More On Social Credit And A Letter By Dick Eastman

(Left/Above: the erudite Dick Eastman)

Recently, Social Crediters have been campaigning against the notion that Usury is the core of our monetary problems. To them it’s the Gap, the difference between purchasing power of the consumer base and output of the productive sector.

However, the Gap is mostly caused by Usury and it’s becoming more and more difficult to understand why the Social Crediters are not willing to admit to this.

(Here’s my analysis of Social Credit for those new to the issue)

Here’s a recent effort by Oliver Heydorn for the Social Credit camp on the socred.org website.

Dick Eastman convincingly took him to task on the issue of Usury being the Gap. Dick communicates via his email list, so I can’t link to it, but email me if you want to get on Dick’s list to receive his top notch work.

And next he wrote me a friendly letter (see below this article), looking to bridge our differences.

The Gap is the difference between what workers produce and the wages they receive. Because wages are lower than the value of production, there is a constant lack of purchasing power for the workers to mop up their own production.

Major Douglas was the one to point at this phenomenon. He proposed printing debt free money by the Government and allowing the people to spend the new money into circulation. If you print only as much money as is necessary to buy up ‘excess’ production, no ‘inflation’ (rising prices) will ensue, Douglas claimed.

I’m not really convinced that this will be ‘inflation’-free, by the way, and I don’t think Dick Eastman is either, he just doesn’t care much and correctly notes that inflation is really the very least of our problems as it stimulates economic growth and reduces the value of debts, things only bankers and the ultra rich hate.

Be that as it may, bottom line is that Social Credit to some extent compensates for Usury in this way and this is why I personally sympathize with the scheme.

Dick Eastman, who wants to use Social Credit to end Rothschild tyranny, has been making the case for years that Douglas’ ‘Gap’ is basically the interest on loans of money. As Eastman correctly notes, the Bankers don’t spend the money back into circulation, but hoard it, to cause deflation.

I’m adding to this they also simply lend it back into circulation, as the extra interest drain of the interest lent back into circulation will only worsen the deflationary pressures both in the medium and long term. In this way they let compound interest also work to crunch us with ever worsening money scarcity (while printing ever more money! Neat, huh?)

The Gap is calculated to be around 50% of production by Social Crediters. Obviously, it’s no coincidence that about 40% of the prices we pay for goods and services are Usury passed by the producers. As calculated in Helmut Creutz’ ‘the Money Syndrome’.

It seems to me that this more or less speaks for itself and in the to and fro between the Social Crediters and Dick Eastman I also could not find any real rebuttal of this by the SC’ers. Dick’s simply right. It’s not an ‘accounting issue’ (as the SC’ers put it), it’s the interest-drain.

Downside of Social Credit

Clearly, this being the case, we need to solve Usury first and what remains of the Gap after we do, can be solved with some extra liquidity if needs be.

Social Credit’s main problem is that it compensates what people lose to Usury. However, people will still be paying, even with freshly printed notes.

Why do the Usurers need to continue to suck up Trillions per year? That’s the whole issue, is it not? We have a couple of Trillionaires at the top of the food chain who have stolen the rightful inheritance of the Earth’s masses through compound interest.

It’s all unearned income. All that these guys do during the day to ‘make’ this money is bribe politicians, newspapers and ‘economists’.

Compensating people for the interest-drain is not enough. The interest-drain itself must be stopped.

Responding to Dick Eastman

As Dick notes, we do agree on a great many issues and we share a hobby too: preparing Austrians for luncheon. Especially the Austrians’ criminal defense of deflation is something both Dick and myself feel very strongly about indeed.

Furthermore, while I do have a proposal of my own, I’m not at all hung up on it.

The Goals of Monetary Reform as I see them are to

1) end Usury and its associated scarcity of money

2) end artificial inflations and deflations, the boom-bust cycle

3) democratize credit allocation, so bankers nor technocrats can direct the economy.

These are the parameters along which I have analyzed the different monetary reform proposals out there, including Dick Eastman’s (the latter in email correspondence, not on Real Currencies).

I support with reservations anything that moves in the right direction, and unreservedly all proposals that achieve the three main goals of monetary reform as I see them.

Dick wants to replace the current usurious credit based money supply with Social Credit and allow for free full reserve banking, assuming that competition between banks will lead to low interest rates and decent behavior of these institutions.

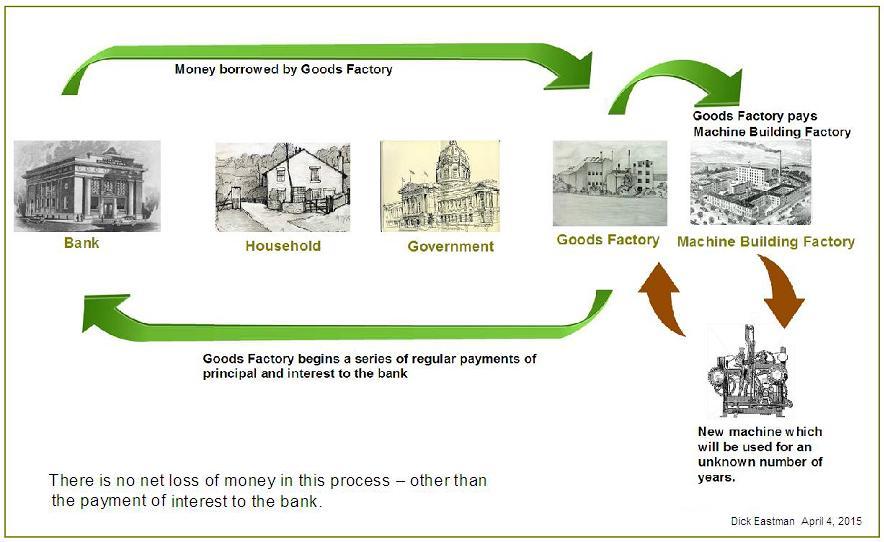

In the diagrams in his letter we can see how his proposal would lead to constant circulation of all the money, including that used for interest-payments. So the interest-drain, or gap, will be solved.

However, in doing so Dick, like the wider Social Credit community, also overlooks that Usury is paid by those who don’t have money to those that do. Ie: the poor will borrow from the middle classes, who in turn will borrow from the rich. At least some of the wealth transfer through Usury will continue. It will still be the rich depositing money to lend in these banks.

Furthermore, while Eastman hopes to reach out to our Muslim brethren in the faith, he ignores why Islam rejects Usury: because it is unearned income. In Islam every transaction must lead to both participants adding to the greater whole. The Usurer just takes. He adds nothing, risks nothing and loses nothing.

In an interest-free environment there is no ‘risk’ as all risk is mutually insured, just as the credit is mutual. ‘Debtors’ (people promising to pay) pay a one off service charge to cover the risks for the community. Since most lending will come with collateral, risk is minimal as it is anyway.

This is in fact already the case today. There is no real ‘risk’ in the financial industry. For instance: houses going under water is because of the deflation the banks cause themselves willfully.

Last, I’m not as optimistic as Dick is about the disciplining effects of the market on bankers. Bankers will be bankers, experience shows. Eastman puts them in a cage, but a wild animal can find ways to escape, especially if its incentive, Usury, remains in place. They will be colluding again in no time. Such is the power of the love of money and its weaponization: interest on loans of money.

He puts my position as: “Your answer is simple enough. Kill the vampire — and have government make the loans at zero interest. Certainly that remedy would fix the problem. Usury is killed. You are happy. Luther is happy. Mohammed (pbuh) is happy. God is happy. Right?”

But then points at the problem of Government being in control of credit creation and allocation.

And that obviously is indeed a major problem, if Government is the one to dole out the credit.

However, that is not my position. It would not achieve goal number three: democratic credit allocation.

I’m looking for interest-free credit facilities that work according to a clear cut charter, semi-private, semi-public not-for-profit institutions. And they should allocate the credit based on rights. The understanding must be that people simply have a right to credit as it is their promise to pay which is monetized. The Money Supply and the Credit of the Nation are part of the Commons and all commoners have rights to access to their fair share in the available credit. Based on rules that balance the needs and rights of both individuals and the community (other individuals).

They must be credit worthy, based on collateral and have a reasonable plan (a normal business, a mortgage). The credit facility must provide no more credit than stable prices allow.

In this way credit allocation can be to a large extent made to be predictable. No technocrats looking for control, but professionals simply facilitating people’s natural rights.

90% of society’s demand for credit can be covered in this way. What remains are risky ventures. These need financing too, but this can be reasonably done on an investment basis, where those providing the capital also share in the risk. Brokerages can provide the infrastructure for this.

What is more, and this is the key point: what Eastman proposes, full reserve banking, can just as well be done interest-free! People can just save with ‘banks’ (for lack of a better word) interest-free and their money can be used for lending, as long as the ‘bank’ guarantees the deposit, which can be well done by having borrowers pay one off charges to cover uncollateralized defaults. This is known as JAK Banking.

And let us not forget that Usury is the main cause of defaults to begin with. Clearly the credit worthiness of people vastly increases if they don’t have to pay interest on their loans.

Conclusion

Solving Usury will solve at least 80% of the gap. It’s really hard to see how the Social Crediters can get around this.

However, Usury is worse than just the gap. It’s a wealth transfer from those who don’t have money and thus must borrow to those who have already more of it than they can spend.

It is unearned income.

The whole idea that money should breed money is irrelevant.

The Time Value of Money is a hoax, cooked up by 16th century Jesuit monks in Salamanca, who laid the groundworks for what later became Libertarianism. This was the end of Usury prohibition in Europe. It paved the way for centuries of Usury and is leading directly to the destruction of the West and to World Government.

There is no need for Government nor Banks to control lending, it can all be done in democratic, decentralized, and not-for-profit fashion.

Let us end all rents and unearned income. The economy should be based on production, not parasiticism.

Having said this, I admire Dick’s work and I’m grateful for this opportunity to make this case against Usury once more, and to fire up everyone to take up arms against the Money Power menace.

Let us not rest until this Demon is defeated once and for all!

Related:

Social Credit

Social Credit With Demurrage

More On Mutual Credit

Rationalizing Usury: The Time Value Hoax

The Difference Between Debt-Free Money And Interest-Free Credit

The Goal Of Monetary Reform

Forget About Full Reserve Banking

Dick Eastman’s letter:

Dear Anthony,

Very good to receive this email from you.

We have been sharing thoughts and friendship for a long time. We agree on almost everything — including the deflation that results from the practices and systems of usury. Our common goals might be better attained if we could agree on the same remedy. I think we can.

As I understand it you are saying that usury is wrong in the sense of a morality that is a morality that best serves people. The last I looked it appeared to me that you advocate the elimination of interest on loans under all circumstances and that you would have a government agency make all loans interest free. Yes, that would eliminate usury. The structure of the financial system would be so changed that the gap in purchasing power due to the draining of interest to financiers/capitalists/bankers would be gone. End of problem. End of story.

In my opinion, not without some thought, you charging money to allow others to spend your money today instead of you spending it, provided they promise and do give you that same amount of money later on, is a freedom that in a well designed market economy/ money system/ lending system could be a positive benefit to both borrower, lender and society as a whole.

My idea has been to find out exactly where interest under the present system is killing us and to do something about that. Why is the usury system killing us?

I think I have isolated what is good and what is bad about usury under the present system — and what would be all good without bad under a different system.

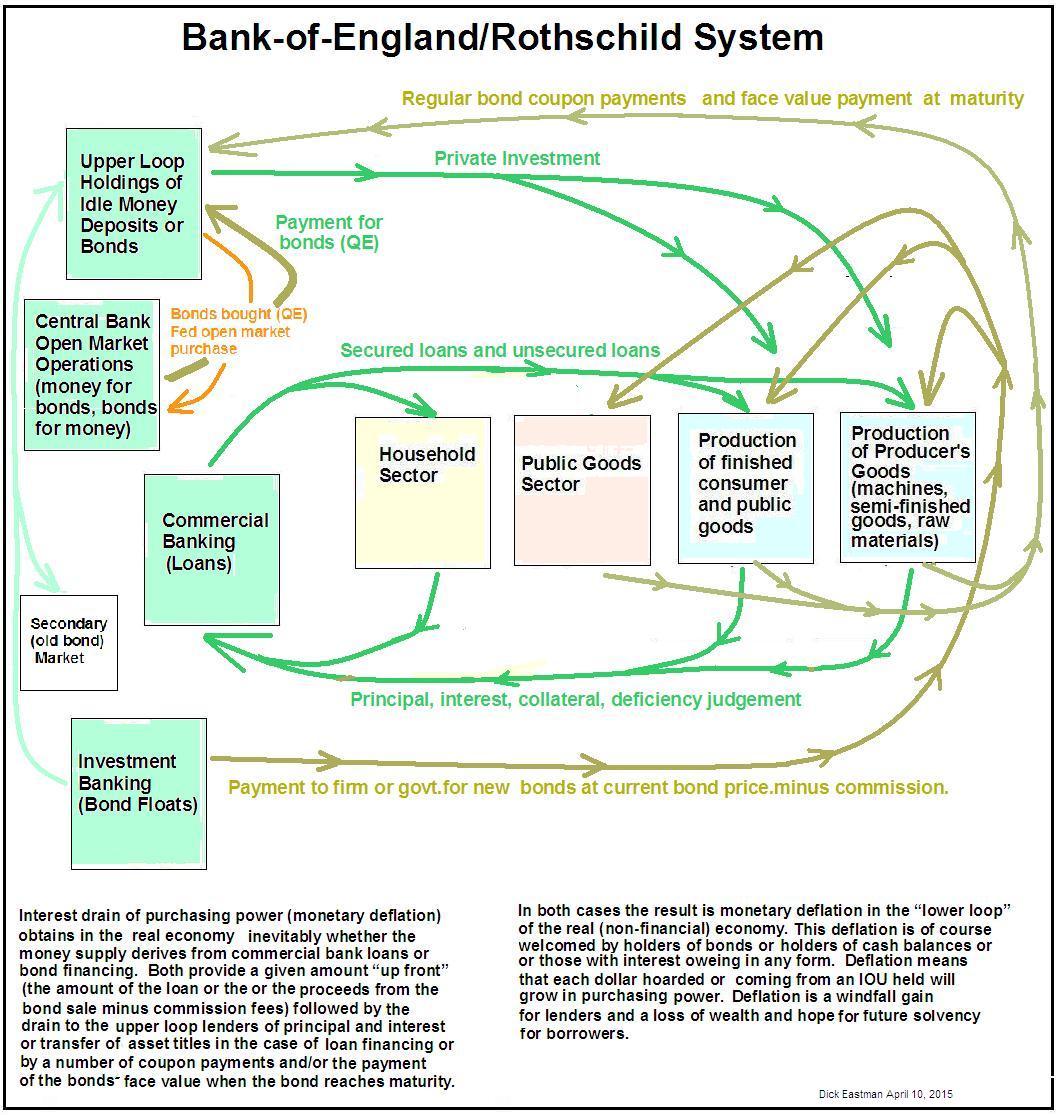

The system of today’s usury I call the Bank-of-England/Rothschild system, named after both the bank that initiated the system and the family name of those who have most effectively used the system to the detriment of all nations and peoples except their own.

I have identified elements of the Bank-of-England/Rothschild system that cause the most trouble. Sometimes the gold standard. Always the private issue of the nations money. The tendency to want deflation to make the money the monopolize to be worth more per unit so they can increase their real wealth by simply hoarding money and not spending — the cause of the leakage of purchasing power from the real economy, causing hardship and loss in the “lower loop” (most households, businesses, local government that provides public services). The Bank-of-England/Rothschild system has always opposed national treasury money — the green-backs backed only by the word and authority of a good government. Such a money system would cut down their power from that of just short of God to something more on a scale of of their standing among common humanity.

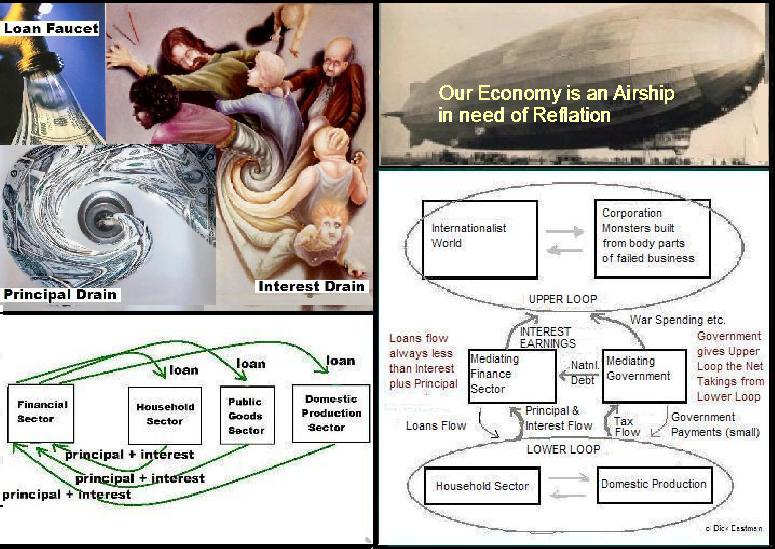

In the past I have just hinted at the problem with this diagram:

But now I have two diagrams that together, I think, captures the essense of the problem.

New money comes in only a few ways — all involve borrowing at interest. These ways are 1) commercial bank loans at interest and secured by collateral or primacy lenders’ claims in any bankruptcy; and 2) bond financing — where money comes when a corporation or government writes an IOU promising to pay some amount in the future — which is then sold for a lower price in the current bond market. The new money is not really new — it comes from the interest earnings that are being hoarded by those who have been holding on to money simply to create deflation and to gain from deflation. But bond financing also involves interest drain. The hoarders give up the gain from hoarding for the bigger interest gain in buying an IOU (bond) — and the bond maker gets the money and spends it on war or new Wal Mart outlet buildings or high fructose processing plants — which for a time increases money in circulation (monetary inflation) — but as with bank lending and interest collecting — the IOU stipulates a face value that must be paid at a future date that is bigger than the bond price the bond sold for — and on many bonds their is a coupon amount that must be paid at regular intervals as well. Soon the gain in money circulating from the buying of a new bond with money that was being hoarded — is soon followed by the payment of coupon amonts and bond face value back to the hoarders — more deflation — unless the corporation or government chooses to roll over the debt buy writing new IOUs to get money to pay the obligation on the old IOU. This is the true heart of darkness — both bond financing and bank loan financing have the same effect. An upward jump in money supply followed by a decline — as principal and interest are paid and as coupon and face value are paid — that takes the money circulation lower than before the financing was undertaken.

There is one more mechanism for making new money — the bonds themselves can be sold by those holding them to the central bank in exchange for funds — referred to by the concealing euphemism Quantitative Easing (QE) — but thise of course gives money only to the hoarding class — the people who only part with their money deposits when interest rates are very high or when bankrupt assets and privatized public utilities come up for distress sales in extreme buyer’s markets.

The above explains everything. Why depressions happen. Why bust follows boom. The debt increases to trillions upon trillions of dollars owed. Why possession of the world is being transfered to the credit monopoly that provides the credit money (the all-borrowed money supply).

I know this has been your understanding of the matter too. This is the great evil exposed. The vampire has two fangs — the all-borrowed money supply and deflation-intensified-by-hoarding which only higher interest rates or a Greek Island or Chrysler Motors going up for auction in a distress sale can induce to spend.

This is the system we both do not like. This is the system that grips our countries, Holland and the US, and everyone else’s country as well.

Your answer is simple enough. Kill the vampire — and have government make the loans at zero interest. Certainly that remedy would fix the problem. Usury is killed. You are happy. Luther is happy. Mohammed (pbuh) is happy. God is happy. Right?

But then comes the old crotchety American who says the government passing out money interest free is garl-durn socialism, even communism, where Congress (or the Tweede Kamer over there) , our federal legislature is the biggest whorehouse in the world, I am sure the Tweede Kamer operates the same. Buying votes. Giving contracts to those who contribute to the elections or who control the political parties that decides who will be ministers will run the government. BUT ONCE YOUR COUNTRY’S POLITICIANS OR MY COUNTRIES POLITICIANS HAVE THE POWER TO CREATE MONEY AND THEN LEND IT OUT AT THEIR OWN DISCRETION you will have created a monster of state power that is just as terrible and corrupt as Bank-of-England/Rothschild power. The state will be a god. People will wait in line for loans like people wait in line for an operation or a CAT scan under socialized medicine. And only those who contribute to the party and the politician will get moved to a shorter line. The heck with that noise. Can’t a European see the problem there?

I can’t join with you if you insist upon replacing usury with a government that makes money and then passes it out in loans to those the government chooses to lend them to, to those the state deems to be “deserving.” They can’t just lend to everyone all they want at zero interest — or everyone would borrow and borrow with promises to repay later until they die — and then try to collect after they are dead. So there must be some kind of rationing, some constraint on who gets loans — and you would leave that up to the government, to politicians, to the political parties, to those who pay the bosses of the political parties — in fact the same people who already own congress and the Tweede Kamer under the Bank-of-England/Rothschild system our two countries have now.

So I ask you. Can we agree to be rid of the Bank-of-England/Rothschild system — but not replace it with the all powerful National Money Power that you have been so naively proposing.

Now you are not the only one I would like to come to full agreement with. There are also the Moslems (peace be upon them all in this world and the next). They too are against usury. Like you they reject my proposals because they are simply evil and unjust and socially destructive.

Well, I have extended an olive branch to you and to them — but have not gotten a response. I propose a system where business people who want to make a new kind of device, for example, can get a lot of money from a lot of people on condition that those people get their money back after the device is build and selling, plus some more money for their willingness to lend.

But would not that not necessarily be usury?

No. I thinking of a replacement for usury, that is not usury, but which does allow little people to pool their money to support an entrepreneur with a good idea in the hope of a gain for themselves later on. What I propose to accomplish this will not be usury, but will be an actual silent partnership, where the vampire “lender” is transformed into a small silent partner — sharing in risk, having the rights of a small partner rather than a creditor. Here is how it would work.

The economy has plenty of money in it, coming from the state and being introduced exclusively through the new money dividend — debt free money to each person in each household on a regular unfailing basis.

Now there will be people with great inventions or ideas for products that people would enjoy if only someone would make them — but these inventors have no money to realize their idea and put it on the market. They need money, and “advance” so they can pay employees and materials suppliers and tool suppliers until the product is selling and can pay for itself. \

Now instead of going to a bank for a loan like they do now, and instead of writing up an IOU and selling it as they do now (bond financing), we would instead have, not a Bank, but a populist institution called a “Pank.” I slightly change the name because I want to underscore the idea that the “Pank” is something completely different for the following reasons.

Here is how Anthony Migchels would start a “Pank.” He calls up his internet friends and says, “I know a sharp young fellow named Daan whose wife Isa is a great dress designer, really different and cool. And Daan has invented a new treatment for fabric that makes it really fantastic to touch and that draps in a really attractive way that every woman will want to own one. We need to hire five hundred seamstresses and buy 500 sewing machines, plus the material, plus the building, plus the chemicals for the treatment and so forth. I want to open a “Pank” to provide Daan and Isa with the advance they need. Will you you subscribe — (this replaces becoming a depositor in a bank) ? And what if I, Anthony Migchels the “Panker” am wrong and Daan’s idea is no good, or the government will not let him use his chemicals, or the style of dress Isa designs just doesn’t sell? Well then, in that case, we as silent partners must share the loss with Daan and Isa. If you put up ƒ300 (gulden — post-euro) and the business fails, you are only entitled to claim half of what you subscribed. (Now THAT is what makes this no longer usury. A banker would lay claim to the full debt obligation and would have priority before Daan and Isa could get one tiny penningen from liquidation. But under the new Dutch “Panking System” no such loan contract would be legal. Pankers and the subscribers the panker attracts will not be insured by the governrment. Panker and subscriber would be exposed to all the risk Daan and Isa are exposed to.

Then why would anyone every become a subscriber to Anthony Migchel’s bank? Because everyone knows that since the early 21st century Migchel’s has been known as one of the most honest men in Holland, a man with good sense and an eye for a good deal and a man with a good heart who would not ask people to subscribe to his Pank to a venture unless he was sure it would succeed. In other words — when you subscribe you money to a “panking” venture you are putting your trust in the integrity of the “panker” to pick the right entrepreneur with the right idea in the right market at the right time given all the factors that might affect the success or failure of such fashion design innovation.

Is then “panking” usury? You might look at the fact that the panker takes money from people with an understanding he will return that much and more later on if the venture of Daan and Isa succeeds. That looks like banking and therefore like usury. But then again — notice that the “panker” and the subscribers are taking the same risk as Daan and Isa. Notice that in the event that the business fails and cannot pay the “pank” what was hoped — that Anthony and Daan and Isa and the subscribers divide the loss among themselves. That is partnership, not usury. Under usury the lenders must get completely paid before employees, or other crediters get a penningen.

Furthermore it is not percent of the loan that is owed the pank and the subscribers — but a return of the advance plus a share of the profits. And it would be the hard work and intelligence and shrewdness of Anthony Migchels the panker (remember a panker is one who creates the lending institution that replaces the usurous “bank” of today.

(Note: There is a city called Panker in Shleswig-Holstein in Germany — and in northeastern Pennsylvaina “to pank” means to press down and compact soil or other loose type of material into a more compact mass — which is what in the present usage is what the “panker” does with subscriber’s money before handing it to Daan and Isa to start their dress company. — but otherwise the word “pank” seems to be free for this use.)

Now in Islamic banking riba (usury) is haraam (sin) with no exceptions. However partnerships are not haraam. The pank, with Anthony Migchels, as panker in this case, — anyone can be a panker if they have the name and reputation that earns the confidence of subscribers to take the risk — calls the shots for who gets the money — for whom to partner with, in this case partnering with Daan and Isa.

There is no riba or usury involved in repaying the amount of the advance (called the paying the principal in the Bank-of-England/Rothschid system, so the big question is whether the extra money that Anthony and the subscribers get back is riba or, in Christian eyes, usury — or whether it is shared profit or some other thing. For example, the arrangment could be a joint venture (Musharakah rather than a borrower-lender arrangment), or it could be set up as a work-and-earn-to-own arrangment — where the pank pays for the business and its early operations, paying Daan and Isa fully for their contributions of entrepreneurship, management, know-how, and labor — enough for them to live on while the ownership of the business is sold to Daan and Isa in installments by a pre-specified formula. The pank would take profit left over after paying Daan and Isa what is owed them — until the business — Daan en Isa Mooie Jurken — becomes completely owned by Daan and Isa. The deal is this: The Pank says, we will pay for starting the business you want and for its early operations, paying Daan and Isa a fee for all of their contribution, including Isa’s original designs, and the worth of the chemical formula as purchased by the pank from Daan. The pank will take profits over that — half of profits going to the Pankers (Anthony and his subscribers) — the subscribers replace the savers who put their money in time savings accounts in the old Bank-of-England/Rothschid system.) And that is enough about that — the point is that the pooling of money so that good business ideas can be undertaken can be done without usury, riba or “charging interest” .

Whether Theologicans against usury and Moslems against riba give American populist social credit a “pass” on avoiding sin — the fact remains that the creation of a permanent money supply provided for free to every citizen — and the ending of money creation by banks, and the requirment that banks only lend money that savers entrust to them to lend — will end the tendency and the incentive for the financial system to deflate the quantity of money in circulation. That in itself will end deflationary depression, end the waves of defaults and bankruptcies, end the mounting indebedness to lenders, end the transfer of real asset wealth from the borrowing class to the lending class. It would make businesses more profitable. It would allow businesses expanding and innovating from their own profit to replace borrowing from banks because money is not available to innovate without going to the usurers.

So, Anthony, why can’t we agree that the Bank-of-England/Rolthschild system leads to national ruin all the time, that it is an instrument of class warfare and piracy of rich exploiting the helpless poor. And why can we not also agree that with competitive “panking” – where anyone can become a bank if he has the reputation to attract subscribers — buyer beware! subscriber beware! because we allow panks to fail (if the panker cannot pick good entrepreneurs to invest in, cannot understand all that may affect supply and demand to pick the right entrepreneur with the right venture — whether giving a retailer money to fill his shelves — or betting on a new invention — if he fails he fails — no one will want to subscribe to his pank again.

This would be highly competitive “panking” — a pank is only as good as the ventures it is investing in. The pank would allow little people to get the gains that today only the rich can do — get involved in investing in something big.

Today inder the Bank of England’/Rothschild system — these is no competitive banking. Interest rates are fixed. Everything is fixed. And the game is rigged all in favor of the lender and against the borrower. That will end.

But remember this. Companies that satisfy coustomers will never suffer a bad day because of macroeconomic deflation. There will be no deflation, no laps in consumer purchasing power. And firms will be as successful as the businessman dreamed when he started his business — if he is a good businessman and entreprneur. That means we will be back in a land of opportunity.

There will be no more macroeconomics. No monetary policy. No tending of the national economy. There will be no national interest rate, no international money markets. (I have not gotten into the other phase of American Populist Social Credit — the elimination of corporations and a return to having all businesses either single proprietorship (single owner) or partnerships — with full liability to owners.

There is no democracy unless the people — all of the people equally — are the ones who spend all new money into circulation. The Rothschilds and Rockefellers owning Goldman-Sachs and JP Morgan-Chase should not be creating money and lending it to people at interest to give the economy its money supply. Nor should politicians have that power to create money and spend it into circulation — because that power would lead to corruption and a totalitarian state at least as bad as what we have now.

Let the people have all new money and let them be free to pool their money and jointly undertake big things, if they want to — with a populist banking system (or “panking system” if we want a new name to go with a new system). The populist banks will not be able to create money — they will just be places where good opportunity spotters will find the best entreprneurs to provide money to — ‘advances” can replace the term loans — or “investment money” — or “partnership funds”

let us have a system that Moslems and Christians against riba and usury can participate in with clear conscious that no sin is being committed against god and the ways of righteousness found in the Holy Books.

But most of all let us do away with the evil lies and theft of the Bank-of_England/Rothschild system that plunders the people who create the wealth from the world that God has provided us all to enjoy.

Hallo Anthony Migchels,

Steun je http://www.burgerinitiatiefonsgeld.nu al?

Groet, Herry Neijenhuis.

Of https://www.peuro.nl ?

TuurlijK!

Be sure and include Direct Credit eg Lawsonomics of the 1930s discussion of money and incomes in your Social Credit inquiry. Just a suggestion.

Tell us more. What would you include?

https://www.youtube.com/watch?v=KNWPYQjXSYA

E M Jones

there’s a much deeper layer of the concept ‘usury’ he, nor any americans (or ‘jews’ for that matter), with the exception of those who grok John D Hamaker, can grasp and grapple with, the grounded version. rockdust as money proliferates wealth like nothing else, perfectly desirable ….

It’s fascinating stuff and Michael Jones is an intellectual powerhouse.

But I think it’s time to consider that the Vatican and the Jews are manifestations of the same force.

The Vatican resulted from the centralization of wealth through Usury in Rome.

My hunch is it was actually the Usurers from Rome that later became the landed aristocracy.

Legacy and future of Christianity in the West – A Debate

https://www.youtube.com/watch?v=dMwrMl0tinQ

And how long have I been saying that Anthony?

QUOTE:

Stalin was trained by Jesuits while in the Tiflis Orthodox Seminary in Georgia—openly admitted by “Koba” himself to journalist and Masonic Jew Emil Ludwig (Cohen).

Hitler’s relatives in Ireland state that he played chess with Stalin at the Tavistock Institute.

QUOTE:

4. Of publishing a false statement for the purpose of concealment of status: (1900 to present day) That the Catholic Church, more specifically the Jesuit Order has maintained countless false statements and documents pertaining to the status of Joseph Stalin. That Fr. Joseph Stalin S.J. was a trained, dedicated and fully ordained Catholic priest of the Jesuit order, who was recruited for a historic mission in his final year at the seminary in 1899. That in addition to failing to recognize Fr Joseph Stalin S. J. Furthermore, that the Jesuit Order did permit Fr Stalin to marry not once but twice, while remaining a fully ordained priest. That for his entire life until his death, there is no indication that Fr Joseph Stalin S. J. was ever defrocked as a priest.

Newly released FBI documents now say Hitler was not in the bunker. The book on his escape to Argentina are looking better all the time. (Grey Wolf)

Castro was trained by the jesuits.

http://revoltnow.wikifoundry.com/page/Jesuit-Trained+Movers+and+Shakers

Fidel Castro was born in the village of Brian in Cuba on August 13, 1926 into a rich family, the son of Angel Castro, who was a Spanish immigrant, and his cook Lina Ruz Gonzalez. In his early life Fidel Castro went to Jesuit schools and from there he attended the Jesuit preparatory school Colegio Belen in Havana.

Jesuit-Trained Movers and Shakers – Philippine Resistance Movement

Communist Dictator Castro shaking hands with his boss, Grandmaster and Prince of the Sovereign Military Order of Malta, Andrew Willoughby Ninian Bertie

Controlled Opposition. Fidel Castro was trained in Jesuit schools for seven years, put in power by the Jesuit’s Knights of Malta-controlled Skull and Bones CIA, and advised by a Jesuit, Fr. Armando Llorente during the revolution. Today, Castro continues to be subservient to 78th Grandmaster and Prince of the Sovereign Military Order of Malta Andrew Willoughby Ninian Bertie, cousin of Queen Elizabeth.

http://www.lycos.com/info/fidel-castro–ha…university.html

The life of Fidel Castro has always been bound up with prophesies, some of them strangely accurate. Probably the most known is the one made by [Jesuit] Father Antonio Llorente, Castro’s teacher and spiritual adviser at the [Jesuit] Colegio de Belén. “Fidel Castro is a man of destiny,” prophesied Llorente. “Behind him is the hand of God. He has a mission to fulfill and he will fulfill it against all obstacles.”[1] In this particular case, however, I have the feeling that Father Llorente was slightly confused about whose hand was behind Fidel Castro.

http://aanirfan.blogspot.com/2015/05/the-real-fidel-castro.html

Apparently, Fidel Castro is gay, Jewish, very wealthy and has been an agent of the CIA.

https://dublinsmick.files.wordpress.com/2015/05/bergoglio-ebrei.jpg

Pope Francis makes the list of top 50 most prominent jews world wide!

I posted this on Facebook:

“This is an interesting exposition by E. Michael Jones concerning Jewish Usury throughout the ages.

Jones is a Catholic and he frames the issue as one of the Vatican against the Jews.

And while this is of course in itself an undeniable part of history, I think it was actually an old dialectic.

The Vatican always was a Babylonian institution and many in the conspiracy scene actually see it as the core of the NWO. I don’t agree with that, the Vatican has been fading dramatically over the last few centuries. They were just a vehicle for the Hidden Hand, just as Jewish Supremacism is.

My hunch is that the Usurers who centralized all wealth in the Roman Empire later became the Landed Aristocracy. The Roman Empire itself continued in the Vatican.

The Vatican usurped Jesus to control the opposition he so magnificently fired off and the first thing they did was destroy all the authentic Christian sects throughout the Mediterranean. They destroyed all their sacred texts, some of which have resurfaced in the Dead Sea Scrolls and the Nag Hammadis.

These texts focus on an inner Christ, not Jezus of Nazareth himself, who was the prophet of the Logos and who incarnated it (John 1:14).

To rid ourselves of Jewish Usury does not mean degenerating back into ‘aristocracy’, landlordism and spiritual tyranny.”

I am almost finished reading Jack London’s “The Iron Heel” and it is astounding how closely it fits to today. He never quite grasped the full implications of the gap but he definitely saw it. If he had lived a little longer (died 1916), he would have loved what CH Douglas had to say. I share London’s optimism though that in the final analysis, we will win. 1% can’t control 99% forever. To date, the actors have changed but the game stayed the same. People are becoming more enlightened now and seeing through the false-flag bullshit. Look at France and the skepticism about the so-called terrorist attack of a few months ago. Much as I disagree with Dick on the economic issues, he has it right about the Boston bombings and you don’t need to look hard to find many people remarking about the white backpack that suddenly became black. He points out that the key is withdrawing our support and not falling for the pennies payoff like politicians do.

“But I think it’s time to consider that the Vatican and the Jews are manifestations of the same force.”

Yes it did

https://dublinsmick.wordpress.com/2015/05/12/the-greatest-story-never-told-who-really-started-world-war-ii/

I appreciate Dick Eastman and his efforts to make changes in the monetary system, but I agree with you, Anthony on your excellent rebuttal. The real solution is to put the power of money in the hands of the people, and not of the elites.

Couldn’t agree more. Now the question is how best to do this.

With a collective US “grass-roots” Presidential run, a gathering of all Americans with even vague Presidential ambitions, hopes and aspirations. From the process of organizing a collective Presidential campaign and kitchen cabinet would arise a collective Presidential leadership group culminating with the natural emergence of a true leader, our next President.

If I were running for the Collective Presidency my first need would be for a multi-talented chief of staff capable of navigating the intricacies and pitfalls of the internet or of directing someone else to do so. My chief of staff would, of course, ideally also aspire to the Presidency.

I would turn to Anthony for advice and direction on the Money Issue, an issue second in importance only to the Human Issue while we worked to get our domestic houses in order as Humanity prepares in the coming years for a transition, not to a cashless society controlled by the Money Power, but to a Moneyless Society controlled by our grounded grass-roots collective mutual trust and social credit society. Amen.

These are sentiments I resonate with. I do think there is one problem here though. This is generally a sentiment that is looking for a “Savior.” I don’t believe that is our path. What I do think is needed is for every man and woman to take personal responsibility to learn what is wrong with our present system, find others of the same mind and only lend support to those candidate who put themselves up for office. In every case that there are only candidates who stand for the old guard, I would play the role of conscientious objector by going to the polling booth, deliberately spoiling my ballot so as to say “none of the above” and then go outside and yell out what I did and why I did it.

Can you imagine if the entire country did this? It would lead to either the election of people worthy of our vote or would send a clear message that those in power have no legitimacy. The days of blindly putting our faith in someone else because we are too lazy to take control of our own destinies must come to an end or nothing will change. I have heard all the arguments. You will never get a candidate who stands for all the things you do. That is true. However, if I get a candidate that stands for the correct economic policies that will lead us all out of debt slavery, I don’t care about the rest because they are far less important and can be fixed later. If people don’t have prosperous lives, they will never be happy.

Is prosperity being rich? I don’t think so. It is being able to meet all of their basic needs in a dignified way and then to pour their lives into something they find fulfilling. They can drink their own wine and eat their own food under their own tree on the home they have built for themselves and enjoy their children and grandchildren in peace and contentment. In summary, they can live joyous and fulfilling lives. With the advanced technologies man has harnessed to date, that is entirely possible. Only greed, selfishness and stupidity separate us all from it. We were made in the image of our Creator. We need to start acting like Him. Do we think He just leaves His Creation to fate and the responsibility of others? I don’t think so.

“Only greed, selfishness and stupidity separate us all from it. We were made in the image of our Creator. We need to start acting like Him.”

We are Presidential candidates in a “grassroots” Collective Presidential Campaign. We are sovereign individuals and correspondingly subordinate to the sovereign multilateral national or regional collectives of which we are a part. We are the leaders. We are the indispensable ones not just the chosen ones.

Who holds the debt instrument? Let’s say I loan out my lawnmower to somebody. A credit/debt contract has formed. When lawnmower is returned, debtor has extinguished his debt obligation to me. When credits and debts get together, they extinguish. In the case of this “lawnmower goods” credit/debt relation, it is man to man or “two party.” This is our evolutionary history, where we had credits and debts on each other, and we simply remembered who owed who what.

Talley’s are marks that may describe the good owed. In this case a private tally would be evidence of a debt relation. This adds an element of law, as the tally is a contract, but it’s a private contract between two people.

When the king issues tallies then it becomes money (not credit), because said money has the backing of law/force and is good for taxes. These tallies circulate in the commons and have high acceptance and are good for settling contracts. Money, then settles the difference in a goods exchange, or may trade completely for a good. The Kings tally isn’t really evidence of debt, as it is taken up in taxes and refluxed over and over. The first issuance was seigniorage against money supply.

With Bank of England, BOE model, who holds the debt instrument and what is the nature of this banker money? It has become a three party agreement, where debtor becomes hypothecated by banker. This type of money is credit that returns to ledger for destruction, similar to returning a good that cancels a debt/credit contract. However, new debtor spends this bank credit into money supply where it spins for a time period, to then be recalled. Banker is one party, debtor is the other party, and users in money supply are the third party. In this way, BOE type bank credit has short circuited our natural evolution. Banker holds the debt instrument on the population, and hence collects the usury. This banker third party injected into our relations is similar to a parasite injecting itself into a host. The interest/usury drains toward banker. In a two party arrangement, usury drains to saver/creditor in lower loop where it is likely to be recycled; hence it is less usurious. Usury drains toward the saver. (Yes, a saver could have made gains through rent-seeking and if so, should be taxed.) Channeling or path of money matters. A monetary system may constrain paths by changing money types; MEFO bills are a good example, where the bill channeled purchasing power into military goods – an example of the action, not the morality.

Also, bank usury is front loaded on credit loans, and passes thru debtor’s double entry ledger and onto bankers. Usury money, formerly credit, then becomes floating money as it has no mirror in a debt instrument. Like Gold, banker may choose not to spend and this forces desperate labor to sell their wares for cheap. Banker gets first use of the ‘credit’ now floating usury, and thus gains purchasing power relative to later price debased credit.

Floating money only has taxes to recall it. I’ve searched Douglas in vain for an admission to this reality. I have the Douglas manual, so maybe he admits it elsewhere? This is a huge oversight. Fiscal policy is important when money supply has a large component of floating money.

Bidding up of land, due to its fixed supply, is a form of rents borne by the community. What is not taken up in taxes is pledged to BOE private credit banker. One only needs to observe today’s credit mechanics to see this in action, especially housing bubble. A floating money supply of debt free, allows people to save, and this money type exactly matches goods and services. In the past, private credit was kept from bubbling by forcing new owners to use their savings, hence large down payments on land. Bubbling on financial assets like stocks are another example of a credit bubble not contained with savings. Coins and bills were emitted as treasury seigniorage, so money supply was mixed, and hence some treasury money would become savings in labor’s lower loop.

Credit, if issued, needs to match goods and services, and said credit may be used to front load supply chains, and also be used as a drain knob to prevent inflation. So, Credit can be useful if used properly. Credit should not chase after land as it will bid up prices. If credit is issued against land, it should at least be volume restricted. Private bank credit chases after gains of any type, as only motive is profit; therefore it is inappropriate type in any money supply.

Let’s admit it; man is controlled by prices and money. Money and prices are a control and distribution scheme, so morality has to be encoded in law (or bylaws). Also there are different attributes to money, especially these three, which in my opinion cannot be ignored: 1) volume 2) channeling, and 3) type.

These attributes imply that some sort of monetary authority or moral institution must issue money in accordance with needs of industry and service, as well as improving the commons. This can be done by using legal targets, agreed to in advance. Law done in advance has the opportunity to encode for morality. Since floating money must be in the supply, then fiscal policy has to be a component. Ideally, and also in my opinion, taxes should land on rents; as man will always come up with new rent schemes. Government should also take fees for their activity in inelastic markets, where they are the lowest cost producer. This then lowers the overall tax burden and helps man become economically free.

Who holds the debt instrument? In the case of private banker credit, the banker holds it, and may even on-sell instrument into markets. Mortgage backed securities are evidence of this in action. In this way, man is enslaved as he has to labor to make prices to attract vanishing bank credit (from lower loop). Usury passes thru to upper loop as Dick so elegantly shows. Upper loop is floating money, and hence should be taxed. When taxes are refluxed, that is a pump, and if spent properly into productivity channels, like the commons it creates outsized wealth. Social creditors would spend into households rather than commons, which is insurance against government gone crazy. Households are voters and would protect their money power. I’m not the enemy of the good and labor needs injections to overcome gaps related to waste in supply chain.

In a sovereign system, or in Social Credit, debt free is issued. In Canada’s quasi sovereign system 1938-74, some of their debt free money went on to pay down private debts at credit issuing banks. These private banks were limited to four year loans at 6%, so loan usury was funded exogenously (via debt free money). Canada then had a drain knob, whereby loan is always recalling its credit for destruction. Ultimately, of course, the private bankers used their usury money power to usurp Bank of Canada in 74, with an attack led by Bank of International Settlements. It’s also interesting that 74 was same time frame as Kissinger agreement with Saudi, and Western private banks and capital markets were becoming flush with recycled petrodollars.

(As an aside, Canada also injected social credit style during period mentioned, with injections into households for Children younger than 16yrs old @ $5/month, and another injection for retirees.)

IMHO money power must be contained in its own special fireproof box. Rentiers, who gain private money power, become morally compromised Oligarchs, and want outsized gains at the expense of society. This is the verdict of history as well. I wouldn’t design any money supply with private for profit bank credit as a component. Profits especially should not be yoked to capricious debt instruments which use exponential interest instead of fees; and further – rentier gains are made by these banking corporations, usually by canceling said debts through the magick of swaps. The swap is always uneven as real wealth is transferred to banker creditor, witness austerity asset stripping of PIIGs. History has proven BOE style credit to be a giant rent scheme, a mismatch of money type out of alignment with our evolution; and if we don’t overturn this flawed money system, it may ultimately lead to our destruction.

“Floating money only has taxes to recall it. I’ve searched Douglas in vain for an admission to this reality. I have the Douglas manual, so maybe he admits it elsewhere? This is a huge oversight. Fiscal policy is important when money supply has a large component of floating money.”

Agreed: Social Credit will see rising prices as a result of this. It’s simply not true that the Plutocrats will hang on to all the new money they acquire by controlling industry. They will at some point either spend or lend it back into circulation and this will definitely lead to higher prices.

And very much agreed with your conclusion. It really makes no sense to keep bankers or Usury after all we’ve been going through. We need to harnass money/credit creation for the people and end all rents and unearned income.

If there is no money in money/credit creation, incentives for abuse will drastically lower too. All that remains to be solved is rational allocation.

I think rights based allocation goes a long way, but I’m very much open to other/additional ideas.

As a side note: if Government is to recall floating money through taxation, than it does have both power and incentive for abuse. How would you manage this?

There is always incentive for abuse where man is involved. Many of us are fallen creatures, who are morally compromised, primarily due to our pride defect.

From 38 to 69 Canada had no price inflation, despite spending debt free into the economy. They had built a trans-continental railroad without forming Oligarchy as contrasted to U.S. experience. 4000 miles of Trans Canada highway to cross continent was built. There was Free Education, Universal Health Care, and land grants for returning veterans. This was a period of good government operating a low cost money system to benefit its people. There was no real price inflation except late in the 60’s due to cost push, not excess money.

St Lawrence Seaway was dredged and locks added an engineering feat similar to Panama Canal. Welland Canal between Lake Ontario and Lake Erie was also built, it was eight locks and lifts ships 326ft over Niagra escarpment.

Private Banks were restricted to four year loans at 6%, so usury did not have a time base to go exponential. Mortgages were provided by trusts, similar to Savings and Loans in U.S., where existing money was used (not credit). This formed proper two party arrangements as discussed earlier, and said trusts earned fees and/or low interest rates for their service.

In the modern era, it seems always to be money power that sneaks in through the backdoor, thus breaking down civil society. In Canada’s case, BOC was turned into a Crown Corporation in ‘38 and its stocks were then held in trust. Trustee was Minister of Finance (MOF).

Automatically, one can see system weakness: MOF is just one person, who is arrayed against the remaining government superstructure. That remaining superstructure must operate using taxes. Having MOF spend rather than going to voters for taxes is weakness, and that is where Rothschild’s also stepped in. MOF and Treasury were housed under same umbrella, without good separation.

There are two ways out IMHO: 1) Codify the monetary authority MA as a separate branch of government with constitutional law. Had Canada done this they would be a very different country now.

Effectively, this is a Sovereign system, which is very close to Social Credit. Give MA to the states, or ideally households, to further separate it from fiscal side of government. Now, the fiscal side (taxing side) must make their case to the people when it taxes. It is a fairly good argument for politicians to then allow taxes to fall on rents and unearned income. Monetary side is now controlled and owned by the States, or the people. There must be a strong separation between monetary and fiscal. This separation forces proper taxation and helps keep government in check, hence government is subordinate to the people it serves. I think this is a partial answer to your question, how to keep the taxing government in check.

The other way out (2) is regional currencies, such as Talent system. Talent systems can be linked up with Keynes style Bancors (to mark goods exchanges between systems) to thus grow regional systems quickly and get high acceptance. Use good contract law with morality encoded so the commons accepts it. Contract law is acceptance when one enters the contract, as opposed to constitutional law which should relate to natural law.

Audits and visibility will help perpetuate morality and good governance. Get government, especially local government to issue Talents as percentage of payroll, this to have local power means to shield against vertical pyramid attack. The local taxation body (local government) should be trained to tax properly in a Talent system. (Tax rents and unearned income.)

A sovereign system or a social credit system is not a vertical pyramid. This money is of floating type (FM) and is first injected into households as seigniorage, and beside when money floats government has lost control of it. It can cycle in money supply forever at low cost. 2500 years of coin history proves this to be the case. FM can only be recalled with taxes, or if private credit is also operating – debt instruments will also call in FM during depressions. (This is how bankers grab gold.)

A hidden money power pyramid, using banker credit is what operates today and is our control system.

Communism and fascism are visible power pyramids where both money power and state power are centralized.

A talent system is regional money for local economies thus the pyramids are many, and hence are Federal in structure i.e. small pyramids with few steps in their hierarchy and thus feedback nodes are small and quick. It is also fee based, with just enough income to operate the superstructure. Said fees flux back out via payroll and re-enter local economy.

A state bank like that of Benjamin Franklin’s reduced taxes by having usury re-spent into the commons. This system was overturned by BOE. How? By forcing Colonials to accept BOE banknotes, and stop using Colonial script. Like BOC, Franklin’s state bank was shut down by private money powers; these money powers were a hidden vertical pyramid structure. BOE had debts on their government and the people, and hence controlled the English state.

The answer is really Logos. Any system must adhere to Logos and be defended against those elements who would destroy the higher natural order of man. Man’s pride defect cannot be allowed to have its way, and hence private money power (private profits via usury) should be thrown onto trash heap of history.

It should be a two pronged attack: Proper local money from down low, and Sovereign money from on high. Decapitate anti-logos hidden money power pyramid (or blind its all seeing eye), and also dig out from under its base.

I’m going to do to you what Jim Schroeder did to another who was hard-headed on this point. In the end, that hard-head finally had a light bulb go off in his head. I agreed with the hard-head so I was thrilled by his sensible answers – until I watched Jim dismantle them with reason and common sense. If you are completely honest with yourself and care about the truth first and foremost, you will come to the same conclusion. It’s OK to be wrong. It is not OK to stubbornly hold onto wrong out of pride.

Jim asked two questions. 1) Does a bank offer services that are of value to society? 2) If a bank offers a valuable service, is it not entitled – like other businesses – to make a profit?

Let’s just start there. Don’t go off in the weeds on me. Stay on point and answer just these two questions. The next question is where this will get interesting.

No.

Usury is unearned income and the lender does not do a service, as he produces nothing.

That surprises me. So you don’t value having the service of a bank account that keeps track of all your spendings? You don’t value the convenience of a debit or credit card? You see no need to borrow a money so you can buy a house now instead of saving a decade or so? You see no value in getting a car loan so you can buy a car without having to save for a year? You could see no situation where disaster could strike and you would need to borrow money to meet an emergency? You are rare indeed. I rather think you are either lying or playing with me because EVERYONE who needs to operate in the modern society values these things. If that is true then none of us expects this or ANY business to offer services for FREE. People need to be paid. Expenses need to be met. Businesses are entitled to make a reasonable profit.

Tell me you’re just playing with me or explain just how you expect people to make payments and disbursements of their money – be that wages or dividends or compensated price rebates.

I believe in free market competition. Let private banks that charge interest on loans compete for the same customers with public banks charging nearly zero interest. Bank of North Dakota has been issuing very low interest loans since 1919. A true public government bank could do much better — and has done so for varying periods throughout history of mankind.

Public Banking indeed can be an additional competitive bulwark against the monopoly on credit that private finance currently enjoys. However, such a structural change does not effectively get at the idea/paradigm of debt only. Only an idea/paradigm of monetary grace the free gift/Gifting in the area of consumer finance…is capable of balancing their debt ONLY paradigm. Ideas/paradigms are forces that are pervasive in their reach and effect….and that is why the idea/paradigm of Gifting is the true and complete solution to the problem.

Agreed.

Liam, Usury has nothing to do with real costs. Real costs can be passed on to the consumer.

Loaning money at interest constitutes unearned income. This is the key reason why Usury is condemned by all major religions.

Obviously, 300k interest over a 200k mortgage over 30 years has nothing to do with ‘costs’ of any kind. Nor does paying trillions on the National Debt in debt service, without every repaying principal. It’s all just a really a very transparent wealth transfer to the ultra rich.

Money and Credit are a commons in my view and they should be exploited in such a fashion that people have access at cost price to their fair share in both.

Hi Anthony,

I think that you are making some valid points here. This is why I prefer to define usury as “dishonest profit” rather than as l”ending money at interest”. If the interest charged were so low that it just covered the bank’s legitimate business costs, I don’t think anyone would or should complain. I also don’t think anyone should complain if the banks, by treating their loans as investments, were able to share equitably in the profits of the businesses they lend to (provided that there are profits). But in any case, 300 k over a 200k mortgage or trillions on a National debt are exorbitant quantities to pay for in exchange for access to credit. C.H. Douglas did make it clear that, in his view, interest was often exorbitant under the existing system, even if he did not think that this wealth transfer was the core problem with the existing financial (banking and cost accountacy) system. Fix that particular problem (the inherent lack of consumer purchasing power) with injections of debt-free credit and all of the interest currently charged on long-term chronic public and private debts would be eliminated as the compensatory debt (to fill the gap between prices and incomes) would no longer be required either.

The compensated retail discount mechanism in Social Credit would deal with any inflationary tendency of the economy. Rarely do asset or commodity prices inflate more than 3-4% per month so a retail discount of 10% which is a realistic and perhaps conservative estimate of the discount percentage as the formula for such discount is the difference between the actual total costs of consumption/what individuals bought and the total costs/prices of what was produced in the same period of time. The discount mechanism in Social Credit actually enables prices to go down as innovation and increased production reduces costs.

Sorry Anthony, on this one you are incorrect. I answered thusly to Dick’s not so “convincing” arguments on the socialcredit google group:

Once again Dick, you have COMPLETELY missed the point. Let me dumb it sown a bit more for you. Let us imagine a world where there is NO interest and there are NO loans. We all pay as we play. Let’s see if there is still a problem. To do this, we need to do a little deductive reasoning. We need to set some basic foundations so let’s do that:

1. Prices are set so that a business can derive a profit an recover costs. Let’s break those costs down into 2 classes:

a. Wages for employees, earnings for sole proprietors and dividends for shareholders make up what we call the A costs.

b. All other business expenses without exception make up what we call the B costs.

2. Can you name a single good or service on planet earth comprised of only A costs? There is NOT ONE.

3. Can you name a good or service that is comprised entirely of only B costs? Again, there is NOT ONE.

4. Therefore we must conclude a number of mathematically irrefutable deductions:

a. The price of all goods and services in existence can of a certainty be factored to a specific ratio of A to B costs in comprising the price.

b. It is IMPOSSIBLE in the aggregate for all the goods and services of the world to be purchased by JUST wages, earnings and dividends.

c. Social credit mathematically expresses it thus:

i. Let A be some value greater than zero (see point 2)

ii. Let B be some value greater than zero (see point 3)

iii. Let price be A + B (see point 1)

iv. It is MATHEMATICALLY IMPOSSIBLE for A to meet the price of all goods in a healthy and prospering economy.

v. The shortage is the GAP.

You see. I have just demonstrated for an absolute certainty that interest ALONE is not the root cause of all our woes and if you are honest with yourself, on this basis alone you must re-evaluate all your THEORIES in this new light. Since I have already pointed this out to you several times, I am certain that you will just blindly continue to ignore the evidence and plow on with your false assumptions. It is sad really, because there are so many things you have correctly assessed – 911, the Marathon bombing and others. BUT THIS ONE AND VERY IMPORTANT THING you continue to ignore.

Hey there is still hope. Maybe this time WILL be different. Here’s hoping you finally “get it.” Getting rid of loans and interest will not solve our economic woes because it is not the root cause. The root cause is the GAP – period – end of story. It took me a while to realize this so I don’t fault you for missing it. But here is the seminal truth. Interest on a loan in the final analysis is JUST ANOTHER B COST. The fact that bankers don’t issue the interest to pay a loan when a loan is extended is just another evidence that B costs in general need to be issued in order for prices to be met. If a picture is worth a thousand words, here’s the one I would offer to illustrate the point. Now, prove me wrong with SOUND REASONING PLEASE! Now follow and think about each of these 6 steps:

(see http://www.economiccures.com and study the first figure)

Now let’s say a bit more about the cost accounting flaw itself by illustrating as follows:

1. Let’s suppose a car manufacturer needs $2M to pay for this week’s production run.

2. Let’s suppose the price of the cars is set at $3M.

3. There is no money in the bank because accounts-receivable are pending from previous runs.

4. The business draws down on its line of credit. It just created $2M out of thin air!

5. Of that money, $1M is paid out In wages, earnings and dividends. This provides EFFECTIVE DEMAND with which to liquidate half the cost of the production run.

6. So now we have a $3M price on merchandise and $1M and we just created another $2M so now the economy has enough money to meet the price!

7. Let’s say there is a buyer who steps up to buy a third of the production run for $1M. What is the business going to do with that money? The responsible thing to do is to pay down the line of credit. As soon as it is deposited, that is exactly what happens.

8. We just took $1M in EFFECTIVE demand out of the economy by destroying the money. Paying off debt cancels money as surely as issuing loans creates it.

9. So now there is $2M in inventory to sell but only $1M in the economy left to meet the price.

10. When the 2nd million in sales is deposited, now there is NO MONEY LEFT to meet the $1M price of the remaining inventory.

That is the essence of the accounting flaw. Do you finally GET IT?

So Anthony, by this reasoning how is it even POSSIBLE that “that Douglas’ ‘Gap’ is basically the interest on loans of money?” By this example, it clearly is NOT. Eliminate all debt, loans and usury and you STILL HAVE THE GAP! Therefore the assertion is patently WRONG!

What? No Comment? No counters?

In the middle ages, when usury was outlawed in Christian nations, serfs needed only 14 weeks of labor to provide adequately for their families for an entire year. Where was the Gap back then — or is this merely an modern phenomena? Today we possess technology that infinitely exceeds what they had back then; we can mass produce food, goods and services much more cheaply and efficiently. So why are we in debt instead of in a state of even more surplus?

The difference between us and the serfs of the middle ages can only be Usury. It is the GAP, especially today wherein production costs are so low that — were it not for usury — there would be enough production surplus wherein no one would have to fret about doing without basic necessities: food, shelter or medical care. Anthony wrote an excellent article explaining Basic Income, I highly recommend it. https://realcurrencies.wordpress.com/2014/12/05/the-basic-income/

The big physical difference between the middle ages and the modern world is the great increase in real capital (machines, equipment, etc.) as you have noted. Production in the middle ages was largely hand production. Today production is largely a matter of tools, including machines, computers, and robotics.

Social Credit claims that apart from any question of interest, there is a chronic shortage of consumer purchasing power in the form of incomes distributed in the course of production to defray the costs of production because, under existing banking and accountancy conventions – again, quite apart from the question of interest – real capital involves the addition of overhead costs (to cover capital loan repayments and operating costs) for which no or an insufficient volume of consumer incomes is distributed.

The basic problem is that the existing financial system does not reflect or represent the physical economic reality. Money should be issued at the rate of production and cancelled at the rate of consumption. Under the present system, the money that is issued in production is often cancelled before the item produced has been consumed. Thus there is no money to meet the price-value of that item. This is all explained in my book Social Credit Economics. Visit: socred.org.

It is most definitely a modern phenomenon. In the middle ages, there was no credit money issued out of thin air and thus no money to “retire” so there could not possibly be a gap. Back then, usury was worse because you couldn’t “make up” the money to pay it out of thin air. You had to put yourself into indentured servitude or get very lucky at making more than you borrowed with that loan money.

Go read my response to Dick again. Your remarks tell me you didn’t fully understand what I said. Interest is just another B cost. The problem is not interest, it is the lack of money to meet the B costs.

I have read your critique and i don’t accept your bogus model of economic reality — and that’s all it is a model. I gave you historical facts that are beyond dispute. You assume all sorts of things that are not true: that money without interest is somehow different today than in the middle ages and that without interest charged on money there would be a GAP or debt burden on society.

The only other factor that could account for this GAP would be unearned rents and speculation (e.g., derivatives, high frequency trading, liar loans); but these criminal activities are derived from usury banking practices and would be not be tolerated once usury was eliminated.

Facts? What facts? You gave opinions. I gave math. They are facts acknowledged by people like Keynes who said “Consumption is satisfied partly by objects produced currently, and partly by objects produced previously, i.e., by disinvestment. To the extent that consumption is satisfied by the latter there is a contraction of current demand, since to that extent a part of current expenditures fails to find its way back as a part of net income. Contrariwise, whenever an article is produced within the period with a view to satisfying consumption subsequently, an expansion of current demand is set up. Now all capital investment is destined to result, sooner or later, in capital disinvestment. Thus the problem of providing that new capital investment shall always outrun capital disinvestment sufficiently to fill the gap between net income and consumption, presents a problem which is increasingly difficult as capital increases. New capital investment can only take place in excess of current capital disinvestment if future expenditure on consumption is expected to increase. Each time we secure today’s equilibrium by increased investment we are aggravating the difficulty of securing equilibrium tomorrow.”

Now that is a FACT.

Beyond dispute? That is laughable. People used to think Scurvy was a plague. Turned out to be a vitamin C deficiency. You ascribe the damage done by usury to interest when the cause is the gap. It was back then and it still is now. Only now it is worse because there is a logarithmic increase in debt compared to back then.

Now a point of clarification. You said “You assume all sorts of things that are not true: that money without interest is somehow different today than in the middle ages and that without interest charged on money there would be a GAP or debt burden on society.” That is not what I said. I said that IF the gap was filled, interest would not be a burden and I said that if interest was eliminated, there would still be a big problem. The way things work now, interest most definitely IS a burden. So is the phenomenon of having to pay for capital twice – which is actually the SAME burden. I call it the gap. Keynes said as much (i.e. disinvestment) in the quote above. You’ll need to study social credit a bit deeper to grasp that concept though. You not understanding does not make it untrue. It just makes you ignorant of the facts.

There is one good point you made though and I just realized that I must back-pedal. I said earlier that the gap was not a problem in the middle ages. That is not quite true. Usury fed the gap. The fact that real money was loaned and paid back, and thus was not destroyed, was what I was referring to as not causing a gap. We know that the Rothschilds and gold smiths of the 16-18th centuries issued receipts for gold in excess of what they really had on hand. The money loaned on this basis most definitely did contribute to the gap because it was created when it was loaned out and it was destroyed when it was repaid – exactly like today. If I borrow $100 to make a $200 item to sell and pay out $100 in wages, there is $200 available to meet the price at the instant I put it up for sale. As soon as I am paid $100 for the first half of the goods, I retire the loan and now there is no money left in the economy to sell the last half of my inventory because it got RETIRED from circulation the instant I repaid the loan. This whole discussion assumes the money was created out of thin air when loaned and is retired to hide the scam when repaid. It does not assume this is gold coins loaned and repaid. When is the last time you bought something with gold?

The period in history to which I referred was the first 1500 years of christedom , wherein usury was outlawed. Medici, Fugger and Rothchild private banking dynasties did not exist then. There was no GAP: no debt private or national that burdened society. A mere serf could work 14 weeks to pay his expenses for an entire year. Great Cathedrals were financed with interest free money and built without engendering all monetary inequalities you bloviate about. Conjure all the theoretical mathematical mumbo jumbo you want, that usury did not exist then explains everything.

There are none so blind as those who will not see. There is no one more enslaved than the one who can’t see his chains. Carry on sir. Even the hard of thinking are entitled to be wrong. As William Aberhardt once said, “If they have not suffered enough, it is their God-given right to suffer some more.”

Social Credit reveals that the consumer is rightly charged with capital depreciation but wrongly not credited with capital appreciation. In the primitive economy labour charges constituted the major proportion of costs and so more nearly approximated total costs and prices.

C. H. Douglas proceeded from the standpoint of cost accountancy and made quite clear the fact that the inherent deficiency of effective consumer purchasing-power becomes increasingly burdensome as modern technology increases the capital component of cost in prices. Thus, Social Credit becomes increasingly relevant as the economy becomes more efficient by replacing labour as a factor of production with modern real capital, i.e., tools, plant, technique, automation, robotization and artificial intelligence.

Douglas’s “A + B Theorem” is simply a statement of observable fact. All businesses make internal (A) and external (B) payments. “A” payments are wages, salaries and dividends and are effective consumer purchasing-power. “B” payments are all payments made to other organizations and are not purchasing-power to the personnel of the business making these payments. Although “B” payments originated as “A” payments, they are spent “A” payments. They are not and can never again be effective purchasing-power in the possession of consumers. They have gone back through the production system to be cancelled as purchasing-power when a producer loan is repaid to the bank, or when used to replace capital reserves–from whence they can only be issued to create new production which incurs entirely new and additional financial costs. Because of increasing non-labour factors of production, “B” costs are, of course, always growing in relation to “A” costs.

“A” payments cannot liquidate “A + B” costs, for individual businesses or in the aggregate nationally. The only way total costs can be “liquidated” is through further credit issues to finance new production or to mortgage future incomes. Governments increasingly accrue debt in order to compensate the shortage of purchasing-power in the overall economy. The point is, that payments financed by debt do not finally liquidate financial costs but merely transfer such charges as a claim against future incomes–which is no liquidation whatsoever.

When banks make loans they not only create this very necessary credit but wrongly claim ownership of it. They monetize the community’s real assets but do not create these assets–upon which they will foreclose in the case of loan default. They do not return such foreclosed assets to the community. By claiming ownership of the credits they issue by monopoly privilege they effectively appropriate the communal credit and acquire control over the Cultural Heritage. Monetary theorists who ascribe our economic problems to “usury” as such reveal themselves as captives of religious obsession, seemingly incapable of rational scientific analysis of the comprehensive role of money and credit. As such they seem willing to overlook the theft of our rightful inheritance in the communal capital while engaging themselves in shadow-boxing with a result rather than a cause of economic evil. Their are willing to sacrifice our very inheritance for a “mess of potage.”