Social Credit with Demurrage

(Left: Sylvio Gesell, the man who devised demurrage and popularized Georgist thinking in Europe)

The easiest and most transparent way of migrating to a usury-free economy is by simply replacing the usurious credit based money supplies of today with interest-free credit. In this way we would be able to do exactly what we always did, but better. However, demurrage is an equally viable way. It may be a little esoteric for most Americans, but demurrage money mimics the ways of the ancients who built the wonders of the world in Antiquity and the Cathedrals in the Middle Ages.

Ross Noble is well known here at Real Currencies as REN for sharing his wisdom generously. He has been creating an approach based on debt-free money, spent into circulation by the people, basically Social Credit. The problem with Social Credit is that it does not end Usury and Noble suggests a demurrage to achieve that.

A demurrage is a negative interest, a tax on holding money. This strongly discourages hoarding cash. This is a hard concept for many people to get their heads around. But the fact is that hoarding the means of exchange has negative implications for others using the money. Hoarding cash hinders circulation and this is a fundamental monetary problem.

Saving should be done through assets, not cash.

Money is not wealth, it’s a means of exchange. It derives its value from the agreement to use it as such. The ‘store of value’ function is a result of the agreement, but the agreement does not have the purpose of creating a store of value.

Demurrage is based on the idea that money should perish as does produce. It is because money does not perish as quickly as produce (and other products), it is used to store wealth. But using it to store wealth destroys its use as a means of exchange, which needs unhindered circulation.

In older times, farmers stored their harvest at central warehouses. They got a receipt in exchange. This receipt was used to pay others. But because the receipt represented decaying goods, it lost value over time.

The great boon of demurrage is that the negative interest is a clear incentive for those holding money to lend it out interest-free. Better still, it would greatly encourage paying in advance. This is even better, because it diminishes the need for debt. Many investments would become viable without any debt at all, simply because consumers would pay up front for much of the production of what they need.

It is important to understand that the cost of society to the demurrage (negative interest) is a tiny fraction of the cost of usury. The reason for this is that the money supply is very small, because it circulates very quickly, up to a hundred times faster than usurious units. As a result the demurrage is typically not even enough to finance the operation of the monetary system, let alone as a tool of plunder.

Ross has been so kind as to work out a number of the details and issues related to his proposal, you can find them below.

I post this purely for discussion purposes. It is an unfortunate fact of life that most monetary reformers are very much in the box of their own preferred system. Most interest-free crediters hate demurrage. But they simply don’t understand it and I’m convinced it’s equally viable as interest-free credit.

The more I think about Ross’ proposals, the more I like them. I hope the points below will enhance the discussion and awareness of Interest-free economics and help diminish the tunnel vision that I believe is badly damaging monetary reform in general.

Related:

Don’t hoard the means of exchange! (part 1)

the Power of Demurrage: the Wörgl Phenomenon

Social Credit

Social Credit with Demurrage (SCD), a non-usurious economy

Ross Noble (REN)

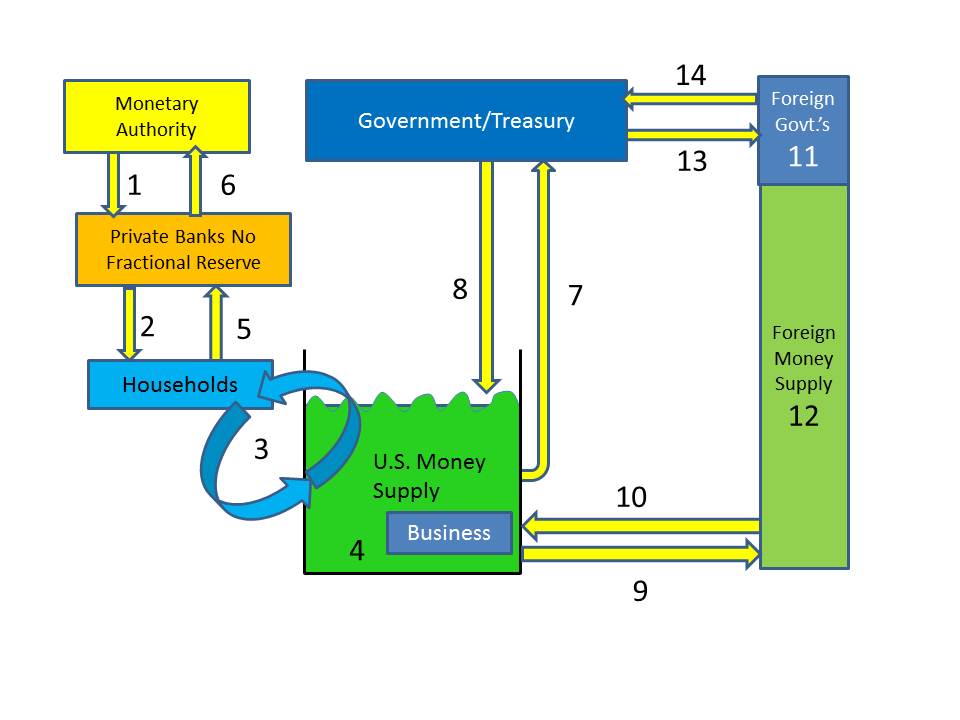

The objective is to outline flow paths and design features for SCD.

- Monetary Authority (MA) issues new U.S. Dollar money into the accounts of Households. Each money unit has a date stamp, necessary in order to calculate holding tax. Banks are Private and do not create money. Banks do accounting functions and serve us; they make their profits from fees. Most money is already in the supply and hence represents past wealth accumulation. Money volume is held to the amount required to match goods and services production.

- Households pull money as needed from their bank accounts.

- Households spend their output and engage in transactions by using money from the money supply. Path 3 is modeled as a circle; money spins from transaction to transaction, jumping from person to person. As people buy and sell their goods and services, money effectively spins in a circle. The rate of spin is velocity. Since this money has demurrage, the spin rate is forced to some natural maximum.

- The money supply is shown as a fixed volume with some variation turbulence at the surface. Note that business sector is buried in the money supply. Business also buys and sells into the marketplace, and hence they have spinning money flow (not shown) similar to households.

- Households (and business) store their savings at the bank.

- The monetary authority charges demurrage holding tax on money stored as checking. Pipe 6 drains money from checking accounts at the demurrage rate. Money stored as bank savings is available to be lent out to borrowers. Savings are at zero percent interest, and made available to borrowers under a contract brokered by banker. Savers are Creditors and Debtors are Borrowers. Each party signs legal loan contracts, but said contract is non-usurious. In this way real saved money, representing past wealth accumulation, is available as capital for borrowers. Real money, unlike today’s bank money, stands on its own power and represents past labor energy. Borrowers are now under pressure to spend their newly loaned money, or they will be penalized with a holding tax. The holding tax is the minimum necessary to force money into maximum velocity. Three percent per year perhaps is enough – the tax rate may be derived by experience. Monetary Authority recycles demurrage money back into households via pipe 1. In my view, MA spends as redistribution, as all statistical populations follow a Gaussian bell shaped curve.

- Government taxes the population to run its affairs. Government does not create money; it is a user of existing money. Government also is under pressure to spend, as the money they taxed is date stamped.

- Government recycles the money it formerly taxed on pipe 8. Government uses money to transact their goods and services and in the process throws money back into the supply. Government may also tax and redistribute if approved by the political process.

- Foreign economies transact with the U.S. via pipes 9 and 10. If there is trade imbalance, money will accumulate in direct proportion. For example, if China sells excess goods to the U.S. on pipe 10, pipe 9 drains U.S. dollars from the economy.

- If the U.S. sells excess goods to China on pipe 9, then Yuans will accumulate into the U.S. money supply on pipe 10.

- Foreign governments may grab U.S. dollars from their money supply 12, and send them back to the U.S on pipe 14, to buy Treasury bonds at zero percent. Alternatively, foreigners are compelled to spend excess accumulations of dollars, buying goods and services from U.S.; otherwise they are penalized with a holding tax.

- Foreign money supply may be many foreign economies, but only one is modeled here for simplicity. All foreign economies are eager to spend dollar accumulations; otherwise they are penalized by the demurrage holding tax.

- Excess money travels pipe 13 or 14 to buy Government Treasuries. Foreigners buying Treasury Bonds are effectively making a loan to U.S. government at zero percent. U.S. government is then compelled to spend as the former foreign money (due to trade imbalance) is date stamped. Foreign economies most likely will elect to spend their U.S. dollars into the U.S. economy acquiring goods and services from Main Street via paths 9, 10.

The new money unit described thus far is an abstract accounting identity, a bearer instrument, controlled by legal fiat. All U.S. dollars carry an information date stamp, which is updated as the demurrage is paid. Abstract accounting identities are numbers in a computer, or on a ledger. In our current bank money system, 97% of the U.S. economy is abstract bank money, carried as numbers in a database.

Physical representation of money must have high carry costs or some other negative attribute making it undesirable. Making all money coins, making them large, and possibly limiting them to $20 will incur carry costs thus propelling people away from money’s tangible form. Another alternative is to recall small denomination tangible paper notes on a regular basis, making them a hassle. The undesirable nature of physical money needs to exceed the negative attributes of demurrage money. The abstract intangible form of MA bearer money (U.S. dollars) as numbers in data bases, can easily jump from ledger to ledger at computer speeds, so actual costs are very low despite the high velocity transaction rate.

The monetary authority uses demurrage as the heart pump to propel money into circulation. In the unlikely event Government doesn’t do its fiscal policy job with appropriate taxation on land and market rents, the monetary authority may operate an inflation escape valve by injecting new money into households. Household, Government, and Business sector loops will tend to balance, money supply is recycled at the drain rate. Foreign loops are also in balance as hoarding is discouraged via the holding tax. The money supply maintains its volume with little turbulence.

Advantages:

- A new type of economy emerges. Capital is no longer usurious, nor does it have advantage over goods and services production. Capital no longer retreats and outwaits labor. This is a third way non usurious economy. We escape history and stop alternating between the dialectical poles of usury Capitalism or some form of Statism/Marxism.

- Government must tax the population to wrest their money away. The people own their money power through their Monetary Authority. Also, government is compelled to search for taxable rents in the marketplace; taxing rent seeking will be an easy sell to the populace. Having new money erupt in the population gives the people a measure of control over government, keeping government small and limited to its role. If there is any inflation due to excess money creation, the people get first seigniorage.

- Marginal utility on Capital drops to zero. Holders of money must spend in order to avoid demurrage taxes. Spending zero interest money means that money can find useful employment serving the economy without raping it. Formerly marginal jobs become living wages and those who want work will find it.

- About ½ of the economy demonetizes and converts back to a gift economy. Once debt peonage disappears and usury capital no longer demands exponential service, people may choose to spend their time gifting. Women may choose to stay home and raise their children rather than being forced into the workplace to make money to service money. Families are more likely to stay intact, leading to less stress, less drug use, and a healthier lifestyle.

- The market begins to work with accurate pricing signals, as pricing does not have hidden rents. Inflation is low or zero, as the monetary authority injects or subtracts money demand, based on the Consumer Price Index.

- Inflation is low or zero because demurrage keeps the money unit stable and volume is controlled. Demurrage holding taxes actually tax the holder not the unit. The money unit is made to come to par before it can be spent. Since money becomes stable, pricing becomes transparent, and market mechanisms begin to work with new efficiency.

- Wealth is stored as productive assets, like shares in companies. This further accelerates entrepreneurship, wealth generation, and local control.

- War is less likely, as compounding debts are impossible with zero interest rates. Psychopathic usurious money powers have been ejected from their citadels.

- The dual “volume x velocity” nature of money finally comes under control, as the velocity factor is made to find its natural maximum.

Disadvantages

- The monetary authority is an agent who operates in the people’s best interests. MA is of the people, yet also above them. MA must be constrained by law and staffed by wise moral individuals who are insulated from the political process.

- SCD is a strategic goal, with no easy tactical path toward implementation. Scales must fall from eyes, otherwise people will continue to insist that money “needs to grow” with positive interest. Mutual Credit or possibly other monetary systems are necessary tactical steps toward humanity reaching the goal of an advanced non-usurious economy.

Trackbacks & Pingbacks

- Interest-Free Credit (including MPE!) and the Management of Volume | Real Currencies

- Our banker “money”system is THE great usury conspiracy. – Roger M. |

- How to manage the Volume of Money in Mutual Credit | Real Currencies

- Social Credit with Demurrage | Real Currencies ...

- Social Credit with Demurrage | The Money Chroni...

- More On Social Credit And A Letter By Dick Eastman | Real Currencies

- Beyond the End of History – Voted Money as the Next Evolution of Political Economy (Part 2.2) – Anon

- Beyond the End of History – Voted Money as the Next Evolution of Political Economy (Part 2.2) | Anon

- The Votive Economy III – Banking, Government and Law | Anon

And what about the VOLUNTARY market system of universally accepted metallic currency mankind traded with for thousands of years, of which the ONLY faults were either bimetalism or the seemingly perpetual bankster fraud of issuing more paper than reserves of metals on deposit to back them?

For those are the ONLY problems market money has ever had, ever.

The MA’s have NEVER and will NEVER EVER be trustworthy, as history has proven over and over again, but a gold or silver coin will ALWAYS be?

PLUS there’s NO INTEREST involved with the metals mankind chose, never was.

PLUS its perfectly MORAL to enter the voluntary renting of risk capital.

Whereas its perfectly IMMORAL to rent money created from thin air at zero cost as debt.

THATS the WHOLE F’g issue sport.

Complete dribble and Non sense. Free markets don’t exist and never have existed. Markets aren’t voluntary and have always required coercion. Voluntary markets are a contradiction in terms. Markets are a result of government intervention. Currency is the result of government. As for gold and silver it has always been minted by sovereigns and very rarely appear in the market place. Why are no countries using gold because it doesn’t work. What are people using instead of federal reserve notes? People are using hours based systems which are a form of paper money and they are using bitcoin and digital currencies a form of credit. Interest steals from people and drains the life out of an economy so yes it is immoral.

Ooops, typo..

……….but a gold or silver coin will ALWAYS be. [period]

„Saving should be done through assets, not cash.”

I’m afraid it is a mistake. Savings through assets lead to speculation and asset bubbles.

I have small improvement to the great Gesell’s concept.

The goverment/community should run special personal bank accounts for savings. Personal savings in this public institution should not be charged with negative interest rate.

Savings reduce money in circulation. The community runs savings accounts and knows how much money was taken away from the economy. Valuable knowledge. Savings are safe and do not diminish.

Money shouldn’t be saved, instead wealth should be saved. In the SCD economy, money is always available and ready to trade for wealth. A money savings account is contrary to the purpose of SCD. It’s a mistake to allow money to retreat and out-wait labor. Capital cannot be allowed to be above labor’s output (goods and services), otherwise we give Capital unwarranted advantage. When we make Capital above labor, we have given the floating entity called money too much power. People become fixated on acquiring money and it consumes their mind.

This author says it better than I can:

http://www.secondspring.co.uk/articles/borruso.htm#8back

“When demand is not satisfied with the amount of tribute expected, as happens in time of prosperity, it withdraws from the market, causing economic stagnation, deflation, unemployment and depression, as happened in the years 1932-39. This is the reason for the economic cycles, not the sun spots as Prof Jevons (1835-82) in all seriousness proposed, or other queer reasons offered by conventional wisdom.” …. And

“The undue advantage [Capital] is embodied in a tribute that supply is obliged to pay to demand. Either supply lowers prices to the level imposed by demand, or pays interest to get a loan of money. Gesell identifies usury with this tribute, and not with theories of “fecundity,” “productivity,” “profit,” “missed gain,” “money that works,” “excess interest,” or “exploitation.” Usury is a form of power. From this primary imposition it gets transferred to everything that demand and supply exchange, from capital to consumer goods.”

Our “savings” will be in the form of wealth, maybe share percentages in other people’s homes, maybe in certain businesses, in art, education, health, etc. The market won’t be driven into booms and busts because the money system no longer has unwanted positive feedback in the form of leverage, usury, or volume displacement.

Asset bubbles are a matter of volume Robert. Savings diminish effective volume. Prices should allow to be set by supply and demand with optimally circulating money. Once that equilibrium has been achieved, there is no possibility of price inflation or asset bubbles.

In a world of “opaque” balance sheets and Special Investment vehicles, I suggest that stocks could not be considered a place to represent or store wealth. Please note; Money is credit in circulation. Credit comes from shared belief ie trust in the other party in a transaction. Currency is only a clue of this cycle of relations between people. Therefore any theory of money must allow for the spirit that makes wants measurable. The provision of currency and credit is a religious experience linked perilously to nationality. Good luck in choosing the God that regulates this system. Thanks rduanewilling

Your GOD is a floating entity. He is money of a bearer type. Because this money type can demand services/goods paid to the “bearer” with no questions asked, the money GOD has been imputed with powers. We gave him those powers as our creation. Do this experiment: Go into a crowd and hold a $100 dollar bill in the air. See how many people look at you and how many people eye the money. This form of money, has the Godlike powers to make people disconnect that bill from you, their eyes will go toward the “bearer” bill. Pay the bearer upon demand -this money has the power behind it, and that power is law, force and faith agreement.

So, what about law and force? Our civilization creates law and force institutions, and we use money to settle transactions. Therefore, this floating entity has now taken on legal ramifications, as money is used to settle contracts.

But law has this other interesting character. It is usually codified in advance, and in full daylight. We can use this nature of the law to our advantage. I cannot change the predatory nature of humanity, but law – done in advance, has the opportunity to work for our better angels. Sheriffs are a good example; typically they work in full daylight and faithfully execute their job. Since magna carta times, they have worked for the people, and usually to good effect. Private money created in the dark and controlled secretly will always give the God ugly powers.

The framers of our Constitution worked in daylight; many of them sacrificed their own life and liberty to create a system of lawful governance. Any predator in this scenario is soon found out and ousted.

The monetary authority is like a sheriff. They issue and control the people’s money for them. The GOD has been collared. The Wolf has been turned into a dog, who works for us. Demurrage changes the nature of the independent bearer entity we call money. It gives it a kick in the behind and makes it move. The tax shackles the God to its owner who must pay the tax. The Tax makes the unit come up to par, so inflation cannot be a perverting factor. Because it moves, it doesn’t easily hoard, thus perverting the volume in supply. The tax is respent into the supply, so it is non-usurious. Any MA agent who circumvents the law will go to jail. All they have to do is follow the CPI, and that is in full daylight. If MA illegally spends the tax, that can be easily found out with normal accounting procedures. The MA will actually be constrained under pretty tight “moral” bounds.

For humanity to move forward, we need to control our God. Money signals information to us and sets prices in the market, it must come under control.

Reblogged this on seeds for natural justice and commented:

The easiest and most transparent way of migrating to a usury-free economy is by simply replacing the usurious credit based money supplies of today with interest-free credit. In this way we would be able to do exactly what we always did, but better. However, demurrage is an equally viable way. It may be a little esoteric for most Americans, but demurrage money mimics the ways of the ancients who built the wonders of the world in Antiquity and the Cathedrals in the Middle Ages.

Ross Noble is well known here at Real Currencies as REN for sharing his wisdom generously. He has been creating an approach based on debt-free money, spent into circulation by the people, basically Social Credit. The problem with Social Credit is that it does not end Usury and Noble suggests a demurrage to achieve that.

Under the Islamic system

-Usury is forbidden

-Hoarded wealth is subject to compulsory charity ( a donation to some needy person or cause) at the rate of 2,5% of wealth in possession for a year but above a basic treshold ( about the equivalent of about ZAR3000.

I agree with this comment – 0% interest is the ultimate end to usury. At first glance, negative interest may seem an antidote to positive interest (usury) but when one views the mechanics; we find that many problems associated with usury would remain.

Banks become recyclers of existing money and the money we hold at banks may be lent out to others. Would it still be available to the “savers” if it has been lent out to others? Who would want to lend money for mortgages that may require the “saver” to wait for 30 years?

And, what if there is a bank run? This heightens the concern with depositing money in a bank account where it will effectively become someone else’s asset.

I can see how companies like James Turk’s “GoldMoney” would prosper by such a set of circumstances. GoldMoney allows people to buy allocated precious metals that are held in repositories. The value may be traded with other account holders or the precious metals may be exchanged for currency at will. They would enable people to avoid banks and their “demurrage holding tax” while storing their wealth in speculative assets. There would be many other models created to side-step the demurrage tax, especially for the wealthy (e.g. pirate coves).

Perhaps as an unintended consequence, you would push companies to spend profits as quickly as possible rather than building their balance sheets. If a manufacturer wanted to build their balance sheet, they could pass on the “Three percent per year perhaps is enough” (demurrage holding tax) to others in the supply chain. The next link in the supply chain (e.g. wholesaler) might do the same thing and the next link (e.g. retailer) might do the same thing which would lead to compounded negative interest (interest on interest) and subsequently, a higher cost of goods to the consumer.

In my opinion, a sovereign nation should never indebt itself – if it does, it is no longer sovereign. Treasury notes represent a mortgage upon the private and public property of the Nation.

Pledging private and public collateral is part of the fraudulent sovereign debt scheme. A sovereign nation may directly use its credit alone to issue money – there is no need to incur any debt or to encumber private and public property. Our government has unnecessarily and egregiously leveraged the property and resources of the nation for no reason other than to satisfy the claims of private banks and investors that lend money that they don’t have.

I take it that you mean that the money is created debt and interest free? It is a national dividend of sorts. If so, I like the concept and think we need to find ways to get debt free money into the economy to try and right the “debt is greater than money” imbalance.

It’s hard to project oneself into this world, so questions are only natural:

“I agree with this comment – 0% interest is the ultimate end to usury. At first glance, negative interest may seem an antidote to positive interest (usury) but when one views the mechanics; we find that many problems associated with usury would remain” – “Money stored as bank savings is available to be lent out to borrowers. Savings are at zero percent interest, and made available to borrowers under a contract brokered by banker.”

Actually demurrage isn’t really negative interest. It appears so to the user, because every time they choose to hoard their money, they have to pay a fee tax if their money is not up to par. The Fee is recycled into the money supply by MA re-spending. Think of it as a fee that makes money appear to degrade at the same rate as goods and services. In this way, there is no mismatch of types. Our money medium then matches our output, which is goods and services. We use money to trade our output, and our output in the form of goods and services suffers entropy.

I didn’t treat savings well in the article. Think of your savings account as holding savings stored as shares, or possibly even precious metal. It is up to you how to invest, and your banker is always looking to help you …for his fee. I will suggest that 3% per year may even by too high of a fee in an economy where prices remain stable for decades. In that world, long term investments at 3% may become viable. In this new world, the cost of things drops dramatically, because rents in the form of usury are not embedded in prices. Also, land is not driven up in artificial price because it is no longer they hypothecation source for money creation. I would expect homes to cost a fraction of what they do now, and said home could be paid off in short time frame, probably 7 years or less. Also, the housing stock is likely to be gifted from generation to generation as savings in the form of wealth (not money) grows, and people are no longer debt slaves. The total stock of demurrage taxes is actually very small, because the money supply shrinks. If velocity goes up by 50X, the total money volume must shrink by that amount. The large gift economy sector also does not need money. Taxes are against the volume, not the velocity.

For very high risk investments, your share price of a business or venture is asked to grow at a high rate, not the money supply. If the venture is successful, then the share may command money from the economy when it is sold. If wealth in general is increasing and said wealth is demanding money for trading, the money supply has been following along as MA injects into the base of the population. Remember MA uses CPI to determine injection or drain. China, for example, has a larger money stock now, as their wealth is increasing. Growing the money supply with increasing wealth is non- inflationary, as it matches increased “monetized” goods and services.

All i would add to this wonderful monetary hybrid is that the physical form of social credit in circulation should never be entirely replaced with a digital system. The MA shouldn’t be given more authority than is necessary to maintain the overall volume and authenticity of the demurrage time stamps. A centralized digital card might lead to a Big Brother MA being able to unlawfully track, restrict, ration or terminate a person’s credit accounts. Physical credit units preserve one’s freedom to spend and pay for one’s debts without hindrance and as one chooses.

PM, We keep running into the predatory nature of man don’t we? In the alternate currency movement, it permeates our thinking.

Actually, I’m worried about the government going rogue and surrounding the MA with tanks and telling them to inflate the supply because war drums are pounding, or a false flag event was foisted on the people.

The MA is to restricted to very tight bounds, a very narrow focus, and should have independent review. At some level, civilization needs an institution it can trust. Keeping everything in broad daylight and exposed is about the best we can do. If we cannot do that, we don’t deserve civilization. I personally think there are trustworthy “sheepdog” people walking among us in the population. Most of the people who visit this site would be good candidates for MA employment.

But, I agree: There should be no unlawful tracking, restriction, or rationing – the people are to have maximum freedom, which is why I wish them have their own money.

However, be wary of the physical unit’s design. For example, the physical form in the past e.g. gold and silver, has been used to control the abstract ledger (clay tablet) figures. Predators in the population cannot be given the money power.

My view: We are now hurtling into the future, and all money is becoming abstract numbers in a data base. Worse, credit money as an abstraction is controlled by illuminist private entities who hypothecate and use usury to fund tyranny.

How to handle the physical form of money, how to construct the MA, how to staff the MA, is up for grabs. We can figure it out, I’m making initial suggestions here and I definitely appreciate any thoughts to making it work. Synergy happens in a team, and the end result is always better than that created by one person. There are bound to be holes and details not considered that will need patching.

Also, this construct is difficult to grasp at first, because it is a reality unlike what we live in today.

As long as the physical units have not intrinsic worth and are subject to negative interest, i don’t think they could pose any threat from predatory speculation.

Of course, the only way to really test this system would be to let a pack of hedge fund/k street gorrillas https://www.youtube.com/watch?v=8C-e96m4730 try to game it.

Reblogged this on VolsHours.

These are some of the questions I’m getting:

1) I don’t understand the negative tax

Answer: It’s a tax or fee on money. That’s all. When you choose to spend, your money may have decayed, and you have to make it come up to par. You pay sales taxes, and income taxes now, don’t you? This is a small tax relatively speaking, and it is targeted to where it has an outsized “good” effect.

2) But, I want to save my money.

Answer: Go ahead. Save it. Three percent or so a year is pretty trivial. Especially, when compared to what we are paying now. Inflation is a tax, and it is probably about 4%, even in our stagflation economy. How about the cost of usury embedded in all goods and services, which amount to about 40%. So, which is better? 3% demurrage or 44% in today’s current environment?

3) Instead of hoading money, won’t people try to corner the market on goods? Say, maybe gold?

Answer: Go ahead – hoard goods. Demurrage is only concerned with hoarding the means of exchange. Corning the market on goods is a form of rent taking, and that arena falls to the government. Cornering the market on goods is visible, and hence easier to find and prosecute than our current “money as wealth = savings” paradigm.

4) But, I want to loan out my money and make a good return:

Answer: Good luck with that. You have to compete with other people also willing to loan out their money. If you can get 3 or 4% return on your money for a risky investment, you may loose it all. It is your risk and your money.

Some other important considerations: The supply system is front loaded with money, as each chain in the production cycle is funded. This breaks apart big vertically integrated companies. Small companies proliferate, and the people become owners in the commonwealth. The market then prices labor, so rents in the form of excessive labor takings is damped. Conversely, those whose labor is being stolen, will now instead have access to new jobs where they are paid properly.

>>>>>>Money is not wealth

satire from the 1830s; the source of the wisdom of these new faningled monetary reformers is the great (and other) financier(s), Mr. Biddle:—

Monday. McThwackem lent me to-day a dissertation by a learned professor in a South Carolina college, intended to prove that “money is not wealth.” Ah, these professors in colleges, they are the men ! Surely wisdom was born with them, and when they die, wisdom will, I fear, die also. One of them, (he belongs to the University of Pennsylvania) not long since proved, or attempted to prove, that “all the use of metallic money is to create a confidence.” Now his brother of South Carolina proves, or attempts to prove, that “money is not wealth.”

But wasn’t Silvio a spartacist, an Illuminist ? thereby a satanist ? (what heroes pick you for yourself you pious boy?)

>>>>>Saving should be done through assets, not cash.

We have already discussed that what you propose is to take this drunken sailor money and run to the nearest stock market and speculate; you and Larry leech want these illuminatist notes to maintain their purchasing power for a period, while ye acquire your silver pieces, but for the rest of us, they should expire by friday.

if money is not, or should not be, a store of purchasing power, why should it have purchasing power at all, why not expire at the moment you receive it ? if money should store purchasing power for the first 5 days, then you just contradicted yourself.

There are several examples of in history of expiring money, when people had to run to the store and spend their earnings because it would loose its purchasing power by the end of the day — a lot of good this hyper velocity did.

So how would this work? how would you save up for an automobile if your money looses 52% by the end of the year ?

What people actually did in the olden days, was that they prepared for the winter, preserved and stored up food; food that did NOT expire, but lasted until the next harvest

Money circulates in a society just fine, no need for mandated velocity stimulation. During great and not so great depressions –and during periods of less then full employment– it is purchasing power and per capita quatity of money that is lacking, and not velocity.

(please learn from Mr. Kitson –he did not go bankrupt and was not an Illuminist, as Gesell)

>>>>demurrage money mimics the ways of the ancients who built the wonders of the world in Antiquity and the Cathedrals in the Middle Ages.

This is a bold faced invention of the usual kind; when the cathedrals were built gold/silver alone was considered money (perhaps you could post the story of the financing of construction of the cathedral at Reims ?); construction of temples of the middle-east were financed how ?

http://www.tomwoods.com/blog/the-greenbackers-fake-quote-industry/

http://realcurrencies.wordpress.com/2012/08/02/lincoln-was-indeed-a-money-power-agent/

What has Mary E. Hobart writen as to what money is? she quoted Bastiat, because she was under the impression that money should store purchasing power:—

You have a crown piece. What does it mean in your hands ? It is, as it were, the witness and the proof that you have at some time done some work which, instead of profiting by, you have allowed society to enjoy in the person of your client. This crown piece witnesses that you have rendered a service to society, and, moreover, it states the value of it. It witnesses, besides, that you have not received back from society a real equivalent service, as was your right. To put it in your power to exercise this right when and how you please, society, by the hands of your client, has given you an acknowledgment or Title, an Order of the State, a Token—a crown piece, in short, which does not differ from other titles of credit (Promissory Notes) and if you can read with the eye of the mind the inscription which it bears you can distinctly see, ‘Pay to the bearer a service equivalent to that which he has rendered to society. Value received stated, proved and measured by that which is on me.’ After that you cede your crown piece to me. Either it is a present or it is in exchange for something else. If you give it to me as the price of a service, see what follows : Your account as regards the real satisfaction with society is satisfied, balanced, closed. You rendered it a service in exchange for a crown piece; you now restore it the crown piece in exchange for a service. So far as regards you, the account is settled. But I am now just in the position you were before. It is I now who have done a service to society in your person. It is I now who have become its creditor for the value of the work which I have done for you.

Money circulates in society just fine when it is taxed. In Venice, the government bank spent the gold and silver specie forcing it into currency movement. Most of their money was actually abstract numbers on the ledger. In the Greenback era, the “backers” wanted to export 2X more than imports thereby forcing specie into circulation. In 1909 when government allowed bank money to be good for taxes, that forced government to not spend specie (pay to their employees). In effect, by not taxing and then spending specie, it forced it to not circulate. It also made crap bank money, based on debt, exchange for floating money.

I can see it is going to be a long haul to bring everybody to a common understanding. There is a common thread that runs through economics. Velocity and Volume and money types are a big factor that are not comprehended apparently.

SCD money does not perish, it spins in the economy forever. It is actually a hard currency. The hardest there is, because it is brought up to par by the holder. The unit is almost always the same size and shape barring some small inflation. It is issued and floats in the economy, and it is a sovereign currency. I’ll say it again, it is a sovereign floating currency much closer to gold and greenbacks that Gessel’s money.

And so, credit money that actually does disappear is better? How? Greenbacks that are converted by banks and then trapped in their reserve loops are better? Greenbacks that are recalled from the stock market during the harvest cycle, causing a panic was good? Gold money that is trapped and not spent has been good for us? Most systems throughout history had fatal flaws.

I can also design a specie system that works. But, once again, it all depends on taxation and the system design.

Correction, Gessel actually did want to spend directly from government, only he used the physical form of paper notes. I’m suggesting the intangible ledger form of money can be brought under control. Gessel also wanted government to spend into existence, similar to greenbacks, thus taking first seigniorage. I disagree with that, the people should get benefit of new money first.

The Worgl experiment was currency once removed, where the demurrage floating currency was based on a stock of stored Austrian Schillings.

you are building a straw man; don’t compare your figment to bank currency, compare it to real currency

the answer to usury is not drunken sailor money; the answer to bank-notes is not drunken sailor money

>>>>I can see it is going to be a long haul to bring everybody

you seem to be confusing yourself with somebody

>>>>> it spins in the economy forever. It is actually a hard currency.

yes, it spins until it achieves escape velocity

No, it is the most worthless currency, that is why it drives into hiding everything that is valuable

>>>>>I can also design a specie system that works.

No need; it has been put to practice (successfully) 200 years ago.

http://www.yamaguchy.com/forum/index.php?topic=6.0

http://www.yamaguchy.com/library/duncan/charter_07.html

http://www.yamaguchy.com/library/uregina/bailey.html

for more than 100 years, now, 1 kilogram is the weight of water 10cmx10cmx10cm at 21 degree temperature; it has not changed; in fact, care is taken that the etalon in France is maintained/preserved, to which every weight and scale is compared.

But, somehow, ye want the measure of value to change by government mandate, by Friday; why?; from where have ye acquired this idea of the constantly shrinking measure of value ? who is your mentor ? who is your fountain ?

i had to laugh at the escape velocity quip. Name, we all respect you – well at least I do. You’ve probably spent your life digging through archives and bringing valuable information available to us.

Yes, some of those systems worked in the past, and they were also usurped. I’m going to diagram them next. YOU are my mentor.

Ironically, demurrage money is the only one that doesn’t shrink in value. I know, it is like saying right is left and up is down. Labor energy is input to the money unit “volume” and makes it come up to par. The unit is forced into not shrinking.

All other money types do not match labor, and they often have problems when they are floating as demand. All of the other ones are not a measure of value. And of course, Gessel would say, “There is no such thing as value, there is only price.” My addition is that there can only be accurate price when markets work right. And markets don’t work right when the money unit is not constant.

Figuring out value, like Marx tried in two volumes, in my opinion – is like trying to figure out how many Angels can dance on the head of a pin. There is only price, and that is determined when people bargain. Markets discover price, not value.

Take care,

REN

>>>>Gessel would say, There is no such thing as value, there is only price.

But, as we know, Gesell was an Illuminist, and not a bright person, either:

value and price are two completely different things: a hammer has value and it also has a price (price is determined by cost of production and demand; value by usefulness and sentiment)

neither was Gesell an expert on money; he simply tried to invent something new for the sake of inventing; he did not know that nothing new can be invented about money

Your class-room computer model is just that. The hyper inflationary periods were the closest things to a real life experiment/experience; when the whole of the money supply lost ist purchasing power by the minute; the hyper velocity (stimulated by the hyper loss of purchasing power) did not do any good for the economy

The Alberta Prosperity Certificates (which demurred 1% per week) piggy-backed on the stable Canadian Dollar (so did the Gesell scrips). During the same period over a 1000 municipalities issued certificates (scrip money) to supplement the volume of money –because the great depression and those 7 years of leaness wasn’t caused by the slow circulation of currency but by the reduction of the per-head volume (the baloon of Migchels’ much vaunted credit-system burst and money was wiped from existence)

DMC money isn’t piggybacked on anything other than the labor energy of the people, and the credit of the nation.

Balance of payment problems lead to hyperinflation.

“Never in History has it been domestic…It is always a balance of payment problem e.g. debt”

Now, avoiding sophomoric ad-hominems – how is it possible to have balance of payment problem when the money itself compels foreigners to re-spend, and hence there is no mechanism for debt growth?

On Hyperinflation, per Dr. Hudson

http://michael-hudson.com/2012/08/fireside-on-the-great-theft/

“The municipalities would receive dollars, and turn them over to the Reichsbank. It then would issue German currency against this for local spending – using the dollars to pay the Allies. The Allies would pay America, and that would keep the circular flow going. But to do this, interest rates had to be held down in the United States, to make German and other European borrowing more profitable for international lenders.

The same thing happened in Chile, which is another textbook hyperinflation. Rogers wrote a book on the process of hyperinflation in France that also occurred in the 1920s. The classic study of German inflation is by Salomon Flink, The Reichsbank and Economic Germany. The book actually was printed in Germany at that time. The same thing happened in Russia in the 1990s. The Russia hyperinflation occurred as a result of the depreciation of the ruble. This was already determined in advance at the meeting in Huston, Texas, between the World Bank and the IMF and the other Russian authorities. All this was published at the time, even before break-up of the Soviet Union. So to talk about hyperinflation as if it is a domestic phenomenon is to ignore the fact that never in history has it been domestic. It always is a balance-of-payments phenomenon, associated either with war or a class war, as in Chile’s case.”

>>>>Balance of payment

I do not make it a question or a problem, you is the one building up a straw man, again. (it seem to zoom over your head that i was referring to practical experiences when the whole entire currency consisted of units that expired rapidly, and people were hyper motivated to pass them on hyper fast; ye have no practical example when currency was 100% demur –until then, it is just a class-room computer model….. your model may require more time to achieve escape velocity, but it would)

There is NO balance of trade problem; this artificial problem is produced by bankers (without whom ye seem to be un-able to exist); in normal (banker-free) society trade would be what the dictionary says “trade” is: exchanging goods for goods (and not goods for bank-book entry)— merchant takes a boat-load of product from one country to another, sells it, buys something and takes it back home or to a third country; you may bring into the country any goods you want, you may take out of the country any goods you want, but you may not take money out of the country (perfect natural trade, free trade, trade balance)

Yes, with positive interest humanity should have a third currency. The third currency intermediates between sovereign types. This then gives politicians time to intervene and work out political solutions to debt. Keynes Bancor is a good example. But, then the schemers will likely take over the third currency, and we descend back into debt.

Napoleon forced balance of trade rather than let his money be manipulated, but his republic was then taken out by scheming Kings and Queens in league with private money powers. So how are foreign powers or private money schemers going to take out a money type they knowingly traded with, which has demurrage coded into its DNA? By knowingly accepting and using the unit, they have accepted it as contract. They then accept that it will “go bad” and are compelled to send it back to its country of origin, thus buying goods and services.

Why bother with political solutions like Napoleons? Mercantilist and scheming foreigners will look down at their SCD money and know they’ve been beaten. They beat themselves when they accepted it in trade.

The unit doesn’t expire. Do people suddenly stop working and paying taxes? Does the earth stop spinning? People bring it up to par with a fraction of their labor energy, and the MA will respend what little excess they have. In fact, the tax may not even create enough revenue to pay for MA bureaucratic costs. The MA creates new units if needed. The money supply is always full. The idea that the money disappears is phantasmagoria. The idea that it is based on, or propped up by another currency is equally invalid.

I think that you cannot set the interest rate on saving accounts to zero and interest on loaned money to zero. There have always will be ricks such as dead of borrower or some other circumstance that will lead to default on loan. So the interest on loans maybe higher than zero. It can be some sort of year tax, not compound interest, but it cannot be zero. If it is exactly zero, one default on loan will cause a bank to not have enough money to return them to the saver. So that means that interest on saving account maybe positive, if bank performs well, or negative, if bank is performs bad. In reality we will never have tax free credit, maybe interest (usury) free, but not tax free. Money authority will have to watch usury rates in banks and adjust demurrage tax according to them. Usury have to be kept as close to zero as possible.

And I think that you have to state that money with demmurage will be the ONLY legal tenter of the country and government taxs will be payed ONLY with that form of money.

Good thoughts Dark, thanks. The savings account is filled with paper assets, some of which are holding value at zero, and some are appreciating much faster. But, the money supply only grows relative to the general economy. If you need a chunk of money to trade for another asset, you simply sell said asset. There is always money in the economy ready to trade.

Zero interest rates will be an outcome of the system over time. At first, there will be positive interest on money as people will be suspicious. A system that doesn’t have busts and booms is off everybody’s cognitive map. Being able to readily sell assets without losses is also off people’s map.

Yes, it is the only legal tender. Also, consider that mutual credit will likely work well as an adjunct in this system. This form of legal tender holds its value. It is something like a liter bottle. The size and shape of the bottle are constant. The user has to fill it as part of the usage “fee.” When the user trades his money unit, it is filled and has the right shape. With inflation, the unit shrinks, and makes market economies work poorly due to bad price signaling.

Creditors are people who have extra money to loan out. Banks are trusted intermediaries between people. Creditors have excess money to loan out, and they are compelled to loan their money out because of the tax. Debtors want to borrow because they have desire. If the Debtor doesn’t pay back his loan, the Creditor takes it in the shorts. The Creditor looses, as he risked his money when he loaned it out. It has nothing to do with bankers going bust, because banks don’t make money. A bank cannot go bust, as they work only for transaction fees. Creditor risk is lessened because SCD is lawful money and the law will be invoked when the credit/debt contract has been broken.

Any new money that enters the system is created -debt free and from nothing – by the Monetary Authority. The MA does’t spend it into existence, but gives it to families. But, most of the time, the money supply is simply recirculating, as money mediates between creditors and debtors.

Think hard on this: A creditor is pushed to loan or spend due to the tax. A creditor is pushed to invest in the commonwealth – that is business or enterprise, in order to own shares in the economy. Risk/Reward ratios remain, but they are now in the “share” part of the economy. Risk/Reward is a pulling force rather than push. You gamble by taking risk on enterprise, and if it pays off, that “share” instrument grows i.e. pull. Great, you just became rich as your gamble worked out. Trade your now grown share for another form of asset, and there will be money in the supply to allow that trade to occur.

Liquidity preference theories and “time” preference theories become nonsense in SCD world. The behavior of bankers changes also as they become agents of the people.

Vile, anti-semitic cartoons:—

http://projects.vassar.edu/1896/0415csm.jpg

http://projects.vassar.edu/1896/0820csm.jpg

http://projects.vassar.edu/1896/0621dnr.jpg

In today’s debt money world, we borrow for student loans in order to acquire a ticket to the middle class, and then we borrow to buy housing. Borrowed money is created from nothing and usually collateralized against housing. Credit money of this type represents a tax against the future. The money supply in the future needs to be larger in order to pay for the borrowing of today. It is something like walking inside of a funnel, where what is in front represents needed future money, to pay for the debts accumulated behind us. The funnel shape is a function of the exponential of usury applied to money originating as credit/debt.

But, markets are pushed in the short term and this function is outside of usury. If a property has $1M cash flow, at 20% interest, it can generate a $5M loan. If interest lowers down to 5%, that same property can generate a $20M loan. The low interest rates put people into a bidding war, driving up property prices in an asset bubble. The highest bidder wins, and hence rents are capitalized as debt+ usury flows to the banker. The cash flow from the property now vectors to the banker. Between the costs of housing, student loans, regressive taxes on social security, Obamacare – the population has maybe 25% of their output left over to buy goods and services. Labor cannot trade with other labor fairly as the money exchange medium is siphoned away. This is debt deflation, also called balance sheet recession.

In SCD world, this cannot happen. The money type does not originate as credit. Money is simply in the economy and represents goods and services. It matches our output, and we produce goods and services as our labor.

Because the money itself is different, then banks have new meaning. Banks become vaults where accountants manage said money. Money is not created at banks. Money already in supply comes from the past, and represents past wealth. Demurrage tax insures that money is available in the supply, so labor can exchange their output.

For example, a hammer manufacturer in today’s world cannot sell his hammers to a population who only has 25% available to trade for goods and services. His hammers as goods and services become less “valuable” and he has to lower prices to attract the scarce money. In the meantime, the owners of capital on the receiving end of debt flows can buy now depressed goods and services relatively cheaply. This causes the population to split into financial plutocrats vs the laboring poor – it destroys the middle class.

SCD money tax is calibrated to allow labor some small savings, hence there is a non-punitive savings buffer. The small tax is enabled due to Pavlovian nature of man. Man can be trained to think money is his God, or he can be trained to think money is an exchange medium. Since man swims in the money environment, he will take his cues from said environment, thus the money system guides his behavior. This is not drunken sailor money forcing man to spend recklessly. Instead, it forces him to not SAVE huge drunken amounts of money recklessly, thus disallowing savings from damaging volume in supply. The calibration can be done against savings only if necessary, since velocity money is already in movement and doing its intended job.

All usury capital is stagnant floating money. It has come to rest and wants to out wait labor. The nexus between usury capital and legitimate savings are very close. In SCD world, large amounts of money for exchange can be had by selling saved assets. Supply and demand start working properly because money has become a fair marker representing our output.

In the old days, certain money would circulate faster because it was overvalued while other money was hoarded because it was undervalued. For example, let’s say you have 2 coins, each marked 1 shilling, but one coin (overvalued coin) is clipped, debased, light, or contains less silver than the other (undervalued coin). Both are worth 1 shilling but the clipped coin would circulate while the undervalued coin would be hoarded, as per Gresham’s Law. However, Gresham’s Law doesn’t only apply to gold/silver coins, as I will proceed to prove a priori:

Let’s say Ron Paul was elected President and implemented a plan to circulate new gold-backed notes alongside the current Federal Reserve Notes. According to Gresham’s Law, what would happen? Imagine that you have 2 notes in hand, each worth $1; one is “backed by gold” but not convertible to gold while the other is just a piece of paper. Now you want to buy a $1 candy bar. Which note do you spend? The rational profit seeker will hoard the gold backed note and spend the Fed note. Even if not everyone does this, the gold back notes will (via probability) eventually end up in the hands of a rational profit seeker and eventually the gold backed notes would be removed from circulation and hoarded, leaving just the Fed notes to circulate.

How does this apply to demurrage money? If each unit has a different expiration date, then at any given time some notes will be closer to expiration than others. What would the rational profit seekers do? Spend those notes that are nearer to expiring while hoarding those with ample time remaining. Those individuals and institutions (like the banks) who handle the most money (i.e. the wealthiest economic players) will hoard new units and circulate those near to expiration, which would likely be disproportionately pawned off on poor laborers. There is nothing to prevent private individuals from hoarding new units and dumping old units off on the poor. Moreover, encouraging notes to circulate (which would happen rapidly as they came near to expiring) is the same as encouraging people to make money “chase goods,” which creates demand. This is good to a point, but if demand skyrockets because people keep trying to speculate against nearly expired notes (i.e. nobody wants to get stuck with almost expired notes, so they try to dump them off on someone else, who will then do the same thing to someone else), then prices will go up. Moreover, international merchants might reject demurrage notes, thus hurting the nation’s international purchasing power.

Just as alcohol prohibition didn’t work and marijuana prohibition does not work, the state cannot eliminate lending at interest as long as people willing enter into usurious contracts. Likewise, the state cannot prevent individuals from spending old notes and hoarding new. If such an endeavor were tried, it could only succeed via complete economic authoritarianism (state owned businesses, banks, and savings accounts). Yet if you say that the accounts of hoarders will be taxed rather than the units themselves expiring, then you aren’t actually arguing for demurrage. Instead, such a system of taxing the accounts of hoarders would be nothing more than a convoluted progressive tax which, just as the current system, would be unnecessarily confusing and could still be corrupted by greedy people in positions of power.

Long story short, I think demurrage would favor speculators and the wealthy while hurting the poorest savers. However, not to be a total douche, I do think that social credit without demurrage is a wonderful idea.

I apologize if I misread the “date stamp” as an expiration date, as referred to in accordance with arrow #1. Upon closer reading, it seems that I read the expiration date into the “date stamp.” But as for this date stamp, would each unit of currency get a new date stamp after each exchange? Or would it be a one-time date stamp when that unit was created? If it is a one-time date stamp (for the unit’s date of creation), then the date stamp doesn’t actually help the MA know for how long a unit has been hoarded. But if each unit gets a renewed date stamp after being involved in a transaction so that the MA knows how long each currency unit has been hoarded, then couldn’t 2 speculators coordinate and make unproductive exchanges between each other simply to renew their units’ date stamps and avoid the demurrage tax? For example, let’s say you and I have $100 each and $100 worth of gold each. If you bought my gold with your $100 and I bought your gold with my $100, then we would have engaged in an unproductive exchange with each of us having lost then regained both our gold and $100. However, the exchange would lead to our date stamps being renewed, thus temporarily safeguarding us from the demurrage tax as long as we keep making unproductive exchanges. If labor is held to be the only exchange worthy of renewing the date stamp, then there is still nothing to prevent 2 speculators from playing the same game. For example, I mow your lawn for $100 or $10,000 and you mow mine for the same agreed price, thereby avoiding the demurrage tax. But mowing each others’ lawns instead of our own doesn’t actually do much for society and because we can set the price however high we want, we could just use it to renew the date stamps on our money and avoid the demurrage tax.

Another issue that comes to mind involves arrows 1 and 6. What if revenue to the MA from arrow 6 is constantly smaller than the outflows from the MA via arrow 1? Does this mean that the MA will create new money? Or will it just be starved of funds? If it does create new money, what prevents it from over-producing money? Is the MA restricted by a fractional reserve of a finite commodity, like gold or silver?

Either way, I’m convinced that if the currency units themselves don’t expire, then demurrage is nothing more than an overly complex progressive tax.. But it’s an interesting thought and it’s nice to see other people thinking about this topic, since monetary reform is a great interest of mine.

This is just the sort of intellectual stress test a monetary system needs before its released into the wilds of the market place. If there is an exploitable weakness, the criminal minds of the austrian school are sure to find it.

Tom,

The money unit is intangible “ledger” accounting identities. That means the tax can progress evenly along with time, probably based on minute or second increments. Goods and services also tend to “rust” slowly, and do not have a discrete step function. In this way, the tax exactly matches entropy on goods and services, so money can then mirror as a good during the moment of transaction. Intangible money does not need discrete “stamping -taxing” intervals.

People often confuse the physical form of money with the intangible. When in reality, money is something like mathematics, an abstract unit created by man’s imagination. When it is on the ledger, we can then make the intellectual leap and allow information to be coded along with money …In this way the intangible is something other than just divisible numbers. With SCD the unit will have a code from which the tax can be calculated. In this world, we are swiping cards or shooting information via our cell phones. This electronic world is upon us now anyway. This new electronic world uses debt free SCD money to do transactions at low cost, despite the tax. The tax is a tiny fraction of the cost of our current double entry credit money system.

The code assigned to the unit is stored along with the units money number. Modern computers can easily handle this. Before you use the unit in a transaction, you have to input the tax. The taxing interval is then up to you, the money user. You pay the tax when you put your money into motion. You make it come up to par in order to use it. Private bankers can be audited by MA agents to make sure the accounting software is not bugged or gamed by criminal elements. No tracking software is allowed by law. The only thing that follows the unit is its code.

Criminal intent finds entry here, with code breakers trying to game the system to not pay a tax. But, I suggest later that criminals will not be using this money. And, if they do try to game this money, and get found out, then sovereign society will deal with them – probably harshly. The risk/reward ratio is very high for trying to get around a minor tax.

Note that I suggested the physical form should have high carry costs, and I did not mention stamps. It might be possible to use stamps, but I haven’t figured how to make it work yet.

This is a new type of system, where the “credit” issued is really floating money. It is seigniorage, and it is compelled to move based on taxation inherent to the unit. People will prefer to use the intangible form because it is less hassle. The tax is minor and is designed to train the human to not hoard. If people want to convert SCD to some other form of money, they can go for it. The monetary authority will simply reduce the sovereign money supply accordingly.

This legal sovereign money is an anchor, where the unit holds its value by incremental labor input via the tax. The unit holds its value as volume is controlled. This unit will also anchor markets as it becomes a reference marker. It has the force of law behind it, and is the unit used for paying taxes and consummating legal contracts. Since it is an anchor, then other currency units can revolve around it. People would soon find out that “other” currencies have risk, especially inflation and crashes. Equilibrium will come about eventually, as people become trained.

Most likely criminals will be driven into other units, maybe even gold or silver. People can trade whatever they want. They are free. But, they are not free to mess around with the sovereign currency. Wall street land sharks are free to hoard physical SCD currency units and try to gain some advantage. But, if the physical form is recalled periodically, or maybe it is large ungainly coins, people will shun it.

To my mind, the physical form is actually the main weakness of this system and must be purposefully designed. Recalling SCD physical currency from time to time, and then heavily taxing large accumulations would do the trick. Also, keeping the denominations small would add to the hassle level, and drive criminals into other currencies. No criminal will want to be caught with a large amount of paper notes subject to random recall – and then subsequent taxation.

Thanks for excellent thoughts on this most important issue.

PM is right, in that any system should be tested, and stressed to see where the weaknesses are.

Regards,

REN

I’m coming closer to understanding how you envision that this SCD money will function now, particularly with the small time increments for demurrage and the tax being paid when money is spent, but I’m still not quite sure of what you mean when you wrote: “This legal sovereign money is an anchor, where the unit holds its value by incremental labor input via the tax. The unit holds its value as volume is controlled.” When you refer to this “incremental labor” that will hold each unit’s value, what do you mean? Does this labor refer to the act of taxation, or something else? If this “incremental labor” is simply taxation to control the unit’s volume, then you could/should probably say so in simpler terms. If “incremental labor” is not referring to the taxation of the money supply, then you need to elaborate because you lost me (whose labor? what is the nature of this labor?).

I’m also still skeptical of demurrage in general. It seems like a good way to increase velocity of circulation, but social credit without demurrage should also increase velocity of circulation because when more people have money (disposable income and investment capital) then more money is spent and velocity increases anyway. For this reason I think demurrage is unnecessary if you can establish an effective social credit system, preferably one in which the government destroys/retires an appropriate amount of its tax revenue in order to keep the total volume of money under control. Judging by apparent desire to keep the monetary authority autonomous from the state (and the recipient of its own demurrage tax revenue), I anticipate that there will be skepticism regarding the inclination of the government to destroy tax revenues. However, all credit systems (bank credit, social credit, etc.) must be trusted in order to work, so only an incredibly negligent or treasonous government would intentionally destroy its own credit system, but what is to prevent such a negligent/treasonous government from usurping the MA’s authority? The point that I’m trying to make is that (1.) if the demurrage tax is designed to withdraw money from circulation to keep the volume of money under control, then the same goal could be achieved via other taxes. (2.) Any government bent on destroying its own credit system will be able to do so, with or without demurrage money.

My final critique is perhaps the most important because it has to do with popularizing SCD as a monetary alternative. In order to achieve monetary reform, you must have a popular platform that appeals to the mob. When you start talking about “training humans” and punishing savers with more taxes (and taxes are historically unpopular), then you’re shooting yourself in the foot. I understand that demurrage is intended to be a minor tax, but you can’t guarantee that it will stay that way. Moreover, hoarding money can be a good thing. Saving wealth in the form of assets is feasible, but in order to realize their value, you have to sell those assets and you may lose money on the sale because asset prices can fluctuate wildly. Some people, like widows and retired people, would probably be better off if they could just have a cache of cash.

My final point, which goes along with the “hoarding money can be a good thing” argument, involves the quantity theory of money. In your last post you wrote: “The unit holds its value as volume is controlled.” Obviously if the volume of money changes rapidly then it can destroy trust in the credit system and cause problems, but the volume of money can change (let’s say increase) without causing prices to increase (at least not too much), so long as the increase in the money supply isn’t exorbitant. This is because money plays an active role in trade, rather than a passive role. In other words, when people spend money on goods or services, they create demand. Sometimes this is referred to as money “chasing goods.” When demand goes up way faster than supply, prices rise. The wonderful thing about hoarding money is that it allows the supply of money to be somewhat larger without prices going up (so long as trust is maintained, since people won’t be inclined to hoard an untrustworthy currency – just look at how people behave during a hyper-inflationary event), because hoarded money is not chasing goods. Furthermore, controlling the volume of money does not necessarily control prices, since fluctuations in the velocity of circulation can always change the levels of demand and, of course, fluctuations in the supply of commodities (and services) is always capable of changing independent of the volume of money.

I’m interested in hearing your thoughts on this and particularly on the topic of hoarding money.

here’s some input on hoarding Tom: http://realcurrencies.wordpress.com/2012/06/19/dont-hoard-the-means-of-exchange-part-1/

There are also parts 2 and 3, you can find them with a google search, I have to reorganize the site to make these and other articles more easily accessible.

Tom,

Answers to paragraphs above:

1)Earths gifts + Labor = all economic activity. The tax on money changes the nature of money. A unit of labor is the most indivisible unit that money can represent. Goods and Services are another way of saying it, but goods and services are an output of Earths gifts + Labor. Therefore, an input unit of labor into money is a tax on labor. Taxing unnatural accumulations (rents) on Earths gifts belongs to the other branches of Government.

2)Traditional Douglas type Social Credit pumps sovereign money into households without regard for inflation. Credit is an improperly used term, when it is really floating money. The only way to drain money out of the supply is to tax it. Money does not want to self-liquidate like bank credit. So is it ok to tax anything and everything but money itself? That type of thinking shows a love of money as wealth, not as an exchange medium. Taxing money is the most effective tax, because it makes money behave as an exchange medium. Taxing money is like pressing on a large nerve ending, as it has outsize effect relative to the pressure. Because Douglas type social credit has inflation as a key component to its model, it makes markets go haywire. With inflation, markets cannot deliver good pricing signals, and hence Douglas Social Credit cannot work by definition. The inflation aspect of Social Credit, and the willingness of politicians to bribe for votes, makes retiring excess Douglas social credit money unlikely. The demurrage of SCD may drain the supply slowly if MA authority chooses to not respend. There are other ways to drain, for example offering bonds. The Federal government can also drain if they wanted to, but most likely they will want to tax and recirculate, thus buying votes of a population cohort. Most likely, government will go after and tax rent seeking activity, as rentier taxes will be an easy sell to a population that owns their money.

3)I’m not trying to create a popular movement. I’m interested in the truth, and some will recognize it when they see it. I’m interested in designing a system that solves our money problems, even if it is an abstraction. Fact: People are heavily influenced by the money environment. Fact: People are Pavlovian in nature and can be trained – our illuminist friends know this well. Fact: Our current money system has indeed trained people, hence their desire to “Save” money, as if money is their God. Asset prices won’t fluctuate wildly because markets will be pricing properly, and the money supply volume is full. With regards to guaranteeing the tax rate, the MA can have “laws” in place for deciding rates. Other than law done in advance, there is little to stop predatory humans. Most likely people will try to get a vote to reduce the small demurrage tax, as they will incorrectly think reduced taxes on money are “good.” The widow is much better off as she owns asset portions of the commonwealth, rather than inflating money as a poor substitute for saved wealth.

4)Some hoarding of money for contingencies is OK, hence the minor tax. Excessive hoarding and allowing Capital to be above labor cannot be allowed. Read and understand this key point later in the discussions. Without understanding how Capital retreats and demands usury one cannot understand how important a money tax is. Allowing Capital to be above labor is why we have accumulations of usury capital. Money is closely linked to the human mind, and tax is a force – plain and simple- it compels behavior. Changing behaviors is a key attribute of this SCD system. The money will never be untrustworthy as it is taxed and the volume is controlled. You don’t have what you need to pay Government, you may go to jail. The Government has an interest in taxing for its needs, and part of the MA charter is to make sure the SCD component of the money supply is full enough to meet the “full” taxation needs of the economy.

Qualified MA members can be selected, something like the Doge of Venice, and then the final members sanctioned with a vote. It is a fully fledged fourth branch of government, but constructed differently from other branches to be non- populist. MA has legal focus, something like the Supreme Court, and its members are to be responsible and faithful to the law.

Regarding the selection of the MA, I believe that you are far too trusting in human nature. What is needed is some hardwired check against formation of an abusive oligarchy. In my view, MA members should not be appointed like EU bureaucrats — far removed and immune to populist concerns, but elected by the people. These officials should always have crowds of people with pitchforks and torches in mind when then make all of their decisions.

Sorry for the belated response. I’ll go point by point.

1. Earlier you wrote: “This legal sovereign money is an anchor, where the unit holds its value by incremental labor input via the tax. The unit holds its value as volume is controlled.” Although I agree about the importance of labor in general, you only need to control volume to maintain trust in the currency and therefore preserve its value. The digression into “incremental labor” is superfluous. Moreover, it brings to mind the Marxist Labor Theory of Value, which is considered to be debunked by mainstream economists.

2. I agree with your criticisms of Douglas type social credit (inflation) and the problem with politicians handing out money. Nonetheless, you dispel the idea of other types of taxes being used to take money out of circulation as if it weren’t possible, just because you’re skeptical of it. Your skepticism is welcome, but it doesn’t make it impossible for other taxes to be used to retire excess money. Hypothetically, the MA could be given authority over a different type of tax (like property tax) and the credit system could still work. My next point only needs to be made to poke a hole in your unnecessary sophistry: you wrote: “So is it ok to tax anything and everything but money itself? That type of thinking shows a love of money as wealth, not as an exchange medium.” Here you made a logical leap that has no justification. There are other reasons to reject another tax on the economy: taxes suck and decrease incentives for investment (If I were a wealthy Chinese man looking to invest in America by starting a business there, additional taxes would make me think twice. Maybe I’d take my investment somewhere else where taxes are lower). Moreover, I know the difference between money and wealth, so your point is invalid.