The ‘Fiscal Cliff’: where do they get all these non-issues?

While the self-declared ‘awakened’ claim victory through the ‘Internet Reformation’, the Money Power continues its relentless drive towards a long term global depression, setting the stage for the collapse of the American Empire. The West is to be ‘realigned’ to submit to deindustrialization and living standards comparable to that of the BRIC nations. The ‘Fiscal Cliff’ is just a good excuse to force through destructive austerity measures that will further the deflation in the economy.

The ‘Fiscal Cliff’ is a set of mandatory spending cuts and tax hikes if Congress does not raise the Government’s statutory spending limits. The debt ceiling will also have to be raised to allow the Government to borrow enough to finance its budget for 2013.

Of course, in itself this is not very exciting. But if the GOP folks do not work with the Democrats, the Government will be forced to cut spending drastically overnight. This would mean a substantial drop in demand in the domestic economy and economists expect a 3% decline in economic activity as a result, which would be pretty disastrous.

More important is the deficit that needs financing, which is projected to be about 1 trillion over 2013, or 5.5% of GDP. Is that deficit a problem?

Yes and no.

It’s a problem because it is caused by some truly insane spending.

Medicare is just a subsidy to the diabolical pharmaceutical cartel that is making trillions per year world wide with poisoning people with vaccinations, chemo therapy, radiation poisoning and many more terrors. It is killing as many as 760 thousand Americans per year in the process. Natural healing based on spiritual wholeness, diet, exercise and energy therapy would heal 99% of the sick at a fraction of the cost.

Worse still is the maintenance of the American Empire, costing about 1 trillion per year. The United States spends more on war and Imperialism (‘defense’) than China, Russia, France, Germany, Japan, Britain, Israel, India, Brazil and scores of other nations combined. Hence, presumably, the ongoing need to ‘rebuild America’s defenses’.

True, the Empire is far less lethal than allopathy, but it is an abomination nonetheless.

Furthermore, the Government pays 450 billion per year in debt service to the Chinese, the Japanese and the International Banking Cartel. While it could refinance the debt overnight interest-free and inflation-free via the Federal Reserve bank. Of course, that would damage the business case of Barclays, Bank of America, Citi Bank and others, who happen to own the Federal Reserve Bank.

But purely financially speaking, there is no problem. The Federal Reserve Bank buys up about 90% of whatever the Treasury is offering the Bond Market. There are no other buyers. The Asians are tired of America and the banks are not lending. This means that all new debt is financed interest-free. The Federal Reserve takes a very low interest rate on the Treasuries at the moment, and the Fed, since the sixties, pays back all profits it makes to the Government anyway, meaning any interest the Government pays is reimbursed.

This means that the Government can continue these deficits basically indefinitely.

But….but….musn’t our kids pay this debt back?

No, the debt will never be paid back, because it is our money supply. If we pay off the debt, we would lose our money supply. Furthermore, the problem is not debt, it’s Interest. Even Greece could pay off all its debts in 20 years if it used what it loses to debt service now to repay the debt.

If we ever chose to pay off the debt, we will simply print enough debt free money to pay it off. This would maintain the same money supply, but debt free.

True, all the serious looking pundits are now explaining for the umpteenth time that ‘everybody knows you cannot spend more than you take in’ and while they do not explain why they did not think of this before they incurred all the debts, this narrative does have a certain allure to the common man.

The problem, however, is that if the Government seriously diminishes spending this just feeds the deflationary spiral that we are already in: it would mean even less demand in the economy. For instance: the recent budget cuts of 16 billion that the Dutch Government recently promised, have been calculated to imply 12 billion less income for the State next year because of declining economic activity as a result of the cuts. It is the same nonsense that has destroyed Greece and Ireland. That’s the insanity on steroids that Ron Paul was selling as ‘the power of ideas’.

And inflation? Does all this borrowing not lead to rising prices?

Ah, yes. Inflation……

Throughout the 19th and 20th centuries the bankers have been scaring us with the inflation bogey man, hiding that money was and is actually scarce. And since the Money Power’s gold dealers took over the ‘Truth Movement’ (which they are now renaming the ‘End the Fed Movement’) through all the libertarian outlets masquerading as the ‘Alternative Media‘ they have been badgering us with the same drivel too.

To begin with: inflation does not mean ‘rising prices’, it means ‘a growing money supply’. A growing money supply can lead to rising prices, but rising prices can also be caused by other problems. Supply shocks for instance. Oil comes to mind when thinking of those.

Similarly, deflation means a declining money supply.

And the fact is: there is no inflation. We are in a crushing deflation. The money supply is crashing.

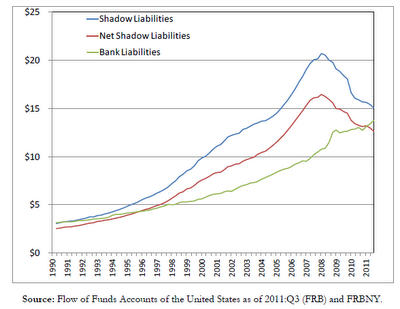

This graph shows the decline in credit flowing through the shadow banking system. A truly crushing deflation.

This graph shows the decline in credit flowing through the shadow banking system. A truly crushing deflation.

There is a massive deleveraging going on. People, both in the real and financial economy, are paying off debts, and every dollar repaid to the bank is a dollar less in circulation. That’s one of the implications of a debt based monetary system, after all.

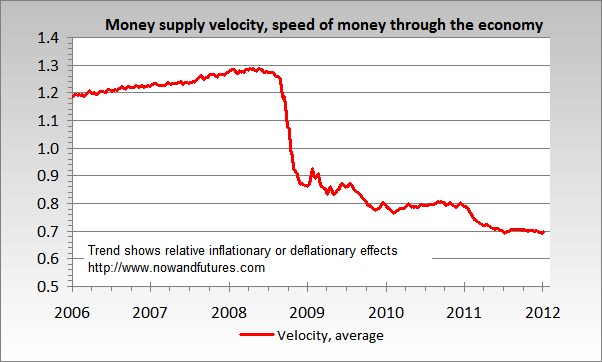

Worse still: the velocity of circulation has imploded since the crunch started. This means that every dollar in circulation changes hands less often, making them less effective. A dollar spent twice finances 2 dollars of trade per year, if it goes around just once, it pays for only 1 dollar of trade. Have a look at the data on velocity below and try to grasp what this means for the economy:

As you can see velocity almost halved (!), meaning a slump of almost 50% in the ‘real money supply’, which is defined as money supply times velocity.

Don’t tell me prices are not rising!

Prices are not rising.

If you look at housing and financial assets, they’re all down big time since their peak in 2008.

However, prices for energy and food are rising, there is no doubt about that. This is not caused by inflation (a growing money supply) but by speculation by that special breed of Satan’s critters we call ‘speculators’. Billionaires, Hedge Funds and investment banks, driving up prices for commodities, especially oil and food. This is a double whammy for the economy: strapped for cash and credit, and rising prices in the primary sector (agriculture and mining) that eventually force their way throughout the economy. Oil prices are further pressured up by the Zionists in the Gulf of Hormuz, which just shows how elegantly the broader Money Power strategy comes together in its various projects.

This combination of depression through deflation (a crashing money supply) and rising prices through speculation in the primary sector is called ‘stagflation’ and we discussed it here some time back.

But aren’t the Fed supposed to be some soulless ghouls?

Of course they are.

But in the scenario under discussion, the Fed is just doing what one expects from a normally operating national bank.

The real depravity of the Federal Reserve Bank and the Cartel at large is shown in the astounding 16 trillion in easy credit it handed to hundreds of major international banks at close to zero rates in the aftermath of Lehman’s demise. Citigroup alone got a mind numbing 2,5 trillion in credit lines, only a small fraction of which apparently has been repaid since.

This is where the crime is and also where real inflationary pressures might come from, although much has gone to simply prop up busted balances, and thus not adding to the money supply.

Conclusion

The Money Power wants a massive, global depression. In Europe it’s organizing it through the Euro ‘Crisis’, ‘forcing’ the Governments into self defeating austerity, aggravating an already catastrophic deflationary nightmare. The United States is in a much better position, because the Federal Reserve is just buying up all the US debt for basically nothing. This, the ECB cannot do. Until recently, anyway, because it means Germany and the other northern nations are underwriting southern debt.

The ‘Fiscal Cliff’ hoax is exactly the kind of excuse they need to ‘look responsible’ while furthering the wider agenda. It’s completely bi-partisan. Whether you have a black democrat coke snorting, mass murdering sodomite banker stooge in the White House, or a white republican one does not matter.

Both are Goldman Sachs property.

At least Dubya was eligible…..

It does not matter whether they let the ‘cliff’ transpire, or whether they ‘compromise’ with drastic cuts for the coming year: the effect will be crashing demand in the economy, furthering depression.

They’re only bickering about the details. Whose voters will pick up the tab? The Democrats in California, or the Republicans in the South?

Eventually America will be busted in the Middle East and they will lose their petro-dollar based hegemony. This is when a new monetary system will be introduced. The only questions are how big the bang will be with which the US will go down and if the new system will be World Currency or the final preliminary one.

The ‘Fiscal Cliff’ is just one of those many non-issues facilitating the way forward.

Related:

We are in Stagflation

Inflation? Deflation? Stagflation?

the Problem is not Debt, it’s Interest

Phoenix Rising, the Return of the Gold Standard

A dollar note is a dollar of debt plus interest. They are printed or are a digitally entered reserve.

The FED is buying the bulk of our own treasuries AND toxic “assets” to the tune of $85B per month.

That’s a TRILLION /yr alone.

This IS money creation, and in no case in history has new money creation, whether by clipping coins or rolling presses, versus the moral non-coerced free market way of money supply and demand vis mining, is absolutely resulting in rising prices. The precious metals are just getting started despite central banksters manipulating gold and silver via their paper ETFs SLV & GLD.

Only a free market of commodity money, as well absent the kluge of bi-metalism or any govt controls, can free all of mankind from his subhuman shylocks and their perpetual wars of profit.

The East is justifiably draining the West’s metals, this tune has been played over and over again in history. The banksters are who conned China into letting our banks and corps help them make their cattle more productive by giving them a little more “free range”. Win/win for the oligarchs once again. Think how much of USSRs & Chinas scarce resources were litterally moth-balled for future elite use by western finance’s both creating & supporting these brutal regimes?

BTW, I’m all for global criminal courts, indictments, trials and the repossessions of the vast wealth stolen from all nation’s peoples by starting at the TOP wealthiest of global banksters, corporations and FED chairs and SectTreas’s.

Back in the free banking era of NO central banks with specie and bank notes circulating, bank notes traded at discounts depending upon the perceived solvency of the issuer.

Therefore, a free market where depositors could ruin over issuing banksters by running them out of business. ALSO in those days the banksters and shareholders estates and assets were ALL up for grabs until depitors were made as whole as those assets went. Jail time too, if short, or not.

Mankind already discovered the best money, that ONLY monarchs and nation states and the banksters that captured them for self enrichment via the back door, and have screwed us all out of what worked when left unintervened for thousands of years.

There is only one immutable currency; Mathematically Perfected Currency, which solves inflation, deflation, and multiplication of falsified debts through interest by a banking system. We do NOT need banks, no big ones, no small ones, NOT ONE!

“A dollar note is a dollar of debt plus interest. They are printed or are a digitally entered reserve.”

As soon as you say this you lose all the educated idiots who don’t understand the power to print and the warnings of various Presidents and Prime Ministers.

FED’s Quantitative Easing is swapping new digital money (created on FED’s keyboard) for securities. Securities are usually held as reserves in Private Banks. Why? Securities are near money that allow banks to meet their capital requirements, and also earn interest. With the swap, private banks receive digital money for their “security.” The new FED ” digital money” lands as bank’s reserves, does not earn interest, and since it has become reserves there is no direct transmission path to the real economy. QE does effect the real economy mainly by putting a floor price on securities.

In an endogenous money system, where banks create credit money, the only way to ‘add’ to the supply is when government goes further into debt to deficit spend.

The blocked reserve transmission path is why we are still in deflation despite all the QE “printing.” Banks are capitalized, but M1 and M2 is still down some 4T since the peak in 2008. Velocity also has dropped dramatically as Anthony has shown. People are not taking out new loans, but instead are de-leveraging. Debt free money issuance if spent into the economy, not into banks as reserve swaps, would go on to pay down private debts. Debt free money sources not in banks, but at the Treasury, as seigniorage. Any sort of sovereign money system makes our Caananite money power friends go beserk.

In a balance sheet recession, former credit bank money is entering the ledger and disappearing faster than new credit money comes on line via new loans. Unlike real money, credit disappears. Debt free would source out of the treasury and then vector into the double entry ledger (liability column) meeting a negative number and destroying it. Poof, the liability is erased. The banker does not know where the “dollar” came from, he may assume it originated as credit.

The unit, its properties, and its path always need to be considered in any discussion. We reformers are not good at agreeing and defining these properties. My view is that you need money in the economy, and some credit. You also need knobs for emergencies, such as natural disasters; this in order to make counter-cyclical demand.

Gold mysticism is not the solution, social credit is.

How does social credit solve inflation and deflation? Only Mathematically Perfected Economy does that.

No you can still print money but debt free money, to solve deflation. Inflation is controlled by interest rates not this destructive negative interest rate, Keynesian crap.

Monetary inflation is not even possible because the debt (principal + interest) is always greater than the remaining principal in circulation…

So what happened during the Weimar republic?

http://michael-hudson.com/2012/08/fireside-on-the-great-theft/

“Every hyperinflation in history is brought on by collapse in balance of payments.” My comment: In the case of Germany, the banks were privatized at Wall Streets insistence….. The Versaille treaty also ignored a cardinal rule: Never allow your debts to be denominated in a foreign currency.

“They (Germany) were ordered by the Allied powers to print Deutsche Marks not for domestic spending, not to run a domestic deficit, not to rebuild Germany, not to employ labor, but to throw reichsmarks onto the foreign exchange market to obtain the foreign currency to pay the Allies, so that the Allies could turn around and pay the arms debts for what they bought from the United States before entry into World War One. It was the collapse of the foreign exchange that caused the hyperinflation, not domestic spending. ”

My comments: Western “private banking” bear raiders then invaded with bear raiding shorts, accelerating the hyperinflation; they did this knowing reparations put downward pressure on the mark. This event led directly to WW2, especially as Germans looked for who had perpetrated this evil on them. (Yes, to a large degree it is our Caananite friends who still own the money power.)

Triangular flow path would be credit dollars issued from Wall Street Banks, to German municipalities (as trade for bonds) to German Central Bank, to Britain/France, then finally back to U.S. Treasury to settle reparations. Germany would trade additional Deutsche Marks for hard currency on the markets, as Hudson discusses.

Excellent Anthony! Concise and eloquent bordering on the verge of major pent-up-NWO-frustration 🙂 – this should be pre-Pulitzer material. Congrats!

Thanks Bourchakoun. Too much praise……Really!

All we need is people’s government debt free currency spent into the economy through infrastructure to replace the debt notes. No need for debt.

http://actionparty.ca/news/monetary-reform/canada-debt-free-is-it-possible-/

5.5% of GDP?? More like nearly 7% and that`s if you actually believe the GDP numbers??lol

Its funny that official US GDP numbers have not fallen since the designed financial collapse??lol

The fact is, the US is bankrupt and Amerikans are debt slaves to the bankers. Just to put this in context, the US Federal Reserve Banks now holds more US gov. debt that China and they did this by digitally creating Monoploy Money!!

Anthony – Kudos on a fine article!

The math just doesn’t work with the interest-debt money system which is a pyramid scheme. In order to make the interest payments; some amount must be borrowed at interest – interest on interest – the definition of “compounding” which we know will grow exponentially. An unsustainable economy breeds a dysfunctional society.

Anthony wrote:

That’s the great news – we can repay the debt anytime we want by creating money based on our sovereign credit. Banks monetize credit-ability and collateral through debt but a sovereign nation may monetize the creditability without incurring any debt.

For example; the U.S. government owes social security and medicaid almost $3 trillion dollars. The U.S. has the option; through congress, to create the money to repay the debt and in doing so, retire the bonds currently held.

The bonds would be retired and the money would remain in the plan to represent by far the largest sovereign wealth fund on the planet. The money would be available to pay out as benefits.

The crazy part is that we (federal government) have borrowed our own money and now are expected to repay it with interest? Anyways, we can simply retire the debt which is around 20% of the entire national debt.

Congress seems content to sit back and allow the non-Federal Reserve to run a pyramid scheme on the people they supposedly represent. They need to get off their collective asses and start eliminating the phony debt.

Thanks Larry. Looking forward to continue our interaction in 2013!

Spot-on. Well said!

Great Liam, thanks!

“Natural healing based on spiritual wholeness, diet, exercise and energy therapy would heal 99% of the sick at a fraction of the cost.”

BULLSHIT

You think so?

What would you do when diagnosed with cancer?

I would add orthomolecular medicine which includes vitamin-mineral-high-level-therapy and herbal healing – though with energy medicine in addition with the many times invented (many developers from the 30s to the 50s) and suppressed Rife-machine no one really knows what would be possible – heck – healing all the current diseases and even healing bones in hours in Star-Wars-like vitamin-mineral-“bacta” tanks could be possible. The problem is that when you suppress everything that is either unpatentable or way too effective (and thus being anti-eugenical) for a good 100 years you end up in a totally ineffective (Alzheimers 100% healing rate within 2 weeks!!!! with orthomolecular medicine alone!!! etc.), absolutely deadly (insuring both future profits and eugenical depopulation-goals) and also terribly costly medical environment. Financial revolution that Anthony proposes, technology suppression (numerous “super-cheap energy generators etc.) and medical reboot would make this a world in which everyone is well-off, has an abundance in living space, products and good food and is super-healthy. But there is one problem – in such a world those families would not rule very very soon – so I guess that is unlikely to happen any time soon.

Money is a tool, like a net. It will always imprison us, as long as we are fool enough to continue to believe it has the power of life & death over us. The above blogger should check out what a Resource Based Economy is & learn that insulting the people he confirms as being right by the end of the article is simply foolish. You point you finger at “truthers” (as if being honest is a bad thing, says something about the author me) & then come to most all of the same conclusions we have about how we are being bent over, by bankers, as a species & then taken for a ride like they own us. You’re falsely sugar coating what you seem to know has the potential to harm a lot of people & making fun of the people who have been pointing out what’s under your spoon full of aspartame. As long as humanity is dumb enough to believe that paper & computer digits trump the morality of taking care of our fellow humans, then we deserve to stay in this mental trap. Our monetary systems are failing us because they are no longer relevant. Vertical Farms, open source 3D printers, along with the sustainability of earthship biotecture home designs could end the abuses of our monetary systems in a decade. Greed & ignorance, is all we have to lose.

I’m a little puzzled by this reaction Karma! I certainly avoid aspartame, so whatever it is that is apparently blinding me, it is not artificial foods.

Open source 3D printing etc. sounds great. We will need a means of exchange to facilitate the people to trade that kind of stuff. True, when money is plentiful and interest free, it will become far, far less important. If money is not scarce, people will not crave it.

Jac Fresco and his resource based bla bla is the collectivist’s dream, because they will be deciding who will get what, just like they do now through the centrally controlled monetary system.

The ‘Resource Based’ economy sounds cool, because logical. Shouldn’t the economy be about resources, instead finances? Of course it should!

With a rational money system, plentiful (in the sense that all beneficial trades can be financed and all useful investments made) and without usury, the economy WILL be resource based. Money will only be around for exchanging and accounting purposes. It will be easily accessible and only used to manage the resources.

The aim of the article is not to whitewash our monetary system, you can only assume that through sloppily reading only this article. I made quite clear that the FED is a bunch of vampires.

But NOT because they are buying up treasuries. That’s what they must do. People only get hurt if they don’t.

When a central bank is “easing”, it triggers an increase in money supply by purchasing government securities on the open market thus increasing available funds for private banks to loan through fractional-reserve banking (the issue of new money through loans) and thus the amount of bank reserves and the monetary base rise. By purchasing government bonds (especially Treasury Bills ), this bids up their prices, so that interest rates fall at the same time that the monetary base increases.