It’s a given that State money is better than money provided by private bankers. But ultimately Private Monopoly and the State are competitors for power and both a threat to the individual and the commonwealth. Transcending a dialectic does not mean choosing sides, it means addressing the issues both forces have in common. Like Materialism and the Concentration of Power.

Surely it’s a no-brainer to say that the Government at this stage must urgently retake the monopoly on currency from the Money Power. The US Government pays 450 billion per year in interest payments to international banks and other Governments to service its National Debt. With the BIS now openly calling for higher interest rates it will quickly get much worse. Government money allows for a reasonable financing of the State and is the very least monetary reform should aim for.

But to say something is better is not to say something is ideal. And Government money can be designed in good and bad ways. The good ways decentralize power, the bad ways centralize power. Usurious Public Banking ends interest payments on the National Debt but continues interest-slavery for the many and keeps capital scarce and expensive for small business.

Interest-free Public Banks would be much better as they would completely end the uncanny power centralization through Usury. But it would still mean that technocrats would decide who would be financed and who not. Meaning technocrats would decide the direction in which society develops. It’s also not clear whether Government would really properly manage the volume of money. Both inflation and too scarce money would be risks.

How should Government be organized?

At this point it seems fair to say that there is no known reasonable way of organizing State Power.

Democracy has failed and has been exposed as a pleasant curtain to hide behind for the monied classes. According to the Protocols it has given them ‘the power of appointment’: they just put some of their useful idiots in front of the public to choose between.

They describe how they want to give everyone a vote, both to dilute the vote of those actually knowing what they talk about and to be able to say: ‘you wanted this, you voted for it’.

Voting is not a ‘right’, it’s a sacred responsibility and it should be left to the competent. And who are the competent? God only knows. I’d say, let only 50+ year old heads of households vote. But perhaps 60+ is better.

Because of Democracy’s denouement, some call for more autocratic methods. Monarchy, or even Fascism. But a strong leader is grand, as long as he is strong. A monarchy thrives with a good king but history shows they are far from the norm.

In short: it’s not clear how Government must be run and automatically assuming that Public is better is risky without a clear cut appraisal of the who, what and how of Government.

For sure, a mountain is not built top down and we need models of self-governance.

Selfless Service

Furthermore, behind the public vs. private dialectic there are bigger questions, for instance: what drives people?

Part of the dialectic is the fact that ‘private’ is associated with the profit motive and public with the public interest.

But both are wrong.

It’s a disgrace that economic theory promotes the despicable lie that people are solely driven by ‘self-interest’. By profit. This is an utterly materialistic world view and one of the key lies upon which the whole house of cards is built.

Memehunter’s ‘The Satanic Core of Libertarianism‘ explores how de Mandeville’s Fable of the Bees or Private Vices, Publick Benefits ‘pointed out that self-interest and the desire for material well-being, commonly stigmatized as vices, are in fact the incentives whose operation makes for welfare, prosperity, and civilization.’ (Mises).

Keynes and the Libertarians eulogized it. It provides the rationale to claim ‘greed is good’. Because de Mandeville created the illusion that ultimately society is served when individuals relentlessly seek self-interest.

Public workers, on the other hand, are supposed to serve the public interest. They don’t. They serve the interests of the State. The State is not the Commonwealth! It is not the Sovereign. But historically it has always usurped sovereignty. So the State does not serve the public interest. It serves private interests: its own. That of its workers. And, of course, that of those bribing the politicians and civil servants.

It’s not black and white, the public gets something in return for putting up with the insolence of office. But the point is clear.

Both public and private workers serve other aims than the public interest and these aims and the paradigms associated with these aims are materialistic in nature.

For true liberation for mankind, we need to get rid of this materialistic outlook. The notion that there can be such a thing as ‘private interests’.

There is no permanent happiness in private gain. Private gain creates the fear of loss. The great joy of mankind is in service of both each other and the One. Both within in the family and in the world.

Rudolf Steiner said that a society can only thrive if people are willing to give away the added value of their production to society. Jesus said to give away everything to follow Him. We can own anything that furthers the Kingdom of Heaven, as long as it does so. No more, no longer and not as a goal in itself. The great paradox of this is, of course, that we would all live in far greater abundance and security.

Altruism is truly enlightened selfishness and not that stupid great satanic turn around we are brainwashed with.

Of course, this always was and remains a radical proposition. Many will not agree. Others will say it’s a nice idea, but it’s certainly not what we have now.

And since it certainly is true that our current ways are very different, we must be careful of power centralization in either public or private hands.

All this may sound ‘philosophical’ or ‘idealistic’ or even irrelevant, but ultimately it’s fundamental to the entire equation and we as a species will either have to move on and start living more from this mindset, or continue to put up with the selfishness of Bureaucracy and the cruel banality of the ‘market’.

The Commons

Perhaps the simplest thing to say is that Money is part of the Commons, like Water, Air and Land.

We see how the Transnationals are now attacking Water as part of the Commons. Water is ‘not a human right’. Land has long ago been privatized. But Land and Monetary Reform are in many respects the same fights and we can add Water to the equation too.

Money has never been fully appreciated as an intrinsic part of the Commons. Because so few people actually realized that the nature of Money was something we could think about. And those that did were mostly led astray by the silly ‘theories’ the Money Power keeps inventing.

The rape of the Commons, our Human Heritage, must end and we must reclaim what rightfully belongs to us. Why are we paying rents on Land and Money and soon Water to ancient families, Corporations and Governments?

Instead of benefiting from our fair share we are simply exchanging ever more of our labor for it. The invisible slavery to artificial scarcity.

The Commons by nature should serve the individual, families, tribes and the Commonwealth and no one can own them or exploit them for their own purposes.

The Commons are public and they must be exploited in the public interest. Meaning they provide all commoners equitable access to their fair share.

When we look at monetary reform, we want interest-free, stable money. We need local communities to be able to have a say in where the money is going to. We need equitable individual sovereign access to capital.

This is what it means to optimally exploit Money as part of the Commons in the mutual interest of all individuals.

Relating to the public vs. private issue this means the question is never that private entities can ‘own’ the Commons. That kind of private is not to the point and to be rejected.

The Commons are, or should be owned by none. Not by the Government, nor by private interests. Government perhaps has a mandate to protect the Commons from private usurpation. But that is not ownership.

Exploitation of the Commons in the interest of the commoners can be done by both private and public entities. Private entities don’t automatically serve private interests, nor do public entities automatically serve public interests. They should have a clear charter explaining their goals: low cost Water, Land or Money services to the commoner.

Both can have their place and have their own problems. Bureaucrats love rules, Businessmen love cutting costs, hurting quality. They like rents. Both will continue to try to grab control beyond their needs.

Ultimately the commoner needs to know his rights and duties and the Money Power’s mind controllers have a great grip on our collective consciousness. It remains a great challenge coming to terms with all of this.

Conclusion

Money is part of the Commons. This is what I suggest is behind the Public vs. Private dialectic.

There is a great struggle going on in which the Money Power is privatizing more and more of the Commons. Land was robbed from the commoner long ago and nowadays they’re after Water.

But in reality the Commons cannot be really be privatized. For instance: Land should be reasonably made available to the commoner. This is the basis of Henry George’s work.

Money never was a conscious part of the Commons as most people didn’t realize it was possible to even consider its nature, let alone come to sound conclusions. But its crucial importance, the very fact that it depends on the agreement of those using it for its existence, makes it so.

The question is how to manage the Commons. Practice shows that having the Government do it leads to problems. The Government takes rents, centralizes power and is usually just a big &^%$%^&$# to deal with, especially for the less credulous.

It’s usually certainly better than private ownership of the Commons or control for profit. But to firmly entrench Money Power in the Commons, we need to look beyond Government and rationally look at what role private market players have to play in providing the necessary services to the commoner.

Because everything that centralizes power in the hands of the State will simply empower Leviathan. And Leviathan will always look to turn against its master.

Related:

The Daily Bell: Usurious Commercial Banking is Good, Interest-Free Government Money is Tyranny

In an amazing development, the Daily Bell editor Anthony Wile has just announced the Daily Bell is over. He’s pulling the plug, moving on to other ventures.

Anthony Wile says ‘hasta la vista’.

Of course, they have their own agenda and we can’t tell why, but the simple fact is: the Daily Bell never recovered from the fierce debates that raged in the first half of 2012.

When the first discussions started in December 2011, they were growing explosively and already close to the top 30,000 on Alexa, which is very high for high class conspiracy sites.

When I at the time picked them for some serious chatting about the basic Austrian propositions I did so for a simple reason: they were the leading outlet offering high end analysis of the NWO from an Austrian perspective, combined with a rational, courteous tone of voice. Rockwell and other outlets avoid outright conspiracy theory, even though very influential in the Alternative Media. The Daily Bell was very much directed at the Truth Movement itself and many freethinkers were attracted to it.

In the beginning far from all was clear to me, it was a great test for myself first and foremost: to see how interest-free economics would hold up against Austrianism in a head on dialogue with some highly competent people. This was long before we established the incredible amount of money and effort behind Austrianism as a mind control operation. After all: it was their insistence in the face of the facts about usury and deflation that made Jason Erb, Memehunter and myself wonder about what was behind it all. The rest is history.

The Daily Bell was a multi million dollar operation. Considering what we’ve been reporting on, the millions behind Rockwell.com, Mises.org and and the thousands of ‘independent’ ‘free market’ think-tanks and the simple fact that they had four paid elves with a hundred years of experience with Austrian Economics between them, located in Switzerland, this is absolutely fair to say.

With hindsight I have no qualms to suggest that the Daily Bell was purposely built up to further colonize the Truth Movement and to co-opt the whole thing through Libertarianism.

It all got a little ugly pretty quickly. It was not always pleasant. In fairness: I don’t mind a big fight, but I don’t like kicking a floored opponent and the simple fact is: I tried to disentangle myself in a friendly ‘let’s agree to disagree’ kind of way, when they started to clearly and purposely misrepresent my positions.

In the spring of 2012 Memehunter spent weeks on end in all out clashes in their comment sections with the elves and they tried everything to spin his positions into obscurity. It was his sheer determination in patiently rebutting everything they threw at him that eventually busted them. Their Alexa rating started dropping massively at the time, and somewhere around May last year they shut down their comment section altogether. But this was no solution as it cost them even more readers.

Several times Memehunter and I decided to leave them alone, Memehunter actually retired, but they kept coming back. Reopening the debate, looking for ways to recover past glory. It got so stupid and annoying that Memehunter ended his retirement and opened up the Daily Knell. Ravaging whatever was left of their economic credibility.

Their fury was palpable. Both from their tone of voice when (indirectly) attacking us, calling us ‘bought and paid for websites attacking those defending Freedom’. And from the enraged Abu Aardvark, whom ultimately forced me to implement a comment policy to end his trolling. He also angrily commented on other websites, claiming we were lying and attacking the Daily Bell because they were opposing evil. His handle was probably used by the elves or maybe even Wile himself.

Intellectually speaking this was a struggle to the death. It had to be. When writing my last two articles, I was not even sure I was doing the right thing responding to their final challenges. On the other hand: no opponent more dangerous than a wounded one.

So now they’re actually closing down. Undoubtedly this is a major defeat for Austrianism and a big victory for Interest-Free Economics and the Truth Movement, which needs a clear picture on the monetary.

They will be back though, the vehicle is gone, Gold buggery will remain with us.

This was purely business, never personal. I wish Anthony Wile and the Elves all the best in their further pursuit of happiness.

Here are the main articles, in order of publication. The articles link to the main DB challenges and responses.

Discussing Gold and Interest with the Daily Bell

Daily Bell: wrapping up

The Daily Bell tolls for another round in the debate

Meanwhile, at the Daily Bell……they might have a point about Ellen Brown and OWS

The Daily Bell: Usurious Commercial Banking is Good, Interest-Free Government Money is Tyranny

The sulking Elves from the Woods of the North

See the Daily Knell for Memehunter’s great work on Libertarianism and the Daily Bell.

Here is his ‘the Daily Bell Hoax?‘, exposing the crucial Agora connection, tying the whole Libertarian Leadership together as basically a small clique.

Here are Jason Erb’s articles on the Daily Bell.

And an interview Jason and I did a year ago.

Controversy continues to rage about Central Bank ownership. Most major Central Banks, except for the FED, are publicly owned. However: this is not really important. Control is what matters and Central Banks are the Money Power’s centralized controllers, private or publicly owned.

By Anthony Migchels, for Henry Makow and Real Currencies

The shocking realization that the Federal Reserve Bank is privately owned by its member banks is one of the defining moments in any Truthseeker’s path. Eustace Mullins, coached by the indefatigable Ezra Pound, wrote ‘the Secrets of the Federal Reserve’, listing the banks owning the system. Ed Griffin then infamously plagiarized this book with his ‘the Creature of Jekyll Island’, to push the John Birch/Libertarian poison of the Gold Standard as a solution. We’re still dealing with this today, as seen in the ‘End the Fed’ movement.

The FED itself is now starting to move against its critics, claiming they ARE a Government institution, although partly independent. As Central Banks should be, which is today’s conventional wisdom in the Mainstream.

Here’s some text from the link, from the FED itself:

“The 12 regional Federal Reserve Banks, which were established by the Congress as the operating arms of the nation’s central banking system, are organized similarly to private corporations–possibly leading to some confusion about “ownership.” For example, the Reserve Banks issue shares of stock to member banks. However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System. The stock may not be sold, traded, or pledged as security for a loan; dividends are, by law, 6 percent per year.”

So while the FED tries to downplay private ownership, it does not deny it. Its stock cannot be traded, but this is not a limitation, it’s a sure way of keeping outsiders out. After all, it’s a club, and we’re not in it.

Furthermore, a dividend of 6% per year is not bad. It depends on the value of the stock, of course.

On the other hand, after paying its shareholders, the Federal Reserve returns what remains to the US Government, so it’s not entirely fair to say that the FED is printing money and then has the State pay interest on it. It paid the State 89 billion over 2012.

Nowadays the situation is even further confused by the fact that people like Tom Woods from the Hate the State crowd openly call Central Banks ‘statist’ operations, messing up the ever so fair ‘free market’ operations of the banks. They will say funny stuff, for instance claiming or implying that Central Banks are responsible for ‘money printing’, their dreaded enemy of ‘inflation’. However, it is the private banks that do by far the most of the money creation. They are the ones lending, after all, and they lend freshly created ‘credit’.

Europe

It becomes even more complicated when we realize that all European Central Banks are completely publicly owned. They are corporations with 100% Government ownership. They do operate as ‘independent’ entities, though. Before the ECB they set interest rates and managed the volume without Government interference. Nowadays this is done by the ECB, which in turn is owned outright by the national Central Banks.

Before the second World War, all European Central Banks were owned privately. But the massive upheaval caused by the Great Depression and the powerful monetary reform movements that shook the Money Power had raised awareness about private ownership of the financial systems of the West and nationalizing the Central Banks was a handy way of diverting this attention. After the war all major European Central Banks became publicly owned.

It is therefore simply wrong to state that Rothschild owns all Central Banks!

This is important, because getting straightforward facts like these wrong is clearly damaging the credibility of conspiracy theorists.

Control vs. Ownership

Central Banks were created by the Banks for the simple reason that Fractional Reserve Banking is incredibly unstable. There is an eternal incentive for the banksters to loan out more than they can cover with fractional reserves, leading to all sorts of destabilizing busts. This was hurting the Money Power’s control over the money supplies of the World and Central Banks were created as ‘lenders of the last resort’: in case of a panic a Central Bank could keep busted banks afloat, maintaining sufficient confidence in the system.

Furthermore, they were useful tools for Sovereign borrowing. The basic contract between Sovereigns and the Central Banks was, that the Central Bank would always provide the State with all the money it would ever need, in return for guaranteed interest payments through taxation.

Also important was the monopoly on national currency that is closely associated with Central Banking. In earlier days, both in Europe and the US, free banking and local Sovereign money created a diverse monetary environment, more difficult to control for the Money Power. By ‘legal tender’ laws their units became the sole accepted way of paying taxes, giving the banking units a massive advantage in the market place. These were the early steps in further and further monetary centralization in ever fewer units, with World Currency as its final goal.

And finally Central Banks have the opportunity to ‘regulate’ banks. This is a simple trick: make regulation incredibly complex and expensive, and it becomes impossible for the vast majority of market players to comply. It’s the same deal as the Pharma maffia has with the FDA: new drugs are so incredibly expensive to test that it is impossible for low cost natural cures to go through the process, as they will never provide the return necessary to cover the cost. Exit competition and another excuse to keep prices artificially high for the cartel.

Conclusion

Public vs. Private is just another dialectic. It matters not whether money is managed privately or publicly. What matters is whether we have stable and cheap (interest-free) money. If a private interest-free Mutual Credit facility can provide it, grand. If Government can do it, fine. A mixture of both is probably the way forward.

Central Banks are a mixture of both: they have public and private aspects. But the bottom line is that Central Banks do the bidding of the Money Power’s banking cartel. They keep competition out of the market. They prop up busted banks, maintaining some kind of ‘stability’. They oversee private usurious credit creation and maintain the banks’ ability to rake in trillions per year in interest. They allow the banks to create the boom/bust cycle.

High time for a new paradigm.

Afterthought:

Several people have brought to my attention that it is simply wrong to state that all major CB’s except the Fed are private: the situation is far more mixed. Some European CB’s are (partly) privately owned and also a major CB like BoJ is publicly traded (and thus privately owned).

However, the basic proposition of the article, that it is wrong to say that Rothschild owns all CB’s and that it’s about control more than it is about ownership, still stands.

Nonetheless, this is an annoying slip, partly explained by the fact by my geographic location: the Dutch CB and the Bundesbank for instance are completely publicly owned.

Related:

The Daily Bell: Usurious Commercial Banking is Good, Interest-Free Government Money is Tyranny

End the Fed: a Trojan Horse destroying the Truth Movement from within

Why Tom Woods is wrong about the Greenbackers

In all fairness: I’m astounded by the impact my blogging here at Real Currencies has had on the blogosphere. True, it’s still marginal, but it has been reaching some of the best and brightest out there. So this is as good a time as any to thank both my readers and my many friends in the Alternative Media who have been very supportive of my work.

Usury is slowly but surely gaining traction as one of the more fundamental issues of our time and it’s simply wonderful that some of my writing has been supportive of that trend.

Austrian Economics has been dealt a severe blow, as before there was simply nowhere people could go for a solid, comprehensive appreciation of this utterly detestable mind control operation, trapping so many honest seekers trying to fathom the ‘dismal science’, which is actually a sacred science and which is so fundamental to our well-being here on planet Earth.

I want to thank first and foremost all my readers for putting up with my many flaws and mistakes. And for their wonderful feedback, both in content and in terms of appreciation, the latter category sometimes so positive I had difficulty taking it in.

Next I want to express my gratitude to Henry Makow, who has given me a powerful platform and has helped me immensely in becoming a more effective writer.

And also the many others that have posted my articles, particularly Rixon Stewart, Zen Gardner, Mike Rivero, Doug from Blacklisted News, the good people of Before it’s News and many others.

And of course Memehunter and Faux Capitalist’s Jason Erb, with whom I’m very happy to be associated. Without these guys our little anti-AE campaign would have been unthinkable.

There is no particular reason for all this, but I feel this is in some ways long overdue.

The below list is just my personal choice, based on impact, number of views and ratings.

So here goes:

1. The Dying Dollar and the Rise of a New Currency Order

This article, outlining the longer term trends in terms of the Money Power’s World Currency project was well received immediately after publication, but the reason why it’s my number one is simple: it got no less than 130,000 views, which is major for a fringe blog like Real Currencies. A month after publication it got picked up by Matt Drudge and this netted 120,000 views within 24 hours. From there it was linked to by dozens of other leading websites, including fromthetrenches.com, raidersnewsupdate.com, goldsilver.com and many others. The comments it received on these sites showed the article was eyeopening to many and some people were elated to be exposed to this kind of stuff, notwithstanding its automatic assumption of ‘conspiracy’ and Money Power.

2. On Interest

A bit of a Real Currencies classic, outlining the basic problems with Interest. It was posted on Henry’s site, but also infowars.com, Activistpost.com and many other sites. It remains an excellent primer.

3. Top Ten Lies and Mistakes of Austrian Economics

Another classic. While more than a year old, this article continues to be picked up by many sites and is often shared on Facebook, also on some pretty big ‘walls’. It is often linked to by Libertarian outlets, who are often shocked by its audacity. At least, that’s what I gather from the comments. It covers all the main problems of Austrianism. It’s also well read on Recovering Austrians.

4. How the Money Power created Libertarianism and Austrian Economics

This article certainly cost me a lot of friends in the Alternative Media. Some will still not touch anything from me because of it. It killed my cooperation with Activist Post, for instance. They say you know who’s in power by knowing who you can’t criticize and this is an excellent case in point. They are our friends, not, the Libertarians?

This article would have been impossible without Memehunter and was the start of a series that devastated the credibility of Austrianism for all who care to know.

5. Mutual Credit, the Astonishingly Simple Truth about Money Creation

This article is an introduction to the basic mechanics of Mutual Credit and remains a great way of quickly grasping the simplicity of it all.

6. Understand that the Banking System is One

A clear cut article on banking as a monopolistic cartel. It explains why it is a distraction to follow financial news too closely, let alone all this nonsensical discussion about who is to blame, whether it’s Government, the Banks or the Central Banks. It is closely related to The Few Banks that Own All.

7. The Ron and Rand Paul Betrayal

Months after I published The Ron Paul Challenge: 10 reasons why the Alternative Media is failing this test, all became clear in the elections: Ron and Rand had supported Mitt Romney from day one, getting Rand in pole position for the 2016 ticket. Ron Paul proved to be the most outrageous sell-out in generations and even today the Alternative Media has difficulty coping with this incredible defeat, having been fooled by yet another Money Power Change Agent. This article was also widely read and while he applauded me for not doing the ‘I told you so’ line, Henry introduced the article on his site with ‘We feel vindicated’. Opposing Paul was not a very popular position, but hey, there is fun in that too!

8. Take your Money out of the Bank NOW! (Video)

This article topped the charts at Before it’s News, with tens of thousands of hits and the associated video was also well viewed on Youtube.com.

It makes the mindblowingly obvious case that still very few dare to underwrite: boycott the banks.

9. The US Empire is not the Money Power!

This article was important to me at the time I wrote it. It addresses the mistaken notion that Putin is an enemy of the PTB, because he resists American Imperialism. Too many people assume the NWO is the American Empire, but while the Empire is owned by the Money Power, it is only a tool. Now that it has conquered the world for them, as it was created to do, it can go.

10. Could the Euro die?

An influential article that corrected the false notion that the Euro would fail because ‘all fiat currencies eventually fail’ kind of nonsense that was still quite prevalent in the Alternative Media at the time. It makes the case that the Euro would live through the crisis, simply because it’s the Money Power’s pet project en route to World Currency. Of course this is not set in stone, the Money Power can fail. But should it do so, it would be a devastating defeat for them. Their entire political capital is behind the Euro and this should be of course part of the equation in our analysis.

It was posted both at Activist Post (for which it was written) and on infowars.com In the months after it I noticed a distinctly different tone of voice in infowars’ Euro analysis, taking this issue into account. I later did a better version for Makow: The Battle for Europe: will the people or the Euro survive?

(Left: Not all Elves are evil, but many are)

While some say Elves do not exist, in the days of yesteryear they were well known as tricksters, messing with livestock and fooling people with their strange beliefs.

Cross breeding between Elves and humans is possible, but when the Old Norse hero Helgi raped an Elf woman, she bore Skuld, who became so adept at witchcraft that she was almost invincible in battle. So perhaps it’s better to leave the Elves alone after all.

The problem is: they won’t leave us humans alone and strange noises keep coming from the distant fairy lands of Austrianism. Recently the Elves again opened fire with ‘the Con of Public Banking‘.

Here’s some of their text:

“Ellen Brown has written another statist hagiography called The Public Bank Solution. As a libertarian-oriented website promoting free-market economic approaches, we obviously disagree with her premise.

We don’t mind disagreeing with her because she is a nice person and she doesn’t do what some allied “neo-Nazi” websites do when confronted with their faulty analyses, which is to immediately launch vicious animadversions in place of logical rebuttals (because they have none).

We call such sites “neo-Nazi,” because public banking, LETS and other such alternative solutions have at their heart certain authoritarian premises, either overtly or covertly. A deep fascist impulse seems to run through the conversation.

Do they seek the lash? They may repudiate Hitler, but don’t believe it. They are likely in favor of the entire socialist paraphernalia, from private bank confiscation, to top-down monopoly money printing by the state and even the rule of one “superhuman” individual with a self-proclaimed “iron will” of the sort mentioned by Adolf Hitler and Benito Mussolini.

They admire people like Margrit Kennedy and her husband, both of whom had extensive careers with UNESCO. In fact, as we have extensively shown, the United Nations is the foremost backer of certain kinds of alternative LETS systems.”

The fascism of denouncing Usury! The iniquity of exposing massive elite financing of Austrianism! How much must these endearing creatures suffer before us primitive humans will understand how we have wronged them?

The conclusion of the Elves’ article runs: “The erudite Ms. Brown aside, those supporting such ideas do so with intentions much different than they claim, and some of them are, from what we can tell, maliciously opportunistic and plain evil.”

When confronted with this down to earth comment on the article and its conclusion, “Hmmm. I, George Washington’s Blog and others who agree with Ellen are a pack of liars – and the North Dakota State Bank is an example of evil? Give me a break please.“, they responded: “It is evil to attack Austrian, free-market economics as a knowing part of a Jewish genocidal, globalist conspiracy, label those who believe in freedom and write about it at great risk to themselves as elite conspirators, claim that a 10,000 year old freedom conversation is actually a Jewish con job, constantly celebrate the state over individual human action, etc. Evil seems to sum it up. ”

Yes, the cushy ‘middle class wages’ Gary North was making in the sixties at the Volker Fund and the multi-million dollar mansion that Daily Bell Editor Anthony Wile owns in Toronto certainly indicate grave risks to their health and fortune in valiantly defending the rights of the rich.

And then there is this quote from their article on ‘BIS demands Global Depression?‘:

“This is absolutely true but to blame “Austrianism” for this – and Austrianism is a term of contempt, as the correct phrase is Austrian economics – is entirely disingenuous. Just because one understands the reality of economics doesn’t mean one is supportive of the kind of ruin that the BIS now demands.”

In all fairness: the Mises Institute itself calls for ‘Radical Austrianism‘, and I assume they actually take pride in the term. But I don’t mind taking some credit for having slanted the phrase to become ‘derogatory’ in their ears. The day is not far off that their ‘correct phrase Austrian economics’ will sound like a curse too.

The Elves live in the Woods……

A few months ago I responded to Tom Woods’ rather simpleminded ‘Why the Greenbackers are wrong‘. A little while later Woods indirectly answered this with ‘the Greenbackers’ Fake Quote Industry‘. In my response to his original article I made a little fun about the difficulty the Libertarian leadership seems to have with the rather blatant Government conspiracy known as 9/11. Woods simply turns this argument upside down:

Woods: “The correct argument against the Fed is not that we need the federal government to create our money more directly rather than delegating the task to the Fed, but that is the Greenbacker objection to the Fed. No free-market person thinks this way. No one who takes liberty seriously thinks this way. This naivete on the part of the Greenbackers is especially hard to believe since so many of them are 9/11 Truthers. That means their position is this: we believe the U.S. government conspired to kill thousands of its own citizens in the interest of furthering its imperial ambitions, but we think they are the best people to trust with the creation of money.

Not all Greenbackers are Truthers, to be sure, but the position is terminally naive all the same.”

Note that Woods studiously avoids taking a position here himself. In fact, we know his position: he’s on the side of the Government. Woods, hating the State, has a wonderful future as a leading Libertarian politician and he certainly is not going to destroy that future with something as silly as 9/11 Truth.

We know all too well how the Libertarians chuckle at the ‘conspiracy industry’. That’s only one reason we keep warning the Truth Community about this Trojan Horse messing up our affairs.

After this brazen assault on the Truth Community, he goes on to make a little fun about the many fake quotes that circulate in the Populist movement. This is indeed an annoying phenomenon. Two great populist classics, Ellen Brown’s ‘Web of Debt’ and Bill Still’s ‘the Money Masters’ were slightly compromised by these quotes and here at Real Currencies we have been spreading them too, until the uncompromising gaze of the uncanny Name789 sternly reeducated me on these matters. As usual, I was the last to learn, as Bill Still already in 2011 opened up a page warning for bad quotes in his film, after the copyright holders of his film refused his request to correct them. Ellen Brown had no problems admitting some mistakes back in 2010. That’s what normal people do when they launch major works and are shown inevitable inaccuracies after the fact.

Here’s how Tom Woods concludes his article: “If they can’t be bothered to carry out this most fundamental obligation of the scholar (to check quotes, A.M.), how can we believe they have fulfilled the far more laborious task of studying economics beyond the slogans of their fellow Greenbackers? Their record makes me skeptical. You should be skeptical, too.”

So because we get a few quotes wrong, people shouldn’t believe anything we say and we should now all forget about the $450 billion the US Government loses on ‘debt-service’ to the banking cartel on the National Debt. Let alone about the $300k interest the common man pays for his $200k mortgage. I’m certain there is a term for this kind of logical fallacy, but I forget what it is.

We should not forget this is coming from a ‘Catholic’ guy who has managed to ignore 1500 years worth of quotes by Catholic scholars denouncing Usury in his ‘the Church and the Market’. According to Mises himself Christianity is ‘a religion of hatred’ because it despises ‘free market’ ideology, so I’m not too sure about Woods’ scholarship either.

…..and the dark and dangerous Woods are in the cold and dreary North

Of course, it’s ‘Grumpy Gary’ who’s behind the ‘fake quote’ trick. North has been devising sly arguments against all those pesky little monetary reform programs that have been popping up over the last century or so for more than fifty years now and his body of work pervades the entirety of Austrianism. In 2010 he thought to do away with Ellen Brown with the ‘fake quote’ trick and utterly failed. Previously we discussed his take on usury and how he tried to make the uninitiated believe that the problem is not interest, but fractional reserve banking. Worse still is his outrageous take on Usury in the Bible, exclaiming it’s bad to be in debt, but quite alright to lend out money at interest. Talking about bad quotes…….

Anyhow, for a normal person it’s always difficult to fathom outright lies. It’s always nasty to call someone a liar, because it’s hard to prove we’re not dealing with honest mistakes and the basic instinct is to stick with the benefit of doubt.

But recently I came across this little gem:

[youtube=https://www.youtube.com/watch?v=yqUSbrHguO0]

We watch Gary North so you don’t have to, so I certainly don’t recommend wasting an hour on this dreary piece of work. Here’s the deal: North is talking to some young people at a Libertarian get together. It’s a seminar in which the youngsters are trained how to deal with ‘Greenbackerism’ and the ‘murky underworld of Social Credit’.

The core of the lecture is how to deal with the notion that economies are depressed because of a lack of purchasing power. North explains a line of reasoning the youngsters can use in arguments when faced with this fundamental economic issue. As we know, Austrianism denies that deflation stifles economic growth and causes depressions. They even go so far as to deny that deflation caused the Great Depression (North does that again at about 29 min in the video). Hilariously, as I cannot help myself from gloatingly repeating, they use this FED study to back up this notion.

Deflation and Usury are closely related to the theme of ‘scarcity of money’, the notion that there is insufficient liquidity in the economy to finance all plausible trades, causing permanent depression. This is at the core of Social Credit, Keynesianism and Interest-Free Economics. It’s also well analyzed in the Protocols.

But whereas there is clear and insurmountable statistical evidence proving that a declining money supply will lead to a contracting economy, Austrianism has only deductionist arguments, i.e. wholly devoid of any empirical proof to counter this.

And this is why the video is so interesting. Because Gary openly admits this. He begins this lecture with a number of tips on how to defend what he (at 6:50) calls ‘ideological positions’. Meaning he openly distances himself from any scientific basis for his beliefs.

In short, according to the master Mind Controller Gary North himself , Austrianism promotes the purely ideological position that deflation and scarcity of money do not exist and that ‘markets will clear’ when they are ‘free’. Money has nothing to do with it.

Not only that, in this seminar Gary is teaching the youngsters on how to defend these purely ‘ideological’ and ‘unpopular’ positions and he even has no qualms to admit from whom he learned to do it himself: at 10:31 he starts explaining how the communist cadres of the old days went about defending ‘unpopular’ and ‘minority’ positions.

Conclusion

We can rest assured that the Libertarian Leadership knows exactly what it’s doing. They know quite well that Usury, Deflation and Scarcity of Money are the great problems of money and their whole ideology (and they know full well it’s an ideology and thus pseudo-science) is centered around arguments combating those trying to alleviate the suffering of the multitude by addressing these most fundamental problems. They have been paying Gary for more than 50 years to keep us all busy and distracted. They are grooming Tom Woods to push Gary’s venom as the future head of the Mises Institute or even in the Senate itself. They are funding Anthony Wile and the Daily Bell to call those looking for answers ‘fascists’ and ‘evil’.

Elves do exist, but they’re not really evil. They’re just a sorry bunch looking for attention and getting more of it than they should.

Related:

End the Fed: a Trojan Horse destroying the Truth Movement from within

Why Tom Woods is wrong about the Greenbackers

The Daily Bell: Usurious Commercial Banking is Good, Interest-Free Government Money is Tyranny

Discussing Gold and Interest with the Daily Bell

Debunking Tom Woods’ ‘Catholic’ Austrian Economics (Memehunter)

Recently a 1996 NSA report surfaced, ‘predicting’ a crypto-cyber unit eerily close to Bitcoin. So eerily close, that, knowing their M.O., the question arises whether this report is a prediction, or a plan.

The report can be found here. I don’t know how long it has been circulating in the Alternative Media, but it seems it just surfaced. It is stunning. It looks very much like an architectural design of the kind of issues this cyber unit should solve. It is stunning not only because it so closely resembles the architecture of Bitcoin, but also since it so conspicuously avoids all the real problems with our monetary system, i.e. Usury, scarcity of money and the manipulation of volume.

If we look at similar ‘predictive’ reports on for instance population control, which have had such a major impact on the Truth community, we must conclude that this particular NSA report on crypto-cyber currencies looks more like a design than a prediction.

Meaning that Bitcoin just officially became a Money Power meme.

Bitcoin architecture

The NSA report goes deeply into the challenges a crypto currency faces and lists the various security and implicated regulatory risks. Both from the point of view from regulators and developers of such schemes.

Amazingly, a key writer of the report is called Tatsuaki Okamoto. In the Bitcoin community this has been picked up as remarkably similar to Satoshi Nakamoto, the pseudonym of the enigmatic developer of Bitcoin.

As we have been discussing, Bitcoin was designed to be scarce and deflationary. Interest-free credit is impossible with Bitcoin and this year we have seen wild trading in the cyber-unit, with a massive bubble and the unavoidable crash. Nonetheless, Bitcoin’s rate at this point is about $110 today, up from $5 November 2011. Its total market capitalization topped $1 billion at its peak and is still substantial.

Implications

An interesting issue is In-Q-Tel’s involvement. In-Q-Tel is the ‘not for profit’ investment arm of the CIA. Undoubtedly just another control mechanism. In-Q-Tel is investing or planning on investing in Bitcoin, presumably by buying some of them. The CIA has been involved in an extensive dialogue with Bitcoin people. It is unclear as to what this ‘dialogue’ amounts to, but obviously, combined with this shocking NSA paper, the whole thing looks pretty suspect.

So what are the bad guys up to? Are they creating a unit with which they can finance their international drug trade without risking money laundering in the banking industry, which is forced to be more and more transparent?

Perhaps it’s not for nothing that American legislators have shown alarm at the uncontrollable flow of funds?

Or is it all just a ruse to undermine free market currencies and regulate them to death, using Bitcoin as some sort of monetary false flag?

This latter scenario would explain the heavy handed and totalitarian way the DHS recently seized some account owned by Mt. Gox, the biggest Bitcoin exchange. Note the DHS is not some financial regulatory body, but the Gestapo itself.

Conclusion

Even today it’s too early to come to conclusions about Bitcoin. Perhaps it’s still a well-intentioned try, destined to failure by its faulty design, or destroyed by the agencies. Or it was designed from day one as a tool to help maintain control of the money supplies of the world.

But it is amazing how the NSA report addresses the ‘need’ for privacy with transactions as the main monetary issue, ignoring all the far, far more important problems we have with our money, and how Bitcoin answers exactly the challenge put forward.

Knowing the ways these people think and operate, this NSA report basically puts to rest the notion that Bitcoin was a completely innocent ‘free market’ or ‘human action’ kind of thing to begin with.

Related:

Bitcoin: Blessing or Trap?

Baffling Bitcoin

Bitcoin, impressive but flawed

I’m visiting Ireland, God willing, from July 2nd to 9nth. I’ll be staying in Dublin with my aunt for a week.

The preliminary schedule now is:

Tuesday July 2nd

A meeting with Bill Still, who’s leaving that day after being in Ireland for 10 days, as of June 22nd. The details are still to be settled, but I’m really looking forward to meeting Bill.

Thursday evening July 4th

A meeting in Cork

Friday evening July 5th

A meeting in Dublin

Sunday afternoon July 7th

Optional: A follow up meeting in Dublin

Cathal Spelman of Fair Money Ireland is organizing these events.

I’ll be meeting people interested in the key issues of monetary reform, including the implementation of Community Currencies, where I’ll be looking to share some info on how to get these units to the next level, able to compete with Euro in the market place.

If you have any suggestions for me during this trip, please let me know.

I hate to say it, but I’d really appreciate any contributions for the costs of this trip too. Thank you very much.

Related:

Concepts of the Gelre, or: What is ‘High Powered Working Capital’?

Mutual Credit, the Astonishingly Simple Truth about Money Creation

Mutual Credit for the 21st century: Convertibility

Left: Kerry Bolton

Kerry Bolton’s ‘the Banking Swindle’ is a brilliant expose of the fight against the Money Power in modern history. Not only does Bolton authoritatively compare a number of important financial systems of the past, he frames the debate of the twenties and thirties of the last century. In doing so, he connects us to our forebears and gives important clues on the way the struggle should be waged.

By Anthony Migchels for Henry Makow and Real Currencies

Kerry Bolton, Ph.D., Th.D., born in 1956, hails from New Zealand and is a prolific writer and political activist. He has written on the occult, mass immigration and the politics of the Right. The Right to Bolton is the original conservatism, based in God, Nation, Family and, most importantly, monetary reform. It seems, from a distance, that he is somewhat disenchanted with the Right because they have forgotten the all importance of the monetary issue.

Michael Hoffman faces the same problems: many ‘conservative’ groups and organizations consider his ‘Usury in Christendom’ anathema.

Bolton asked me to write a foreword for his book and this is an excellent opportunity to thank him for the invitation because I more than fully support this book. It’s a brilliant and timely effort for several reasons.

In the first place: it’s a short and fast paced read. Only 188 pages, including introduction, three forewords, and the index. Modern, accessible English, a spacious font so not very many words per page. It can be read in a couple of hours.

It starts with a short introduction of Modern History, rewritten to show how the bankers managed to conquer Europe via Holland and Britain. This serves as an excellent primer for those looking for a heads up on these fundamental issues in their reeducation.

He describes how the current financial system came to be and what problems it brings.

But where the book really takes off is his vivid description of the public discourse of the thirties in reaction to the Great Depression. It transpires that very concrete opposition to the financial system itself was universal throughout the industrialized nations. Social Credit activists were active throughout the west. The dominions saw major Social Credit movements. But also other financial systems were both promoted and, what is more, even implemented.

New Zealand, for instance, implemented financial policies that were very similar to those of Hitler’s Germany. A large scale social housing project financed with State Credit solved 75% of unemployment during the Great Depression. This iconic project has disappeared in a memory hole. Canada also printed its own Government money from the mid thirties up to the early seventies. Here is an eye-opening account of the Canadian economy with Government money.

The level of public involvement in these discussions seem to have been huge. They were talking banking and monetary reform in pubs and on street corners, all over the West.

In Britain itself there were the ‘Green Shirts for Social Credit’, started by John Hargrave, who had met C.H. Douglas in 1923. The Green Shirts kicked off in 1930 and 1932 Hargrave realized that nothing could be done through Parliament and that a fully devoted agitation was necessary. Bolton:

“Hargrave advocated a militant campaign that would break the media blackout. The Green Shirts took to the streets on marches, behind drums and banners, held street corner meetings, and sold newspapers on the street, delivering the Social Credit message in a cogent manner. Facing the violent opposition of the Left, they were noted for their discipline in the face of provocation. They were also noted for throwing green painted bricks through the windows of banks and using the consequent court cases to publicize their views.”

Bolton analyzes the struggle for monetary reform in all major western nations, including Father Coughlin, who at his peak was followed by 40 million Americans, and Japan.

I must say that this comprehensive overview was actually eye opening for me. Such large scale agitation for- and implementation of real monetary reform on such a level, I never really realized what kind of trouble the Money Power faced back then.

It also shows that the system may not be quite so unassailable as it often looks. True, while today’s depression is probably not much less worse than 80 years ago, its consequences have been much milder. Millions of people actually starved or were close to starvation back then. However we may feel about the much dreaded well fare state, it has prevented that kind of mass suffering during this crunch. On the other hand: we can also be sure that this is a vital part of the Money Power’s calculations this time round. Because hunger is a powerful motivator and the usurers have learned to sedate us to the nastiest side effects of our hidden slavery.

Other Systems

Another interesting aspect of the book is its analysis of a number of financial systems that were either launched during times of economic hardship as a result of scarcity of money, or states that were simply not (yet) part of the banks’ control grid. For instance Czarist Russia, much hated by the Rothschilds for their intransigence. Russia was modernizing rapidly in the last decades before New York’s coup d’état in 1917. And it was financing this modernization without the usurers. This, undoubtedly, was the prime reason for the ‘revolution’.

Or how about the Greybacks? I never heard of them. Apparently they were actually real debt free notes, as opposed to the interest-bearing bonds backed Greenback, printed by the South to finance the war. As always, the money system in use is a great hint as to the nature of the real dynamics behind the scenes. I’m not well enough versed in US history to come to any conclusions, but Bolton makes a very plausible case that the Confederacy was a real rebellion and that they were cut off from bankster loans.

Just as the British inflated the Continental, George Washington’s debt free unit, the Union destroyed the Greyback through counterfeiting.

Conclusion

The Banking Swindle is in many respects an effort to reconnect the Right to its roots of opposition against the Money Power. Although, after reading the book, I understand why Bolton considers the classical populist resistance against Money Power the Right, in this day and age this Left-Right paradigm has been so utterly discredited that I wonder whether it is useful to cling to the notion of the Right. The Right today is associated with Capitalism and the Banking Swindle actually quite clearly describes how the anti-usury activists were clearly seen as a third way, next to the great Marxist-Capitalist dichotomy of the day.

Furthermore, conservatism itself is in many ways outdated. Exoteric Christianity is hardly acceptable to many very spiritually inclined people and its universalism makes it very difficult to cooperate with. As Wayne Walton puts it: religion divides, spirituality connects. New words are necessary for old truisms. Each new era needs its own paradigms. Not the underlying truths change, but the people looking at them do. Reconnecting to our roots and traditions does not mean reliving the past.

People in the Truth Movement are a pretty heterogeneous bunch. The kind of awareness that it represents and which is now influencing more and more people cannot be called ‘conservative’, even though personally I nowadays feel very connected to real conservatism.

But having said that: the real issue is how the Banking Swindle exposes both the scale and the nature of a truly international, diverse and very powerful monetary reform movement. Post war propaganda and guilt by association have labeled these movements as ‘fascist’, but many of them were not and fascism itself of course is ridiculously demonized. These movements have been discredited and marginalized and Bolton does a wonderful job of rehabilitating them and showing their profound importance.

This is exactly the kind of inspiration and insight we need to build on.

Robert Stark interviewed Bolton at Counter Currents.

Related:

Meet the real deal: Michael Hoffman on Usury in Christendom

Abraham Lincoln was indeed a Money Power Agent

Left: Kelly McRae

Garry Kasparov, née Weinstein, the thirteenth World Champion, is widely considered to be one of the very best chess players to have ever lived. A couple of years ago he wrote a book called ‘How Life imitates Chess’. And indeed: every chess player is at some point bound to be amazed by the many similarities between Chess and the Real World.

It must be said that for political advice Bobby Fischer, another candidate for the ‘best ever’ title, was a better chess player to go to. After he retired as a player in 2005, Kasparov unfortunately joined the dark side: he’s now organizing the opposition against Putin in the name of the New York CFR, whose great predecessors conquered Russia in 1917. But Bobby’s ‘anti-semitic’ credentials were impeccable: he knew all about the Jewish Question. He died in infamy after exclaiming in a radio interview after 9/11 that ‘the Jews’ were behind it and that America deserved what it got for what it was doing to the world.

According to Boris Spassky, the 10th World Champion, all the great players were aware of the realities of the world. In a remarkable interview in New in Chess, the leading international chess magazine, a couple of years ago, he commented quite outspokenly and extensively on how the champions saw the political situation in the world. Stating among other things that Russia had been plundered by international Jewish capital after the fall of Communism.

Kelly McRae, a Real Currencies reader, recently created the very nice cartoon below using a typical example of how chess indeed often mimics reality: This side of the board is white and I’m playing a Rothschild, I don’t know which one. They all look the same to me.

This side of the board is white and I’m playing a Rothschild, I don’t know which one. They all look the same to me.

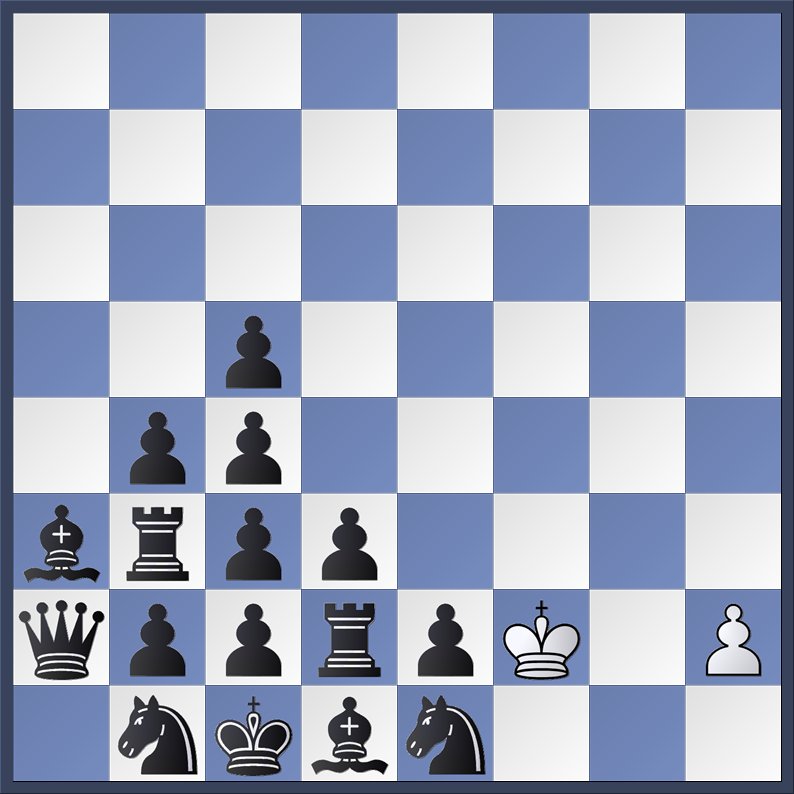

Here’s a better view of the position:

Of course the position is bizarre: black’s entire army is still intact, while white has only a pawn left. That’s why they call this kind of thing ‘grotesque chess’. By the way: in chess studies white represents the good guys.

This study can be seen as an analogy for the situation with the Money Power in more than one way. White’s position looks hopeless, that’s obviously the main thing. Here’s the solution, involving a few more clues:

1.Kxe1 (before marching the h-pawn, white takes black’s only active piece) Qa1 2.h3! (a wonderful point: even in this desperate situation white just loses a tempo. Just like in the real battle, where even now haste on our side would just be a sign of weakness) Qa2 3.h4 Qa1 4.h5 Qa2 5.h6 Qa1 6.h7 Qa2 7.h8N! (of course! No Queen, but the most modest possible minor promotion. The humble knight now begins a remarkable journey) Qa1 8.Nf7 Qa2 9.Nd8 Qa1 10.Ne6 Qa2 11.Nxc5 Qa1 12.Ne4 Qa2 13.Nd6 Qa1 14.Nxc4 Qa2 15.Na5 Qa1 16.Nxb3#

Now we can see why white played 2. h3! instead of h4: the black Queen had to be on a1. This is also the reason for the ‘inefficient’ route the Knight took. Emphasizing again that every step has to be taken and it will take as long as it will need to.

So what is the morale of the study from our point of view?

I think the key is that Black’s position, while wielding the almost largest possible material advantage, is brought down by the inner inconsistencies in his own position, which lacks all coordination. Only his Queen can play a useless move. This is also the Money Power’s problem, because it is all based on lies. On managed conflict. Everything must be organized in roundabout ways. It’s incredibly wearisome and complex to maintain all the lies at the same time.

Just a little fun.

Thanks Kelly!

Here’s her story of the cartoon: http://www.kellymcrae.com/1/post/2013/06/real-hope-reigns.html

The management of the volume of money is a very hot potato for all involved in monetary reform. Many in the interest-free credit community seem to think that no management is necessary at all, as long as the credit is asset-backed. And that we can always have all the credit we want. However, we need a stable money supply. It’s immaterial whether the money is asset-backed or not.

‘The issue of money ought to correspond with the growth of population…. The revision of issue is a material question for the whole world.‘ (Protocol 20)

The notion that everybody can have as much credit as he has assets to offer in an interest-free credit environment is quite widespread. Those promoting LETS based schemes and Mathematically Perfected Economy also seem to believe this.

However, with an interest-free credit based money supply, more credit means more money. The money supply grows when new credit is issued and shrinks when debts are repaid.

Their reasoning is, that as long as the credit is backed by assets, it will maintain value as money.

But prices are a function of the volume of money. If volume grows (with constant velocity, supply and demand) prices will rise, if volume shrinks, prices will dwindle.

Once the credit becomes money, it follows the laws of money, no longer the laws of credit.

Easy proof is today’s situation. Our current money is asset backed credit. True, it’s a usurious money supply, but just look at the housing market. We all agree the bubble was created by the FED through low interest rates, leading to a high demand for mortgage credit. With a mortgage one’s credit is basically decided by the market value of the house one is buying and of course one’s income. You’ll get more credit for an expensive house than for a cheap one, as long as you can afford the monthly payments. And this creates a positive feedback loop. The higher prices get, the more demand for credit there will be, the more money comes into circulation, leading to even higher prices.

Until the Mortgage Backed Securities hoax popped and the Bank of International Settlements simultaneously raised the capital reserve requirements for the banks. Overnight there was no credit for anybody anymore. The banks wouldn’t even lend to each other. The money supply collapsed, velocity collapsed and housing crashed catastrophically and devastated the economy.

Simple as that. This would be exactly the same in an interest-free credit environment. Even the deflationary crash would happen with an interest-free credit scenario, as at some point a panic would be unavoidable because incomes would not be able to rise as quickly as the prices of the assets. Which would tell at some point.

The problem is, the value backing the asset is a market function. Price is a result of supply and demand (as classical economics teaches) AND volume of money (as commons sense and experience dictate). If left unchecked, asset bubbles would be unavoidable.

Interest-free credit based money supplies need stable volume to achieve stable prices for the assets backing the credit.

Incidentally, I do not fully agree with the above Protocol quote. It should be slightly fine tuned to adjust not to population, but to the value of transactions in the economy. More transactions (in terms of their monetary value) mean a larger need for money.

An interest-free credit based money supply should be stable compared to the volume of transactions and the available credit should be shared equitably amongst the people and businesses using the money.

So if Volume must be managed, who should do it?

Some kind of monetary authority is necessary. Throughout history it was either the Sovereign and his scribes and priests or the Money Power that managed the volume. Basically history is mainly the struggle between these two forces for control of the money supply. The Sovereign and the people needed each other and the people were better off with him in control. Money would be plenty and non-usurious.

But the Money Power slyly preyed on the all too common misunderstanding that money is wealth, instead of an agreement. In older days senior Government officials knew this, but nowadays don’t.

Saying the ‘market’ should do it is just New Speak for saying the Money Power has been doing just fine over the last few millennia. In the old days it was those owning the mines that circulated specie and beguiled the gullible masses with it. They combined control of specie with fractional reserve banking. It goes back all the way to the ancients. Please read David Astle’s incredibly important and brilliant book on ancient Sovereign money and how it was busted by Gold and Silver racketeering if you still believe Gold has anything to do with ‘freedom’.

Nowadays the Money Power is the banking cartel with the Central Banks and ultimately BIS at its apex. Calling Central Banks ‘statist’ operations is just one other silly joke invented by the Volker Fund and its successors. Many similar stupid jokes have been circulated by the Money Power’s henchmen over the last 5000 years.

On the other hand: Government these days is clearly unfit to do it. They can’t even wipe their own behinds, let alone ours. They don’t know money, are all sell out crooks, corrupt to the core. They’re almost done surrendering sovereignty to supra-national (bankster) entities. Only the mediocre turn to bureaucracy and never has this age old truth been more true than today.

One could argue that Government would look very different if it provided an interest-free, plentiful money supply, as this would free herself from the Money Power too. But the Nation State itself is a very artificial construct. In fact, it’s a product of the Money Power itself. Medieval Europe was highly decentralized. The strong kings that created these European empires in Spain, Italy, France and England in the late middle-ages were already strongly in collusion with the financier class. The Amsterdam Empire of the 17th century was the first undisguised Bankster proxy, later outshone by the British Empire they had taken over through Cromwell and William III, Stadtholder of Holland and Prince of Orange.

Before then regions with their own dialects and customs were highly autonomous, even when part of a larger kingdom.

In the United States too, there was a long struggle to consolidate power with the Federal Government at the cost of regional and State rights, culminating in the Civil War, when Lincoln finally got the bankers their coveted highly centralized government, including national currency.

So the case for regional currencies, in whatever form, remains.

Conclusion

Some kind of monetary authority is necessary. There will always be a greater demand for credit than for money. Therefore additional funding schemes should be available besides the interest-free credit used to create the money supply. JAK Banks come to mind. But also brokerages, where people can invest and share in both profit and loss. This is close to Islamic banking.

Nobody in his right mind wants the ‘market’ to do it, since the ‘market’ is now close to externalizing the hierarchy it has been building for millennia into a full-blown World Government. It’s not a matter of ‘public vs. private’. It’s a matter of non-usurious, stable and plentiful money decentralizing power vs. usurious, unstable and scarce money centralizing power. If private Mutual Credit facilities can deliver stable interest-free credit, then let them do it. If the Government can create a decent Social Credit with Demurrage unit, fine.

Perhaps other forms of governance over these units can be suggested. Or new ways of combating abuse. Wider education about the simple mechanics of money are indispensable for improvement.

Either way, this is a crucial issue. It’s also a divisive one. People are attached to their ideas. In Interest-Free economics this issue is underestimated and that’s a very serious weakness. Many people don’t believe in Interest-Free economics exactly because they don’t see how volume is properly managed.

Answers are available and questions remain too. But the volume always has been and always will be managed one way or another.

Related:

Mutual Credit, the Astonishingly Simple Truth about Money Creation

Mutual Credit and Inflation

The Jak Bank: Interest-Free Full Reserve Banking!

Social Credit with Demurrage