One reason why we have a few money lenders and landlords running the whole world, with the rest of us toiling as serfs to pay their monthly dues to them, is because we have no real inkling of how we would live without them.

And the difference is so enormous, that one shies away from speaking of it, for fear of being condemned as a foolish Utopian.

But here are a few characteristics of a Usury free society with a liberated Commons and current technological levels.

– A man would work a maximum of 15 weeks per year to provide for his wife and children.

– Self Employment and Small Business would be the norm. Wages would be for the young and the simple.

– Men and women would see stress levels decline dramatically. They would spend far more time with each other, their children, their families, and their friends.

– By far most people would live a very comfortable middle class existence. There would still be a few rich people, but they would be much less rich, and not able to dominate society because of their wealth.

– Building would see costs decline by 80 to 90% (!). An architectural revival and boom of uncanny proportions can be expected.

– Every man and his family would have access to decent land and living and working space at very low cost. By far most people would own some land, but vast landholdings would no longer exist, because there would be no renting.

– Food production would be heavily decentralized, and many families would grow at least some food themselves. Food quality would improve incredibly.

– Poverty would be out of the question. There would still be differences in class, but they would be more about genetics and education and not about wealth. But there would be no disenfranchized underclass, and only the most problematic people would be unable to join the general well being. The barbarization of the poor would end, and a great emancipation of those now oppressed by Usury and wage slavery will result.

– There would be no Big Pharma (owned by the Banks) to war on Natural Health. Combined with low stress and excellent nutrition, health, both physical an psychological, and longevity would grow substantially. Substance abuse would decline.

– There would be no Trillions for the Plutocrats to fund all these problems aimed at distracting us and centralizing power. No Migration, no Climate Change, no Bankers orchestrating many and enormous wars. There would be no funding for endless fake news, bogus ‘science’, devious ideologies aimed at dividing people.

– Families and local communities will have plenty of funding for their own needs, though.

– General corruption levels would decline immensely.

– Urbanization would decline and the country side would be repopulated, as abundant money would revive local economies, and there would be no Plutocratic land holdings keeping people out.

– There would be still inequality, but based on merit, and added value, not on property. Hard work and achievement would be rewarded. Wealth inequality levels would be far lower, though. What is more, money will no longer be the main driver of status. Aristocracy will be based on service. On spiritual and intellectual excellence, not on the acquisition of treasure.

– The State could decline very seriously in scope and impact, returning to its basic jobs of providing a basic legal system and defense, not endless nannying and other massive overreaches. Although this remains an important issue in itself. National Socialism, for instance, created a massive totalitarian State supposedly to ‘fight unearned income’ and ‘provide for the citizenry’. But the real aim and focus of economic decentralization is to promote autonomy and economic independence for the common man. This is the core issue. When this goal is achieved, nobody will need a big State to depend on.

– And there is of course Lietaer’s question: ‘What would the Cathedrals of the 21’st Century look like?’. With interest-free lending, major, very long term investments become viable again. It took European cities a century to build a cathedral, back in the days of the Usury-free Catholic economy. What would people build today, if they had a hundred years to create it?

This is what is at stake, and this is what they have stolen from us. This is how we would live, without Usury, without the landowners, without the speculators. Without the parasites who add nothing, and have everything. Without their silly ‘making money with money’ schemes, which have no other purpose than exploiting the toil of the masses, aka Capitalism.

Note that for all this no ideology is needed. Just the acceptance of reality: that money does not grow automatically in a bank account, and that only labor creates wealth.

That we all need a fair deal.

A man produces easily enough for at least five people to live well. This is the reality. We have the duty to ourselves to claim this production for ourselves, and our loved ones.

To say No to Slavery, and Yes to what basically amounts to the Promised Land.

The World is run by the Banking Cartel, who is the real hegemon, not some Nation State.

When Banks rule, it is obvious that they rule through money. Here is how they do it.

By Anthony Migchels. This article was written for, and first published by HenryMakow.com

How we know the Banks rule

Let us first ascertain that the Banking Cartel is indeed the hegemon. And this can be proven by one simple statistic: the World is indebted to them to the tune of $247 Trillion Dollars. That is three times World GDP.

This debt costs about $12 Trillion per year to service, which is about one sixth of World GDP. It is known that all this money ends up with the richest 10% of the people worldwide. Even much worse: about a third of this money (about 4 Trillion) ends up with the richest 0,0032%. These are the people that control the Banks.

Compare this to the income of the US Federal Government, which sits at a paltry $3 Trillion. US Government debt to the Bank is about $21 Trillion, and US total debt (including households and corporations) is perhaps as high as $70 Trillion.

Not only is the Government’s income markedly lower than that of the Banking Cartel, it is dependent on them for money.

These numbers are self evident. They expose the true nature of power, and they also show how ridiculous it is to speak of ‘economic growth’ and ‘wealthy countries’. Obviously, the United States cannot be ‘rich’ when it has $70 Trillion (3,5 times GDP) in debt. There will be wealthy people in the US, yes, but the country itself is poor and broke, as is also proven by the fact that 80% of Americans own nothing, and live paycheck to paycheck.

Besides the obvious implications of the massive debt, it has been established that all the major Banks in the World (European, American, Chinese, Japanese) own each other. They ARE a cartel. It’s not speculation, it’s a fact.

Controlling the Money Supply

To control means to be able to start, sustain, and stop something. Banks control the money supply. They create the money, they decide how much money there is, who gets it, and they destroy the money (when debts are repaid).

And they control all the money supplies in the World. Including that of Syria and Iran. And North Korea. Which is not surprising, as the Communist Manifesto demands ´the centralization of all credit in the State, by means of a national bank and an exclusive monopoly’.

Libya seems to have been the last country with monetary independence: Gaddafi ran an interest-free monetary system, with the issueing organization securely in his own hands. People got interest-free loans for business ventures and mortgages. When the ‘rebels’ (Zio-Capitalist-Wahhab proxy goons) were still a bunch of start ups in Benghazi, the first thing ‘they’ (in reality their sponsors in the State Department) produced was a charter for a Central Bank.

All ‘national’ currencies worldwide, are created in the same way: as an interest-bearing debt to the Bank. Which is noteworthy in itself, because there are many natural ways of creating currency, and this uniformity is a key tell-tale sign of centralized control.

It is sometimes hard to fathom for people why money is so incredibly crucial in the economy, but it’s really very simple: money is half of all transactions. The seller provides goods and services, the buyer provides money.

So on the one hand, there are all the goods and services in the World, on the other hand, there is the money.

Money is the gateway to everything else. Without money, most transactions would not take place. By controlling the volume of money, one controls price levels in the economy. By keeping money scarce, one creates artificial scarcity of everything.

By controlling money, one controls the entire economy.

How they translate control of money into control of everything

Here are the three main Banker tools of exploiting control of money:

1) Usury, which is interest on loans of money.

2) Creating inflations and deflations, the boom and bust cycle.

3) Credit allocation: Bankers decide who gets money, and who doesn’t. They control who can invest, and in what.

We have already seen what damage Usury does: working people pay $12 Trillion per year to the idle classes, parasites who inherit billions and suck up billions more in interest, without ever producing anything that is of use to anybody.

Usury is the main driver of debt. The last 25 years or so, States, Corporations and individuals have paid more interest than they currently have debts outstanding. Without Usury, there would hardly be any debt.

By controlling the volume of money, both in the general economy, and in specific markets, they control all price levels. Yes, ALL price levels, in all markets. Even Oil (the biggest market) they can just increase prices tenfold in a matter of moments. They did this in 2006-2008. This is true of all assets and commodities.

By lending liberally, for instance for speculation on the Stock Exchange, or real estate, they create booms, inflations causing higher prices. Next, they cite ‘lack of confidence’, or ‘bad fundamentals’, and stop lending, which diminishes money in the market, and lowers prices, leading to busts.

During the busts, most people are forced into liquidation at depressed prices. Only the Plutocrats have enough money to pick up the pieces for pennies on the dollar.

The 2008 Credit Crunch alone has created about $50 Trillion in damages worldwide (bailouts plus missed economic growth). Unsurprisingly, the wealthy became much wealthier in the last ten years, while working people (the 90/99%) saw income and asset positions decline massively in real terms.

And last, but not least, the Banker privilege of deciding who gets credit: the implication of this is obvious: the absolute worst people in the World get to decide who gets money, who can invest, and in what. Therefore, Bankers decide in what direction society will develop. So obviously we have mass poverty, people working 50 hours per week, 50 weeks per year while having nothing. That is how the filthy rich like it.

When Bankers decide who gets money, then the Fed can just print $16 Trillion for Bank bailouts, while politicians will tell everybody we can’t afford food stamps and social security.

Conclusion

Yes, the Bankers rule, and they rule through money. They prey on our ignorance. We don’t understand they are a Cartel (a Monopoly), we don’t understand how they create the money, how they set all prices, how Usury automatically concentrates all wealth with the very richest.

But once one does understand the problem, the solution is obvious: take control of the money supply, create usury-free credit, manage volume to allow stable prices (which is really not complicated), and allow local communities to allocate credit for their own needs.

Note that the problem is not fixed with some Gold Standard, while they own all the Gold, and will only lend it at interest to us. The problem is also not fixed with letting the State create the money, but leave all credit (at interest!) to Banking. Crypto currencies are bogus items who do not solve any of our monetary problems. Mindless speculation is not going to solve Banking.

Nationalizing the Fed is also far from sufficient, and at best a minute step in the right direction. The Fed only exists to facilitate Commercial and Merchant Banking, and was created by the Banking Industry.

Keep this in mind: the essence of Banking is not ‘money creation’ as most of the Alternative Media will tell you. The quintessential nature of Banking is lending at interest. THAT is what a Bank does, and that is how they have conquered the entire World.

Only interest-free credit can solve Banking and the New World Order.

This is it folks……….September 22nd will be the official opening of ‘De Florijn’……..

We’ll come together in Utrecht for a small party, and even though I realize most reading this will be too far away to accept the invitation, I want all of you to know you’d be most welcome to partake in the celebrations.

At last! It has proven a thorny path to get it all programmed, but it’s here now!

Sure, in the years ahead, we’ll keep developing, but this is our version 1.0, suitable for ‘production’. Now we can at last start the business of building a viable network of businesses and consumers paying with ‘De Florijn’.

Honestly, I have difficulty believing it myself, but this is my dream of ‘the future of money’. De Florijn, and the Talent architecture upon which it is based, has got it all:

– Fully interest-free with zero cost (!!) credit

– Convertibility to Euro

– Always sufficiently available

– Impervious to foreseeable international financial shocks

– Impervious to speculation and ‘making money with money’

– Providing much needed liquidity where it matters: on Main Street

– Taking only one minute for individuals, and a few minutes for businesses to open an account

– Ultra low cost: free for individuals, only F 10,- per month for businesses

– Seamless payment with a smartphone or even older mobile

– Ready for paper money (although we will be offering that at a later stage)

Priorities

Our first priority now is to build a network of paying businesses that allow us to operate professionally. Already there are about 250 accounts, 30 businesses and 220 private individuals/consumers.

We have a solid marketing plan, based on good contacts with the Alternative Media in the Netherlands (who reach hundreds of thousands of people) and resellers, who we offer good compensation for every business they connect to the network. We hope to activate a lot of people in this way.

Our second goal is to work with people everywhere who want to open up high powered alternative currencies to support their own communities and countries, based on the Talent architecture.

Surely, this is not for everyone. But if Usury is the problem, than obviously lending interest-free is the solution.

A fundraiser

This is always the challenge when embarking on basically any product that requires wider acceptance to gain usability and effectiveness: how to survive until you are breaking even?!

Raising funds for this project has proven an uphill struggle from the beginning. Alternative currencies are both esoteric and clearly anti-establishment in nature. Hardly very attractive to State, Banker, or Venture Capitalist types.

So we, me and my colleagues, are turning to you. We need your help. This project needs and deserves wide(r) support. Monetary reform cannot be left to a handful of people, and it cannot be achieved overnight. At least those who understand the issues need to be involved, or it will never work. A lot of money and years of research and development has gone into it already. M., the man who has programmed everything, has worked with me since 2012 and has spent hundreds of hours on different versions of the system.

We are looking to raise some money to help us get through the first year of operation. We are hoping to raise at least ten thousand dollars. This money will go to operational expenses (travel, telephone, hosting, meetings, marketing materials) and if at all possible subsidizing our cost of living, so we can focus as much as is humanly possible on building the network.

We are looking for donations, but if you would be interested in investing a larger sum of money, that would be great too. We can offer you very reasonable terms. Please contact me at ‘realcurrencies(at)gmail.com.

If you would like to support monetary innovation along the lines as we have been discussing here at Real Currencies, than this is your chance.

Please use the Donate button on the right -> Under the ‘Believers Only’ picture.

Thank you so much.

PS: We’ll keep you posted on further developments!

Two interviews, one with Mike of Rethinkingthedollar.com, and one with Marco Janssen of the Janssen Report.

The first interview focuses on the threats to the dollar, and the monetary system, how it really works. Mike is used to talking to people coming from a more Libertarian perspective, with an emphasis on Gold and ‘money printing’ (instead of Usury) as the core issue.

The second is with Marco, my colleague board member of the Florijn Foundation. Marco has come on board earlier this year. He has been researching the financial system and Usury for years now and has been reporting on the economy on his Youtube channel.

In this interview we discuss how the financial system is the underlying source of really most problems we are facing. From about 16 minutes onwards we discuss solutions and the Florijn/Talent.

Another status update

We’re moving on splendidly with our payment app. We’re also implementing ‘pay per SMS for the 30% or so folks who don’t have a smartphone (yet). Combined, this will guarantee a simple and seamless payment experience for all mobile phone users.

It’s going to be very soon now, that we can at last launch officially!

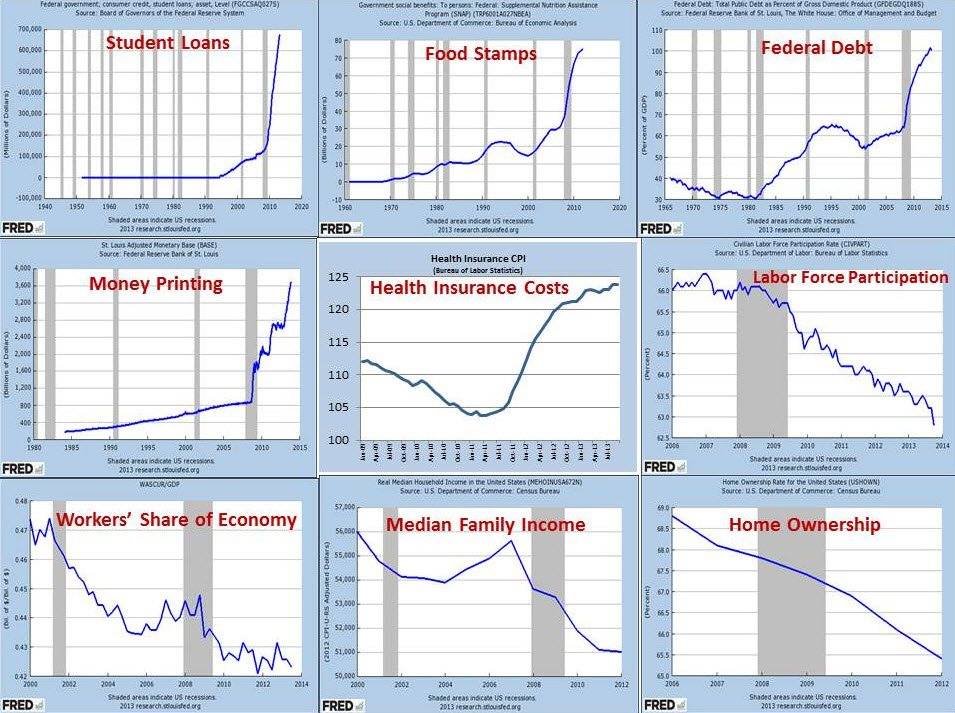

And a little reminder of why we need monetary innovation:

As we can see, any notions of ‘economic growth’ and ‘recovery’ are just complete baloney.

All these ‘journalists’ out there, all these ‘economists’, they should be profoundly ashamed of themselves for plugging all these lies.

There is no economic recovery. There is only wholesale money printing and deeper and deeper indebtedness of both sovereigns and private borrowers, including corporations.

Real incomes and asset positions of normal people are plummeting. All the ‘economic growth’ of last few years was just putting extra liquidity in the economy and making sure only the insiders would share in it. The incomes and asset positions of the 0,001% have been ballooning over the last 8 years.

The only way this is heading is further South.

We’re getting tired of waiting for the next round, it’s wearying with this sword of Damocles over our head, and with all the fear porn out there.

But the fact is, the West is doomed and we need solutions now more than ever.

Related:

More On The Talent

Dear Monetary Reformers

Here’s a much needed, short update on our great adventure: the implementation of our Talent architecture in a nationally circulating currency, ‘de Florijn’.

We had been planning to crowdfund for ‘de Florijn’ and next create the website, but as always, things turned out differently: we decided to first create the product, before looking for financing.

Unfortunately, things always seem to must move slower than either hoped or anticipated, but as they say: things go as they must.

But we have spent our time well: in December last year we opened our site in beta phase: you can find it at https://www.betalenmetflorijn.nl. Before we open up officially, the design will be further revamped and modernized, to make it focus completely on our simple, but revolutionary new currency.

We have also opened up a foundation to manage it all once we open. With me, Barry Annes and Marco Janssen as board members. The latter two gentlemen are consummate professionals and fully aware of the issues at stake. Marco regularly reports on the economy with his ‘Janssen Report‘.

We have about 130 account holders already, which is a nice start, although we will be looking for a few more before launching.

The main issue we’re negotiating at the moment is that we need a solid app for smartphones, to guarantee a modern and seamless payment experience. When done, working with ‘De Florijn’, buying them on the exchange, paying with them in stores, will be easy, safe, fast and up to speed with what people expect from today’s mobile applications.

Once this final hurdle has been taken, we will launch and start a funding campaign.

Working without money has been the bane of the whole project and we desperately need funds to keep going while we build the network until it reaches a size that allows the operation to self finance. This will be with about 1000 paying companies on board, something we hope to achieve within the first year after launching.

If you, in the meantime, can find it in your heart to make a donation to keep us going while we finish the final stages of the development, that would be really very much appreciated. We need all the help we can get, and we need to get it from you, because, as you will appreciate, there is plenty of money for saving banks, but not so much for solving banking.

Please use the donate button on the right. Thank you so much.

The whole thing is really very exciting: ‘De Florijn’ really stands a credible chance of developing into a widely used complementary payment device, directly addressing the key issues in the economy: scarce and expensive credit, small and medium business being savaged by deflation, the Internet and Transnational competition.

Not only that: the Talent infrastructure can be implemented by any ambitious monetary reformer who would like to create a truly comprehensive complementary currency anywhere in the Western World and beyond. There is nothing available anywhere, that comes even close to it. Remember: we are creating interest-free credit that is convertible to Euro or any other dominant banking unit. We’re currently working with several people who are looking to make a contribution in the need to bring people real monetary solutions.

Thanks again for your ongoing support of Real Currencies, ‘de Florijn, and the Talent!

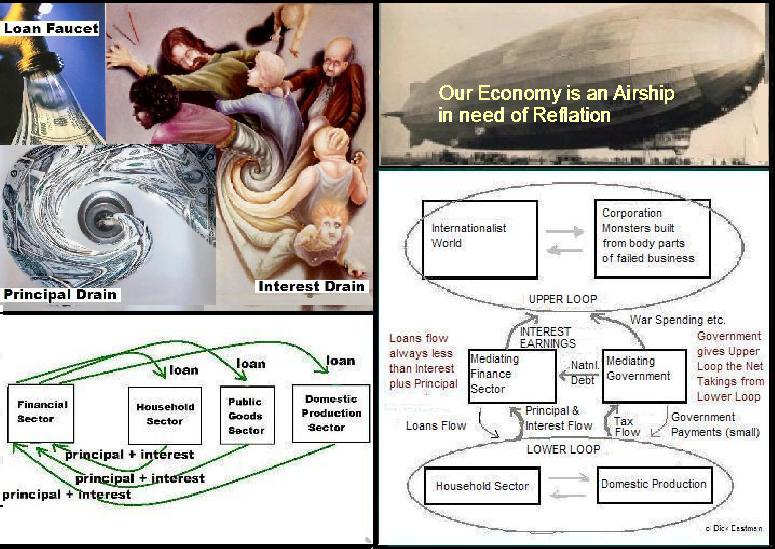

(Left/Above: the erudite Dick Eastman)

Recently, Social Crediters have been campaigning against the notion that Usury is the core of our monetary problems. To them it’s the Gap, the difference between purchasing power of the consumer base and output of the productive sector.

However, the Gap is mostly caused by Usury and it’s becoming more and more difficult to understand why the Social Crediters are not willing to admit to this.

(Here’s my analysis of Social Credit for those new to the issue)

Here’s a recent effort by Oliver Heydorn for the Social Credit camp on the socred.org website.

Dick Eastman convincingly took him to task on the issue of Usury being the Gap. Dick communicates via his email list, so I can’t link to it, but email me if you want to get on Dick’s list to receive his top notch work.

And next he wrote me a friendly letter (see below this article), looking to bridge our differences.

The Gap is the difference between what workers produce and the wages they receive. Because wages are lower than the value of production, there is a constant lack of purchasing power for the workers to mop up their own production.

Major Douglas was the one to point at this phenomenon. He proposed printing debt free money by the Government and allowing the people to spend the new money into circulation. If you print only as much money as is necessary to buy up ‘excess’ production, no ‘inflation’ (rising prices) will ensue, Douglas claimed.

I’m not really convinced that this will be ‘inflation’-free, by the way, and I don’t think Dick Eastman is either, he just doesn’t care much and correctly notes that inflation is really the very least of our problems as it stimulates economic growth and reduces the value of debts, things only bankers and the ultra rich hate.

Be that as it may, bottom line is that Social Credit to some extent compensates for Usury in this way and this is why I personally sympathize with the scheme.

Dick Eastman, who wants to use Social Credit to end Rothschild tyranny, has been making the case for years that Douglas’ ‘Gap’ is basically the interest on loans of money. As Eastman correctly notes, the Bankers don’t spend the money back into circulation, but hoard it, to cause deflation.

I’m adding to this they also simply lend it back into circulation, as the extra interest drain of the interest lent back into circulation will only worsen the deflationary pressures both in the medium and long term. In this way they let compound interest also work to crunch us with ever worsening money scarcity (while printing ever more money! Neat, huh?)

The Gap is calculated to be around 50% of production by Social Crediters. Obviously, it’s no coincidence that about 40% of the prices we pay for goods and services are Usury passed by the producers. As calculated in Helmut Creutz’ ‘the Money Syndrome’.

It seems to me that this more or less speaks for itself and in the to and fro between the Social Crediters and Dick Eastman I also could not find any real rebuttal of this by the SC’ers. Dick’s simply right. It’s not an ‘accounting issue’ (as the SC’ers put it), it’s the interest-drain.

Downside of Social Credit

Clearly, this being the case, we need to solve Usury first and what remains of the Gap after we do, can be solved with some extra liquidity if needs be.

Social Credit’s main problem is that it compensates what people lose to Usury. However, people will still be paying, even with freshly printed notes.

Why do the Usurers need to continue to suck up Trillions per year? That’s the whole issue, is it not? We have a couple of Trillionaires at the top of the food chain who have stolen the rightful inheritance of the Earth’s masses through compound interest.

It’s all unearned income. All that these guys do during the day to ‘make’ this money is bribe politicians, newspapers and ‘economists’.

Compensating people for the interest-drain is not enough. The interest-drain itself must be stopped.

Responding to Dick Eastman

As Dick notes, we do agree on a great many issues and we share a hobby too: preparing Austrians for luncheon. Especially the Austrians’ criminal defense of deflation is something both Dick and myself feel very strongly about indeed.

Furthermore, while I do have a proposal of my own, I’m not at all hung up on it.

The Goals of Monetary Reform as I see them are to

1) end Usury and its associated scarcity of money

2) end artificial inflations and deflations, the boom-bust cycle

3) democratize credit allocation, so bankers nor technocrats can direct the economy.

These are the parameters along which I have analyzed the different monetary reform proposals out there, including Dick Eastman’s (the latter in email correspondence, not on Real Currencies).

I support with reservations anything that moves in the right direction, and unreservedly all proposals that achieve the three main goals of monetary reform as I see them.

Dick wants to replace the current usurious credit based money supply with Social Credit and allow for free full reserve banking, assuming that competition between banks will lead to low interest rates and decent behavior of these institutions.

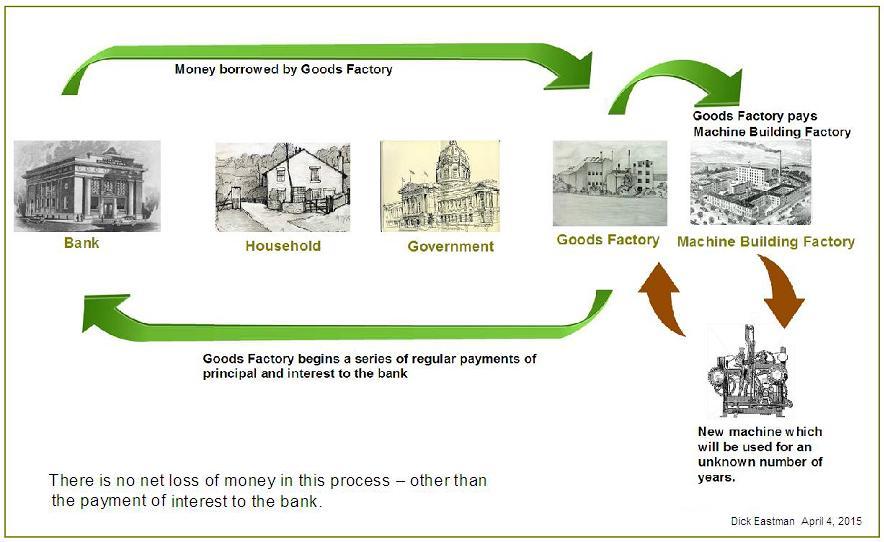

In the diagrams in his letter we can see how his proposal would lead to constant circulation of all the money, including that used for interest-payments. So the interest-drain, or gap, will be solved.

However, in doing so Dick, like the wider Social Credit community, also overlooks that Usury is paid by those who don’t have money to those that do. Ie: the poor will borrow from the middle classes, who in turn will borrow from the rich. At least some of the wealth transfer through Usury will continue. It will still be the rich depositing money to lend in these banks.

Furthermore, while Eastman hopes to reach out to our Muslim brethren in the faith, he ignores why Islam rejects Usury: because it is unearned income. In Islam every transaction must lead to both participants adding to the greater whole. The Usurer just takes. He adds nothing, risks nothing and loses nothing.

In an interest-free environment there is no ‘risk’ as all risk is mutually insured, just as the credit is mutual. ‘Debtors’ (people promising to pay) pay a one off service charge to cover the risks for the community. Since most lending will come with collateral, risk is minimal as it is anyway.

This is in fact already the case today. There is no real ‘risk’ in the financial industry. For instance: houses going under water is because of the deflation the banks cause themselves willfully.

Last, I’m not as optimistic as Dick is about the disciplining effects of the market on bankers. Bankers will be bankers, experience shows. Eastman puts them in a cage, but a wild animal can find ways to escape, especially if its incentive, Usury, remains in place. They will be colluding again in no time. Such is the power of the love of money and its weaponization: interest on loans of money.

He puts my position as: “Your answer is simple enough. Kill the vampire — and have government make the loans at zero interest. Certainly that remedy would fix the problem. Usury is killed. You are happy. Luther is happy. Mohammed (pbuh) is happy. God is happy. Right?”

But then points at the problem of Government being in control of credit creation and allocation.

And that obviously is indeed a major problem, if Government is the one to dole out the credit.

However, that is not my position. It would not achieve goal number three: democratic credit allocation.

I’m looking for interest-free credit facilities that work according to a clear cut charter, semi-private, semi-public not-for-profit institutions. And they should allocate the credit based on rights. The understanding must be that people simply have a right to credit as it is their promise to pay which is monetized. The Money Supply and the Credit of the Nation are part of the Commons and all commoners have rights to access to their fair share in the available credit. Based on rules that balance the needs and rights of both individuals and the community (other individuals).

They must be credit worthy, based on collateral and have a reasonable plan (a normal business, a mortgage). The credit facility must provide no more credit than stable prices allow.

In this way credit allocation can be to a large extent made to be predictable. No technocrats looking for control, but professionals simply facilitating people’s natural rights.

90% of society’s demand for credit can be covered in this way. What remains are risky ventures. These need financing too, but this can be reasonably done on an investment basis, where those providing the capital also share in the risk. Brokerages can provide the infrastructure for this.

What is more, and this is the key point: what Eastman proposes, full reserve banking, can just as well be done interest-free! People can just save with ‘banks’ (for lack of a better word) interest-free and their money can be used for lending, as long as the ‘bank’ guarantees the deposit, which can be well done by having borrowers pay one off charges to cover uncollateralized defaults. This is known as JAK Banking.

And let us not forget that Usury is the main cause of defaults to begin with. Clearly the credit worthiness of people vastly increases if they don’t have to pay interest on their loans.

Conclusion

Solving Usury will solve at least 80% of the gap. It’s really hard to see how the Social Crediters can get around this.

However, Usury is worse than just the gap. It’s a wealth transfer from those who don’t have money and thus must borrow to those who have already more of it than they can spend.

It is unearned income.

The whole idea that money should breed money is irrelevant.

The Time Value of Money is a hoax, cooked up by 16th century Jesuit monks in Salamanca, who laid the groundworks for what later became Libertarianism. This was the end of Usury prohibition in Europe. It paved the way for centuries of Usury and is leading directly to the destruction of the West and to World Government.

There is no need for Government nor Banks to control lending, it can all be done in democratic, decentralized, and not-for-profit fashion.

Let us end all rents and unearned income. The economy should be based on production, not parasiticism.

Having said this, I admire Dick’s work and I’m grateful for this opportunity to make this case against Usury once more, and to fire up everyone to take up arms against the Money Power menace.

Let us not rest until this Demon is defeated once and for all!

Related:

Social Credit

Social Credit With Demurrage

More On Mutual Credit

Rationalizing Usury: The Time Value Hoax

The Difference Between Debt-Free Money And Interest-Free Credit

The Goal Of Monetary Reform

Forget About Full Reserve Banking

Dick Eastman’s letter:

Dear Anthony,

Very good to receive this email from you.

We have been sharing thoughts and friendship for a long time. We agree on almost everything — including the deflation that results from the practices and systems of usury. Our common goals might be better attained if we could agree on the same remedy. I think we can.

As I understand it you are saying that usury is wrong in the sense of a morality that is a morality that best serves people. The last I looked it appeared to me that you advocate the elimination of interest on loans under all circumstances and that you would have a government agency make all loans interest free. Yes, that would eliminate usury. The structure of the financial system would be so changed that the gap in purchasing power due to the draining of interest to financiers/capitalists/bankers would be gone. End of problem. End of story.

In my opinion, not without some thought, you charging money to allow others to spend your money today instead of you spending it, provided they promise and do give you that same amount of money later on, is a freedom that in a well designed market economy/ money system/ lending system could be a positive benefit to both borrower, lender and society as a whole.

My idea has been to find out exactly where interest under the present system is killing us and to do something about that. Why is the usury system killing us?

I think I have isolated what is good and what is bad about usury under the present system — and what would be all good without bad under a different system.

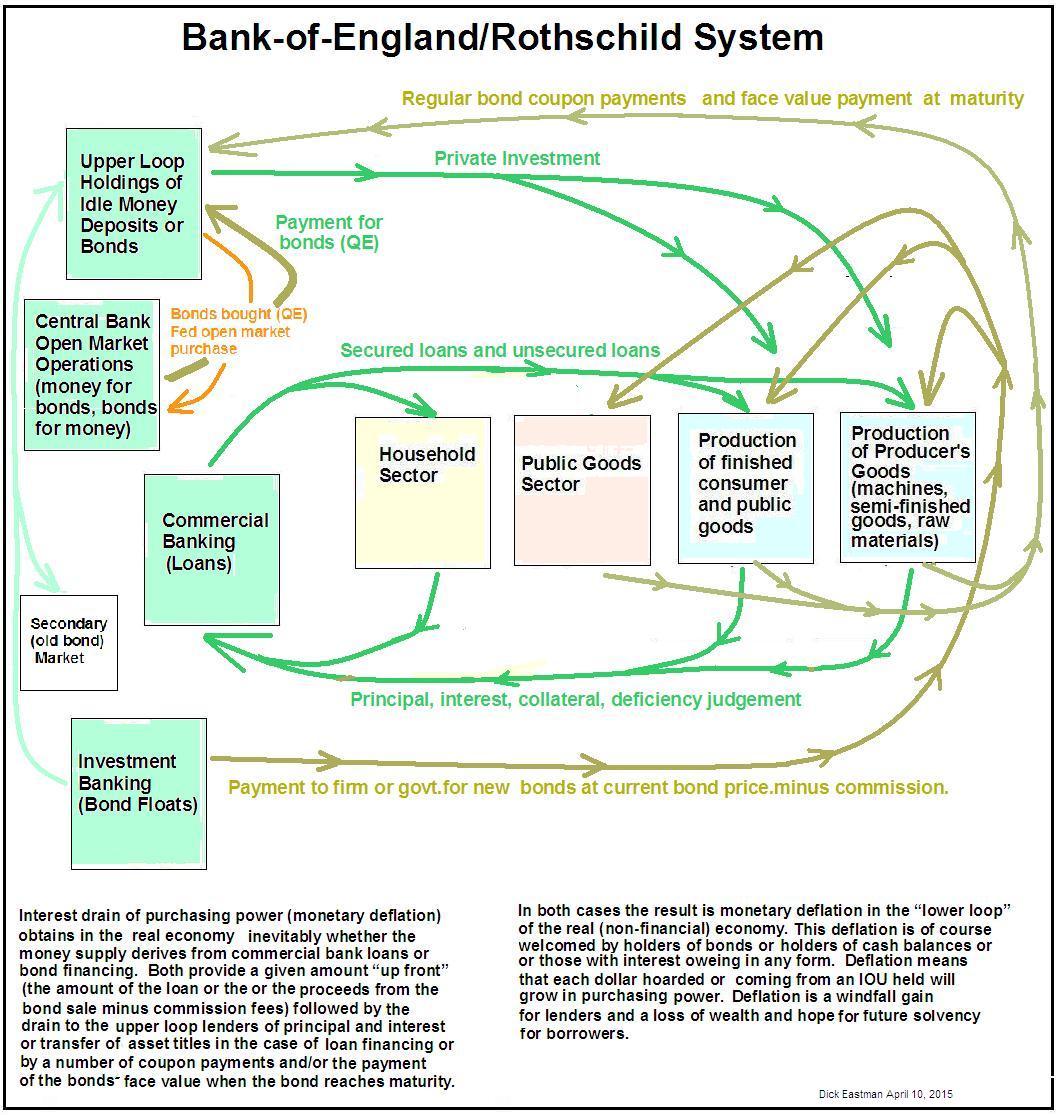

The system of today’s usury I call the Bank-of-England/Rothschild system, named after both the bank that initiated the system and the family name of those who have most effectively used the system to the detriment of all nations and peoples except their own.

I have identified elements of the Bank-of-England/Rothschild system that cause the most trouble. Sometimes the gold standard. Always the private issue of the nations money. The tendency to want deflation to make the money the monopolize to be worth more per unit so they can increase their real wealth by simply hoarding money and not spending — the cause of the leakage of purchasing power from the real economy, causing hardship and loss in the “lower loop” (most households, businesses, local government that provides public services). The Bank-of-England/Rothschild system has always opposed national treasury money — the green-backs backed only by the word and authority of a good government. Such a money system would cut down their power from that of just short of God to something more on a scale of of their standing among common humanity.

In the past I have just hinted at the problem with this diagram:

But now I have two diagrams that together, I think, captures the essense of the problem.

New money comes in only a few ways — all involve borrowing at interest. These ways are 1) commercial bank loans at interest and secured by collateral or primacy lenders’ claims in any bankruptcy; and 2) bond financing — where money comes when a corporation or government writes an IOU promising to pay some amount in the future — which is then sold for a lower price in the current bond market. The new money is not really new — it comes from the interest earnings that are being hoarded by those who have been holding on to money simply to create deflation and to gain from deflation. But bond financing also involves interest drain. The hoarders give up the gain from hoarding for the bigger interest gain in buying an IOU (bond) — and the bond maker gets the money and spends it on war or new Wal Mart outlet buildings or high fructose processing plants — which for a time increases money in circulation (monetary inflation) — but as with bank lending and interest collecting — the IOU stipulates a face value that must be paid at a future date that is bigger than the bond price the bond sold for — and on many bonds their is a coupon amount that must be paid at regular intervals as well. Soon the gain in money circulating from the buying of a new bond with money that was being hoarded — is soon followed by the payment of coupon amonts and bond face value back to the hoarders — more deflation — unless the corporation or government chooses to roll over the debt buy writing new IOUs to get money to pay the obligation on the old IOU. This is the true heart of darkness — both bond financing and bank loan financing have the same effect. An upward jump in money supply followed by a decline — as principal and interest are paid and as coupon and face value are paid — that takes the money circulation lower than before the financing was undertaken.

There is one more mechanism for making new money — the bonds themselves can be sold by those holding them to the central bank in exchange for funds — referred to by the concealing euphemism Quantitative Easing (QE) — but thise of course gives money only to the hoarding class — the people who only part with their money deposits when interest rates are very high or when bankrupt assets and privatized public utilities come up for distress sales in extreme buyer’s markets.

The above explains everything. Why depressions happen. Why bust follows boom. The debt increases to trillions upon trillions of dollars owed. Why possession of the world is being transfered to the credit monopoly that provides the credit money (the all-borrowed money supply).

I know this has been your understanding of the matter too. This is the great evil exposed. The vampire has two fangs — the all-borrowed money supply and deflation-intensified-by-hoarding which only higher interest rates or a Greek Island or Chrysler Motors going up for auction in a distress sale can induce to spend.

This is the system we both do not like. This is the system that grips our countries, Holland and the US, and everyone else’s country as well.

Your answer is simple enough. Kill the vampire — and have government make the loans at zero interest. Certainly that remedy would fix the problem. Usury is killed. You are happy. Luther is happy. Mohammed (pbuh) is happy. God is happy. Right?

But then comes the old crotchety American who says the government passing out money interest free is garl-durn socialism, even communism, where Congress (or the Tweede Kamer over there) , our federal legislature is the biggest whorehouse in the world, I am sure the Tweede Kamer operates the same. Buying votes. Giving contracts to those who contribute to the elections or who control the political parties that decides who will be ministers will run the government. BUT ONCE YOUR COUNTRY’S POLITICIANS OR MY COUNTRIES POLITICIANS HAVE THE POWER TO CREATE MONEY AND THEN LEND IT OUT AT THEIR OWN DISCRETION you will have created a monster of state power that is just as terrible and corrupt as Bank-of-England/Rothschild power. The state will be a god. People will wait in line for loans like people wait in line for an operation or a CAT scan under socialized medicine. And only those who contribute to the party and the politician will get moved to a shorter line. The heck with that noise. Can’t a European see the problem there?

I can’t join with you if you insist upon replacing usury with a government that makes money and then passes it out in loans to those the government chooses to lend them to, to those the state deems to be “deserving.” They can’t just lend to everyone all they want at zero interest — or everyone would borrow and borrow with promises to repay later until they die — and then try to collect after they are dead. So there must be some kind of rationing, some constraint on who gets loans — and you would leave that up to the government, to politicians, to the political parties, to those who pay the bosses of the political parties — in fact the same people who already own congress and the Tweede Kamer under the Bank-of-England/Rothschild system our two countries have now.

So I ask you. Can we agree to be rid of the Bank-of-England/Rothschild system — but not replace it with the all powerful National Money Power that you have been so naively proposing.

Now you are not the only one I would like to come to full agreement with. There are also the Moslems (peace be upon them all in this world and the next). They too are against usury. Like you they reject my proposals because they are simply evil and unjust and socially destructive.

Well, I have extended an olive branch to you and to them — but have not gotten a response. I propose a system where business people who want to make a new kind of device, for example, can get a lot of money from a lot of people on condition that those people get their money back after the device is build and selling, plus some more money for their willingness to lend.

But would not that not necessarily be usury?

No. I thinking of a replacement for usury, that is not usury, but which does allow little people to pool their money to support an entrepreneur with a good idea in the hope of a gain for themselves later on. What I propose to accomplish this will not be usury, but will be an actual silent partnership, where the vampire “lender” is transformed into a small silent partner — sharing in risk, having the rights of a small partner rather than a creditor. Here is how it would work.

The economy has plenty of money in it, coming from the state and being introduced exclusively through the new money dividend — debt free money to each person in each household on a regular unfailing basis.

Now there will be people with great inventions or ideas for products that people would enjoy if only someone would make them — but these inventors have no money to realize their idea and put it on the market. They need money, and “advance” so they can pay employees and materials suppliers and tool suppliers until the product is selling and can pay for itself. \

Now instead of going to a bank for a loan like they do now, and instead of writing up an IOU and selling it as they do now (bond financing), we would instead have, not a Bank, but a populist institution called a “Pank.” I slightly change the name because I want to underscore the idea that the “Pank” is something completely different for the following reasons.

Here is how Anthony Migchels would start a “Pank.” He calls up his internet friends and says, “I know a sharp young fellow named Daan whose wife Isa is a great dress designer, really different and cool. And Daan has invented a new treatment for fabric that makes it really fantastic to touch and that draps in a really attractive way that every woman will want to own one. We need to hire five hundred seamstresses and buy 500 sewing machines, plus the material, plus the building, plus the chemicals for the treatment and so forth. I want to open a “Pank” to provide Daan and Isa with the advance they need. Will you you subscribe — (this replaces becoming a depositor in a bank) ? And what if I, Anthony Migchels the “Panker” am wrong and Daan’s idea is no good, or the government will not let him use his chemicals, or the style of dress Isa designs just doesn’t sell? Well then, in that case, we as silent partners must share the loss with Daan and Isa. If you put up ƒ300 (gulden — post-euro) and the business fails, you are only entitled to claim half of what you subscribed. (Now THAT is what makes this no longer usury. A banker would lay claim to the full debt obligation and would have priority before Daan and Isa could get one tiny penningen from liquidation. But under the new Dutch “Panking System” no such loan contract would be legal. Pankers and the subscribers the panker attracts will not be insured by the governrment. Panker and subscriber would be exposed to all the risk Daan and Isa are exposed to.

Then why would anyone every become a subscriber to Anthony Migchel’s bank? Because everyone knows that since the early 21st century Migchel’s has been known as one of the most honest men in Holland, a man with good sense and an eye for a good deal and a man with a good heart who would not ask people to subscribe to his Pank to a venture unless he was sure it would succeed. In other words — when you subscribe you money to a “panking” venture you are putting your trust in the integrity of the “panker” to pick the right entrepreneur with the right idea in the right market at the right time given all the factors that might affect the success or failure of such fashion design innovation.

Is then “panking” usury? You might look at the fact that the panker takes money from people with an understanding he will return that much and more later on if the venture of Daan and Isa succeeds. That looks like banking and therefore like usury. But then again — notice that the “panker” and the subscribers are taking the same risk as Daan and Isa. Notice that in the event that the business fails and cannot pay the “pank” what was hoped — that Anthony and Daan and Isa and the subscribers divide the loss among themselves. That is partnership, not usury. Under usury the lenders must get completely paid before employees, or other crediters get a penningen.

Furthermore it is not percent of the loan that is owed the pank and the subscribers — but a return of the advance plus a share of the profits. And it would be the hard work and intelligence and shrewdness of Anthony Migchels the panker (remember a panker is one who creates the lending institution that replaces the usurous “bank” of today.

(Note: There is a city called Panker in Shleswig-Holstein in Germany — and in northeastern Pennsylvaina “to pank” means to press down and compact soil or other loose type of material into a more compact mass — which is what in the present usage is what the “panker” does with subscriber’s money before handing it to Daan and Isa to start their dress company. — but otherwise the word “pank” seems to be free for this use.)

Now in Islamic banking riba (usury) is haraam (sin) with no exceptions. However partnerships are not haraam. The pank, with Anthony Migchels, as panker in this case, — anyone can be a panker if they have the name and reputation that earns the confidence of subscribers to take the risk — calls the shots for who gets the money — for whom to partner with, in this case partnering with Daan and Isa.

There is no riba or usury involved in repaying the amount of the advance (called the paying the principal in the Bank-of-England/Rothschid system, so the big question is whether the extra money that Anthony and the subscribers get back is riba or, in Christian eyes, usury — or whether it is shared profit or some other thing. For example, the arrangment could be a joint venture (Musharakah rather than a borrower-lender arrangment), or it could be set up as a work-and-earn-to-own arrangment — where the pank pays for the business and its early operations, paying Daan and Isa fully for their contributions of entrepreneurship, management, know-how, and labor — enough for them to live on while the ownership of the business is sold to Daan and Isa in installments by a pre-specified formula. The pank would take profit left over after paying Daan and Isa what is owed them — until the business — Daan en Isa Mooie Jurken — becomes completely owned by Daan and Isa. The deal is this: The Pank says, we will pay for starting the business you want and for its early operations, paying Daan and Isa a fee for all of their contribution, including Isa’s original designs, and the worth of the chemical formula as purchased by the pank from Daan. The pank will take profits over that — half of profits going to the Pankers (Anthony and his subscribers) — the subscribers replace the savers who put their money in time savings accounts in the old Bank-of-England/Rothschid system.) And that is enough about that — the point is that the pooling of money so that good business ideas can be undertaken can be done without usury, riba or “charging interest” .

Whether Theologicans against usury and Moslems against riba give American populist social credit a “pass” on avoiding sin — the fact remains that the creation of a permanent money supply provided for free to every citizen — and the ending of money creation by banks, and the requirment that banks only lend money that savers entrust to them to lend — will end the tendency and the incentive for the financial system to deflate the quantity of money in circulation. That in itself will end deflationary depression, end the waves of defaults and bankruptcies, end the mounting indebedness to lenders, end the transfer of real asset wealth from the borrowing class to the lending class. It would make businesses more profitable. It would allow businesses expanding and innovating from their own profit to replace borrowing from banks because money is not available to innovate without going to the usurers.

So, Anthony, why can’t we agree that the Bank-of-England/Rolthschild system leads to national ruin all the time, that it is an instrument of class warfare and piracy of rich exploiting the helpless poor. And why can we not also agree that with competitive “panking” – where anyone can become a bank if he has the reputation to attract subscribers — buyer beware! subscriber beware! because we allow panks to fail (if the panker cannot pick good entrepreneurs to invest in, cannot understand all that may affect supply and demand to pick the right entrepreneur with the right venture — whether giving a retailer money to fill his shelves — or betting on a new invention — if he fails he fails — no one will want to subscribe to his pank again.

This would be highly competitive “panking” — a pank is only as good as the ventures it is investing in. The pank would allow little people to get the gains that today only the rich can do — get involved in investing in something big.

Today inder the Bank of England’/Rothschild system — these is no competitive banking. Interest rates are fixed. Everything is fixed. And the game is rigged all in favor of the lender and against the borrower. That will end.

But remember this. Companies that satisfy coustomers will never suffer a bad day because of macroeconomic deflation. There will be no deflation, no laps in consumer purchasing power. And firms will be as successful as the businessman dreamed when he started his business — if he is a good businessman and entreprneur. That means we will be back in a land of opportunity.

There will be no more macroeconomics. No monetary policy. No tending of the national economy. There will be no national interest rate, no international money markets. (I have not gotten into the other phase of American Populist Social Credit — the elimination of corporations and a return to having all businesses either single proprietorship (single owner) or partnerships — with full liability to owners.

There is no democracy unless the people — all of the people equally — are the ones who spend all new money into circulation. The Rothschilds and Rockefellers owning Goldman-Sachs and JP Morgan-Chase should not be creating money and lending it to people at interest to give the economy its money supply. Nor should politicians have that power to create money and spend it into circulation — because that power would lead to corruption and a totalitarian state at least as bad as what we have now.

Let the people have all new money and let them be free to pool their money and jointly undertake big things, if they want to — with a populist banking system (or “panking system” if we want a new name to go with a new system). The populist banks will not be able to create money — they will just be places where good opportunity spotters will find the best entreprneurs to provide money to — ‘advances” can replace the term loans — or “investment money” — or “partnership funds”

let us have a system that Moslems and Christians against riba and usury can participate in with clear conscious that no sin is being committed against god and the ways of righteousness found in the Holy Books.

But most of all let us do away with the evil lies and theft of the Bank-of_England/Rothschild system that plunders the people who create the wealth from the world that God has provided us all to enjoy.

This is an interesting second interview with the guys of The Plane Truth.

We get to the bottom of the international situation. Is there a real struggle between Russian and the US Empires? Or is it a war of both States against the Peoples of the Planet?

Babylon is One and while the actors in the play often believe in what they do, ultimately their actions amount to manipulated events. States need war. It’s why they exist. The Money Power manipulates events from behind the scenes and Ezra Pound’s conclusions, that wars are caused by these Banker manipulations, still stands.

We also discuss the main monetary reform proposals out there and the need to improve on them.

Talking with Robert Stark on the Basic Income

This interview happened a few months ago (sorry for the delay Robert), but its relevance is ongoing.

In Greece Syriza has already shown itself to be what the initiated had long seen: a harmless (for the Bankers, anyway) Marxist outfit. In their program there is nothing about real monetary reform, or doing anything substantial about the Banks or Usury.

After some mutual huffing and puffing from Berlin and Athens, both parties have agreed to bury the hatchet for four months. Interestingly, at that stage the development part of the BRICS Bank will come on-line.

Will Greece dump the EU and walk over to Globalism Sino-Russian style? Putin has been proposing his Eurasian economic sphere and is building extensive internationalist organizations. Both in the former Soviet sphere and with the Chinese. The Russians have already indicated that they are ready to bail out the Greeks.

Furthermore, Syriza seems to be making serious moves towards some sort of Basic Income scheme. Interestingly, the EU seems to be all for it.

And this is where this interview becomes relevant, because this is the Marxist style of course, is it not? Just plunder the middle classes to ‘save the poor’ and thus work around the problems of Capitalism, instead of solving them.

Which could be achieved by paying off the National Debt to the Banks with some freshly printed interest-free credit, provided by a newly opened State controlled credit facility. Let alone allowing normal Greeks to refinance their mortgages and business loans too.

Redefining God

Thankfully, the infatuation with Putin in the Truth Movement seems to be subsiding somewhat. The more level headed are speaking up and there are too many questions.

Truth be told: Russia, notwithstanding the fall of the Soviet Union, has been preparing for war for decades. Putin used his oil wealth to revamp his military and the question is how ‘abandoned’ these massive underground facilities under Yamantau (the Urals) really are.

BRICS, including its bank, is just intended as a dialectical counterpart for Western Globalism.

For those looking for some much needed, effective deprogramming concerning the BRICS saviours, we can recommend Redefining God. Ken is very much on top of it.

He’s also got a very effective analysis of the Annunaki narrative.

Youtube is full of videos where people have used photoshop etc. to undo NASA editing of the materials they are disclosing to the public. Obviously, this indicates that NASA is disclosing these secrets purposefully and the question is why and how they will spin it.

The wider picture

There is a huge disconnect between the level of awareness of people on the Web and the atrocious propaganda that parades as ‘science’ and ‘news’ in the Mainstream.

But in terms of political movements, it’s hard to point at anything substantial. All political parties globally are operating within the paradigms that the Matrix provides. Whether it’s Nationalism or Marxism.

Nobody is calling for anything serious and even within the monetary reform scene there are really very few who will speak up against the Banks as the monolithic central power globally. And who will discuss serious solutions in terms of fundamental monetary reform, which by their nature are both radical and simple.

So for the time being we can conclude that, while awareness is growing, the Money Power is still very much in control.

Because the chaos that is mounting has been created over many years and while the exasperated masses are waking up to the need for change, they are still clueless about what change they exactly need.

And as usual the Bankers have their ‘solutions’ ready instead.

Related:

The Plane Truth: Usury And The Rise Of The Bankster Dictatorship

The Basic Income

The BRICS Bank: Next Stop On The Road To World Currency

(Left/Above: Mrs. Baars waving to the peasants)

In an iconic 2011 moment, Occupy protesters met Wall Street bankers enjoying themselves with drinks. A veritable Marie Antoinette greeted them by toasting with her champagne. The divide between the ‘haves’ and the ‘have nots’ could not have been clearer.

By Anthony Migchels for Henry Makow and Real Currencies

Here’s the famous clip.

A source close to the Baars family, E.A., 21 years old, has come forward. Living and very much enjoying ‘the lifestyle’ herself, she is also worried about the blowback against the banker decadence.

Here’s her story.

The Baars Family

It turns out that the lady in pink is Mrs. Baars, wife of Goldman Sachs managing director Willem Baars, who hails from Holland. He has been making a career for himself with the infamous vampire squid that is at the core of Wall Street’s pirate nest. Managing Directors are the second management layer at Goldman Sachs. Only the partners, of whom there are only a few dozen, are higher up the ladder. Partners are allowed to use their own private funds in the Bank’s insider trading rackets, guaranteeing enormous private wealth for the few who make it.

Still, a modest ‘managing director’ can look forward to a $500k base salary. Bonuses for Mr. Baars typically amount to about $8 million per year. Additionally, there is an options package worth about $30 million.

God only knows what Mr. Baars must do for that kind of money. He maintains all his actions are legal. Which is not completely unbelievable, since Goldman Sachs employees in Congress write the laws.

He seems to be involved in mergers and the like. Typically, the insider knowledge that consulting about these matters brings is exploited by the traders of the bank in the markets.

How they see the protests

To Mrs. Baars, the protestors are just ‘peasants’. Losers, jealous of the riches of the bankers. The bankers really feel like ‘Masters of the Universe’. They see themselves as ‘the new Aristocracy’. To them, what they do is all ‘legal’ and thus justified. They deny any wrongdoing, or that their riches come at the expense of others. The protestors are basically just whining scumbags, in their view.

In the aftermath of the meeting in Wall Street on that day in November 2011, hundreds of protestors went to the Baars residence in New York and spent hours at the gates there. One of the Baars cars, a Bentley, was thrashed.

This was certainly a tense moment, but to the Baars family this just shows what losers the protestors are.

The Lifestyle

It’s all about ‘the Lifestyle’. The Baars family owns 15 luxury cars. Several mansions in America and Europe. A $20 million, 46 meter yacht in St. Tropez.

Says E.A.: “Wall Street and the City are driven by money, status, luxury, trophy wives and more money.” She continues: “just walk into any Mayfair club and you’ll see models and bottles.”

While Mr. Baars makes enormous profits for Goldman, Mrs. Baars’ job, as a banker wife, is to look good and let the money flow. Shopping is the lady’s main pass time. Trips to Milan with her girlfriends to buy shoes a routine matter.

For the kids, there are endless parties. Spraying expensive champagne is a routine device. The fun is in knowing that the peasants would have to work for months for what they blow away in just seconds.

Luxury, looking good, asset positions, new stuff. Glimmer and glamor make life nice. Are what gives status in the social scene.

Within the Baars family, there is a strong sense that the money must keep coming in to keep up. Addiction to money comes with fear of loss.

Conclusion

They’re children with their hands in the cookie jar. Mrs. Baars is just an uppity blonde who likes to shop for shoes. Avarice and narcissist ambition unchecked.

And it’s end of life. Soon, the American economy will face the crunch of an era. The banking families that employ naive upstarts like the Baars family, are ready to ditch the vehicles, including Goldman Sachs, that have allowed them to usurp all the wealth of the nation and indeed the entire West. Their executives, no longer useful, will be thrown to the wolves. The angry masses will gladly devour them when the time comes.

The ‘solution’ to the problems they have been creating has long been prepared.

And our source? She loves both the people with whom she grew up and ‘the lifestyle’, but she is haunted by the venom of the disenfranchised. She faces a choice.

But: it’s a choice that, in different guises, we all face at some point in life and it’s the same choice that humanity as a whole will finally have to face up to too.

Related:

Ten Atrocities That Would Not Exist Without Usury

Banker Babes doing what they do best: shopping

Dear friends,

I hope you have a blessed Christmas with your loved ones and many blessings for the coming year.

For me personally, 2015 will undoubtedly prove very exciting, with the Talent going national in Holland very soon now.

Internationally, I think we’re all waiting for the next phase in the controlled demolition of the American Empire and the West. It does seem that the Money Power is moving on to Asia. The collectivist mindset of the Chinese is closer to our masters’ attitudes and ambitions. While the West was indispensable for conquering the globe for them, now that it has, it has become a liability.

Mass immigration, feminism (destroying the family) and the ongoing rapid destruction of living standards all throughout the West are making life more and more difficult and many people are becoming desperate with the tyrannical nature of ‘democracy’ and its petty laws, fines, and victimless ‘crime’. We will see growing numbers of people leaving the West in the years ahead.

And let us hope it will be just that. The idea of war between the US and Russia (which will quickly involve the Chinese too) is simply unspeakable and it would be just so devastating if the foolish peoples of these Nations would allow their heinous ‘elites’ to pull this one off. It seems hard to believe ‘they’ could, but there can be little doubt they wouldn’t mind some more slaughter.

Wars and rumors of wars……..it must all come to pass. They are worldly affairs and we must not allow fear or anger to overtake us when considering these matters.

The Spirit is in complete control and all is well. This fundamental truth we must keep hammering home to our dying egos, who thrive on negative emotions, however justified they may seem from a worldly perspective.

Our task is to ‘crucify self’ (ego death), and executing the simple tasks the Spirit wants us to do each day. And leave the rest to Him, difficult as it may be. We are, after all, just very unsubstantial dots in a vast universe.

Christmas

Christmas celebrations are under attack all over the West. Multiculturalism is being used to mind control Jews, Muslims and other immigrants into claiming they are ‘insulted’ by this ‘non-inclusive’ celebration.

All bollocks of course. Immigrants have a duty to integrate and show respect for the traditions of the host nation. Mass immigration in the US in the 19th century was a success because immigrants were expected to learn the law and language of the land and partake in the norms of the nation. Jews, of course, never have been known for their integrative skills and are often behind the Marxist pressures against Christmas.

The attack is multi layered. On one level it’s an assault on Western Tradition, on the other against Christ himself. Because ultimately the whole war is against Christ.

Jesus Christ is not the man that was born 2000 years ago. It’s the Spirit that came into the flesh in the man. The Word, that created everything. The Son. He spoke through Jesus of Nazareth.

Creation is pervaded by, and springs from what physicists like Tesla call ‘the ether’. This ether is self aware and a person. It animates all beings. He lives in us all, whether we realize it or not. He is all knowing, all powerful. It is this being that spoke to us through the man whose birth we celebrate today.

A human being consists of a number of ‘aggregates’, as Gautama called them: the body, the senses, the emotional body, the mental body and volition. Our identification with these aspects is what we call ‘ego’.

Spirit is immaterial and precedes matter. We can learn to observe Him by realizing that he is what remains after excluding everything we can observe via the other ‘aggregates’. He is not what we see, not what we hear, not what we think, not what we feel. What we ‘see’ beyond these materialist experiences, is what the Buddhists call ’emptiness’, and Jesus the ‘the Holy Place’. It is here that we are ‘in the shadow of the Almighty’.

Learning to break our identification with the material aspects of our being and identifying with ’emptiness’ instead, is what the Spirit during his stint on earth called ‘dying to self to be reborn in the Spirit’. Obviously, few ‘born again Christians’ have died to self or would know what Spirit is. Likewise: a true Taoist would know very well what this is all about.

True believers, then, are not recognized by their knowledge of scripture. ‘One knows a tree by its fruit’ and the Spirit knows his own and True Israel, since the new covenant, is among all the races. It is they who have ‘crucified self’ and do the Spirit’s will. Because only those that do the Spirit’s will, as they have learned it in communion, can say they believe.

It is not for everyone. Even today most people don’t realize they need saving, so why would they look for the Savior living in their hearts, anxious to befriend them?

But if you do realize that you need saving, than study these matters. Go to the Spirit, as he so emphatically requests through Jesus of Nazareth: ‘come to me and I will give you peace’, he promises. And he delivers too.

And it is this awareness that is the real enemy of the New World Order. People dying to self and doing the infallible will of the Creator is what they fear, for obvious reasons. Clearly the Banker’s power quickly starts looking a whole lot less impressive, once you realize that the Spirit can work through selfless people.

And let us not forget that they were already beaten, back then. What we are facing today are basically just mop up operations after the enemy’s back has already been broken.

And this is the real reason why Christmas is under attack.

So don’t worry about Christmas being in fact a ‘pagan’ celebration of the winter solstice. Some of the pagans were infinitely closer to the Spirit than the ‘christians’ who destroyed them in the name of that spiritual tyranny known as the Vatican.

All our traditions are suspect in many ways and most obviously the world is at war with the Spirit and we should not take it all too seriously. But we should also not become unwitting stooges of the adversary, trying to alienate us even further from our traditions and way of life, sinful as they may be in many ways.

So with this in mind, enjoy Christmas and this chance to rest, to be with those closest to us, who love us and bear with our many faults, just as we struggle to bear with theirs.

May the Spirit be with you and all of us in these troubled times. Soon, real soon, love will again govern all our relations.

your brother in Christ,

Anthony

Gilets Jaunes: Take your Money out of the Bank NOW!

In an interesting development, the Yellow Vests of France are calling for a run on the Bank: January 12th, they are planning to pick up their savings.

I’m reposting this 2012 article, because it seems relevant, Henry also posted at his site, and as a bonus, here’s a long chat I did with my old friend Wayne Walton. We talk about the Gilets Jaunes Bankrun, and just about everything concerning the monetary, the stuff you won’t even hear in the Alternative Media:

– Bankrun

– ‘Time value of Money’

– Usury as the core issue with our money

– Christ in the Truth Movement

– Gold and Bitcoin, the Liberty Movement, their defense of Austerity and Deflation

– Intricacies of interest-free currency design

– De Florijn

– The true nature of Capitalism

The Credit Crunch is not some natural phenomenon but an all out assault by the Money Power. What is worse: even without the crunch we are paying trillions per year in interest for absolutely nothing.

The solution is simple: quit their banks.

By Anthony Migchels for Henry Makow and Real Currencies

The Money Power’s goals are obvious. It is not just the massive multi trillion wealth transfer that is under way. It is about bringing the West down a few notches. The US seems strong with a nominal $30.000 per capita GDP, but when the dollar devalues against the Brazilian Real and the Chinese Yuan things will quickly look different. It will also end cheap raw materials.

The reason this crisis exists is because the banks, politicians, the media and economists are colluding in fooling the many into believing we need banks for our money supply. Most of them probably even believe this is true themselves.

They say we need the banks, because otherwise the real economy would have no money to trade with.

All this is complete and utter rubbish, of course. If banks can create credit, then anybody can. That’s just common sense.

Just imagine: we are led to believe that we need to cough up trillions just to have a means of exchange. One that is completely paper/computer based. I.e., almost free of cost.

Banking is part of the Babylon Mystery and bankers believe we are still enthralled with their ‘fractional reserve banking’ sleight of hand. And they are right. Although people are waking up, they still don’t get it.

A good example of this is the ‘take your money out of Bank of America’ of last October. Bank of America decides to rake in an extra 60 dollars per year with a silly fee. This upsets people.

While they are paying $300k interest over 30 years on their $200k mortgage. Which the bank created the moment they borrowed it.

Meanwhile, 45% of our disposable income is lost to cost for capital included in the prices we pay for our daily needs.

In other words: Penny wise, pound foolish.

People still don’t understand how badly they are being raped. They still don’t understand how they are fleeced through interest on fictional debt.

Coming to terms

Of course, it was a great step and absolutely fantastic to see people finally showing a little teeth. But it shows how hesitantly people are coming to grips with the reality of banking.

Boycotting the banks is the blindingly obvious approach. If somebody is enslaving you with interest and fractional reserve banking while destroying the economy by not lending why would you patronize his business?

To say this is irresponsible as it will worsen the crunch is ridiculous: propping up a system that only exists to enslave us is irresponsible, not disconnecting from it.

But only few even within the Free Media are willing to accept this simple conclusion.

The fact of the matter is: many are still enthralled with the ‘magnificent edifice of international finance’, as Rothschild mouthpiece the Economist once called it.

It is unfortunate that there is still widespread misunderstanding about both money and our real problem with it.

People do not yet understand how pervasive the enslavement through interest really is.

That’s why they fall for the notion that Gold will solve our problems. But what does it matter whether we pay all this interest for Gold or for paper based credit? The Money Power owns both and all the interest will end up in the same place.

The mind control of the rich, the social conditioning to accept the current order and its despicable ‘morality’, to defend it at the cost of oneself and one’s loved ones is very profound and pervasive in our beliefs. They are not easily uprooted, not even by the ‘Internet Reformation’.

In the mean time we are ignoring the real solution: interest free money. Either debt free, in the form of Social Credit, which would work out like a ‘Citizens Dividend‘.

Or interest free credit, through Mutual Credit.

These solutions are real and we can implement them today.

We would no longer pay interest on a mortgage, which would also mean much lower rent.

While paying 45% less for what we need, because there would be no longer any cost for capital included in prices. World Government would be dead and Big Business would face the competition of well funded small business.

The reason we are not doing this is not only because Washington and Brussels are owned by the Money Power in the City of London.

The main reason is we don’t see the problem and therefore we miss out on the solution.

Fight Back!

We don’t need to wait for reform on a national level. We can create our own currencies. High powered currencies, not just the simple barter units that are now starting to float everywhere in the world. We can create extremely effective, interest free credit based units, convertible to dollar or euro. In effect providing us with a printing press with which we can back the world interest free.

But these will take time to build up. Meanwhile, isn’t it the obvious thing to pull our money out of the banks?

How is it possible that this is being resisted by many well meaning people in the Alternative Media? Is there really anybody out there who still believes the banks will mend their ways? That they somehow will stop being the psychopathic enslavers that they are?

We should not have one dime in that system. Every dollar we put in the banking system gives them a dollar income per year. Remember that. The system, through fractional reserve banking, multiplies your dollar by ten and takes interest over each of them. Real interest (including credit cards) are probably close to 10% and that means they make a dollar per year over every dollar you have in your account.

Remember that 40 years ago nobody had a bank account. Before then there were no computers and the banks couldn’t have handled the administration.

You don’t need a bank to keep your money. The whole idea is insane! Nowhere is your money more prone to abuse and risk than in a bank.

And you can maintain an account for monthly payments, just keep its balance at almost zero. Pay your bills and take out the rest.

Force the FED and ECB to print ever more for bailouts.

Pay cash only. Don’t support their cashless society. Liquidate all your paper assets, both to blow up the system and to minimize your own exposure to the implosion. Let them squirm and lie ever more transparently with every new bailout that they need to force upon us. Let them show their hand. We’re not going to ‘repay’ odious debt.

We’re not afraid. We don’t need them.

Let them eat cake.

Related:

The Swiss WIR, or: How to Defeat the Money Pow

Mutual Credit, the Astonishingly Simple Truth about Money Creation

Understand that the Banking System is One

On Interest

Budget of an Interest Slave

This is an abridged version of Financial Warfare 2012: Boycott All Banks