What a buttload of pathetic misinformed malarky, WADR Anthony.

Are YOU on the banksters side or WHAT????

AUSTRIANS AREN’T, never have been and never will be. They DETEST the banksters and their impoverishing fiat from thin air PLUS interest.

Deflation IS GOOD.

Dont you know we ALL want lower vs HIGHER prices? Since lowering prices = rising stds of living.

In Defense of Deflation

Mises Daily: Tuesday, August 10, 2010 by Doug French

The Obama stimulus and bailouts haven’t decreased unemployment rates or bankruptcy filings while home prices and home sales have fallen and can’t get up. PIMCO’s Bill Gross told Bloomberg this can all be fixed with nearly zero interest rates and additional debt to stimulate the animal spirits of investors and entrepreneurs. The federal-funds rate has been pegged at 0 to .25% since December 16, 2008, and Uncle Sam’s debt is $13.3 trillion and counting. If this hasn’t goosed the animal spirits, what will?

The failure of central bankers to make things all better again by creating some money and lowering some interest rates has the financial press fretting about deflation and thinking the US economy is turning Japanese. James Bullard, who heads the Federal Reserve Bank of St. Louis, came out with a paper entitled “Seven Faces of ‘The Peril’.” He concludes that the Federal Open Market Committee’s (FOMC’s) “extended period language may be increasing the probability of a Japanese-style outcome for the U.S.” To avoid that outcome, Bullard argues that the Fed’s most important tool is quantitative easing — printing money to buy government debt.

The Wall Street Journal’s James B. Stewart claims deflation is bad because “deflation erodes profits and asset values,” in his “Smartmoney” column.

People wait to buy expecting lower prices, reducing demand. Lower profits cause companies to cut expenses, including employees. It is a downward spiral that, if Japan’s experience is any indication, is difficult to arrest.

Mr. Stewart is wrong on all counts. Profits are the difference between the price we sell a good for and the price it costs to produce that good. As Jörg Guido Hülsmann makes clear in his book Deflation & Liberty, “In a deflation, both sets of prices drop, and as a consequence for-profit production can go on.”

And while asset values may drop, the assets don’t go away. The real wealth of the nation — assets used for production — are still available to produce. However, it may be that because the debt is liquidated on those assets as prices fall, new owners will own and operate the assets, but commerce and production will certainly carry on.

Lower prices increase demand; they do not reduce or delay it. That’s why more and more people own flat-screen TVs, cellular telephones, and laptop computers: the prices of these goods have fallen, and people with lower incomes can afford them. And there are more low-income people than high-income people.

Lower prices don’t mean lower profits; nor do they mean that employees will be laid off. More demand for a good or service means more employees needed to produce those goods and services. “There is no reason why inflation should ever reduce rather than increase unemployment,” Hülsmann writes.

People become unemployed or remain unemployed when they do not wish to work, or if they are forcibly prevented from working for the wage rate an employer is willing to pay. Inflation does not change this fact.

Hülsmann goes on to point out that only if workers underestimate the amount of money created by the central bank and therefore reduce their real wage-rate demands will unemployment be reduced. “All plans to reduce unemployment through inflation therefore boil down to fooling the workers — a childish strategy, to say the least.”

Of course, Mr. Bullard over at the St. Louis Fed doesn’t mention anything in his paper about individuals attaining their goals through subjective knowledge and pricing decisions. Instead he draws lots of lines on graphs and talks about Taylor-type policy rule, zero bound, the Fisher relation, “targeted” steady states, and lots of stuff that has nothing to do with economics.

So while the bond-buying Mr. Gross says zero rates will arouse the animal spirits in all of us, Mr. Bullard worries that “promising to remain at zero for a long time is a double-edged sword.” Bullard writes that zero rates are “consistent with the idea that inflation and inflation expectations should rise in response to [that] promise.” But in the same paragraph he continues,

But the policy is also consistent with the idea that inflation and inflation expectations will instead fall, and that the economy will settle in the neighborhood of the unintended steady state, as Japan has in recent years.

Wow, no wonder Keynesian central banking is so hard. You’re damned if you cut rates and damned if you don’t. “I moved the line on the graph. Let’s see some animal spirits for crying out loud!”

In the real world, banks aren’t lending because, as Murray Rothbard points out in America’s Great Depression, if rates are too low, bankers have no incentive to lend, especially in a risky economic environment. Also, as Professor Jeffrey Herbener wrote in the Asian Wall Street Journal, “with distressed banks, reflation fails to induce another bank credit expansion.”

Keynesians have mistaken the impotency of the Bank of Japan to restart credit expansion in the 1990s as a liquidity trap. But the problem is not that interest rates are so low everyone expects them to rise and therefore hoards cash. Banks refuse to lend because of the overhang of bad debt. Any cash infusion is held as reserve against it. Businesses refuse to borrow because of their debt burden, built up to expand capacity during the boom, and their over-capacity resulting from their malinvestments.

Japan has tried every stimulus trick in the book — in addition to holding rates at zero — and still its economy has been in a funk for two decades. But firing a worker in Japan is virtually forbidden and don’t get the idea that consumer prices have fallen through the floor. According to the International Monetary Fund (IMF), last year saw the biggest drop in consumer prices at 1.13%, after prices rose 1.4% the year before. The chart of Japan’s inflation rate is essentially flat. Not exactly the deadly deflationary spiral it’s made out to be.

Hülsmann explains that the Japanese government hasn’t allowed deflation to heal their economy, with “the only result of this policy [being] to give a zombie life to the hopelessly bureaucratic and bankrupt conglomerates that control Japanese industry, banking and politics.”

As for Bullard’s quantitative-easing (QE) idea, the Bank of Japan has done plenty of it, buying not only government bonds but corporate debt and stocks as well. Bullard’s colleagues over at the San Francisco Fed have studied whether it worked. In a 2006 report, Vice President Mark M. Spiegel wrote that QE lowered long-term interest rates and “there appears to be evidence that the program aided weaker Japanese banks and generally encouraged greater risk-tolerance in the Japanese financial system.”

Spiegel concluded, “In strengthening the performance of the weakest Japanese banks, quantitative easing may have had the undesired impact of delaying structural reform.”

“Deflation is one of the great scarecrows of present day economic policy and monetary policy in particular,” Hülsmann told his Economics of Deflation class at this year’s Mises University. It seems a nation will destroy its finances battling the nonthreat. The Organization for Economic Cooperation and Development (OECD) says the Bank of Japan “needs to keep interest rates close to zero and continue its asset-purchase program until there is a ‘definitive’ end to deflation,” Bloomberg reports. But in the same report the OECD worried that the Bank of Japan’s ability to stimulate would be curtailed by Japan’s public-debt-to-GDP ratio approaching 200%.

Sounds like the folks at the OECD, like Mr. Bullard, can’t make up their minds. What Austrians know for sure is that, as Professor Hülsmann makes clear, “the dangers of deflation are chimerical, but its charms are very real.” Inflation, on the other hand, only helps those who are massively indebted and inefficient — governments.

http://mises.org/daily/4623

This is the problem Marxbites:

Winston Churchill, who was involved in the reinstatement of the Gold Standard in Britain in the twenties testified to the House of Commons in 1935, when the deflation of the Great Depression had made Gold untenable:

“Look at the enormously increased volume of commodities which have to be created in order to pay off the same mortgage debt or loan. Minor fluctuation might well be ignored, but I say quite seriously that this monetary convulsion has now reached a pitch where I am persuaded that the producers of new wealth will not tolerate indefinitely so hideous an oppression. . . . I therefore point to this evil, and to the search for the method’s of remedying it as the first, second and third of all the problems which should command and rivet our thoughts.”

I also responded with another comment, you can find it higher up. And I have another one for you.

Winney was FULLY a Rothschild puppet, or didn’t YOU know that?

The LARGEST cause of the GD was the 20’s monetary expansion Benny Strong wrought upon us so the stinkin Brits COULD go back on gold at the pre-war pre-inflationary exch rate.

Churchill, FDR, Stalin & Mussolini were merely a regular mutual admiration society of like-minded dictators. In fact Hitler made the cover of Time in the early 30’s.

Funny how the anti-bankster Hitler was also actually their own puppet to boot. But then, thats how shylock ALWAYS rolls.

“If my sons did not want wars there wouldn’t be any”

Guess who?

GOLD NEVER failed anybody ever, only banksters seeking REAL WEALTH in exchange for worthless fiat is what always queered the system. The 1800’s included when Govt serially allowed shylock the special privileges of even stopping depositor redemptions of bank notes for specie.

Of course I know ‘Winney’ was a Rothschild Puppet and Jewish to boot.

And of course a depression is usually preceded by easy money. That’s how the Money Power works.

The point is: they create the boom/bust cycle. On purpose.

Gold failed everybody all of the time, except the inventors of Austrian Economics: the bankers, who have owned all the gold for as long as people can remember.

WRONG, the Banksters are WHO didn’t follow the rules per usual. They issued MORE paper than specie in reserves creating inflation when we were SUPPOSED to be on a 100% backing.

They CHEATED, however GOLD NEVER FAILED ANYONE, the Banksters DID.

You just NEVER actually really read any Rothbard but for his critics have you?

You are pre-conditioned, as I used to be myself.

Austrian economistss are the globes almost sole anti-statists among economists.

Who cares if they, some 70 yrs ago, took money from Rockefeller? Doesn’t mean they haven’t rightly excoriated them as the criminals they fully deserve the moniker of.

IN fact very few schools of economics are as completely critical of TPTB as are the Austrians.

Read Rothbards Wall Street, Banks and American Foreign Policy.

http://www.lewrockwell.com/rothbard/rothbard66.html

I DARE you to show ANY proof that Austrians EVER supported the shylocks much less the corporate state now fully under their control..

It NEVER happened Anthony.

Well, I certainly offered a great deal of proof that the shylocks offered the Austrians a great deal of help. And not 70 years ago, but up to today. Just check How the Money Power Spawns Libertarians I also showed why: because they support usury, deflation and Gold, while blaming the state for everything and ignoring money power.

Pure BALDERDASH Anthony.

The Austrians are non-stop critics of the evil money powers my friend.

Rothbard spent his entire career sussing out that very nexus between the monied elites and the brutal subhuman policies of empire.

“This is the classic Austrian case against Fractional Reserve Banking.

Let’s bury it forever.

Consider this: what do you think the Money Power cares whether it gets $150,000 interest over a $100k mortgage in Gold or in Paper?

My hunch is they would like to see us sweat for Gold even more than for Paper. They have been worshiping the Golden Calf ever since the days of Moses, after all. Yes, this is a very old story. So it is perhaps not so surprising that our favorite Libertarian has such an outright Old Testamental world view.

Gary North is trying to make us believe that the choice at hand is to pay our Masters in Gold or in Paper.

But the real question is:

Would you prefer to pay $150,000 interest on your mortgage in Gold, or pay no interest at all?”

More pure bunk.

Under free banking with 100% reserves, the levels of depositor savings is what governs the interest rate, historically when unfettered by statists, usually runs 2-3% MAX, where more savings = lower rates, and visa versa.

Money evolved organically as commodities from shells to salt, to Au & Ag finally, and NOT by some rulers dictat.

could you please give me a source for the 2-3%?

Thanks for reading the article.

IIRC it was in Charles Adams great series on the history of taxation here: well worth anyone’s listen, at the bottom. All the rest are great too. He’s a tax accountant and great tax historian.

I also think its where I got the figure that the serfs never paid more tribute than 5-8% total or they just took off for greener pastures.

http://mises.org/media/author/600/Charles-Adams?action=category&ID=-1

Oh man, it’s really all there, isn’t it.

‘Wonderful, tv’s get cheaper, now the poor can buy one’.

Like I said: that’s not deflation, that’s prices going down due to tech. Typical Austrian lie.

Nowhere is it mentioned in the article the debts appreciate in real terms. Destroying the extra purchasing power due to declining prices.

This one is also nice:

“And while asset values may drop, the assets don’t go away. The real wealth of the nation — assets used for production — are still available to produce. However, it may be that because the debt is liquidated on those assets as prices fall, new owners will own and operate the assets, but commerce and production will certainly carry on.”

Yes. New owners. And who do you think these new owners will be? The Poor?

Can More Inflation Revive the US Economy?

The fall in the headline consumer price index (CPI) in April for the second consecutive month has raised concern that the US economy might have fallen into a deflationary black hole. Year on year, the CPI fell by 0.7% in April after declining by 0.4% in the month before. For most experts, the emergence of deflation poses a serious threat to the economy. It is held that a fall in prices causes consumers to postpone their expenditure. Furthermore, deflation also raises real interest rates and the debt burden, thereby depressing further the overall demand for goods and services, so it is argued. After falling to negative 3.6% in July 2008, the real federal funds rate has been in an uptrend, climbing to positive 0.9% in April this year.

So how does one counter deflation? Some economists propose policies to promote a higher rate of inflation.

According to Harvard professors of economics Gregory Mankiw and Kenneth Rogoff, a higher rate of inflation will set the platform for a decline in real interest rates and for an increase in current consumer expenditure. Additionally a higher rate of inflation will work towards the reduction of the debt burden. This, they contend, will provide a necessary boost to economic activity.

So what is the level of inflation required to pull the economy from a deflationary black hole? Some experts, such as Rogoff, hold that 6 percent is the right figure:

I’m advocating 6 percent inflation for at least a couple of years. It would ameliorate the debt bomb and help us work through the deleveraging process.

So it seems that in the current economic setup a little bit of inflation is the correct remedy for the economy.

But how can something normally regarded as bad news — something that destroys the economy — at the same time promote economic health? Our Harvard professors don’t try to provide an answer to this question. All that matters for them is that a higher rate of inflation is going to revive consumer outlays, which they hold is going to strengthen the economy.

Are Increases in the Consumer Price Index What Inflation Is All About?

The main problem with this way of thinking is the definition of inflation. Most economists hold that inflation is a general rise in prices that can be captured by the consumer price index, but they disagree about the causes of inflation. In one camp are the monetarists, who argue that changes in money supply cause changes in the CPI. In the other camp, we have economists who argue that inflation is caused by various real factors. These economists have doubts about the proposition that changes in money supply cause changes in the CPI. They believe that it is likely to be the other way around.

We suggest that inflation is not rises in prices as such but the debasement of money.

Historically, inflation originated when a ruler would force the citizens to give him all the gold coins under the pretext that a new gold coin was going to replace the old one. In the process, the king would falsify the content of the gold coins by mixing it with some other metal and return to the citizens diluted gold coins.

The ruler can now use the stolen gold and mint coins for his own use. What was now passing as a pure gold coin was in fact a diluted gold coin. The expansion in the diluted coins that masquerade as pure gold coins is what inflation is all about. As a result of inflation, the ruler could engage in an exchange of nothing for something. (He could now divert real resources to himself).

Under the gold standard, the technique of abusing the medium of the exchange became much more advanced through the issuance of paper money unbacked by gold. Inflation therefore means here an increase in the amount of paper receipts that are not backed by gold yet masquerade as true representatives of money proper, gold. Again, the holder of unbacked money engages in an exchange of nothing for something.

In the modern world, the money proper is no longer gold but rather paper money; hence inflation in this case is purely the increase in the stock of paper money. Please note: we don’t say that inflation is about general increases in prices. Also note that we don’t say that the increase in the money supply causes inflation. What we are saying is that inflation is the increase in the money supply.

Once it is realized that inflation is about increases in the money supply, it becomes clear why it is bad news. When money increases, there are always first recipients of money who can buy more goods and services at still unchanged prices. The second recipients of money also enjoy the new money. However, the successive recipients derive less benefit as prices of goods and services begin to rise.

So long as the prices of goods they sell are rising much faster than the prices of goods they buy, the successive recipients of new money still benefit. The sufferers are those individuals who get the new money last — or not at all. They find that the prices of goods they buy have increased while the prices of goods and services they offer have hardly moved. In other words, monetary growth or inflation causes a redistribution of wealth.

On closer inspection, we can also establish that monetary injections give rise to demand for goods and services, which is not supported by the production of goods and services, implying that monetary growth leads to an economic impoverishment of wealth generators. Furthermore, monetary inflation gives rise to the menace of the boom-bust economic cycle.

Once it is established that the subject matter of inflation is the expansion of the money stock, we can attempt to ascertain whether the use of inflation can help to revive the US economy.

Monetary Inflation and Prices

What is the price of a good? It is the amount of money asked per unit of a good. Observe that, without money, one cannot even begin to discuss what prices are. Yet most economists, while discussing prices, never even mention money.

For mainstream economists, an increase in economic activity is almost always seen as a trigger for a general rise in prices, which they erroneously label “inflation.” But why should an increase in the production of goods lead to a general increase in prices? If the money stock stays intact, then we will have a situation of less money per unit of a good — a fall in prices. This conclusion is not affected even if the so-called economy operates very close to “potential output” (another dubious term used by mainstream economists).

Another popular explanation for a general rise in prices is the increase in wages once the economy is close to the potential output. If the amount of money remains unchanged then it is not possible to raise all the prices of goods and wages. So again, the trigger for a general rise in prices has to be monetary expansion.

An increase in the price of a particular good means that more money is now paid for this good. Likewise, if for a given stock of goods an increase in the money supply occurs, all other things being equal, this would mean that more money is going to be exchanged for the unit of this stock of goods. This means that the price of a good has now gone up.

Observe that in this case the increase in money supply (i.e., inflation) is associated with the increase in the prices of goods. (We have seen that most economists and commentators define inflation as a general rise in prices, which is summarized by the so-called consumer price index. Note again that, while a general rise in prices may be associated with inflation, it is however not inflation).

But now consider the following case: the rate of growth in money is in line with the rate of growth in goods. Consequently, there is no change in the prices of goods. Do we have inflation here or don’t we?

For most economists, if an increase in the money supply is exactly matched by the increase in the production of goods, then this is fine, since no increase in general prices has taken place and therefore no inflation has emerged. We suggest that this way of thinking is false since inflation has taken place, i.e., the money supply has increased. This increase cannot be undone by the corresponding increase in the production of goods and services.

For instance, once a king has created more diluted gold coins that masquerade as pure gold coins, he is able to exchange nothing for something irrespective of the rate of growth of the production of goods. Regardless of what the production of goods is doing, the king is now engaging in an exchange of nothing for something, i.e., diverting resources to himself by paying nothing in return.

The same logic can be applied to paper-money inflation. The exchange of nothing for something that the expansion of money sets in motion cannot be undone by the increase in the production of goods. The increase in money supply — i.e., the increase in inflation — is going to set in motion all the negative side effects that money printing does, including the menace of the boom-bust cycle, regardless of the increase in the production of goods.

Following our conclusion that inflation is about increases in money supply, it obviously cannot be beneficial for economic growth, as our Harvard professors have suggested. On the contrary, an increase in inflation results in the economic impoverishment, by diverting real wealth from wealth generators to the holders of newly printed money. It leads to consumption without supporting production.

Inflation and the Pool of Real Savings

Is it true that inflation helps to alleviate the debt burden in the economy? What raises the debt burden is the declining ability of individuals to create real wealth. Obviously, then, more inflation weakens the ability to create real wealth and can only increase and not reduce the debt burden.

Printing money can only temporarily help the first receivers of newly printed money. It cannot, however, help all the individuals in the economy. We can thus conclude that inflation can only raise and not lower the overall debt burden in the economy.

That inflation is a destructive process cannot always be seen when the underlying bottom line of the economy is still ok. For instance, when authorities are increasing the money-supply rate of growth while the pool of real savings is still in good shape, economic activity follows suit.

It is easy then to conclude that inflation and economic growth are moving in tandem. Once, however, the pool of real savings is in trouble, no monetary pumping can revive economic activity. (Remember, every activity, whether of wealth or non-wealth-generating nature, must be funded. Funding cannot be replaced with printing more money, i.e., more inflation. Funding is about real savings).

On the contrary, an increase in the rate of inflation, as recommended by our Harvard professors, further weakens the process of real savings formation — the key for economic growth. Good examples in this regard are the Great Depression of 1930s and Japanese depression of 1990s.

The importance of correct definition of inflation cannot be emphasized enough. Failing to identify, i.e., define inflation can produce nasty surprises. For instance, for most experts the key for a healthy economy is price stability. If general rises in prices follow a stable growth path economists are of the view that this points to a stable economic growth.

Now we have seen that while increases in money supply (i.e., inflation) are likely to be revealed in price increases as registered by the CPI, this need not always be the case. We have seen that prices are determined by real and monetary factors.

Consequently it can occur that if the real factors are pulling things in an opposite direction to monetary factors no visible change in prices might take place. In other words, while money growth is buoyant, i.e., inflation is high; prices might display low and stable increases.

Clearly, if we were to regard inflation as rises in the CPI, we would reach misleading conclusions regarding the state of the economy. (The increase in money supply regardless of the CPI rate of growth diverts real wealth from wealth generating activities to various non-productive activities thereby weakening the bottom line of an economy).

On this Rothbard wrote,

The fact that general prices were more or less stable during the 1920s told most economists that there was no inflationary threat, and therefore the events of the great depression caught them completely unaware. (America’s Great Depression, p. 153)

This means that the loose monetary policy of the Fed back then had significantly weakened the pool of real savings, notwithstanding the stable CPI. Hence analysts who ignore monetary pumping and only pay attention to changes in the CPI run the risk of overlooking what is really going on in the economy.

The whole idea that there is the need for more inflation in order to revive the economy seems preposterous given the fact that the Fed has been aggressively inflating since the end of last year. The yearly rate of growth of monetary pumping as depicted by the Fed’s balance sheet jumped from 3.8% in August last year to 152.8% by December 2008. At the end of April, the yearly rate of growth stood at 138.6%.

The growth momentum of our monetary measure, AMS, displays buoyancy. The yearly rate of growth of AMS jumped from 2% in August last year to 12.6% in May this year.

Conclusion

Some prominent US economists such as Harvard professors Gregory Mankiw and Kenneth Rogoff are advocating that the Fed should aim at a higher rate of inflation in order to revive the US economy. So it seems that in the current economic setup a little bit of inflation is the correct remedy for the economy.

But how can something that is normally regarded as bad news, something that destroys the economy, at the same time promote economic health? Our Harvard professors don’t try to provide an answer to this question.

We find this way of thinking is extraordinary, given that the Fed is already pursuing very loose monetary policy. Following our conclusion that inflation is about increases in money supply, it obviously cannot be beneficial for economic growth, as our Harvard professors have suggested.

On the contrary, an increase in inflation results in the destruction of economy’s fundamentals and leads to economic impoverishment.

http://mises.org/daily/3489

End the BOOMS of monetary expansions of, the money from thin air plus interest uber-privileged cartelists, and we wont have the busts they know always comes when they stop inflating to take unfair advantage of and front run as we know they do.

we agree on that marxbites!

the question is: how?

A FREE market of consumer chosen currencies not under anyone’s control.

money from thin air is only a problem when compound interest is attached to it. Fiat money without interest is a pure medium of exchange that cannot be manipulated, horded, or shorted on an exchange like gold.

What austrians fail to understand is that never in the history of the use of gold has not devolved into fractional lending. Never.

They also fail to realize that interest free fiat has never fail to bring about indefinite prosperity. 700 yrs of tally sticks ended not because of deflation or run away hyperinflation, but cromwell striking a deal with the jews. There are many other historical examples that fail to make the history books because the elites that commisioned all the historians to write them were the same that founded austrian economics; Rockefellers & Rothchilds.

BTW, ONLY voluntary media of exchange can qualify as just and moral, and NONE by force.

Which currency is just and moral and cannot harm us in any respect?

Anything voluntary

One of the main functions of money is to provide liquidity to trade. Arguing which currency will be used will put a strain on that. Myself for instance will only accept an immutable currency. Which currencies would you accept voluntarily?

Stuck with the paper fiats for now aren’t we, and not voluntarily. Though I understand some in the EU are reverting to their pre-EU coinage again.

My druthers are for universally accepted commodity currencies with intrinsic value, or fully redeemable paper receipts for same.

As long as its in the markets hands vs govts or shylock’s.

You seen this yet Holland, by Frank Vanderlip’s (ex-FEDhead) great grandson?

ESF = Exchange Stabilization Fund, created in the wake of the FDR’s gold confiscation.

What I have been afraid to blog about: The ESF and Its History_Part 1

http://www.youtube.com/watch?v=2ssrcD5GdPQ

Its not very long, but jammed packed with seldom seen info.

Whats your take?

The reason fiat currencies have never worked is not that people are flawed; it is because the particular brand of fiat to which fiat has always been restricted, itself is flawed. How in fact can we prove so?

In the case of what you only call “fiat,” what we have is an obfuscation of a promissory note. It isn’t *the paper* which is responsible for the ramifications of this obfuscation — it’s the obfuscation:

All that we are allowing central banks to do is to publish our promissory notes to each other. This perpetrates two very serious crimes.

1. Whereas a promissory note is retired from circulation to the extent it is paid off, the obfuscation first wrongs us by allowing the pretended banking system to take possession of the notes. This as much as launders all money into the possession of the pretended banking system, and from the very outset of any initial “debt” (which is NOT a debt to the banking system at all), artificially enriches the banking system so much as all the principal which is ever coercively “financed” this way.

2. Worse, virtually all property is necessarily financed this way, because interest forces us to maintain a vital circulation by perpetually borrowing interest and principal back into general circulation, as ever greater and eventually terminal sums of debt.

So then, it isn’t the paper; it’s the interest.

Your precious metal monetary standard has no power whatever to arrest this perpetual multiplication of artificial indebtedness by interest; nor can the relatively minuscule quantity of monetary gold in the world sustain the world’s industry; in fact, interest will ultimately transfer title to all property (including gold) to the pretended banking system.

Obviously, you’ve never actually done the math.

WAKE UP.

Interest on money created AS DEBT, no duh.

They can NEVER create enough to pay off the debt when each NOTE equals principle and interest greater than itself, an exponential function. The bastards just learned to restrain the new issue to a few percent/yr of their false receipts.

Interest charged on the loan of risk capital, IF a commodity or its fully redeemable paper receipt, does NOT create the same problem as money created for free as debt.

One borrows to buy today what he would otherwise have to save for. He understands he’s paying a premium for his shortened time preference.

I am FULLY awake.

Couldn’t be bothered to watch the ESF video then?

Shit I forgot. I´m discussing things with an Austrian. Keep the sentences short, rooted in myth and faith, and as thus wholly indefensible or indescribable. “We need small government, let free markets be free, don’t you love liberty and freedom, we need to take our country back!”

Stuff like that is what they respond to. I bother with all of these ‘details’ about ‘how things actually work’ and it sets off their ‘liberal educated elite’ sensors – causing the thinking portion of the brain to shut down

So BIG govt is your deal eh? MORE central planners for you huh?

And maybe you’ll notice I haven’t needed to use any four letter words.

I dont need your nasty attitude.

“What austrians fail to understand is that never in the history of the use of gold has not devolved into fractional lending. Never.”

And ALWAYS 100% attributable to crooked banksters themselves for issuing more paper than specie on deposit, and NOT GOLD itself, duh.

“because the elites that commisioned all the historians to write them were the same that founded austrian economics; Rockefellers & Rothchilds.”

Pure BS. Carl Menger is the father of Austrian classical liberal economics, the same economics as the Turgot’s, eg, of Jefferson’s own following.

BTW, what all the Rothbard critics get DEAD WRONG, is that he broke off with Rand, Cato Inst, Buckley & the Friedmanites for what they all got wrong in his opinion, and esplly Friedman & Cato.

How about Guernsey’s money system? Benjamin Franklin’s Philadelphia colony? WW2 experience in Canada 1938-1974 with their state bank? Even the state bank of North Dakota. Japan’s Postal Bank? The current Kiwi Postal Bank. How about the Kings perod of the Roman empire circa 790 BC. Solon’s reforms?

Austrian’s cherry pick history to serve their false dialectic. OH yes, the free banking period. Oh Wait! The best banks were regulated. Never mind.

Gravity makes one fall down and bump their head. I don’t like it, therefore I should get mad at gravity? It is a plain simple fact that money has law and force elements. Too BAD you don’t like gravity. OOOOH the evil government! Yes, it can be evil if we allow it to be constructed so. Yes, pride defectives can take over government. Yes, pride defectives can also use Gold and host private banks to their end.

When it all boils down, it is who controls the money system, and how it is designed. Money flows in the system and take attributes from said system.

Austrianism can rightly be attacked because the system they promote encourages private money power hosting of society. Clearly that power is not controlled, and hence to the detriment of the people. Austrians are apologists for predator oligarchies, and they hide behind shrill denunciations of government, and magically impute powers to gold or specie. There are no magic powers to metal. FRAUDSTERS!

Where’s Stimpy??? ;>)

Ren says:

Austrianism can rightly be attacked because the system they promote encourages private money power hosting of society. Clearly that power is not controlled, and hence to the detriment of the people. Austrians are apologists for predator oligarchies, and they hide behind shrill denunciations of government, and magically impute powers to gold or specie. There are no magic powers to metal. FRAUDSTERS!

I say:

What a clown!!

You may be ABLE to attack Austrians based in ignorance, but you may NOT attack them on the morality of their position, which is one’s right to 100% self ownership and of his property, and to not be molested by others. Nor the Austrian/libertarian concept of non-aggression against anyone unless proportional self defense..

A market of freely chosen money, whether gold, rice or wampum, puts NO ONE in a superior position to anyone else.

Giving the power to bureaucrats to print fiat that is then coerced upon all by threat of force is IMMORAL!!!!!

Do some actual study of the Austrian School, they aren’t all for gold or anything else specific beyond a totally VOLUNTARY market of currency and goods/services.

They are AGAINST a depreciating fiat that finances endless wars while impoverishing the globe.

Anthony,

I’m sure you understand this, but the statists are just a bunch of liars. On top of that, they are thieves. When any economy uses interest/usury the instability will always be present in the economy. Almost any system that does not include interest will work. But the statist is not interested in the well-being of the people in general. They are evil people whose only goal is the destruction of mankind. Freedom, happiness, goodness, high moral values, are not things that are promoted by the statist. They are too busy stealing from the producers.

So when a statist speaks, I wouldn’t pay any more attention to them We have to stop feeding the beast. When they start talking, just walk away. Don’t turn on the statist TV. Don’t listen to statist talk radio. And there’s no point in debating them because they don’t really have any authority over anything. How can a liar have any power? The only way they do is because we all are too ignorant to know how to get away from their bullshit. We can certainly save a lot of time by simply not paying any attention to them because it will only twist our own minds if we listen to them.

I know Al, but I can’t help myself. I just like to poke a little fun at them every now and again, and I have been behaving for months now.

Meanwhile, many people do fall for their nonsense and I guess there is a market for a little truth about the issue.

If we want to understand the present system, I don’t think it’s a good idea to first define it as something it is not, and then attempt to explain the rest in a false context.

Because the banking system never gives up consideration commensurable to the debts it falsifies to itself, therefore our promissory obligations remain representations of entitlement so long as they are unfulfilled; and therefore likewise, paid principal is strictly to be retired from circulation, as payment cancels/nullifies their former representation of entitlement.

Thus the banking system is a mere publisher of further representations of our promissory obligations to each other; it has no property or entitlement at stake (as ostensibly/falsely justifies “interest”); and our promissory obligations rightly remain obligations to pay and to retire principal at an essential rate of payment — which, owing to the concerns of both the creditor and obligor, must equate to the rate of consumption of the related property over the proprietary determinate lifespan of the related property.

1. Banks are not the creators of the money; we are the creators of the money. The banking system merely publishes further representations of our promissory obligations to each other — and *that* (our promissory obligations) is what the money is created/comprised of.

2. It is correct only to say that the banking system *CLAIMS* to work according to fractional reserve “principles” (falsifications of principle).

Why?

They are not even the creators of the money!

Thus they can’t *rightly* claim to be creating money in regard to *any* “principle” — whatever that purported principle is.

You can only truly understand *purported* fractional reserve policy therefore in this light.

A tendency to relate to fractional reserve otherwise stems from poor diligence (purported Austrian economics for instance), blaming excessive indebtedness on fractional reserve policy. Nothing could be further from the truth, for the following reasons:

First of all, fractional reserve policy stems from the deficiencies of the gold standard. As Benjamin Franklin indicates in his 1729 “Nature and Necessity of a Paper Currency,” it was impossible to sustain the further prosperity the colonies were capable of, by adhering to their precious metal monetary standards. When the deficient volumes of gold and silver were augmented by (substantial) further paper currency, the colonists found they could sustain further prosperity.

Why was this impossible otherwise?

The answer to that question is simple: any volume of circulation which is insufficient to represent all entitlement, deprives us of an ability to sustain so much prosperity.

But this is the underlying reason the gold/silver standards of the world are effectively repealed by additional issuance of further currency (generally paper, but also further metals).

Fractional reserve policy therefore relates to addressing the inherent deficiencies of artificial precious metal (or commodity) “monetary standards.”

Yet the whole idea of “reserves” is itself preposterous. First of all, the only reason you might “need” them is if the currency fails; and the only reason it will fail is if you tolerate the present obfuscation of our promissory obligations to each other; and thus, even if you do deem that you need them to redeem the currency at such a time of failure, that doesn’t fix the problem, because the reason for the failure is a terminal sum of falsified debt.

The purported Austrian economists want to restore the gold standard, only because they refuse to understand/acknowledge a) that the gold standard can only fail to provide sufficient representation; and b) because they likewise refuse to acknowledge that interest multiplies initial sums of falsified debt into terminal sums of falsified debt.

Thus, as the Austrians advocate banking and even elevated rates of interest (purportedly to discourage excessive borrowing), they are advocating returning to the original causes of failure in both forms: a) a return to a (finite, limited) commodity standard imposes deficient powers of representation; and b) higher rates of interest multiply falsified debt at escalated rates, as we are forced to borrow greater sums of periodic interest back into circulation, and this increases the sum of falsified debt at a greater rate.

Thus the so-called Austrians promote a faster rate of failure with an even far more limited and preclusive circulation.

That should put fractional reserve policy and its adversaries into perspective.

But the reason mathematically perfected economy™ needs no “reserves” is, MPE™ makes the very represented property the “reserve” of faulted systems. That is, only under MPE™ do you have adequate representation (even at virtually no cost); no multiplication of debt or cost; and immutable value of property and entitlement, in a fact of perpetual redeemability.

All that may be a lot to get your brain around from a simple eradication of interest and obligatory schedule of payment, so give it some thought. Test how these principles alone fulfill all these objectives, and you’ll better understand what money is created of, who its creators are, who the real creditors are, and what the issues of former trials such as precious metal monetary standards are. When you understand the latter, it is a simple matter to put fractional reserve policy into perspective; and when you do understand it in these terms, you’ll likewise see this explanation even fits the historical pattern of its inception.

Why?

Because the faults of the gold/silver standard doomed the standard to fractional reserve policy. But that isn’t why we suffer a terminal escalation of debt.

I should probably make another thing clear about fractional reserves:

A *central bank* requirement for 10% reserves means generally that the faux creator is required to have 10$ in gold (or other specific material [“dollars”]) for every 100$ falsely created (which purported principle is to be distinguished from applicability to all further, downstream *lending*).

As you say then, different requirements for *lending* may alleviate any ostensible restriction on the overall volume of circulation; but that would only apply if downstream/peripheral banks can also either create money or loan multiple instances of the same money.

All that means however (if it is the case in the particular system), is that “fractional” “reserve” limitations are really no limitation at all.

But what would drive that subversion of purported principle (or pretention of principle)?

The very obfuscation of the currency.

Why?

Because it and it alone imposes a need to persist in a perpetual escalation of further faux “borrowing,” merely to maintain a vital circulation, so long as it is possible to maintain a vital circulation (until a terminal sum of debt destroys credit-worthiness to borrow further).

“Thus, as the Austrians advocate banking and even elevated rates of interest (purportedly to discourage excessive borrowing), they are advocating returning to the original causes of failure in both forms: a) a return to a (finite, limited) commodity standard imposes deficient powers of representation; and b) higher rates of interest multiply falsified debt at escalated rates, as we are forced to borrow greater sums of periodic interest back into circulation, and this increases the sum of falsified debt at a greater rate.

Thus the so-called Austrians promote a faster rate of failure with an even far more limited and preclusive circulation.”

WRONG!!!!!!

The Austrians favor a voluntary system of commodity money not controlled by ANY special interests, but by the decisions and choices of individual market participants, as mankind had come to over millenia before shylock learned he could issue unbacked paper at interest the same way Caesars debased their own state issued coin.

Under a NON-bastardized full redemption gold standard there can BE no debt as we now have cranking out exponentially compounding interest expenses.

Usury IMO is charging interest on money from nothing. OTOH if I risk loaning you my REAL money for a period of time, I fully expect to be compensated for that risk as well as the opportunity costs of not having my money at hand.

On a gold std the interest for risk loan capital comes from PRODUCTION, like mining.

The best economists understand fiat currencies as the “false receipts” that enrich the statists at the people’s expense.

YOUR QUOTE: ¨I fully expect to be compensated for that risk as well as the opportunity costs of not having my money at hand.¨

But under MPE nobody would have to borrow from you, because that same credit is available free of interest if creditworthiness is in check. We leave the subprime market for the Austrians to service 🙂

Contracts are always set in nominal terms, not in real terms. So when real prices change, there are winners and losers. When prices go up, sellers are winners as are debtors. Buyers are losers, as are creditors. When prices go down, the sellers and the debtors turn into losers. So beyond any real economy effects inflation has on business through accounting, inflation and deflation act as transfers of income, creating winners and losers.

Despite perceptions that the Austrians were deflationists, Friedrich von Hayek famously said: “I am not only against inflation but I am also against deflation.” As such, the goal of economic policy making is to prevent price volatility – to prevent levels of inflation or deflation.

Only MPE accomplishes his.

MPE accomplishes price stability, although I don’t mind really about inflation.

But the Austrians ARE Deflationists, whatever von Hayek said 50 years ago. Just look at Marx Bites’s comment.

They R NOT deflationists EXCEPT for the GOOD kind of deflation that productivity innovations bring.

There are TWO KINDS Anthony, the GOOD as above, or the bad that ALWAYS results from monetary expansions, eg, the proverbial bust.

so why was Ron Paul going to take 1 trillion out of the budget, knowing full well it would destroy the economy?

No it wouldn’t Anthony. It has to be borrowed from shylock, PLUS interest.

Our current debt alone is 16T.

Better to borrow the dollar into total worthlessness is it? Being we only have about 4% left of the 1932 dollar’s value left to depreciate to ZERO.

SPENDING via borrowing vs production/savings is the entire world’s MAIN problem.

Austrians DESPISE shylock with a passion. Rothbard absolutely HATED the Rockefellers and their ilk, and spent his entire career exposing the nexus between power and American policies PROVING their disparate power over govt that literally negates our own.

I know that this is your position Marxbites. I understand, I’m not looking to aggravate

But the problem is there: read the why bankers love gold story and also top ten lies and mistakes of austrian economics.

And, while you’re at it: how the rockefellers and the volker fund financed Mises, Hayek, rothbard, gary north and all the rest of them.

It’s all there. Austrianism denies usury is a problem. They want to have us pay interest for gold. In gold.

Lets say I have a lawn mower, that for illustration only, cost me $200 and has a useful lifespan of 200 hrs (made in China right?).

Since I dont use it every day, it occurs to me that I might rent it out at a few percent more than the $1/hour it cost me.

My neighbor who’s own mower is in the shop is eager to voluntarily rent mine by the hr while his is being repaired.

Where’s a single smidgeon of immorality in the above arrangement?

Why is it not the same as if I loaned my neighbor the money to get his fixed and he was willing to pay me back 5% more then I lent him with zero coercion?

IMO ALL interest is NOT usury, just when its leveled upon money shylock creates from ZERO production or with any real value INVOLUNTARILY, eg by state force.

“Rothbard absolutely HATED the Rockefellers and their ilk”

Are you sure about that? Maybe he was simply a good actor…

http://realcurrencies.wordpress.com/2012/03/11/old-rothschild-and-rockefeller-hands-controlled-the-libertarian-communist-dialectic/

And have a look at this:

http://realcurrencies.files.wordpress.com/2012/03/libertarianism_connections_new.jpg

the spam filter is after you TTU, I don’t know why!

Have YOU listened to, or read, hundreds of hours of Rothbards audiobooks and scholarship like I have?

I rather doubt it.

Here’s a taste of the excellent essay that was most responsible for lifting the power elite scales from my own long duped eyes. See if you can detect ANY slack Murray gives these SOBs whatsoever please.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Wall Street, Banks, and American Foreign Policy

by Murray N. Rothbard

Businessmen or manufacturers can either be genuine free enterprisers or statists; they can either make their way on the free market or seek special government favors and privileges. They choose according to their individual preferences and values. But bankers are inherently inclined toward statism.

Commercial bankers, engaged as they are in unsound fractional reserve credit, are, in the free market, always teetering on the edge of bankruptcy. Hence they are always reaching for government aid and bailout.

Investment bankers do much of their business underwriting government bonds, in the United States and abroad. Therefore, they have a vested interest in promoting deficits and in forcing taxpayers to redeem government debt. Both sets of bankers, then, tend to be tied in with government policy, and try to influence and control government actions in domestic and foreign affairs.

In the early years of the 19th century, the organized capital market in the United States was largely confined to government bonds (then called “stocks”), along with canal companies and banks themselves. Whatever investment banking existed was therefore concentrated in government debt. From the Civil War until the 1890s, there were virtually no manufacturing corporations; manufacturing and other businesses were partnerships and had not yet reached the size where they needed to adopt the corporate form. The only exception was railroads, the biggest industry in the U.S. The first investment banks, therefore, were concentrated in railroad securities and government bonds.

The first major investment-banking house in the United States was a creature of government privilege. Jay Cooke, an Ohio-born business promoter living in Philadelphia, and his brother Henry, editor of the leading Republican newspaper in Ohio, were close friends of Ohio U.S. Senator Salmon P. Chase. When the new Lincoln Administration took over in 1861, the Cookes lobbied hard to secure Chase the appointment of Secretary of the Treasury. That lobbying, plus the then enormous sum of $100,000 that Jay Cooke poured into Chase’s political coffers, induced Chase to return the favor by granting Cooke, newly set up as an investment banker, an enormously lucrative monopoly in underwriting the entire federal debt.

Cooke and Chase then managed to use the virtual Republican monopoly in Congress during the war to transform the American commercial banking system from a relatively free market to a National Banking System centralized by the federal government under Wall Street control. A crucial aspect of that system was that national banks could only expand credit in proportion to the federal bonds they owned – bonds which they were forced to buy from Jay Cooke.

Jay Cooke & Co. proved enormously influential in the post-war Republican administrations, which continued their monopoly in under-writing government bonds. The House of Cooke met its well-deserved fate by going bankrupt in the Panic of 1874, a failure helped along by its great rival, the then Philadelphia-based Drexel, Morgan & Co.

J.P. Morgan

After 1873, Drexel, Morgan and its dominant figure J.P. Morgan became by far the leading investment firm in the U.S. If Cooke had been a “Republican” bank, Morgan, while prudently well connected in both parties, was chiefly influential among the Democrats. The other great financial interest powerful in the Democratic Party was the mighty European investment-banking house of the Rothschilds, whose agent, August Belmont, was treasurer of the national Democratic party for many years.

The enormous influence of the Morgans on the Democratic administrations of Grover Cleveland (1884–88, 1892–96) may be seen by simply glancing at their leading personnel. Grover Cleveland himself spent virtually all his life in the Morgan ambit. He grew up in Buffalo as a railroad lawyer, one of his major clients being the Morgan-dominated New York Central Railroad. In between administrations, he became a partner of the powerful New York City law firm of Bangs, Stetson, Tracey, and MacVeagh. This firm, by the late 1880s, had become the chief legal firm of the House of Morgan, largely because senior partner Charles B. Tracey was J.P. Morgan’s brother-in-law. After Tracey died in 1887, Francis Lynde Stetson, an old and close friend of Cleveland’s, became the firm’s dominant partner, as well as the personal attorney for J.P. Morgan. (This is now the Wall St. firm of Davis, Polk, and Wardwell.)

Grover Cleveland’s cabinets were honeycombed with Morgan men, with an occasional bow to other bankers. Considering those officials most concerned with foreign policy, his first Secretary of State, Thomas F. Bayard, was a close ally and disciple of August Belmont; indeed, Belmont’s son, Perry, had lived with and worked for Bayard in Congress as his top aide. The dominant Secretary of State in the second Cleveland Administration was the powerful Richard Olney, a leading lawyer for Boston financial interests, who have always been tied in with the Morgans, and in particular was on the Board of the Morgan-run Boston and Maine Railroad, and would later help Morgan organize the General Electric Company.

The War and Navy departments under Cleveland were equally banker-dominated. Boston Brahmin Secretary of War William C. Endicott had married into the wealthy Peabody family. Endicott’s wife’s uncle, George Peabody, had established a banking firm which included J.P. Morgan’s father as a senior partner; and a Peabody had been best man at J.P.’s wedding. Secretary of the Navy was leading New York City financier William C. Whitney, a close friend and top political advisor of Cleveland’s. Whitney was closely allied with the Morgans in running the New York Central Railroad.

Secretary of War in the second Cleveland Administration was an old friend and aide of Cleveland’s, Daniel S. Lamont, previously an employee and protégé of William C. Whitney. Finally, the second Secretary of the Navy was an Alabama Congressman, Hilary A. Herbert, an attorney for and very close friend of Mayer Lehman, a founding partner of the New York mercantile firm of Lehman Brothers, soon to move heavily into investment banking. Indeed, Mayer’s son, Herbert, later to be Governor of New York during the New Deal, was named after Hilary Herbert.

The great turning point of American foreign policy came in the early 1890s, during the second Cleveland Administration. It was then that the U.S. turned sharply and permanently from a foreign policy of peace and non-intervention to an aggressive program of economic and political expansion abroad. At the heart of the new policy were America’s leading bankers, eager to use the country’s growing economic strength to subsidize and force-feed export markets and investment outlets that they would finance, as well as to guarantee Third World government bonds. The major focus of aggressive expansion in the 1890s was Latin America, and the principal Enemy to be dislodged was Great Britain, which had dominated foreign investments in that vast region.

In a notable series of articles in 1894, Bankers’ Magazine set the agenda for the remainder of the decade. Its conclusion: if “we could wrest the South American markets from Germany and England and permanently hold them, this would be indeed a conquest worth perhaps a heavy sacrifice.”

Long-time Morgan associate Richard Olney heeded the call, as Secretary of State from 1895 to 1897, setting the U.S. on the road to Empire. After leaving the State Department, he publicly summarized the policy he had pursued. The old isolationism heralded by George Washington’s Farewell Address is over, he thundered. The time has now arrived, Olney declared, when “it behooves us to accept the commanding position… among the Power of the earth.” And, “the present crying need of our commercial interests,” he added, “is more markets and larger markets” for American products, especially in Latin America.

Good as their word, Cleveland and Olney proceeded belligerently to use U.S. might to push Great Britain out of its markets and footholds in Latin America. In 1894, the United States Navy illegally used force to break the blockade of Rio de Janeiro by a British-backed rebellion aiming to restore the Brazilian monarchy. To insure that the rebellion was broken, the U.S. Navy stationed war-ships in Rio harbor for several months.

During the same period, the U.S. government faced a complicated situation in Nicaragua, where it was planning to guarantee the bonds of the American Maritime Canal Company, to build a canal across the country. The new regime of General Zelaya was threatening to revoke this canal concession; at the same time, an independent reservation, of Mosquito Indians, protected for decades by Great Britain, sat athwart the eastern end of the proposed canal. In a series of deft maneuvers, using the Navy and landing the Marines, the U.S. managed to bring Zelaya to heel and to oust the British and take over the Mosquito territory…………

Cont at

http://www.lewrockwell.com/rothbard/rothbard66.html

This is LOADED with what the mudstream media and academe NEVER EVER reveal to us. His Rockefeller stuff comes later, but most all his work is 100% critical of ALL power elites, the MAIN targets of his voluminous ANTI-STATIST scholarship.

Here’s more.

See how “MUCH” Murray “LOVES” these criminals do ya now?

Rockefeller, Morgan, and War

Mises Daily: Tuesday, November 01, 2011 by Murray N. Rothbard

[Wall Street, Banks, and American Foreign Policy (1984)]

During the 1930s, the Rockefellers pushed hard for war against Japan, which they saw as competing with them vigorously for oil and rubber resources in Southeast Asia and as endangering the Rockefellers’ cherished dreams of a mass “China market” for petroleum products. On the other hand, the Rockefellers took a noninterventionist position in Europe, where they had close financial ties with German firms such as I.G. Farben and Co., and very few close relations with Britain and France.

The Morgans, in contrast, as usual deeply committed to their financial ties with Britain and France, once again plumped early for war with Germany, while their interest in the Far East had become minimal. Indeed, US ambassador to Japan Joseph C. Grew, former Morgan partner, was one of the few officials in the Roosevelt administration genuinely interested in peace with Japan.

World War II might therefore be considered, from one point of view, as a coalition war: the Morgans got their war in Europe, the Rockefellers theirs in Asia. Such disgruntled Morgan men as Lewis W. Douglas and Dean G. Acheson (a protégé of Henry Stimson), who had left the early Roosevelt administration in disgust at its soft-money policies and economic nationalism, came happily roaring back into government service with the advent of World War II. Nelson A. Rockefeller, for his part, became head of Latin American activities during World War II, and thereby acquired his taste for government service.

After World War II, the united Rockefeller–Morgan–Kuhn, Loeb eastern Establishment was not allowed to enjoy its financial and political supremacy unchallenged for long. “Cowboy” Sun Belt firms, maverick oil men and construction men from Texas, Florida, and southern California began to challenge the eastern Establishment “Yankees” for political power. While both groups favor the Cold War, the Cowboys are more nationalistic, more hawkish, and less inclined to worry about what our European allies are thinking. They are also much less inclined to bail out the now Rockefeller-controlled Chase Manhattan Bank and other Wall Street banks that loaned recklessly to Third World and Communist countries and expect the US taxpayer — through outright taxes or the printing of US dollars — to pick up the tab.

It should be clear that the name of the political party in power is far less important than the particular regime’s financial and banking connections. The foreign-policy power for so long of Nelson Rockefeller’s personal foreign affairs adviser, Henry A. Kissinger, a discovery of the extraordinarily powerful Rockefeller–Chase Manhattan Bank elder statesman John J. McCloy, is testimony to the importance of financial power — as is the successful lobbying by Kissinger and Chase Manhattan’s head, David Rockefeller, to induce Jimmy Carter to allow the ailing shah of Iran into the US — thus precipitating the humiliating hostage crisis.

Despite differences in nuance, it is clear that Ronald Reagan’s originally proclaimed challenge to Rockefeller-Morgan power in the Council of Foreign Relations (CFR) and to the Rockefeller-created Trilateral Commission has fizzled, and that the “permanent government” continues to rule regardless of the party nominally in power. As a result, the much-heralded “bipartisan-foreign-policy” consensus imposed by the Establishment since World War II seems to remain safely in place.

David Rockefeller, chairman of the board of his family’s Chase Manhattan Bank from 1970 until recently, established the Trilateral Commission in 1973, with the financial backing of the CFR and the Rockefeller Foundation. Joseph Kraft, syndicated Washington columnist who himself has the distinction of being both a CFR member and a Trilateralist, has accurately described the CFR as a “school for statesmen” that “comes close to being an organ of what C. Wright Mills has called the Power Elite — a group of men, similar in interest and outlook, shaping events from invulnerable positions behind the scenes.”

The idea of the Trilateral Commission was to internationalize policy formation, the commission consisting of a small group of multinational corporate leaders, politicians, and foreign-policy experts from the United States, Western Europe, and Japan, who meet to coordinate economic and foreign policy among their respective nations.

Perhaps the most powerful single figure in foreign policy since World War II, a beloved adviser to all presidents, is the octogenarian John J. McCloy. During World War II, McCloy virtually ran the War Department as assistant to aging Secretary Stimson; it was McCloy who presided over the decision to round up all Japanese Americans and place them in concentration camps in World War II, and he is virtually the only American left who still justifies that action.

Before and during the war, McCloy, a disciple of Morgan lawyer Stimson, moved in the Morgan orbit; his brother-in-law, John S. Zinsser, was on the board of directors of J.P. Morgan & Co. during the 1940s. But, reflecting the postwar power shift from Morgan to Rockefeller, McCloy moved quickly into the Rockefeller ambit. He became a partner of the Wall Street corporate law firm of Milbank, Tweed, Hope, Hadley & McCloy, which had long served the Rockefeller family and the Chase Bank as legal counsel.

From there he moved to become chairman of the board of the Chase Manhattan Bank, a director of the Rockefeller Foundation, and of Rockefeller Center, Inc., and finally, from 1953 until 1970, chairman of the board of the Council on Foreign Relations. During the Truman administration, McCloy served as president of the World Bank and then US high commissioner for Germany. He was also a special adviser to President John F. Kennedy on disarmament, and chairman of Kennedy’s Coordinating Committee on the Cuban Crisis. It was McCloy who “discovered” Professor Henry A. Kissinger for the Rockefeller forces. It is no wonder that John K. Galbraith and Richard Rovere have dubbed McCloy “Mr. Establishment.”

A glance at foreign-policy leaders since World War II will reveal the domination of the banker elite. Truman’s first secretary of defense was James V. Forrestal, former president of the investment banking firm of Dillon, Read & Co., closely allied to the Rockefeller financial group. Forrestal had also been a board member of the Chase Securities Corporation, an affiliate of the Chase National Bank.

Another Truman defense secretary was Robert A. Lovett, a partner of the powerful New York investment banking house of Brown Brothers Harriman. At the same time that he was secretary of defense, Lovert continued to be a trustee of the Rockefeller Foundation. Secretary of the Air Force Thomas K. Finletter was a top Wall Street corporate lawyer and member of the board of the CFR while serving in the cabinet. Ambassador to Soviet Russia, ambassador to Great Britain, and secretary of commerce in the Truman administration was the powerful multimillionaire W. Averell Harriman, an often-underrated but dominant force with the Democratic Party since the days of FDR. Harriman was a partner of Brown Brothers Harriman.

Also ambassador to Great Britain under Truman was Lewis W. Douglas, brother-in-law of John J. McCloy, a trustee of the Rockefeller Foundation, and a board member of the Council on Foreign Relations. Following Douglas as ambassador to the Court of St. James was Walter S. Gifford, chairman of the board of AT&T, and member of the board of trustees of the Rockefeller Foundation for almost two decades. Ambassador to NATO under Truman was William H. Draper Jr., vice president of Dillon, Read & Co.

Also influential in helping the Truman administration organize the Cold War was director of the policy-planning staff of the State Department, Paul H. Nitze. Nitze, whose wife was a member of the Pratt family, associated with the Rockefeller family since the origins of Standard Oil, had been vice president of Dillon, Read & Co.