The endless barrage of debt, debt, debt, makes debt-free money sound very attractive. But the problem is not debt, it’s interest and interest-free credit based money is superior to debt-free currency. On the other hand, debt-free money could easily be repaired to again be a competitive proposition.

Debt-free money is simply unbacked ‘paper’ (nowadays it’d be mostly electronic, of course) money, printed (usually) by the State. It can then either spend it into circulation itself or have the populace do it. The former is commonly referred to as the Greenback, the latter is known as Social Credit.

Interest-free credit is credit by bookkeeping. Not unlike our current fractional reserve banking system, although Mutual Credit is a simpler and superior way of creating credit, as there is no need for deposits (‘capitalization’). Hence Mutual Credit is intrinsically stable, while fractional reserve banking based lending facilities go bust routinely.

Debt-free money is spent into circulation and continues to circulate until it is retired through taxation. Interest-free credit is lent into circulation and is retired when the debt is repaid. Often the two meet. For instance: John Turmel recently gave the example of a Continental (George Washington’s debt-free money) being spent on infrastructure and retired through taxation covering the investment. In this way debt-free money is basically used as interest-free credit by the Government and the circulating Continental could be seen as the National Debt.

A noteworthy difference between interest-free credit and debt-free money is that interest-free credit can be spent as often as it is repaid, while debt-free money can only be spent once. This means interest-free credit is more flexible.

Isn’t debt a problem?

Debt as a problem is overrated. It’s not so much the debt, but the interest that is killing us. A mortgage is good example: we go into debt to buy the house, say $100k and after 30 years we have paid $250k, $150k interest. For the repaid debt we obtained a house, for the usury we got nothing.

Crucial to understand is that it is not the bank’s credit. It’s just bookkeeping and the banks keep the books for the community, who really owns the credit. It is in reality our brethren who are allowing us to buy now and pay later. Credit is automatic, when it is mutual.

In the news we hear about debt, debt, debt, but nobody is ever complaining about debt-service, while all the debt could be repaid within twenty years should we stop paying interest and use that money to pay back the principal. Why is this so?

Bankers know loans can go sour. They hate to write them off, but will gnashingly do so, if they cannot avoid it. Business is business and they are realists. But whereas a write off is a one time loss, ending interest payments would just kill their business case.

This is one of the reasons why I prefer an interest strike over debt repudiation too, except for odious debt, which should be repudiated always.

For the debt real stuff was acquired and while the bank loses when the debt is not repaid, it does not gain anything when it is: the money is just retired. It’s not the bank’s, it did not exist before the loan was taken out and disappears when the loan is repaid.

An interest strike, on the other hand, is to a bank what garlic is to a vampire.

The reason the people don’t talk about suspending interest payments to alleviate the debt quagmire is equally clear. They still don’t understand how they are being colonized through Usury. They assume interest on the debt is natural, as they were programmed to.

Having said that, debt is a bond. The lender is the master of the debtor. Less is more. Even when the lender is the community represented by an interest-free credit facility and even when the debt is for a worthy cause, like an interest-free mortgage.

So isn’t debt-free money perhaps better after all? The issue is, that classical debt-free money proposals are accompanied with Full Reserve Banking. The money would not be debt-free for long, once it is spent into circulation. Once it enters the banking system, it will not leave other than as a loan. A usurious loan. Because of the usury, a quick return of money scarcity after spending the money into circulation can also be expected.

So debt-free money in itself does not end interest-slavery. Because the money will be handled by banks, there will also be money scarcity. Not only because of the usury, but also because the bankers will keep money from circulating in the real economy, most notably to feed their gambling addiction in the international financial economy.

Furthermore, a modern economy without credit is unthinkable. People will need mortgages and even more importantly, modern business is impossible without credit. Investments can be very capital intensive and these investments would be impossible to save beforehand. People will perhaps not be too bothered with businesses paying interest, but the reality is the businesses will have to pass on these costs to their customers, being us.

Repairing Debt-Free Money

These days we can provide Full Reserve Banking without interest, through JAK banking. That’s one way of solving the usury problem with debt-free money. Savers don’t get interest on their savings, but they acquire future rights to interest-free loans if they save now and allow that money to be used for interest-free loans to others.

Probably even better is demurrage, where those with a positive balance pay ‘interest’, basically a penalty for holding money. Demurrage is based on the ways of the ancients, who used to store produce at central warehouses and got receipts in return. These receipts were used to pay others and they declined in value, because the produce in the warehouse did too.

Demurrage is designed to discourage hoarding of money. As a result, velocity of money (how quickly it changes hands) is vastly increased. Not only that, the penalty gives a clear incentive to lend interest-free, as it saves the cost of holding on to it. It is also promotes paying in advance, which also amounts to an interest-free loan. Paying up front instead of at the time of the purchase is very beneficial for the supplier, who can use the money to finance investments interest-free. So demurrage lessens the need for credit and provides interest-free credit.

The great disadvantage of demurrage is that there is little experience with it. The upside is, the experience there is, is very positive. The classic case is Wörgl, Austria, where demurrage money solved the Great Depression in 1934.

Conclusion

Interest-free credit is superior to debt-free money. It is more flexible and gets to the heart of the matter, which is usury. We will never be able to do without credit, but we can rule out interest on the debt.

Current debt-free proposals do not comprehensively solve usury, and thus also not money scarcity.

However, debt-free money can be decisively improved, both by interest-free JAK banking and demurrage.

There is no tutor like practice and ultimately we will have to experiment with different systems to know which is best.

The best part of the story is, that we have several ways of solving our monetary problems overnight. Only the knowledge and the will are lacking as yet and this is changing too.

Related:

Debt Free Money alone does not solve Compound Interest

Debt Repudiation or an Interest Strike?

Cause and Effects of Money Scarcity

(Left: William Jennings Bryan, a few months after he delivered his famous speech.)

American Populists always focused on scarcity of money. Expanding the money supply was their main goal, not Usury abolition. But Usury is the fundamental cause of money scarcity.

Money scarcity is the phenomenon of insufficient liquidity in the economy to finance all possible trades. This results in (permanently) depressed economies. Money scarcity always has been the key issue that Populist monetary reformers wanted to solve, ever since the Civil War. They proposed to add Greenback-style debt free United States notes to the money supply. But the call to monetize Silver was even more common. That was the background of Bryan’s famous ‘you shall not crucify Labor on a cross of Gold’ speech, for instance.

Gold as money is always scarce. There is never enough of it. This has been the case throughout US history. The economy grows quicker than Gold supplies and, worse, the Money Power has always controlled Gold (and Silver too, of course) and has routinely withheld massive amounts of specie from circulation.

Austrians deny money scarcity, citing Say’s law, which claims free markets will always clear. Prices will go down and suppliers unable to follow suit will just go out of business. In itself this is not untrue, but the destruction before markets clear is uncanny and leads to the premature death of millions, not to speak of the suffering of millions more who survive. Adding some liquidity to the economy is basically a no-brainer, but then the Austrians scare everybody to death with inflation fearmongering. Interestingly, warnings of inflation have always been the banker line in the past, when resisting adding money to the economy.

Money scarcity is pleasant to the Bankers. They prefer depressed economies, because it prevents the poor from becoming middle class. Bankers like cheap labor and people licking their boots for below sustenance job. The industrial revolution, which caused generation after generation to be destroyed in the sweat shops, is a typical example. Austrians will always hail the industrial revolution as that great era of wealth production, but they like to ignore that the wealth production was done by the laborers, while the wealth itself went to those providing the capital. The industrial revolution was the greatest defeat labor ever suffered against capital.

Furthermore, artificial scarcity of money raises the price of it and this obviously is to the monopolist’s liking. In this way money scarcity is as much a cause of usury as the other way around.

Causes of Money Scarcity

Money scarcity is caused by three main issues: deflation, usury and racketeering. Deflation is obvious: if the economy is operating at near max capacity and the money supply starts dwindling, markets will have to clear at a lower price level, causing recessions and depression in the worst case.

Usury is a constant drain on the money supply. Banks spend some of the interest back into the economy, but not all. They relend another part back causing even more debt and associated interest costs and indeed, worsening money scarcity. The rest is siphoned off to the financial economy (the ‘two-loop economy’), where it is used for their financial con games. Like speculating in commodities (raising prices), creating bubbles on the stock market, FOREX and of course the derivative trade, which is currently their favorite exploitative tool.

And racketeering: manipulating the volume of money. Banks routinely stop lending, saying ‘confidence is lacking’ or calling for ‘structural reform’, which unfailingly worsens the conditions of labor. In the days of metal backed currency, they simply stopped circulating their Gold and Silver. They have been at this forever. Here is a nice story about how the Venetians bankers took Silver out of circulation in the middle ages, causing the long term depression of the 14th century.

Money Scarcity and Empire

Money Scarcity is favorable to Capital, as it makes their monetary means more in demand. Labor will sacrifice greatly to avoid starvation.

However, closely associated to money scarcity is a lack of demand in the economy. Demand is lacking when production outstrips consumption. This is the case in every developed economy and has been the norm in Europe and the United States throughout modern history. This is unpleasant to Capital, because it cannot market all the goods it managed to force Labor to produce cheaply. This is what Social Crediters call the Gap. Keynes called a lack of aggregate demand.

Because of this problem, the merchant class seeks foreign markets and this was undoubtedly a key driver in Europe’s expansion during the Age of Discovery and beyond. Corporate interests looking for markets to dump their excess production still drives Empire to a large extent today.

Conclusion

Money scarcity is implicit in a usurious environment. This is something to keep in mind when we promote debt-free money to solve it, something we will discuss in the next article.

Interest-free money will not only see sufficient liquidity, it will also solve the basic cause of money scarcity, preventing its return.

Related:

Babylon = Usury! We want Interest-Free Money!

Ten Atrocities that would not exist without Usury

On Interest

Is there enough money to pay off debt plus interest? A closer look

A recent story claiming Hungary is now printing its own debt-free money has shocked the Truth community. It is false though. Some nationalist reaction is going in Hungary, but it’s a far cry from genuine monetary reform.

The story originated at the American Free Press. It was linked to at innumerable sites and took Facebook by storm, but unfortunately it is incorrect. Having asked AFP for a reaction, I was told it was an unfortunate editing slip: the story was not passed by the financial editor.

Perhaps I should have reported on this earlier, I did on Facebook a couple of times, but better late than never. Bill Still was more astute and did a solid analysis of the situation about a month ago, see below.

There is some sort of nationalist reaction going on in Hungary. The Government, led by Viktor Orban, has paid off the last outstanding 2,2 billion dollar loan to the IMF and kicked them out of the country. There were no mutual pleasantries when the IMF goons left Budapest. This did not amuse his European ‘partners’, as is also the case with his policy of gaining more influence over monetary policy. ‘Independent’ Central Banks are at the core of modern economics and politics. Surely we don’t want the people to know what Central Banks are up to? Let alone decide on monetary policy? Bankers know best.

Another issue is that Orban has made clear Hungary will not be joining the Euro for the time being. A great relief for Hungarians, but the Eurocrats consider this an uncalled for snub. Considering what happened to the Euro hostile Polish leadership only a short while ago, Orban is certainly showing a lot of courage. Taking an independent line while located between the Russia and the EU is a tricky proposition, requiring both balls and dexterity.

However, for the time being the Hungarian Forint is still produced by the Banks, as an interest-bearing debt to them. Until that changes, nothing really does.

Left: The energetic Karen Hudes

The amazing revelations by World Bank whistleblower Karen Hudes have stunned many and surely it is pretty mind blowing to hear a veteran World Bank insider validate the core of conspiracy theory: that a small group of bankers controls the whole lot, with the BIS at its apex. On the other hand: she promotes Gold based money as the solution.

The notion that a small group of bankers is controlling the world is mainstreaming like wildfire. And Karen Hudes is no small part of that. She is an experienced career banker who studied at Yale University. She is exposing massive corruption within the World Bank, where she has worked for 20 years, including mass resentment from the rest of the world in the American role in this. And she has no qualms talking about how the Federal Reserve and other major Central Banks and the IMF and BIS orchestrate the whole global economy.

A good overview of her accomplishments by Michael Snyder can be found here, a video by her that has been making the rounds is in there too.

What I really like about her style is, she is in no way impressed, let alone in a panic: she’s on the contrary very optimistic and fighting the bad guys with law suits and whistle blowing. So I, like many, am thrilled to see her take on the whole lot and wish her more power.

More Gold Porn

On the other hand, exposing the Gold racket is and remains necessary. And Hudes does promote Gold based monetary reform. I don’t mean to harm Hudes’ message here, it is an undeniable fact of life that many inspired and brilliant people have fallen for the Gold meme at some point. Let us just be grateful she’s out there and for the excuse she provides to rehash this very pressing and mainly ignored issue.

Promoting Gold as a solution for our current problems is simply promoting Money Power policy. Not that it’s a bad investment, but keeping a little Gold at the side for a rainy day is quite something else than suggesting Gold backed money.

Clearly, the Banks have been preparing a return to some sort of Gold standard. For years now, rumors about a Gold backed Yuan have been gaining momentum. FOFOA has been exposing the plans for some sort of monetary role for Gold with the Euro. Central Banks have been buying Gold in major quantities. It is the Powers that Be that control Gold. All of it.

Many different memes supporting the notion that Gold backed money is fair and will save us have been circulated over the years, to prepare us for what is coming. Nesara comes to mind, promising Gold based monetary ‘reform’. OPPT claims we will all be given some.

Austrian Economics with its great champion Ron Paul is the ultimate Money Power Gold meme, of course. They invested billions in that one, giving the Banks’ plans some sort of ‘scientific’ veneer.

The weirdest of these narratives is ‘Road to Roota’, claiming Alan Greenspan is trying to save the United States by preparing the return to Gold as money. It’s certainly true that Alan Greenspan is the most famous and influential Austrianista of them all, but the idea that he would be interested in the well being of these United States?

Gold vs. Paper is just one of their dialectics. They don’t care whether it’s the printing press or Gold that finances the economy. They own both. Alan Greenspan is just one case in point. They have routinely switched between both in the past. During WW1 most nations left the Gold standard. The Money Power reinstated it in 1925, to create the depression. Which it duly did in the thirties, when most countries again turned to the printing press, the system we have today. Gold is deflationary and deflation causes depression.

They have been getting rich by lending massive amounts of Gold to sovereigns for centuries, millennia, now.

Control of the money supply by the banks is exploited in three main ways: usury, manipulation of volume (money scarcity, the boom/bust cycle) and the power to direct the economy by deciding what to finance and not. Gold solves none of these three.

Some say Gold is ‘debt free’ money, because it is dug up and spent into circulation. But Gold mining adds only a fraction to existing Gold supplies, which would be lent into circulation by the banks at interest.

History shows that asset bubbles were the norm during Gold standards. Prices tend to decline during Gold standards and to rise during Paper standards. Deflation has the Money Power’s preference, as it kills the middle classes through protracted depression and money scarcity. Inflation encourages booms and this is better for the many. The Banking Cartel, creating a global depression, wants to use Gold to look like it’s reforming a bad situation, only to make it worse.

America is badly placed for a new Gold based currency. The Fed owns no Gold at all, is my bet. And this is no coincidence, because it has always seemed that the coup de grace for the dollar would also mean the end of Pax Americana. The end of American supremacy is an integral part of the road to global governance.

Gold prices today are heavily reliant on New York’s Commodity Exchange (COMEX), where prices are set by derivatives like Gold futures. Many players on that market are selling Gold that they have only on paper. This is how prices are manipulated. Should people start calling their bluff and insist on physical delivery, COMEX would quickly collapse and this is the great day of reckoning that seems to be unavoidable. Physical Gold prices would go through the roof, the dollar down the drain and America would be caught with her pants down.

When this happens the results for the United States will be devastating.

Conclusion

The Money Power are the banking families and their control grid, including the Banking Cartel, which is one massive consolidated block. To solve the situation we need to get rid of the banks and print some interest-free credit, while managing the volume properly. The money supply should grow and shrink parallel to economic activity. With local democratic control of credit allocation. This would solve all three main problems with money.

If we do that, we would end the Money Power, war, the depression, Transnationals, poverty, the Jewish Question, environmental destruction, wage slavery, the war on the family and the degeneration of the public domain. Simply by starving the beast and empowering the many.

It would vastly increase the standard of living of the great majority of mankind. It would foster an unprecedented cultural, scientific, political, economical, environmental and spiritual rebirth.

Related:

The Dying Dollar and the Rise of a New Currency Order

Why is Gold not rising?

Phoenix Rising, the Return of the Gold Standard

The Few Banks that Own All

(Left: Did Hitler control Hjalmar Schacht or was it the other way around?)

The article on Hitler’s finances and the myth of Nazi anti-usury activism generated a major response. While rehashing the classic revisionist case for Hitler, none has disproven, or even mentioned, the basic case of the article: that the banks financed most of the Nazi economy and that the Reichsmark, like all other currencies, was created through fractional reserve banking, as an interest-bearing debt to these banks.

And many comments point to a wider malaise: deifying the disastrous Adolf Hitler.

I’m now responding to an article written by Justice4Germans and an interview that Deanna Spingola did with Rodney Martin. I’ll also address a number of issues brought forward by feedbackers here and on other sites. Please let me know if there are other serious rebuttals to the article, I’ll have a look at them too, if needs be.

Some fun was made about my sources, most notably the Virtual Jewish library. This was duly anticipated. Few people realize that the best way to find out about somebody is to listen to his enemies. I make a point of looking at all sides of the story and sources should be be judged on the merit of their message first and foremost, while not forgetting who they are or represent. I have no illusions about Ziopedia or the Virtual Jewish Library, but the onus is on the critics to dispel their message and, as we shall see, they did nothing to do that.

Much of what was brought against the article seemed to suggest that these three people had the impression I am not aware of revisionist history, but this is wrong: I’m very well aware of revisionism and go along with a great deal of it. I don’t believe in gas chambers. Stalin wanted to invade Europe and had assembled a major striking force ready to take the whole lot after Hitler and the Western Powers had destroyed each other. Hitler was far from solely to blame for the war. In fact: the Money Power’s people in the British cabinet made sure there would be a war by guaranteeing Poland. Stalin wanted war. Roosevelt did everything in his power to get his, unwilling, people to join the mayhem.

However, Hitler wanted war too, and his apologists simply do not want to see this. Hitler wanted peace with the West, Britain in particular, and his many peace overtures to the West, both before and after September 1st 1939 are what they use to ‘prove’ Hitler’s desire for peace. But he saw war with Russia as his destiny. We can see that both from Mein Kampf and his actions in the late thirties and most certainly after he started Operation Barbarossa. It is most assuredly true that he found a worthy opponent in Stalin, who had his own designs on Europe, quite similar in their utter depravity to what Hitler was planning for Russia.

And what did Hitler intend to do with Russia? To exterminate her and take her land. And to sell it as this wonderful crusade against the bad Jews and their Marxist front. Nothing more and nothing less.

How do we know this?

Reading Mein Kampf is a good start. It’s all about the bad Bolshevists and how German colonization of the East will solve that.

Another very solid indicator is the despicable fate that the millions of Russian POW’s awaited in the German veritable death camps, where they were worked and starved to death by the millions. It seems about 3,5 of the 5,5 million POW’s died in German captivity. The Germans, cowardly, only started to treat them better once they realized they were going to lose.

Yet another brutal example is what happened in the Ukraine. In Barbarossa’s early days, the German invaders were welcomed by the Ukrainians, who had been starved in the greatest genocide of the 20th century, the Holodomor, by Stalin’s mostly Jewish NKVD. But Hitler unleashed such a reign of terror against them, that within months they started their partisan activities and looked at Stalin for answers. As honest commentators know, had Hitler been a reasonable man, really hoping to fight off an evil Bolshevist invasion, he’d have had the Waffen SS recruit a couple of million of Ukrainians, who would have gladly marched on Stalin’s Moscow for him.

But the most damning piece of evidence for the clear and present fact that Hitler was a genocidal maniac in the same league as his ‘great’ antagonists is the Hunger Plan. The well established policy of the Wehrmacht High Command to have the Wehrmacht live off the Russian lands by the third year of the war while calculating this would starve 30 million Russians. That should have left plenty of room for the German Folk! We can already imagine how Nazi propaganda would have been talking about ‘a land without people for a people without land’.

Hitler never had the chance to fully implement the Hunger Plan, but millions of Russians starved because the Germans took their supplies anyway.

What Hitler did to Russia is despicable and Revisionism, notwithstanding its many achievements, becomes a part of the problem when they aim to replace Allied and Russian war propaganda with Nazi agitprop.

The Jewish Question

And that’s another key point: Hitler’s defenders way overrate the Jewish Question. The Jewish Question is real and Jewish supremacy is incredibly annoying, there is no doubt about that. But is it really true that ‘Jews run the World’? I don’t think so: Trillionaires rule the world. Through their control of money, the Banks and through the Banks the Transnationals too. We are ruled by Capital: a small group of families. And they use Jewish Supremacism. They consider ordinary Jews their ‘lesser brethren’ at best, but more likely like total vermin like the rest of us.

How do we know this? Consider this:

1) It were the Jewish Councils that organized the transports to the camps during the war. These Jewish Councils were dominated by Zionists. They had no interest in ‘saving the Jews’. They had an interest in getting those willing to Palestine and they couldn’t care less about the rest. The Zionists, in turn, are owned by the ultra rich, as can be seen from the Balfour declaration, that was directed at Lord Rothschild. We also know that the Zionists did everything in their power to make the Jews’ plight as bad as possible, to uproot them completely, in order to get them to move to Palestine.

2) Jews are interest-slaves too: wealth distribution in the Zionist Entity in Palestine is among the worst in the world.

3) Anti-semitism is used to control the Jewish masses, who are perpetually kept in fear of the stupid Gentiles, who are supposedly always trying to murder them. Holocaustianity is a key part of this agenda. I believe everybody should see the ‘Defamation’ film to understand how the Jews are being manipulated in this way. Combined with this anti-semitism scare is this nasty ultra nationalism that Jews are programmed with and the strong cultural stigma against intermarriage with non-Jews. All this creates a decidedly narcissistic culture, which is very damaging to both the Jews themselves and the poor Gentiles having to live with them.

But the question now is: does that make the Jew our enemy? Or is it those that are programming the Jews? Those to whom the Jews pay their usurious tribute to? Those that made sure they were ethnically cleansed from Europe?

The simple fact of the matter is: Hitler did uproot the Jews and murdered probably about a million of them in the process. But he did nothing to really threaten the ultra rich. He didn’t end banking. The war he wanted was the war they wanted. They made a bundle from their arms manufacturers and their banks too.

It is not the Jewish commoner that is our enemy, however annoying Jewish tribalism may be and however despicable their whitewashing of their elite’s crimes.

Jesus and Paul were closer to the truth. Jesus when he said: “I know the blasphemy of them which say they are Jews, and are not, but are the synagogue of Satan.”

And Paul with his famous, brilliant and very telling: “For we wrestle not against flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against spiritual wickedness in high places.”

The Jews are the most manipulated people of them all and if the Money Power has its way some more will be sacrificed in the Greatest War that they have planned in the Middle East.

More on Schacht and Hitler’s Finances

It is unfortunate that there is so little financial literacy. This never ceases to amaze me: we all know that the bankers are behind all wars, owning both sides of the conflict. So why in the world are we not all studying economics and finance??

It tells in many of the comments too. For instance: in my article I noticed that Schacht oversaw the merger of several companies into I.G. Farben. This is then attacked by Martin as in some way ‘defaming’ Schacht. He says I only mention this because I.G. Farben has a bad reputation for Zyklon B and that it was just some sort of benign industrial giant.

Well I didn’t, because Zyklon B was used to delouse the camp inmates. I don’t see a problem with that. I do, however, see a major problem with massively consolidated industry in the hands of very few people, people who then continue to make an incredible amount of money with war profiteering. I.G. Farben was broken up after the war in its original parts. Agfa, BASF, Hoechst and Bayer. Today these are key components of the Big Pharma Cartel, which is behind chemotherapy, vaccinations and the depopulation agenda. I.G. Farben was closely associated with the Standard Oil Cartel, another issue people like to downplay. It is this close association that actually IS Big Pharma today.

Pharmacy and the eugenics link are also tightly connected, another little something I’m not eager to ignore.

Even worse is that Martin says ‘Schacht only provided a loan for the merger’. And this is why I suggest this financial illiteracy is really killing us. Because what is it that bankers do other than lending? It is by their financing that they control the economy! No financing, no deal. It is this prerogative by which they direct all the economies in the world. It is by the usury on the loan that they get their part of the action.

This blindness to banking, how it works and how bankers influence everything is also telling in the way Justice4Germans describes Schacht: “He spoke perfect English, had spent a lot time in America, had connections, was very egotistical and enjoyed having power and prestige, and to be in the limelight. Thus, Hitler was able to use and manipulate him to make him useful and to act as a kind of firewall against the international bankers while Germany was being reorganized under the NSDAP.”

Well, I’ll venture to suggest it was the other way around: Hitler was rather ambitious and through Schacht the Money Power controlled Hitler. The Money Power wanted Hitler to go to war and they made sure, through Schacht, that he could. They did not want him to nationalize the banks or end usury.

Why was Feder and the Nazi left sidelined after the night of the long knives? The fact is: this already happened in 1931, when Hitler’s financial and industrial backers threatened to cut him loose if he didn’t reign in Feder.

Schacht’s position as Reichsbank President was MUCH more important than Feder’s ministerial position, this is another issue the critics overlook. This position was second only to the Fuehrer himself, in terms of real power.

What was that old (probably debunked) quote about ‘give me control of a nation’s money and I care not who makes the laws’? It seems that this all important lesson continues to elude many.

I repeat the simple fact that Schacht’s is an absolutely exemplary high level Money Power agent bio. Why try to make this go away? To say that Hitler was forced to appoint him to appease his backers (as both Martin and Justice4Germans suggest) basically admits that the power behind the throne was given what they demanded: control of the economy.

Then about Schacht’s policies, allowing the resurrection of the German economy.

As we know the Money Power rules through control of the money supplies of the nations and exploits this control through usury, the manipulation of the volume of money and to direct the economy by financing those it owns (or wants to own) while starving the rest of credit.

What Schacht did, and this is my basic message in the original article, is solve the volume of money. People are highly impressed by the quick solution of German unemployment. I’m not. People like Major Douglas, but also Keynes, would also not have been surprised. The simple fact is that depressions are caused by deflation, a contraction of the money supply. Provide the economy with sufficient liquidity and it will quickly return to full activity.

Schacht provided this much needed liquidity through his MEFO bills. I did not say, as Martin and Justice4Germans seem to believe, that it was rearmament that solved the depression in Germany. I did say that rearmament was where all the (extra) money went. They tried to downplay this, with some justification, by pointing at the public works program (Tempelhof Airport, Bremer Haven, Autobahns) that Hitler initiated, but here too they succumb to whitewashing instead of objectivity, claiming rearmament began only ‘in earnest’ in 1936. However, the mentioned public works clearly greatly enhanced both German productivity and capacity for war and this should not be overlooked. Moreover, Hitler immediately started reinforcing the Wehrmacht, there can be little doubt about that. It was his growing confidence because of the rebuilding Wehrmacht that gave him the nerve to remilitarize the Rhineland in 1935, not because Autobahns provided his troops with an escape route should the French have called his bluff.

German public debt stood at 18 billion in 1939 and total outstanding MEFO bills were at 12 billion Reichsmark.

And this is why it is so important to understand that the Reichsmark was created by the banks through fractional reserve banking, as an interest-bearing debt to them.

Martin says I destroyed my own case when I ‘admitted’ I have no hard data on real interest rates in the Nazi era. Nonsense: I was simply pointing at missing statistics that would further elucidate the situation. Let Martin show these statistics with 0% and I’ll be the first to recant. I provided plenty of evidence of Usury in the economy, including Nathan’s very informative essay (which all ignored), the legal Weimar interest rate of 4,5% that Hitler never changed and the fact that rising interest rates were used to cool the overheating German economy in the late thirties.

Justice4Germans, in his completely bogus ‘bottom line facts’ in his rebuttal to my article (claiming Germany had no debt, while it stood at 18 billion before the war broke out) makes the point that “Under the National Socialists, Germany’s money wasn’t backed by gold (which was owned by the international bankers). It was essentially a receipt for labor and materials delivered to the government.”

Completely ignoring that Germany left the Gold Standard in 1931, in the final years of the Weimar republic. In fact: most nations would leave the Gold Standard during the thirties. It’s completely irrelevant, whether money is backed by Gold or not, I’ve done more than my fair share in exposing this crucial fact here at Real Currencies over the last few years. What matters is, is the money circulated as an interest-bearing debt or not? Money today is not backed by Gold, that is the whole point: the German monetary system, the Reichsmark, was exactly the same as most nations have today and at the time. That is where the claim of ‘the myth of Nazi anti-Usury activism’ comes from!

The real question is: who owned the banks that lent the Reichsmark into existence during the Nazi era? Only the much maligned (by Hitler apologists) Henry Makow asked this question and my answer can be found under the article on his site. ‘Could it have been the Jews’, Makow wondered? And I’m willing to bet a fiver it were indeed the Jews. I have seen no data whatsoever that the owners of the banks were disowned and it’s a sure bet the Jews owned the banks during the inter bellum.

So Schacht solved the problem of deflation and money scarcity, but he did nothing to address usury. And Hitler didn’t either. Nor did Walter Funk, who succeeded Schacht in 1939.

Martin also makes a very favorable description of the European Economic Zone that the Nazi’s had in mind. Martin explains there were real elections in the occupied Western territories (Holland, Belgium, France). He also mentions the Japanese Greater East-Asian Co-Prosperity Sphere, calling it ‘similar’. Well, this is just a typical example of an all too credulous take on Nazi and Japanese benevolence. Both Empires aimed at a sphere of influence that would put their own countries at the center and the others as suppliers of raw materials and markets for the products of German and Japanese industry. Europe was to become a German dependency. To believe that the occupied territories would have been anything else but vassal states is really a very typical example of taking this Hitler worship way too far.

National Socialism, the Protocols and the Public vs. Private dialectic

Hitler brought the entire economy, including finance, under State supervision. As I described extensively, domestic capital markets were tightly controlled by the State and only the State had real access to them. All available financial means were gobbled up by the rearmament effort, especially after 1935.

And this is something very important, because there is this tendency to think that the problem is that banking, and especially central banking, is private, and that all will be solved if the State takes over. The fundamental mistake underlying this notion is the idea that the State is the Commonwealth or at least represents the public.

Personally, I’m completely cured of that idea. The problem of money and tyranny is NOT going to be solved by having the State take control. Most certainly not if the State does not provide interest-free credit, not just for itself, but also for the commoner, because the key problem is centralization of power and Usury is the ultimate centralizer of power. Capitalism is the concentration of power in private hands, the Plutocracy. But the Plutocracy itself intends to consolidate this power in State hands: they want World Government and the Protocols explain this all too well. Marxism is their tool in the Public vs. Private dialectic, showing they have absolutely no problems consolidating power in State hands. The question is always the same; ‘who owns the State’? And the answer is always the same too: the Plutocracy.

Where the Protocols are famous for their explanation of the conspiracy that is undermining the Gentile peoples and States, their emphasis in the final chapters, say Protocol 18 and beyond, are more focused on how they will manage their Kingdom, once the conspiracy to take over the world has come to fruition.

And this is where it gets really interesting. Because a closer look shows that there is no mode of Government closer to the Protocol’s ideals than………..National Socialism. I know full well that this will sound insane, or even worse, irrelevant, but I strongly suggest reading the latter part of the Protocols again with this idea in mind. I’d be most interested in anybody dispelling this notion.

Here are a few examples:

The Protocols claim that the King who needs a body guard is weak. People will think he has enemies to fear. The Protocols say that their King will walk in public without guards, but encircled by hundreds of people ‘who just happen to be there’, but in fact serve as a shield. This is exactly how the Fuehrer moved in public before the war.

The Protocols also have a strong focus on race although they make it clear that in the end everything will be decided by numbers. Again: this is exactly the same in Nazi Germany, where the German people were more or less God in name, but behind the scenes it were the wealthy that ruled, just as everywhere else.

Another example is the focus on the King as embodiment of the popular will. It’s hard not to think of the Fuehrer here. They also succinctly describe how unemployment is the greatest threat to government and that public works will be used to prevent unemployment and unite the interests of the King (who decides what will be built) and the workers, who will have a job and associated sustenance.

But the most important thing is the way the Protocols describe the State as the center and source of public life. The complete subservience of the individual to the State as the embodiment of the greater whole, being the Nation.

All these crucial issues are clearly at the core of National Socialism. For instance: point 25 of the NSDAP 25 point program says: “For the execution of all of this we demand the formation of a strong central power in the Reich. Unlimited authority of the central parliament over the whole Reich and its organizations in general. The forming of state and profession chambers for the execution of the laws made by the Reich within the various states of the confederation.”

What was it with Hitler and Britain?

Just think about it: Anglo-German economic rivalry was the one of the key drivers behind European politics after 1900 and a fundamental reason for the Great War. Germany was industrializing and historians nowadays agree that it would have dominated the European mainland within years, were it not for the war. It is this rivalry that was to drive British business interests in the Greater war too.

And yet Hitler had this incredibly naive notion about the British as Aryan brothers in Mein Kampf.

How is it possible that he would not have known that Jewish Money and the British Aristocracy had merged throughout the 19th century and that the Money Power’s capital was London? Why did he ignore the lethal struggle between German and British economic interests? Why did he make this ridiculous speech about the ‘need’ for the British Empire and its ‘civilizing force’ after insanely letting the British Expeditionary Forces (BEF) escape the continent at Dunkirk? Why did Nazi propaganda only in the late thirties begin in earnest to expose Western Capitalism in the same vein as they had been attacking Marxism, as the Jewish Money Power fronts that they both are? Why did Hitler arrogantly, stupidly and suicidally attack Poland, knowing this would mean war with the Brits?

Was he fooled to believe there would be an Anglo-German entente, allowing him the continent and Russia?

If so, how did this happen? It must have been going on since the early days, because it was already prevalent in Mein Kampf. It would explain a great deal, including his many hopeless peace proposals with the West and Hess’ inexplicable flight to Britain. Just last week it was reported he brought with him a detailed peace treaty, offering to leave Western Europe in exchange for a free hand in Russia.

The idea of Hitler falling in a British/Money Power trap like this is speculation, but it most certainly would be very typical of perfidious Albion.

Conclusion

The Money Power has always pitted nation against nation. The British against the Germans, the French and the Russians. The Dutch against the French and the British, The Americans against most others and the Jews against all.

They get away with this, because people over identify with their nation. It aggrandizes their brittle ego. They are easily fooled with silly propaganda about the bad other. Then they gleefully join in the rape, the plunder and the genocide. Not unlike the Talmudists, they believe they can take the other’s stuff and even lives, if they’re not part of the same race or nationality. Or because we believe they are hopeless and bad.

We are all in this together and this is what we must come to terms with.

The Revisionists don’t understand money and don’t understand how Germany’s monetary system operated in the thirties. What is worse, instead of seeking truth, they are seeking to whitewash National Socialism and Hitler.

It is understandable, considering the insane lies that have been spread about both. Germany must be rehabilitated. Not as a poor victim of the mean Jews, who attacked from all sides, but as no greater part of the problem than we all are.

We are not going to solve the Jewish Question, let alone the real issue, Plutocratic High Priests of the Synagogue of Satan, by becoming them. By taking over the world from them with their own means.

We all suffer from Usury and degeneration brought upon us by the Money Power’s henchmen, among them Organized Jewry. Throughout the war, all the nations suffered immensely, including the Jews. The sole victors were the Plutocrats.

In all this, Hitler was part of the problem and not the solution.

Related:

Hitler’s Finances and the Myth of Nazi Anti-Usury Activism

Hitler’s Finances, Schacht in his Own Words

The Public vs. Private Dialectic, or: Money as part of the Commons

Last Saturday Jason Erb interviewed me. We discussed the basic issues and the last half hour we talked a little about the article and its backlash.

(Left: the Emperor wears no moustache……)

There is the widespread notion that Hitler was fighting the Money Power and that he was a problem for the Bankers because he created a Usury free economy. But there was no Usury free Third Reich economy. The German taxpayer continued to pay interest over the substantial national debt and commercial banking received interest for its fractional reserve banking based loans, which to a large extent financed the war.

“Our greatest social task is the abolition of interest slavery. This responsibility to abolish interest slavery towers above all other issues of the day. It is the only solution to the greatest problem of our time. The breaking of interest slavery is the most important moral imperative in social terms, it rises in its general significance far beyond all questions of the day, it is the solution of social questions, it is the only way out of the terrible confusion of the time. The abolition of interest slavery will deliver us from ultra-capitalist domination while avoiding both Communist destruction of the human spirit and Capitalist degradation of labour. The abolition of interest slavery opens the way to a truly social economy, by liberating us from the overwhelming domination of money. It opens the way to a state based on creative work and genuine accomplishment.” – Gottfried Feder 1919

Where does Hitler’s reputation for anti-Usury activism come from? It was more Nazi propaganda to get him to power than his actual policies after he did. It was not Hitler, but Gottfried Feder who was the anti-Usury man of the Nazi. Hitler in Mein Kampf: ” For the first time in my life I heard (through Feder, AM) a discussion which dealt with the principles of stock exchange capital and capital which was used for loan activities. After hearing the first lecture delivered by Feder, the idea immediately came into my head that I had found a way to one of the most essential prerequisites for the founding of a new party.

To my mind, Feder’s merit consisted in the ruthless and trenchant way in which he described the double character of the capital engaged in stock exchange and loan transactions, laying bare the fact that this capital is ever and always dependent on the payment of interest.”

And:

“The struggle against international finance capital and loan capital has become one of the most important points in the program on which the German nation has based its fight for economic freedom and independence.”

Point 11 of the NSDAP 25 point program, a manifesto that officially (but not in practice) expressed Nazi policy:

“Abolition of unearned (work and labour) incomes. Breaking of debt (interest)-slavery.”

Hitler put it this way: “Our financial principle: Finance shall exist for the benefit of the state; the financial magnates shall not form a state within the state. Hence our aim to break the thralldom of interest.

Relief of the state, and hence of the nation, from its indebtedness to the great financial houses, which lend on interest.

Nationalization of the Reichsbank and the issuing houses, which lend on interest.”

But as we shall see, Hitler did not implement any serious monetary reform after he came to power. He did make finance completely subservient to the State and, more specifically, rearmament. But he did not nationalize any banks and the Reichsbank was already nationalized by the Weimar Republic by the time he came to power. He did not end interest payments to ‘the issuing houses’, who must have made an uncanny fortune throughout the war. He did nothing to decouple the Stock Exchange from the economy.

Feder was made Secretary of State for Economic Affairs, but was from day one sabotaged by Reichsbank President Hjalmar Schacht and replaced by him in August 1934. It was Schacht who was to manage the Nazi economy, not Feder.

Schacht’s and Hitler’s policies allowed full control of the economy, which was used to maximize production for the sake of war. But it did absolutely nothing to limit in any way massive war profiteering by the financial and industrial classes that brought him to power.

The Reichsmark

The Reichsmark was created 1924 after its predecessor, the Papiermark, had been inflated into oblivion. 1 Reichsmark was 1 Trillion Papiermark. The Reichsmark lasted until 1948, when it was replaced by the Deutsche Mark. So Hitler simply used the monetary system that he inherited from the Weimar Republic. The Reichsmark, like any other banking unit, was lent into circulation. It was a Gold backed unit until 1931, when the depression forced the Reichsbank (the Central Bank) to implement exchange controls, which effectively took Germany off the Gold Standard. A Gold peg remained in place. There were 1, 2 and 5 Reichsmark silver coins.

Hitler inherited the official Weimar 4,5% maximum interest rate. He ruled by decree, but never changed this. In fact, after the Nazi economy began to boom due to heavy spending on rearmament, it seems interest rates were raised to combat inflation. I’ve been unable to find any data on real interest rates during the Nazi era.

Who was Hjalmar Schacht?

Schacht was born in 1877 as the son of an aristocratic family. He joined Dresdner Bank in 1903 and already in 1905 was meeting people like JP Morgan and Theodore Roosevelt. He studied Hebrew to advance his career. In 1908 he joined Freemasonry. He oversaw the financing of Belgian/German trade during WW1 and used his former employer Dresdner Bank for this. This blatant conflict of interest led to his dismissal, but the revolving door was not invented recently and he was taken back by Dresdner Bank after this.

In 1923 he joined the Reichsbank and played a key role in ending the hyperinflation of the day. A little later he was made President of the Reichsbank and remained in this post until 1930. Since at least 1923 he was actively resisting the war reparations that were destroying the German economy and called for resurrection of German power. In 1926 he became involved with the NSDAP and supported their rise to power, although he never became a member.

He oversaw the formation of I.G. Farben in the twenties.

Schacht was a member of the Keppler Circle, a small group of businessmen that were at the heart of the Nazi movement and which financed Hitler’s rise to power. Wall Street was very influential in this group and contrary to what many Hitler apologists claim, played a heavy role in both financing him and war profiteering.

Shortly after Hitler came to power he was reinstated as President of the Reichsbank and when he replaced Feder as Reichscommissar for the Economy, he basically gained full control over the economy. This lasted until he was fired in 1939, when the German economy was overheating and Schacht wanted to limit spending on rearmament and was accused of ‘mutiny’ by Hitler.

Banking in Nazi Germany before the war

After becoming President of the Reichsbank, Schacht immediately started implementing policies aiming at giving the State full control of financial markets. This was known as ‘the New Plan’:

“(1) restriction of the demand for such foreign exchange as would be used for purposes unrelated to the conspirators’ rearmament program; (2) increase of the supply of foreign exchange, as a means of paying for essential imports which could not otherwise be acquired; and (3) clearing agreements and other devices obviating the need for foreign exchange. Under the “New Plan”, economic transactions between Germany and the outside world were no longer governed by the autonomous price mechanism; they were determined by a number of Government agencies whose primary aim was to satisfy the needs of the Nazi’s military economy.”

Foreign exchange controls were implemented to manage shortages in foreign currencies. Rules for credit creation by the Reichsbank were cancelled, aimed at potentially limitless credit creation to provide the economy with the liquidity it needed to get back at full employment.

All policies were aimed at 1) making sure the Government was basically the only borrower at domestic capital markets and 2) to make sure there was always enough credit available.

Price and wage controls and indeed rising interest rates were used to combat rising prices that would have resulted from these inflating policies.

Between 31 December and 30 June 1938, the national debt of the Reich rose from 10.4 billion Marks to 19 billion Marks.

There was no nationalization of banks. In fact: some banks that the Weimar republic had nationalized during the early days of the depression, were again privatized. Private banks played a crucial role in financing the rearmament effort. They were put under close Reichsbank control to make sure their lending was what the State wanted, but nothing was done to limit their profitability.

The Stock Exchange

While railing against this typical exploitative instrument of finance during his rise to power, Hitler did nothing to limit the stock exchange’s scope and operations once he had the chance. The stock exchange system in the Reich was superficially reformed: a number of its outlets were merged and the number of exchanges declined from 25 to 9 as a result. But volume of trading was never threatened and during the early Hitler years it saw annual double digit rises until 1937, when the Reich’s economy started faltering and the stock exchange lost about 10% of its capitalization between 1937 and 1939. After the war broke out the stock market saw a massive boom, rising 50% between the falls 1939 and 1941.

In 1934 heavy taxes were levied on dividend payments higher than 6%, but the aim of this was not to limit profiteering, but to enhance self-financing of publicly traded corporations. They were expected to recycle more of their profits into their own operations, to make them independent of capital markets, which the State intended and managed to completely dominate for its own financing needs. There were loopholes to evade this measure and shareholders were not damaged, as it implied deferment of dividend payments and not real limitations.

The Reich’s policies also made sure the common man did not enter the stock market, as they were expected to lend to the Government and not to speculate. But still, the amount of funds being diverted to the stock market were not invested in the war and “It was then (1942, AM) that the government stepped in and destroyed the last relatively free market in the economy. Loans for the purchase of stocks were prohibited. Shareholders had to file a declaration with the government of all shares purchased since the outbreak of war if their market value exceeded 100,000 Reichsmark. The government could, at any time, request that any of these shares be delivered to it for cash and that the proceeds be invested in securities to be specified by the government. (Nathan)”

MEFO

While every effort was made to assure the State’s domination of capital markets, there was simply not enough liquidity in the economy to create full employment and unlock the German Folk’s full productive capacity for rearmament. This could have been solved by having the State go massively into debt, in typical Keynesian fashion. But this would have created both political and economic problems and, equally important, would have shown the full extent of rearmament to the Reich’s enemies.

Instead, Hitler, right after coming to power, fired Reichsbank President Hans Luther and reinstated Hjalmar Schacht, who was willing to build on Luther’s Oeffa’s: Government promissory notes aimed at creating employment that would create the extra liquidity needed to finance Hitler’s plans.

Schacht created a special purpose vehicle (SPV, a dummy corporation) called MEtallurgische FOrschungsgesellschaft (MEFO), which was used to accept bills of exchange drawn by German weapons manufacturers and received by all German banks for possible re-discounting by the Reichsbank. The bills were guaranteed by the Reich for five years and were thus (indirectly) convertible to Reichsmark.

MEFO bills of exchange were a pure bookkeeping operation and there were no actual paper certificates. They circulated between MEFO, the Reichsbank, commercial banks and manufacturers, not in the wider economy. At its peak there were about 12 billion worth in circulation. Key was that they were kept off the Reich’s books as all transactions were logged at the MEFO SPV. Because of this, nobody really knew the extent of spending on weaponry.

While they solved the depression and allowed for the Nazi war machine, they also created fairly serious inflationary pressures. And while this kind of construct may sound ‘innovative’ to the uninitiated, they would have been a no brainer for an experienced banker like Schacht. As said, they were based on certificates (called Oeffa) that the Weimar Republic was already circulating and national treasuries had been circulating their own certificates routinely, when pressing political issues forced them to increase their financial clout. The US Treasury had its Treasury notes before the Civil War. The UK printed ‘Bradbury Pounds’ (debt free notes) to finance WW1. The Canadian Treasury printed its own debt free money as of 1935 and during the twenties and thirties advanced monetary reform programs were widely discussed throughout the West.

Conclusion

Hitler was heavily indebted to Feder’s anti-Usury stance in coming to power. But early on during his reign he got rid of Feder and relied on Schacht for the financing of his war plans. Unlike Schacht, Feder was not heavily involved with the top bankers and industrialists of the age. The German economy was directed completely to rearmament. Consumption levels were kept low through taxation and wage controls. Imports and production of luxuries were severely restricted.

Schacht made sure the financial industry was focused solely on war preparation and in effect allowed only the State to borrow on the domestic capital markets. International trade was primarily reliant on (scarce) foreign currencies and while there was some international bartering, it was far from dominant. The Reich’s financial industry did not decouple entirely from international finance, although foreign exchange controls were strict. For instance: the Bank of International Settlements continued dealings with the Reich.

There was no usury free economy. The common man or small business actually would have next to no access to credit at all. Even manufacturers were forced to become self financing, so the State could monopolize borrowing on the capital markets. The stock market boomed like never before.

Instead, all policies were directed at securing sufficient funds for rearmament, not at minimizing financial exploitation by the parasitical class that Hitler so vehemently attacked with his rhetoric. Finance was a matter of volume, not cost. Schacht’s MEFO bills have been wrongly jumped upon to claim Hitler was an anti banker man, while Schacht himself has the typical bio of a high level Money Power operative. He was a life long friend of BoE chief Montague Norman and was acquitted at Neurenberg, where the Soviets wanted a conviction while the British made sure he was released.

The myth of Nazi anti-Usury activism is damaging, not only because of its mythological character, but because it allows the Money Power to defame anti-Usury activism through ‘guilt by association’. In fact, many Austrians and Mainstreamers, call usury-free monetary reform programs ‘fascist’. Fascism itself is being rehabilitated because of its supposed stance against finance capitalism. But as we have learned from Bolton’s ‘The Banking Swindle’, the twenties and thirties saw many monetary reform programs throughout the West, far from all associated with fascism. After the war they were relegated to a memory hole because of this false association with fascism.

War profiteering by the industrial and financial class was in no way restricted. As a result, they profited immensely from the war. This was indeed the main reason for them to enable Hitler’s rise to power and their loyal support of his policies during the rearmament and the war. Even today, the main culprits like the Thyssen family, Krupp and the Goebbels step-children owning BMW are among the richest people in Germany. The same banks that financed the Reich’s war are now among the biggest in the world.

(with special thanks to Niels Verduijn and Ad Broere)

Afterthought 1

Let me be the first to admit I, until recently, believed much of what was said about Hitler’s ‘usury-free’ economy and have inadvertently contributed to the harnessing of this meme.

Afterthought 2

I agree with much of revisionist history. Post war historiography is just wartime propaganda. The Holocaust needs serious revaluation. Stalin, Roosevelt and Churchill were psychopaths who committed horrible crimes, against the Japanese, their own people, the people the colonized and against the Germans.

I do feel that at this point many in the Alternative Media go overboard, making Hitler a hero. This is unwarranted. The current article shows, in spite of what many believe, he was far from a renegade in a financial sense. There is also the Hunger Plan: Hitler and the Wehrmacht High Command intended to have the Wehrmacht live of the Russian land they were to occupy by robbing the farmers of their harvests. They cynically calculated this would starve 30 million Russians. Thankfully they never had the chance to fully implement this, but still millions of Russians starved because of the Wehrmacht taking their supplies.

The fact is that Hitler always wanted to invade Russia and his explanation that it was to save the world of Marxism, which he well analyzed to be a Jewish front, is irreconcilable with his take that Britain was a nation of Aryan brothers and the British Empire ‘necessary’ and a great civilizing force in the world: even at that time it was well known that the British Aristocracy had merged with Jewish Money and that the City of London was the Money Power’s capital.

Hitler was an imperialist who wanted to conquer Russia for the third Reich and intended to kill untold millions of Russians to take their land. His rise and fall gave the Money Power everything it wanted, including the war itself, the Zionist Entity in Palestine, the EU, Soviet domination of Eastern Europe, the destruction of the British Empire, the UN and the Cold War.

We will probably never know whether he was a useful idiot or willing stooge, but while he may have been no worse than his antagonists, he certainly also was no better.

Sources:

Hitler and the Banksters, by Ingrid Rimland

Nazi War Financing and Banking, by Otto Nathan

Ziopedia on MEFO’s

Jewish Virtual Library on Schacht

Wall Street and the Rise of Hitler, by Antony Sutton

Related:

Lincolns was indeed a Money Power Agent

Book review: the Banking Swindle

Part 2 and 3:

Hitler’s finances, a Response to my Critics

Hitler’s Finances, Schacht in his Own Words

It transpires that leading Libertarian websites have been catastrophically hemorrhaging visitors over the last 18 months. Gold buggery is definitely on the wane and this means that the classical enemy of Populist Monetary Reform may be on the way out. The Goldites have been confusing the Populists for 150 years.

This is the chance of an era to find common ground for a widely supported Monetary Reform Movement.

By Anthony Migchels for Henry Makow and Real Currencies

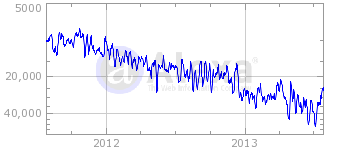

Here are two stunning Alexa graphs. Lewrockwell.com:

Mises.org:

Gary North is also down from about 30,000 to 60,000.

Surely Lew Rockwell’s site and Mises.org are at the heart of Libertarian agitation. They showed solid growth up to late 2011 when they started bleeding visitors. It must be remembered that this was during the Paul campaign, that could have seen the Goldites take over the Republican party, should Paul have resisted Diebold manipulation.

Such a disastrous turn of events has profound implications. Quite clearly the Powers that Be had plans for Libertarianism. As we have been discussing at length, the whole thing was built up over decades and co-opted the Truth Movement in the 2008 and 2012 elections.

Over the last year we have seen clear indications that Libertarianism was mainstreaming. But this is not really important. People still stuck in the Republican-Democrat dichotomy will believe anything, what matters is that Austrian Economics within the Truth Movement has more or less ended as a force. The Truth Movement is the real opposition and the bankers are losing the battle for their mind, also in terms of economics.

Confirmation of this is a recent bizarre rant by North. In a confused diatribe, using the word ‘crackpot’ at least 20 times, he first blathers on endlessly about Keynes being an anti-semite sodomite crackpot (doesn’t Gary know John Keynes was into young boys too?) and then completely loses it in describing American Populism. Said he: “It is, lo and behold, the Rothschilds. In other words, it’s them Jews. It’s them Jews again. It’s always them Jews. Them Jews is everywhere. Them Jews is everything bad. Them Jews is rich. Them Jews. Them Jews. Them Jews. Get them Jews!”

It’s hard to think of a more pathetic example of auto-combustion.

Few still believe that Gold will stop the bankers. Gold is deflationary, which would worsen an already grim scenario and does nothing to end Usury. America itself is in the absolute worst of positions to go Gold because nobody has any, the Federal Reserve least of all.

Rand Paul recently suggested a Gold commission, but without his father he is useless in the Truth Movement. The only one really plugging him is Alex Jones, who was also instrumental in giving Ron ‘Arabs did 9/11’ Paul the platform he needed. But just about everybody has been distancing himself from Jones, especially the last few months saw a flurry of people calling him out for many different reasons. Jones is regularly being slaughtered by his own feedbackers.

The other day hard-core Zionist Rand Paul was calling for war in Syria. Claiming Obama only wanted to fight Assad to a stalemate our man brazenly came forward: ‘I’ve told them I’m not sending my kids or your kids or any American soldiers to fight for stalemate. When we fight, we fight to win, we fight for American principles, we fight for the American flag and we come home after we win.’

What does it all mean?

Austrianism was and always has been the Money Power’s tool to subvert American Populism all throughout the 20th century right up to today. Ed Griffin’s ‘the Creature of Jekyll Island’ is just the perfect example of how they steamroll any platform for monetary reform by confusing the uninitiated. With the decline of Gold buggery we see a vacuum right at the heart of the Truth Movement.

The international implications of this trend are hard to fathom. As we know Austrianism fits well with the rise of the Gold backed Yuan. The Euro also was designed to be backed by Gold. Ron Paul never intended to win the elections and Lew Rockwell, right after Paul’s legendary backstabbing, claimed he was only there to educate the masses on the wonders of Austrian Economics. So it’s not too clear tPtB want a Gold Standard for America, or perhaps he was just too early.

The Truth Movement is the natural heir of the great American Populists who fought for plentiful money ever since the Civil War. But what is the Truth Movement? The great thing is: nobody knows. It’s one big mess and everybody associated with it has his or her own particular perspective. But there does seem to be a certain loose consensus. 9/11 Truth of course. The idea that the world is run by some bankers (Rothschild & Co), that they are trying to establish World Government and that they use wars to create the chaos they need to get there. It despises Zionism and Imperialism. It is more spiritual than religious.

Bankers have bought the entire world by offering bookkeeping services and slapping usury on those with debit accounts. This is called banking and it’s the mother of all hoaxes. It’s the kernel of the New World Order. They brought all Nations and all Governments to their knees and chained us all to interest-slavery with the only commodity that mankind can create in infinite amounts with the stroke of a pen.

If the results would not have been so utterly excruciating for untold billions of people, it would have been funny.

The answer is clear: we desperately need monetary reform. With the Gold meme in decline, more serious proposals are finding a platform. And there are many. There is the American Monetary Institute run by Zarlenga. They managed to get Kucinich on board, who launched HR2990 in Congress. Shortly thereafter he lost his seat, but this was quite a feat nonetheless.

There are the Hamiltonians/Larouchians, for instance the United Front Against Austerity. Ellen Brown’s Public Banking is also heavily influenced by Hamiltonian thinking.

These proposals certainly are very American and would go a long way. They would end the depression and interest payments by the State.

But they do not solve interest-slavery for the common man. He would still have to go to a bank to pay $300k interest on a $200k mortgage. These proposals (with the exception of Public Banking, which can be easily done on City level) also tend to centralize power in Washington and personally I’d like to see more decentralization to the States and local communities.

There are also the interest-free crediters. Mathematically Perfected Economy is one example. Hour money another. Thomas Greco is big on Mutual Credit clearing. These proposals are very strong because of their principled stance against Usury, which is absolutely key.

There are also the Europeans, people like Margrit Kennedy and Bernard Lietaer, who are strongly anti-usury, anti hoarding (of money) and promote regional/complementary currencies.

There are also the proposals that I would loosely categorize as the ‘Chicago Plan’. The AMI is quite close to it. Bill Still has been offering solutions in that direction. Positive Money comes to mind. A weakness of these proposals is full-reserve banking.

And let’s not forget Social Credit, which remains a force.

Conclusion

With Austrianism facing decimation, a united Monetary Reform platform seems more possible than ever.

Sound money is

1. Interest-Free

2. Stable, no boom/bust cycle, which is a result of tampering with the volume of money

3. Decentralized in the sense that local communities and economies have access to cheap credit

The current proposals as discussed show great promise but the finishing touch is lacking. We need a wide scale debate. This will enhance both the proposals and the public interest and understanding.

Banking is One and those that own it are the Money Power. As Michael Hoffman put it: ‘if there is a greater evil than the Money Power, than the Bible is lying……To say that the Money Power is at the very top of the evils that we need to work against basically overwhelms people. They want something else to fight…….Freedom from interest on money, is essentially the battle for freedom from the Money Power……We reject the weaponization of the love of money as it is represented by interest on loans of money!!’

This is, and remains, the challenge for both the Truth Movement and the Human Race.

(Thanks to Faux Capitalist for pointing out the Libertarian Alexa ratings)

Related:

Babylon = Usury! We want Interest-Free Money!

The Ron and Rand Paul Betrayal

How the Money Power created Libertarianism and Austrian Economics

End the Fed: a Trojan Horse destroying the Truth Movement from within

Why Tom Woods is wrong about the Greenbackers

Greenbackers vs. Goldbugs, by Eric Blair (Activist Post)

The Daily Bell calls it quits…

Meet the Real Deal: Michael Hoffman on ‘Usury in Christendom’

Forget about Full Reserve Banking

30 million people starve per year, poor countries pay up to ten times more interest on their foreign debts than they receive in development aid.

All the Usury ultimately ends up with people already owning Trillions. It feeds their avarice, burning away their souls.

They are poisoning our food because there are too many of us. We are buying it, because we need to cut cost to pay off the Usurer. Transnationals would not exist if the many had exist to interest-free capital.

More and more needs to be monetized to pay off ever higher cost for capital. We are rapaciously plundering Mother Nature, destroying our own habitat.

While we are working harder and harder to pay off the interest on our escalating debts (calling it ‘independence’ and ‘self-realization’), we are deserting those that need care, our elders and children.

The Usurer is behind the sexualization and degeneration of the Public Domain. He needs us to be distracted by our carnal nature so we won’t notice our demise.

Wars exist because they create debt and satisfy the demonic forces that have colonized our leaders, who have become power-crazy because of their Usurpation.

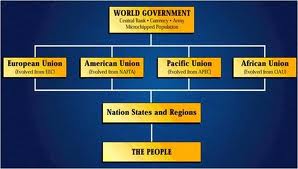

They are working towards a Global Government. A grandiose Despotism that will finally externalize the Usurer’s Hierarchy.

No Peace without Justice!

Interest-Free Money Now!

Related:

Babylon = Usury! We want Interest-Free Money!

On Interest

Budget of an Interest Slave

The notion that volume is irrelevant in Mutual Credit, as long as it is asset-backed, is quite widespread.

It’s a mistake and a serious one. It is badly damaging the credibility of Interest-Free Mutual Crediters and stalling the development of a platform. Usuronomics is the only winner.

Clearly the issue of Volume needs serious attention. Management of Volume is one of the key arguments Usuronomists of various persuasions use to rationalize their pseudo-science. Rising interest-rates dampen demand for credit and thus stops inflation, they will say. And although we know this to be a half-truth, rising interest rates in fact cause rising prices, albeit not through inflation but through higher cost for capital, it’s far from complete nonsense. The notion that endless credit creation is possible under Interest-Free Mutual Credit, whether we call it LETS, MPE, Bartering, Hours or whatever, is simply wrong and destroying our case vis a vis the open-minded.

The goal is not to insult those Interest-Free Crediters holding this position, men I highly respect and consider colleagues. The goal is to make a viable case for Mutual Credit and ridding ourselves of mistaken notions hindering the fulfillment of its promise. As long as serious doubts remain about the Volume issue, it will never happen. It is better to work these things out amongst friends than to get bludgeoned by Austrians, let alone the simpletons of the Mainstream.

Having said that, I had a bit of a problem getting a good handle on the take Mathematically Perfected Economy has to offer and I’m grateful to Australia4MPE for taking up the gauntlet and arguing MPE’s case on the matter. Our dialogue can be found at the comment section of the article on Money as part of the Commons.

MPE’s take and its problems

You’ll have to read the dialogue in its entirety to see what happened, but I’ll discuss it as fair as I can in my own words here.