Bitcoin now stands at $89. It’s the most ridiculous bubble in ages and its bust will be legendary.

Not an extensive analysis this time, just calling the now obvious: Bitcoin is trouble.

Bitcoin was at a mere $6 only 15 months ago and traded at $30 last month. Combined value of outstanding Bitcoins is now almost $1 billion.

As we have analyzed Bitcoin was designed to be deflationary. As a result it suffers from a rising exchange rate, making people hoard it instead of using it for what money was designed to do: exchange goods and services. As it stands now, Bitcoin is just another completely bogus speculative item.

The whole thing is ridiculous, of course: people are paying $89 for just bits and bytes and it is basically no different than speculating with cyberland and ‘avatars’ in on-line computer games. Hardly any serious goods or services can be bought with Bitcoin.

Once reality sinks in, people are going to suffer, not only because of their losses but also because of the dream. And there is a far greater issue here: Bitcoin’s failure will provide regulators with the ideal excuse to clamp down on free market units. The whole thing is starting to look so blatant, it’s probably not unfair to suggest this is just another problem-reaction-solution operation. Considering its shady designer, CIA involvement, recent news that the Government is already looking to get it under control and what is at stake, Bitcoin has become a major liability to free market monetary reform.

Hugo Chávez was loved by many, both in Venezuela and abroad. His fierce resistance of US Imperialism was welcome and much appreciated world-wide. But his domestic policies were openly Marxist and his most notable legacy is the Bolivarian Alliance for the America’s, aiming at social, economic and political integration of Latin American Nations. In short: he was a globalist.

By Anthony Migchels for Henry Makow and Real Currencies

Hugo Chávez is no longer with us. We’ll miss the old rascal: it’s always pleasant to hear people denounce the US Empire. He also did much to alleviate at least the worst of the poverty suffered by millions in Venezuela. These people were tyrannically oppressed by the Empire’s rule over Latin America, especially through its corporations. Millions will never forget him for it.

Resisting the Empire and helping so many out of the gutter in the process are surely noteworthy accomplishments. But we have been blinded so often by the old adage that ‘the enemy of my enemy is my friend’. And this is the case with Hugo Chávez too.

Bolivarianism

Was Chávez a mason? I guess he was. There is this masonic handshake with Obama. There are other signs. But I have not seen conclusive proof and it’s not like he was flashing their signs all over the place, so let’s reserve judgement until proof is delivered.

His great example, Simon Bolivar, definitely was. Bolivar led the rise against Spanish rule in northern Latin America in the early 1800’s. His masonic watchword was ‘liberty’, fitting well with that masonic construct known as the United States, which only a few decades earlier gained ‘independence’ from the City.

He became the president of a major country, named Gran Colombia, which existed between 1819 and 1830. After gaining independence from Spain, the country succumbed to a power struggle between those wanting a strong centralized state and those looking for regional autonomy in a federation. Bolivar led the quest for centralization of power, an eternal tell tale of the real enemy. In 1830 Gran Colombia ceased to exist: the conflict ended when it fell apart in a number of smaller entities, Venezuela, Colombia and Ecuador. Later Panama seceded from Colombia.

One of the Banker’s more memorable, yet unknown defeats. It certainly didn’t damage the reputation of their man Bolivar and that is probably not a coincidence. Money Power defeats are not part of the history they write, lest they might inspire others.

Chávez made the reliving of the Bolivarian dream a key part of his agenda. Venezuela is a fairly rich country because of its oil and Chávez invested billions upon billions in his project, called the Bolivarian Alliance for the America’s. It was Chávez’ answer to the failed US driven ‘Free Trade Area of the Americas’.

He financed FARC, a ridiculous outfit run by coke-dealers parading as Marxist champions of the people. True, they’re probably not worse than the Empire run Government in Bogota. But it’s always the same: the conflict itself is the goal and both protagonists either are directly run from the City, or are their most welcome stooges without realizing it.

The Marxist: did he really help the poor?

Chávez openly called for a ‘socialism of the 21st century’. He denounced the Soviet Union as State Capitalism, which is a very apt description. But his own politics were similar in many respects. He created thousands of ‘communal councils’ throughout the country. In Russian that’s ‘soviets’. They are touted as wonderful examples of ‘participatory democracy’, but outfits like these are actually comfortably run from the top down with tools like the ‘delphi method‘.

He started tens of thousands of state-owned cooperatives, financed with government credit.

As a result, the private sector tanked: during his reign the number of private sector jobs declined with an astonishing 30%. Half of Venezuelans depend on the informal economy to survive. Public payrolls have ballooned.

Venezuela enjoyed an unprecedented oil-boom under Chávez and he used some of this money to build Social Services, alleviating the plight of the poor. Housing was a top priority for him and public spending on health also rose significantly, from 1.6% of GDP in 2000 to 7.7% in 2006. These are basically his main achievements. But an oil-boom will end and it remains to be seen whether the welfare state is sustainable with such a severely mauled private sector.

Chávez did absolutely nothing about the real issue: banking, debt and usury. The Venezuelan Central bank is State owned, like in most nations, except the US. But State owned means: providing State sanction to private banks to loot economy with their usury.

Its banks are private, many are run by his pals. There was a crisis in Venezuelan banking a few years ago, leading to nationalization of some of them. Meaning the Venezuelans were on the hook for their ‘balances’, better called black holes. He actually arrested a handful of bankers. But most were left to continue their plunder unscathed.

While he wisely paid off all debt to the IMF and the World Bank in 2008, Public Debt itself rose from $1400 per capita in 2002 to $3400 in 2010. During this time there was a major inflation, the Bolívar lost 90% of its value. Meanwhile, he fixed the Bolívar-Dollar exchange rate at only one third of the Dollar’s real value, an incredible subsidy for Transnationals repatriating their profits and the wealthy importing luxury goods. The poor paid for this subsidy and it cost them untold billions.

In short: while redistributing wealth from the middle classes to the poor through taxation, monetary slavery, our real predicament, ruled supreme during his reign.

Chávez was a self-styled ‘socialist-feminist’, attacking paternal rights and the family.

“in 2008, during an event to commemorate the 9th anniversary of the National Institute of Women (which is now a government ministry) Chávez criticized machismo and declared himself a “convinced socialist-feminist”.

“Socialists must be feminists or they won’t be complete human beings. With the support of our women we must strengthen unity in Venezuela… We have to take firm steps towards…the total emancipation of gender and be more just with our women,” he said.

He added that women were condemned by history, but the “Bolivarian administration developed community plans against family violence and in favor of single mothers, which has meant huge positive advances”.” (Source)

The results have been predictable: sexual degeneracy, single mums and escalating teen pregnancy.

Also not helping the poor is the fact that Venezuela succumbed to an incredible rise in crime under his watch. Hard to believe, but these days one is more likely to be murdered Caracas than in Kabul or Baghdad.

As usual with commie strongmen ‘helping the poor’, Hugo took good care of himself: he seems to have owned between one and two billion dollars at the time of his death. Not bad for a kid from the gutter.

Conclusion

Many people will never forget Hugo Chávez. He helped emancipate the poorest. He scolded the Empire.

But his legacy is built on quicksand and in the typically Marxist way he did nothing to stop the root cause of poverty. All he did was destroy the private sector and the middle classes to give to the poor and to centralize power in Caracas by switching from a private economy to a State run one. The wealthy had nothing to fear and much to gain under his rule. He became very wealthy himself. Meanwhile he furthered the Internationalist agenda by laying the foundation for Latin American ‘cooperation’.

It remains difficult to see for many that the evil US Empire is ‘opposed’ by no less evil forces. Be it the Russian, Chinese or whatever leadership.

Hugo Chávez was one of them.

Related:

The US Empire is Not the Money Power!

Muammar Gaddaffi and the Money Power

Is China part of the New World Order?

A few months ago Robert Stark interviewed me again. The result was recently posted at Counter Currents.

You can listen to the interview here.

Some points we discussed:

- The essence of capitalism

- Satanism as Ayn Rand’s Objectivism plus rituals

- How the wealth of monopolies is based on a lie

- The Catholic arm of usury and libertarianism

- The intellectual framework of the great hoax known as libertarianism

- The basic ideas of Keynesian economics

- The “End the Fed” movement as false front

- Public Banking as not interest free

- The Jak Bank of Sweden; its four principles

- Usury as prohibitive of long term investment

- The affiliation of anti-usury movements with anti-Semitism

Related:

Robert Stark interviews Anthony Migchels

Interview with Faux Capitalist’s Jason Erb

(left: one of those Cypriots holding the bag)

In a stunning, but inevitable development, savers are getting a haircut in Cyprus. Raping depositors, however necessary if they insist on keeping the banks open, will only further erode confidence in the system. Did the Money Power miscalculate? Are they upping the ante in preparation for their endgame? Or was their hand forced by mounting German opposition?

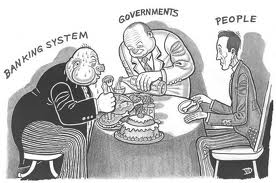

‘The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks.’

Lord Acton

By Anthony Migchels for Henry Makow and Real Currencies

The euro may not fail, because if it does, they will never be able to sell World Currency. If they can’t even make it work in Europe, how is it going to work on a global scale? That’s the reason why all member states are kept on board at whatever cost, either to Brussels, Frankfurt, the national economies or even, it seems, the banking system itself.

It’s not unfair

The story of today is about those poor savers that did absolutely nothing wrong, are indeed the backbone of the economy, and are now being mauled so badly. But this celebration of victimhood is not to the point. What is really absurd, is forcing the taxpayer to guarantee the holdings of savers. Meaning the poor guarantee those that actually do have money. The taxpayer guarantees of deposits always were a clear sign of banking supremacy. Banks have been going bust routinely for centuries and nobody would have kept a dime with them, without the depositor guarantees. It’s just another example of how they privatize profit and socialize loss.

The truth is that the banking system could not exist without savers and the banking system is the scourge of the world. So savers are not only insanely irresponsible with their own money, they’re backstabbing all the rest of us too with keeping their money in banks. True, very few will agree with this line, but it seems the inescapable conclusion of a clear cut analysis of our long term predicament as interest-slaves.

So what’s the story?

What are the forces driving this seemingly suicidal step?

During the negotiations about the ‘rescue’, the issue of the Bond holders was of prime importance. Prime Minister Juncker of the small Bankster nation of Luxemburg warned against a Bond holder haircut and indeed they seem to have been spared. Although viper bank Barclays warned that even touching deposits was a clear threat to Bond holder confidence. The Bond market is everything in finance and we’ll know the end is there if they quit the market. They paid in Greece, but it seems they managed to scare the Germans and the IMF away from their assets this time.

This is in fact a crucial trade off: lest we forget, the Bond holders are mainly the international banking cartel itself. So either it pays for the debt crisis they created themselves with direct haircuts, or by raping the depositors, whose confidence they need in the long run. And of course: making the banks pay just creates a new round of busts for the ‘too big to fails’, ‘forcing’ the taxpayer into a new round of bailouts.

The key driver behind the Euro crisis is the Money Power agenda of consolidating power in Brussels. The issue is fiscal union. Over the last few decades a lot of political power has been centralized in Brussels. About half of European legislation is already from there, instead of national capitals. But real political power is with those running the budget and that’s what Brussels is after here. The Euro crisis’ main goal, from the Money Power’s point of view, is to sucker people into handing over the power over their budgets to Brussels. How this is achieved is of lesser import, there are several ways.

One of them is the infamous European Stability Mechanism (ESM), an utterly tyrannical outfit, financed by the Nations and run, without any democratic oversight, by a commission of finance ministers. The ESM’s goal is to bail out any bank even before it becomes a problem. The ESM is backed by a law forcing the nations to cough up any sum the ESM demands within seven days.

The other is ECB money printing. The big difference between the Fed and the ECB is, that the Fed is backed by only one Government and the interests of the Fed and Washington are highly aligned. The Fed will always provide Washington with whatever liquidity needs. The US cannot go bust, because the Fed will always print whatever is needed. Nowadays, with nobody buying US Treasuries, the Fed simply provides the Government with all the money it needs at close to 0%. This is not possible in Europe, because if the Spanish need money, all other Governments, most notably the Germans, are on the hook for it.

This is the reason why the US has not found itself in the kind of debt trap that destroyed Spain, Italy, Greece, Portugal and Ireland. Had these nations still been able to print their own money, they would not have had these problems either.

Structural ECB money printing would make a mockery of ‘fiscal independence’ and would create an almost unstoppable driver for further fiscal integration, as all the nations would in effect be guaranteeing each other and the weaker nations would have to comply with the stronger nations’ demands.

This was the real ‘break through’ behind ECB boss Draghi’s ‘we’ll do whatever it takes’ back in July 2012: what he was really saying was that the ECB, for the first time, would interfere in the sovereign debt market in a major way: printing to keep borrowing costs down for the PIIGS nations. However, although the Germans backed this statement, gnashing teeth and all, they are far from willing to go all the way. They are not going to allow a real debasement of the euro. Most certainly not if they are on the hook for it.

German support for the euro is still fairly strong. The country has benefited immensely from the crisis. Structural imbalances have provided Germany with great exporting opportunities throughout the zone. The nation has seen a massive capital influx from money leaving the South due to lack of confidence. This capital has generated a bit of a boom while the rest of the world burns. But while Germans love the upside of European Colonization through the euro, they hate the downside: backing Southern debt. Merkel is dealing with plummeting confidence and recently an anti Euro party was launched.

People like Merkel and Schauble (the German finance minister who also coordinated the Cyprus deal) are total NWO insiders, but most lower politicians are kept in check with ‘political correctness’ and with the mounting pressures of the crunch, this shallow veneer is becoming ever more fragile. Nationalism, a lethal enemy to Globalism, is rearing its almost forgotten head and the utter disgust with the bankers and local elites are becoming hard to avoid.

So we see two basic conflicts: one being the hard choice for the bankers of either being shorn themselves or to rape the depositors they need in the long run and on the other hand the German refusal to pay the price for the great benefits the euro has brought them.

Of course, the tensions in Europe’s South continue to escalate also. Only a few days ago the Spanish police took to the streets to apologize to the people that they were fighting them, instead of arresting the Bankers. In the Netherlands, another key member, people are refusing austerity to destroy their economy like it did in the PIIGS nations.

Conclusion

The euro may not fail. If it does, it would be a devastating blow to the agenda of World Currency. Rest assured that the Cypriots were threatened with sulfur and brimstone.

The original German demand seems to have been taking 40% of deposits, to avoid further (German) tax payer or ECB involvement. Obviously this is not sustainable: just this Cyprus thing is going to have major consequences. Already we hear of taking 15% of Italian savings but this is not doable. It would mean war. The Italians just did away with Goldman Sachs alumni, Trilateralist and German backed strong man ‘Super’ Mario Monti . They went for Beppe Grillo and it’s not hard to imagine what he would make of such a move. We would see quick new elections in Italy and the end of the current order.

Throughout the South local elites face extinction. In the US it is clear the Government is preparing for civil war, depleting national ammunition production, buying thousands of tanks for the DHS and the recent confirmation of manned and ready internment camps throughout the United States.

Of course, many rational real solutions are available to the credit crisis. But all of these imply the end of banker hegemony and that is, after all, what it is all about.

It remains impossible to fathom it all in real time. Their smoke and mirrors will always fool us and only with hindsight can it all be really understood. But the question of today is: is the Money Power still in control and preparing for a final showdown, or is all this a sign of weakness? It seems fair to say we will know the answer to this question perhaps sooner than most might have imagined.

The latest news (3/19/13 7:11 pm GMT) is that parliament in Nicosia has declined to go along. The whole thing is in disarray and nobody knows what’s next.

Related:

Take your Money out of the Bank NOW! (includes video)

Financial Warfare 2012: Boycott All Banks

Germany, the Money Power’s Golem in Europe

The Battle for Europe: will the people or the Euro survive?

High Treason: The European Stability Mechanism

Solutions:

The Wolfson Prize, I win!

Debt Repudiation or an Interest Strike?

Mutual Credit, the Astonishingly Simple Truth about Money Creation

The Swiss WIR, or: How to Defeat the Money Power

Social Credit

It was bound to happen and it’s a miracle it didn’t happen before. But in the next round of the crunch, savers will pay for their trust in banks. Cyprus is the first to do the right thing. Savers will be levied to keep the banks going: 10% on their holdings over 100k euro.

Obviously, it’s a disgrace that those without savings are paying to make whole those hoarding cash at banks when these banks do what they do all the time: go bust. That’s, after all, the implication of Government guarantees of these savings.

Cypriots will pay a 10% ‘levy’ of savings over 100,000 euros and almost 7% over savings below that.

Now that the taxpayer is broke (and upset), the inevitable is happening. It will only get worse. Governments are as broke as the banks and can no longer keep up guarantees of savings. And of course, why would they? Why do the poor have to guarantee the holdings of the middle class and the wealthy?

People keeping their money at the bank are not only supporting their own slavery, they are risking losing everything.

Here’s the Guardian reporting. Angry Cypriots are trying to get their money from the banks, but they closed down. So let this be a final stern warning, not from me, but from the real world: if you’re one of the happy few still holding money, get it out of the bank now.

Left: Matt Whitlock and Zach Harvey of Lamassu Bitcoin Advisors

Bitcoin, the revolutionary cyber currency, continues to make waves. Its exchange rate is appreciating rapidly and it is discussed at many forums. While its escalating price is attractive, it is also symptom of its main weakness. But it got people thinking in a major way and as such it is already an unforgettable success.

By Anthony Migchels for Real Currencies

Here’s the story of Zach Harvey and Matt Whitlock, the young guns behind the latest innovation: a Bitcoin ATM, allowing people to pay with the in stores, restaurants and other ‘real world’ outlets. It’s an important step forward. To find wide acceptance, free market currencies need to allow both banking style on-line transactions (mainly for Business to Business transactions) and a more direct mode of payment for Business to Consumer deals. This ATM device allows B2C transactions in a modern and convenient way and certainly has the potential to greatly impact Bitcoin’s exposure and reach.

Meanwhile, Bitcoin is heavily discussed on all kinds of forums. The general trend seems to be that people more and more appreciate the idea of free market competition in currency. There are some very unfair critiques also, for instance from anarcho-capitalist outlet ‘the Daily Bell’. One would expect from them more than anybody else to endorse free market innovations, but since it is not Gold, it does not fit in their quaint notions on money. According to them the fact that Bitcoin transactions are logged and are thus traceable is probably the real agenda behind them. They seem to assume we will pay only with coin once nature has run its course. But this is nonsense, of course, we can’t do without solid on-line transactions in the modern age, not for the time being anyway. Logging is implicit in on-line banking-style transactions. The problem is not logging, but who is doing the logging and what is he doing with it. There are privacy concerns, and we’ll see if and how the market solves them, but we cannot blame such a revolutionary initiative for not being perfect from day one.

Certainly, a new currency, not centrally controlled by tPtB, a volume far less easily manipulable, showing the free market way, is a step forward.

The fact that 1 Bitcoin is now selling at 30 dollars is quite something: back in November 2011 its price stood at 6 and it’s hard to think of an asset doing better. However, basically this is Bitcoin’s main problem.

As we discussed earlier, Bitcoin is built on the premise that loss of value (‘inflation’) is the main problem with our money. It is not. Scarcity, deflation and usury are our main problems and although I’ve not yet heard of Bitcoin banking initiatives, unavoidably associated with usurious lending, it is only a matter of time. Bitcoin’s high price and continuing quick appreciation is a very solid indicator that there are not enough in circulation: demand outstrips supply and this will not change. It is also starting to look vulnerable to speculation and market manipulation. Furthermore, because it is so incredibly lucrative to hold them, people will much prefer to pay with dollars, except for the curiosity effect of paying with Bitcoin. This hoarding aggravates an already deflationary scenario and is very similar to the deflationary depression that we are facing today in the wider economy.

There is also the bizarre story of the CIA’s ‘not for profit investment arm’ (whatever that may mean) IN-Q-TEL eying Bitcoin for ‘investment’.

However, Bitcoin was designed to allow many different parameters. Different versions of it can be designed, with quite different basic rules and there are several spin-offs in development. One of these is Freicoin, which was recently released and which comes along with a ‘demurrage’: a negative interest rate, charging the holders of money, instead of the borrowers. This promotes spending the money and ends hoarding. People tend to pay as quickly as possible to avoid the, typically about 6% per year, fine. The legendary Wörgl, operational in 1934 Austria during the darkest days of the Great Depression, is the most famous example of a demurrage currency. Most German regional currencies are equipped with it too.

In Wörgl it ended unemployment within a year and public works were renewing the whole place while the rest of Europe languished. It was so successful, the Austrian Central Bank panicked and closed it down and threatened with a military invasion when the natives got angry. Even today, the basic laws that govern banking in Euroland are explicitly formulated in such a way as to make the basic Wörgl design impossible.

Freicoin’s demurrage will probably solve Bitcoin’s main weakness. It will be interesting to see how it will perform in comparison to Bitcoin. Marketing is very important to unlock its potential.

Conclusion

Abundant, interest-free, free market units, perhaps like Freicoin, are more likely to really threaten the Money Power’s stranglehold over our money supply. But Bitcoin definitely is a major step forward and eye-opening for millions of people. It is a great inspiration for all monetary reformers out there.

Related:

Bitcoin, Impressive, but Flawed

Interest-Free Economics

The Swiss WIR, or: How to Defeat the Money Power

the Power of Demurrage: the Wörgl Phenomenon

Left: Money Power banksters Zhao Xiaochuan and Lagarde preparing World Currency

To many it is unclear whether China is incorporated in the New World Order or a real competitor to Anglo-American Imperialism. However, there are a number of clear indicators that leave little doubt that the Money Power has co-opted the leadership of the Land of the Dragon a long time ago.

By Anthony Migchels for Henry Makow, Real Currencies, and translated for Argusoog.

History shows that the Money Power has several tools at its disposal to motivate peoples in the right direction. Their fingerprints are all over China.

The Chinese people obviously are not interested in a ‘New World Order’ or losing sovereignty. China is a world upon itself. Its immense size, enormous population, ancient culture, so alien to that of the rest of the world, leaves it with more than enough to worry about, without being too interested in the rest of the world. In fact: in the Age of Discovery, Chinese ships were ahead of the Europeans but they were called back by the Emperor: he simply could not handle a wider span of control. Most great nations are rather self-centered, but none so like China.

On the other hand: with all this comes a sense of uniqueness and entitlement and perhaps they can be cajoled by their ‘rightful’ place at the table?

Here is an excellent analysis of the power brokers in China. It opens with the obvious statement that Marxism is a Money Power operation and that Mao therefore did their bidding. He was apparently educated at Yale’s department in China. Yale’s Skull and Bones were very active in Asia and Mao was probably a member. Most American diplomats sent to him were so too.

According to the article, the triads, China’s enigmatic maffia style secret societies, were built up by Masons to combat the Qing dynasty that ruled China until the 19th century and among others resisted the Opium the British needed to sell to China because they had nothing else to offer in exchange for its vast riches.

The membership list of the Trilateral Commission, the Rockefeller confab similar to the Atlantic Bilderbergers, is littered with Chinese names.

Another vital issue is China’s money supply: just like everywhere else, money is created by banks. A Yuan is an interest-bearing debt to a bank. China has a Public Banking sector. This in itself is in an interesting fact and should actually give us pause as to the nature of Public Banking and how it could serve the Money Power. The Emperors printed debt-free cash.

The Chinese are moving to back the Yuan by Gold, clearly promoting the Money Power’s nascent Gold Standard. Meanwhile, its Central Bank President, Zhao Xiaochuan, who is a member of the Group of 30, the Rockefeller sponsored group of leading Central Bankers and academics, is calling for World Currency. As we have seen, opposition against the dollar is not the same thing as opposition against the Money Power.

China is a loyal member of all the international governance organizations.

Furthermore, over the last decades the Money Power has migrated a substantial part of its manufacturing base from Europe and particularly the US to China. Can there be any doubt that they would be very, very sure that that crucial strategic asset would be absolutely safe there?

China’s rise and its implications

The build up of China must be seen in the light of the decades old program of the deindustrialization of the West, particularly America. What has been given to China, was taken elsewhere.

Also, this build up is actually a typical M.O.: think of how US technology and money built up the USSR to create a credible ‘threat’ in the Cold War. Saddam Hussein is another example: he was made strong to be taken down later as part of the strategy to conquer the Middle East. Or Iran, which is bolstered by often Western/Israeli technology that is transferred via China.

China’s rise comes with many dangers. Chinese nationalism is primitive and easily inflamed. Beijing is under incredible pressure from many internal dynamics and happily uses external ‘foes’ to export these pressures. The latest rows with Japan over some trivial islands are a case in point.

Just like the Money Power directed the Orchestra of Europe during the 19th century, it is now directing the Orchestra of a Multi Polar World. We know how it all ended in Europe: tightly knit alliances facing each other with ever more paranoia, unable to extricate themselves from the trap. One assassination was enough to light the fuse.

The same can be seen today, with NATO facing the Shanghai Cooperation Organization of Russia and China, with Pakistan and Iran as close associates.

Conclusion

China is being built up in a very typical fashion. All the pointers that we have come to recognize are there: usurious control of the money supply, Marxism, Capitalism, ‘secret’ societies, China towing the internationalist line.

The US Empire is not the Money Power and China’s rise and opposition against the US fits in nicely with what we have come to expect from the Money Power’s proxies working towards managed conflict and World Government.

Related:

Colonial Elite Rules China for the Illuminati (Bartholomew)

The US Empire is not the Money Power!

Bloomberg, the dying Fed and the birth pangs of the new Gold Standard

Economic growth is forced because of an ever growing money supply as a result of Interest. This is one of the hallmarks of Interest Free Economics.

This guy nails it one minute and that is instructive.

[youtube=https://www.youtube.com/watch?v=Zc2RD6HL0Sw]

Related:

On Interest

Budget of an Interest Slave

The Problem is not Debt, it’s Interest

Usury: why we don’t build Cathedrals these days….

While most of the work is still ahead of us, once in a while it’s nice to report on progress too. Here’s some good news for a change!

I sometimes like to poke a little fun at ‘the awakened’ in the ‘Alternative Media’. This is not the ‘arrogance of the initiate’. I find myself in the blessed realization of knowing very little. It is just my limited way of promoting ever more vigilance.

Awakening is an ongoing process. The reality that we are awakening to is unlimited and so is our capacity to awaken to it. The depravity of the enemy and the slyness of his lies are boundless too.

It is understandable that money is one of the last thresholds to be taken by the many. But there certainly is an awakening going on. Sometimes, when I’m in one of my more sour moods, I don’t see it, but clearheaded observation makes it difficult to deny. The fact that Austrian Economics has had such a major impact in just a few years actually shows how desperately people are looking for answers. The voices of the Usury Free movement were and are still few compared to the lucrative business of promoting Usury and Deflation, but over the last year something has changed. Usury is breaking through. The efforts of those unsung heroes who have been watching our back for decades, long before the Internet arrived, are slowly but surely coming together and having their impact on the mass consciousness. People like John Turmel, Tommy Kennedy, Margrit Kennedy, Helmut Creutz, Hank Monrobey, Mike Montagne and ‘classical’ populists like Zarlenga, Still and Name789 (although he’ll not enjoy being in this list), the Social Crediters and the real Catholics out there fighting Usury, and many others have been scorned by those they were protecting, but they are now finally finding some recognition for their efforts. Before them there were those struggling. They too have their reward, but it did not come from their brethren.

Clearly it’s far too early to claim victory. In fact: the worst battles are still ahead. Here’s a really funny video by Mark Dice offering to give a 1 ounce Gold coin away to anyone who can guess its worth plus or minus 25%. It shows Americans don’t know and don’t care about Gold. They don’t have any either, meaning the coming transition will leave them empty handed, as always.

Be sure not to miss his clincher at the end (at 5:00)!

[youtube=http://www.youtube.com/watch?feature=player_embedded&v=qf_ENBaAna0]

People not knowing about Gold are sure to be oblivious to anything to do with with the mechanics of money in general.

We’ll suffer great defeats and humiliation still. But Anti-Usury activism, Usury Free living is becoming a force to be reckoned with and that in itself is just fantastic to witness.

But whereas the struggle against Usury is only beginning, a major victory against the enemy is the whole Gun issue. Here’s a great commentary by Mike Adams.

To be honest, I found the whole gun debate rather exasperating. Jones backstabbing the movement at Piers Morgan’s. The NRA saying Sandy Hook proves we need more guns at schools. Clearly we don’t need more guns at schools. We need more teachers, more money, more real attention for children. Less sexting, less ‘sex education’, less dumbing down, less psychotropic and illicit drugs. If we want to avoid another Sandy Hook we must close down the CIA and shut the borders to Mossad and other Israeli operatives.

Obviously the NRA was taken over a very long time ago and now only exists to give gun owners a bad name.

But the Americans did not allow themselves to be confused. Adams is right to say that they see this as a great confirmation of valid distrust of Government. The Government IS coming for their guns. And they need their guns, not even so much to keep the crackheads out of their backyard (most Americans still feel safe), but to keep FEMA and their goons under control. I have not been following the gun issue too much, but Mike is saying there are real concerns in Washington that the militias would get small teams of dedicated patriots out there to execute the whores doing Satan’s bidding. While a fear of God in Washington would even be more appropriate, it’s good to know God has some tough guys of His own to deliver the message if needs be.

The gun-grabbing agenda, which was in trouble anyway, John Todd was already saying in the seventies the Americans would lose their guns shortly and that that was a key step for the New World Order, has been set back indefinitely. The beauty is that it will become exponentially more risky for the CIA and Mossad to come up with new bloodbaths: if anything Sandy Hook has programmed the Americans to think ‘bloodbath = gun-grabbing’.

An important aspect of this issue is that the ‘liberals’, the Cultural Marxists promoting sexism, feminism, pornography, the homosexual/transgender agenda, abortion, the breakdown of the family, the neglect of children, the denial of personal responsibility and freedom, legalism, materialism and all the other depravities that the modern age is famous for have suffered an uncanny moral defeat. Slowly but surely they are losing their venomous grip on the ‘humanitarian’ agenda.

Conclusion

Nothing to conclude! I’m enjoying life and am happy to report Victory is inevitable, albeit far off.

Thank you for visiting Real Currencies and may the One bless you and yours!

For the Love of Christ

The struggle against the Money Power and its Usury is only the physical arm of the real spiritual battle: the war against self. It is a way of showing that we are in this world, but not of it.

Usury and Deflation, which is not a lesser scourge, are two of the key ways for Satan to weaponize the love of money, which is the root of all evil.

Not only do they redistribute wealth to the rich, they create artificial scarcity of money.

Scarcity of money is yet another paradoxical monetary issue. Even today, while the world seems awash in cash, money is scarce in terms of Interest-Free Economics, because there is not enough money in circulation to provide for a fully operational economy. Scarcity of money hinders the match between supply and demand.

Money is scarce when there is all the capital we need and all the labor we need, while not all the work is getting done. That’s the situation today, like it has been for a very long time now.

Usury creates scarcity of money, because it systematically redistributes to the rich who recirculate only that part of their wealth they need for conspicuous consumption and ‘investments’ that will only further increase their wealth. Deflation is taking money out of circulation, so its relation to the theme is self-explanatory.

The love of money is the love of self

Because money is scarce, there is always unemployment. Because there is always unemployment, there is always an existential angst. Because there is this fundamental fear, people focus on survival, even at the cost of their brethren. Because they focus on survival instead of doing His will and relying on His abundant Providence, self grows. Because self grows, Christ dwindles.

Jesus taught we need take up our cross to follow Him. And for what is the cross? To crucify self on, of course. That is our main task, every day of our lives. Few hear of this in churches, because the many prefer the easy grace: proclaiming Jesus is Lord and singing nice songs in church on Sunday. To them Christianity is more a social occasion, a pleasant illusion to cover up their fear, shame and guilt. They are not saved, alas. They are the goats, sent to the left.

Killing self never was a popular option. Most people continue to cling to the five aggregates (awareness, mind, heart, senses and body), as the Buddha put it, because they really believe they are self and are not desperate enough to look hard enough for a way out.

Sometimes I am, but self is an incredibly addictive object. Every time my focus on Christ ends my misery, I immediately disconnect from Him for more self-inflicted pain. It is indeed true that it is not darkness we fear, but the Light.

Self crucifixion certainly sounds painful, but that is the voice of self and as always it is wrong. It is self that is the cause of all pain. Jesus did not leave us with painful messages. Truth only hurts in the beginning, when we are still enthralled with the lie. He left us with the key to liberation and He sure walked His talk.

It took me a decade to understand what self or ego actually is. Once you see it, it’s simple enough though: self is everything that preoccupies awareness. Awareness itself is the most sticky bit of self.

“He must increase, but I must decrease.” (John 3:30) is how John the Baptist put it. The endgame of human development is permanent, complete focus on Christ. Through Him we will know our Father too.

Getting our priorities straight

By combating Usury and Deflation we hope to alleviate the pressures of artificial scarcity and to provide people with a more relaxed lifestyle. The idea is that if we take away fear for survival, people will be less absorbed by material issues. Less prone to the love of money.

In all fairness: it’s an uphill struggle. The premise is incorrect. Because it is love of self that allows the system, not the other way around. It is because people love self, that they look up to others with a bigger self. People have no compassion for the ultra wealthy, for their enslavement to matter. They see them as an example. They want to be one of them, instead of seeing these people have a problem and are an even bigger one.

Why fix the system if it is not broken? This is the question that most people don’t even care to ask, because to them the answer seems so self-evident.

True reform, true economic liberation can only come from ending our preoccupation with self. Recently a friend of mine told me Rudolf Steiner taught that society can only function well if people are willing to give, not-for-profit, the added value of their work to the community.

He was right.

It’s a mistake to say: but this can only work when everybody does it. It starts to work when the first one does it. In fact, it were the people who did this throughout the ages that kept humanity going, notwithstanding the horrible odds.

Related:

The Greatest Victory

And he departed from our sight that we might return to our heart, and there find Him. For He departed, and behold, He is here. ~St Augustine

Thank you Jesus, for showing us the way. Thank you Christ for being in all our hearts always. For responding every time we disconnect from self. For the ever growing bliss with every step we take in your direction. For your providence, your forgiveness, for your willingness to rule our hearts and destinies if we let you.

May our faith, our hope and above all, our charity grow every day.

Thank you Father, for the Christ.

Learn how to kill self

“After silence, that which comes nearest to expressing the inexpressible is music.”

[youtube=http://www.youtube.com/watch?v=R3RIn7lgaSI]